|

市场调查报告书

商品编码

1406094

UV 固化树脂:市场占有率分析、产业趋势/统计、成长预测,2024-2029 年UV Curable Resin - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

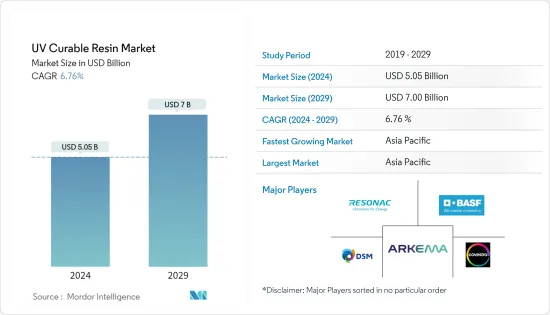

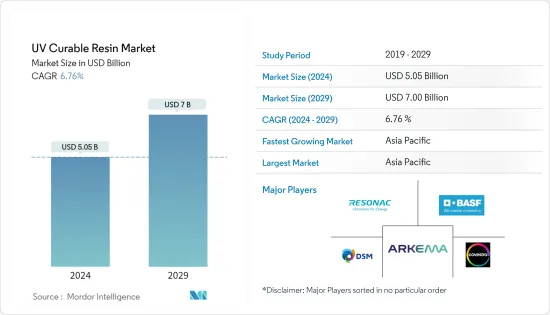

紫外线固化树脂市场规模预计到 2024 年为 50.5 亿美元,预计到 2029 年将达到 70 亿美元,在预测期内(2024-2029 年)复合年增长率为 6.76%。

COVID-19 大流行对市场产生了负面影响。这是因为製造设施和工厂因封锁和限製而关闭。供应链和运输中断进一步阻碍了市场。但2021年,产业復苏,市场需求恢復。

主要亮点

- 推动市场的主要因素是环保工业被覆剂的使用不断增加以及包装应用中对紫外线固化树脂的需求不断增加。

- 高昂的初始资本成本限制了市场的成长。

- 3D 列印、数位列印和印刷电路的应用不断增加,为市场成长提供了各种利润丰厚的机会。

- 亚太地区是最大的市场,由于中国、印度和日本等国家的消费,预计在预测期内将成为成长最快的市场。

UV固化树脂市场趋势

包装产业需求增加

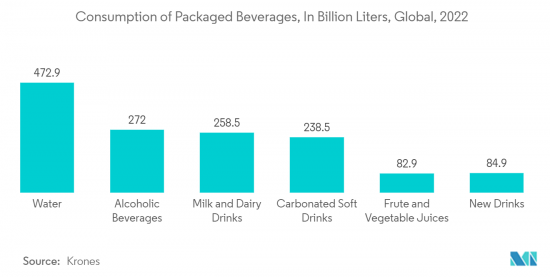

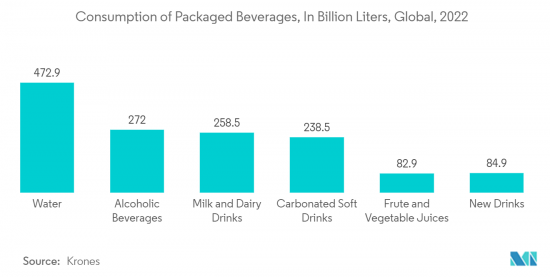

- 紫外光固化树脂广泛应用于食品和药品包装产业。具有优异的涂装作业性,可轻鬆获得均匀的涂膜。

- 由于其耐用性和弹性,丙烯酸酯胺甲酸乙酯被用于软包装涂料,预计将显着增长。

- 根据世界包装组织(WPO)统计,全球包装产业营业额超过5,000亿美元,其中食品包装为支柱。

- 在人均收入成长和电子商务巨头崛起的推动下,中国成为全球最大的包装消费国。根据印度塑胶工业协会统计,印度包装业位居世界第五,年增率约22-25%。

- 高技能的劳动力和低廉的人事费用使得包装和加工食品的成本比欧洲低 40%。人口的增长和对包装的需求的增加预计将推动市场的发展。

- 此外,根据《2022 年 FoodDrink Europe 报告》,欧盟食品和饮料业僱用了 460 万人,营业额为 1.1 兆欧元(约 1.2 兆美元),增加价值额2,300 亿欧元(约2,440 亿美元)。它是欧盟最大的加工业之一。同时,欧盟是全球最大的食品和饮料出口国,欧盟以外的出口额为1,560亿欧元(约1,650亿美元),贸易顺差为730亿欧元(约770亿美元)。

- 因此,上述因素在预测期内正在推动紫外线固化树脂市场的发展。

亚太地区主导市场

- 亚太地区的快速工业化预计将推动市场成长。该地区的油漆和涂料、建筑、电气和电子、汽车等行业以及紫外线固化树脂预计将出现成长。

- 近年来,由于经济扩张和高购买力中阶的崛起,中国包装产业持续快速成长。食品包装是包装产业的主要企业,约占中国60%的市场占有率。 Interpak预计,2023年中国食品包装类别总包装量将达到4,470亿件。这表明包装行业对紫外光固化黏剂的需求不断增加。

- 此外,汽车产业正在使用紫外线固化树脂来精加工汽车零件,预计将促进市场成长。 2022年亚洲和大洋洲的汽车产量约5,002万辆,较2021年成长7%。

- 而且,中国的电子市场是全世界最大的,比工业国家市场的总合还要大。 2022年,中国电子产业将成长14%,预计2023年将成长8%。

- 由于印度製造、国家电子政策、电子产品净零进口和零缺陷零效应等政府计划,印度的电子产业正在蓬勃发展。这些承诺致力于发展国内製造业,减少进口依赖,并振兴出口和製造业。

- 这些因素和政府监管支持导致该地区对紫外线固化树脂的需求不断增长。

UV固化树脂产业概况

全球紫外线固化树脂市场较为分散,竞争对手有大有小。主要企业包括阿科玛集团、BASF股份公司、科思创股份公司、Resonac Holdings Corporation 和帝斯曼。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 增加环保工业被覆剂的使用

- 包装应用对紫外线固化油墨的需求增加

- 其他司机

- 抑制因素

- 初始资本成本高

- 其他阻碍因素

- 价值链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场区隔(市场规模:以金额为准)

- 树脂型

- 丙烯酸酯环氧树脂

- 丙烯酸聚酯

- 丙烯酸胺甲酸乙酯

- 丙烯酸酯有机硅胶

- 其他的

- 作品

- 单体

- 光引发剂

- 寡聚物

- 共同发起人

- 目的

- 涂层

- 印刷

- 黏剂/密封剂

- 其他的

- 最终用户产业

- 电子产品

- 工业涂料

- 医疗保健

- 车

- 包装

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东/非洲

- 沙乌地阿拉伯

- 南非

- 其他中东/非洲

- 亚太地区

第六章 竞争形势

- 併购、合资、联盟、协议

- 市场占有率(%)/排名分析

- 主要企业策略

- 公司简介

- Allnex

- Arkema Group

- BASF SE

- Covestro AG

- DIC CORPORATION

- DSM

- Dymax Corporation

- Eternal Materials Co.,Ltd.

- Resonac Holdings Corporation

- IGM Resins

- Jiangsu Litian Technology Co., Ltd

- Nippon-Gohsei

- SOLTECH LTD.

- TOAGOSEI CO., LTD.

- Wanhua Chemical Group Co.,Ltd.

第七章 市场机会及未来趋势

- 将应用扩展到 3D 列印、数位列印和印刷电路

- 其他机会

The UV Curable Resin Market size is estimated at USD 5.05 billion in 2024, and is expected to reach USD 7 billion by 2029, growing at a CAGR of 6.76% during the forecast period (2024-2029).

The COVID-19 pandemic negatively impacted the market. It was because of the shutdown of the manufacturing facilities and plants due to the lockdown and restrictions. Supply chain and transportation disruptions further created hindrances for the market. However, the industry witnessed a recovery in 2021, thus rebounding the demand for the market studied.

Key Highlights

- Major factors driving the market studied are increased usage of environment-friendly industrial coatings and rising demand for UV-curable resins in packaging applications.

- High initial capital costs are restraining market growth.

- Increasing applications in 3D printing, digital printing, and printed circuits offer various lucrative opportunities for market growth.

- Asia-Pacific region represents the largest market and is expected to be the fastest-growing market over the forecast period owing to the consumption from countries such as China, India, and Japan.

UV Curable Resin Market Trends

Increasing Demand from Packaging Industry

- UV-curable resins are widely used in the food and pharmaceutical packaging industry. They include excellent coating workability, and uniform coating films can be easily obtained.

- Acrylated urethanes are anticipated to grow significantly as they are used in coatings for flexible packaging because of their superior durability and flexibility.

- According to the World Packaging Organization (WPO), the global packaging industry's turnover exceeds USD 500 billion, and food packaging is a pillar area.

- China is the world's largest packaging consumer globally, owing to growing per capita income and rising e-commerce giants. India's packaging industry is the fifth-largest globally, growing at about 22-25% per year, according to the Plastics Industry Association of India.

- Packaging and processing food costs can be 40% lower than in Europe because of highly skilled labor and cheap labor costs. The growing population and increasing demand for packaging are expected to drive the market.

- Furthermore, according to FoodDrink Europe Report 2022, the EU food and beverage industry employs 4.6 million people, including a turnover of EUR 1.1 trillion (~USD 1.2 trillion) and a value-added of EUR 230 billion (~USD 244 billion), making it one of the largest processing industries in the EU. At the same time, the EU is the world's largest exporter of food and beverages, with exports outside the EU of EUR 156 billion (~USD 165 billion) and a trade surplus of EUR 73 billion (~USD 77 billion).

- Hence, the factors above are, in turn, driving the market for UV curable resin during the forecast period.

Asia-Pacific Region to Dominate the Market

- Rapid industrialization in the Asia-Pacific region is expected to drive market growth. The growth of industries such as paints & coating, construction, electrical & electronics, and automotive in the region will result in the growth of UV-curable resins.

- The Chinese packaging industry grew rapidly and consistently in recent years, owing to the expanding economy and rising middle class with greater purchasing power. Food packaging is a major player in the packaging industry, accounting for roughly 60% of the total market share in China. According to Interpak, in China, in the foodstuff packaging category, total packaging is expected to reach 447 billion units in 2023. It indicates an increased demand for UV-curable adhesives from the packaging industry.

- Also, the automotive industry consumes UV-curable resins in automotive parts for finishes which are anticipated to boost the market's growth. Asia-Oceania manufactured around 50.02 million vehicles in 2022, 7% more than in 2021.

- Furthermore, China's electronics market is the largest in the world, even larger than the combined markets of all industrialized countries. In 2022, the Chinese electronic industry expanded by 14% and is expected to grow by 8% in 2023.

- The electronics sector in India is seeing rapid growth due to government schemes such as Make in India, National Policy of Electronics, Net Zero Imports in Electronics, and Zero Defect Zero Effect. These offer a commitment to growth in domestic manufacturing, lowering import dependence, and energizing exports and manufacturing.

- The factors above and supportive government regulations are contributing to the increased demand for UV-curable resins in the region.

UV Curable Resin Industry Overview

The global UV curable resin market is fragmented, with major and minor competitors. Some major companies include Arkema Group, BASF SE, Covestro AG, Resonac Holdings Corporation, and DSM, among the key players.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increase in Use of Environment-Friendly Industrial Coatings

- 4.1.2 Rising Demand for UV Curable Inks in Packaging Application

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 High Initial Capital Cost

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Resin Type

- 5.1.1 Acrylated Epoxies

- 5.1.2 Acrylated Polysters

- 5.1.3 Acrylated Urethanes

- 5.1.4 Acrylated Silicones

- 5.1.5 Others

- 5.2 Composition

- 5.2.1 Monomers

- 5.2.2 Photoinitiators

- 5.2.3 Oligomers

- 5.2.4 Coinitiators

- 5.3 Application

- 5.3.1 Coating

- 5.3.2 Printing

- 5.3.3 Adhesives and Sealants

- 5.3.4 Others

- 5.4 End-user Industry

- 5.4.1 Electronics

- 5.4.2 Industrial Coatings

- 5.4.3 Medical

- 5.4.4 Automotive

- 5.4.5 Packaging

- 5.5 Geography

- 5.5.1 Asia-Pacific

- 5.5.1.1 China

- 5.5.1.2 India

- 5.5.1.3 Japan

- 5.5.1.4 South Korea

- 5.5.1.5 Rest of Asia-Pacific

- 5.5.2 North America

- 5.5.2.1 United States

- 5.5.2.2 Canada

- 5.5.2.3 Mexico

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 Italy

- 5.5.3.4 France

- 5.5.3.5 Rest of Europe

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle-East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 South Africa

- 5.5.5.3 Rest of Middle-East & Africa

- 5.5.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers & Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Allnex

- 6.4.2 Arkema Group

- 6.4.3 BASF SE

- 6.4.4 Covestro AG

- 6.4.5 DIC CORPORATION

- 6.4.6 DSM

- 6.4.7 Dymax Corporation

- 6.4.8 Eternal Materials Co.,Ltd.

- 6.4.9 Resonac Holdings Corporation

- 6.4.10 IGM Resins

- 6.4.11 Jiangsu Litian Technology Co., Ltd

- 6.4.12 Nippon-Gohsei

- 6.4.13 SOLTECH LTD.

- 6.4.14 TOAGOSEI CO., LTD.

- 6.4.15 Wanhua Chemical Group Co.,Ltd.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Application in 3D printing, Digital Printing and Printed Circuits

- 7.2 Other Opportunities