|

市场调查报告书

商品编码

1406098

脂醇类-市场占有率分析、产业趋势与统计、2024-2029 年成长预测Fatty Alcohol - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

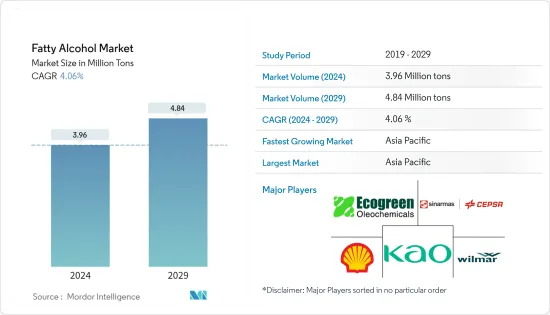

脂醇类市场规模预计到2024年为396万吨,预计到2029年将达到484万吨,在预测期内(2024-2029年)复合年增长率为4.06%。

市场受到 COVID-19 的负面影响。多个国家已进入封锁状态,以遏止疫情蔓延。许多企业和工厂被关闭,扰乱了世界各地的供应链,损害了全球生产、交货时间表和产品销售。目前,脂醇类市场已从COVID-19大流行的影响中恢復,并呈现显着成长。

主要亮点

- 从中期来看,製药业需求的增加以及个人护理和化妆品中脂醇类使用量的增加预计将成为市场的主要推动要素。

- 另一方面,原物料价格急剧上升预计将成为市场的抑制因素。

- 对生物基脂醇类产品的需求不断增长可能对未来几年的市场来说是个好兆头。

- 亚太地区占据最高的市场占有率,预计在预测期内将继续保持主导地位。

脂醇类市场趋势

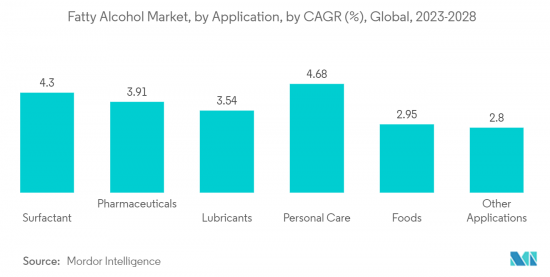

表面活性剂应用主导市场

- 脂醇类主要用于生产清洁剂和界面活性剂。脂醇类是双亲性的,因此充当非离子表面活性剂。

- 脂醇类是 C6 至 C22 伯醇,通常是直链的,这种类型用于清洁剂行业。现代清洁剂最初是基于由脂醇类原料製成的表面活性剂。这些包括天然脂肪和蜡,最近也从各种碳氢化合物来源合成了高分子量醇。

- 世界上大部分脂醇类都转化为界面活性剂和界面活性剂,是生产洗衣精、餐具清洁剂和其他家用清洗产品的基本原料。

- 根据国际贸易中心统计,德国是最大的肥皂和有机界面活性剂出口国,出口额从2019年的118.2亿美元大幅成长至2022年的145.4亿美元。这种成长意味着国际市场对这些产品的需求增加,从而导致对作为界面活性剂生产关键成分的脂肪酸的需求增加。

- 中国化学工业的产品对于肥皂、清洁剂和化妆品等多种产品至关重要。超过 60 家洗衣、护理和清洗产品製造商的存在证实了该行业的竞争力。此外,中国每100户家庭拥有洗衣机约98.7台,清洗产品的消费群也不断扩大。中国消费电器产品的崛起及其对价格实惠产品的关注增加了洗衣机的使用范围和对清洁剂的需求。

- 此外,印度是世界领先的肥皂生产国之一。该国人均香皂和沐浴皂消费量量约800公克。人均香皂和沐浴皂消费量800公克左右,显示国内肥皂产品需求稳定。此外,家庭和个人护理领域约占印度快速消费品市场50%的份额。合成合成清洁剂中间体产量从2019年的714,680吨持续成长到2022年的78万吨以上,显示清洁剂产品的需求正在增加。因此,作为界面活性剂生产原料的脂肪酸的需求将随着印度清洁剂市场的扩大而增长。

- 预计这些因素将在未来几年增加对脂醇类的需求。

亚太地区主导市场

- 中国、印度和日本等主要国家对表面活性剂、个人护理/化妆品和药品等各行业的需求很高,预计这将推动市场估计和预测期间的市场研究。

- 中国是全球第二大化妆品消费国。根据欧莱雅的报告,2022 年该国美容和个人护理市场总产值达 553 亿美元。在经历了因经济不确定性、大量企业倒闭和其他疫情政策变化导致的放缓后,该国美容市场在 2022 年呈现强劲復苏。

- 我国合成清洁剂生产主要集中在广东、浙江、四川三省,年生产量分别为325万吨、114万吨、109万吨。

- 中国的製药业是世界上最大的製药业之一。我们涉及学名药、治疗药物、原料药和草药的生产。在日本註册的药品90%以上都是学名药。截至 2022 年,该国拥有规模庞大且多元化的国内製药业,约有 5,000 家製造商,其中许多是中小企业。

- 根据国家投资促进和便利化局(Invest India)的数据,印度在美容和个人护理(BPC)市场中排名第八。意识的提高、获取的便利性和生活方式的改变等因素正在推动市场的发展。印度个人卫生用品市场预计年终将达到150亿美元。

- 洗髮精中使用的脂肪酸甲酯可以有效去除头髮上的皮脂和固态颗粒等污垢。根据印度国家投资促进和便利化局(Invest India)预测,未来两年印度护髮市场规模预计将达到48.9亿美元,复合年增长率为6.6%。

- 为了促进日本化妆品产业的成长,2023年4月,东京化妆品工业联合会、日本化妆品工业联合会、西日本化妆品工业联合会、中部化妆品工业联合会合併,成立日本化妆品工业联合会(日本化妆品工业联合会.JCIA)成立。日本化妆品产业主要企业之一的花王株式会社发布的报告显示,去年日本化妆品市场整体成长超过3%,预计未来几年将进一步成长。

- 由于该地区终端用户行业的快速增长,预计在预测期内对脂醇类的需求也会增加。

脂醇类产业概况

全球脂醇类市场较为分散,市场上存在大中型企业。市场主要企业(排名不分先后)包括 PT.Ecogreen Oledochemicals、壳牌 PLC、花王公司、丰益国际有限公司、Sinarmad Cepsa Pte.Ltd。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场驱动因素

- 製药业需求不断成长

- 个人护理和化妆品中脂醇类的使用增加

- 市场抑制因素

- 原物料价格急剧上升

- 其他阻碍因素

- 产业价值链分析

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买方议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章市场区隔(市场规模)

- 按类型

- 自然资源

- 石化产地

- 按用途

- 界面活性剂

- 药品

- 润滑剂

- 个人护理

- 食品

- 其他用途

- 按地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 欧洲其他地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东/非洲

- 沙乌地阿拉伯

- 南非

- 其他中东/非洲

- 亚太地区

第六章 竞争形势

- 併购、合资、联盟、协议

- 市场占有率(%)**/排名分析

- 主要企业策略

- 公司简介

- Arkema

- Croda International PLC

- Godrej Industries Limited

- Kao Corporation

- KLK OLEO

- Musim Mas

- Procter & Gamble

- PT. Ecogreen Oledochemicals

- SABIC

- Sasol

- Shell PLC

- Sinarmad Cepsa Pte. Ltd

- VVF LLC

- Wilmar International Ltd

第七章 市场机会及未来趋势

- 对生物基脂醇类产品的需求不断增长

- 其他机会

The Fatty Alcohol Market size is estimated at 3.96 Million tons in 2024, and is expected to reach 4.84 Million tons by 2029, growing at a CAGR of 4.06% during the forecast period (2024-2029).

The market was negatively impacted due to COVID-19. Several countries went into lockdown to curb the spread of the pandemic. The shutdown of numerous companies and factories disrupted supply networks worldwide and harmed global production, delivery schedules, and product sales. Currently, the fatty alcohol market has recovered from the impacts of the COVID-19 pandemic and is growing at a significant rate.

Key Highlights

- Over the medium term, the growing demand from the pharmaceutical industry and the increasing usage of fatty alcohol in personal care and cosmetics products are expected to be the major driving factors for the market.

- On the flip side, high volatility in raw material prices is likely to pose as a restraint for the market.

- The growing demand for bio-based fatty alcohol products is likely to act as an opportunity for the market in the coming years.

- The Asia-Pacific region accounts for the highest market share, and the region is likely to continue its dominance in the market during the forecast period.

Fatty Alcohol Market Trends

Surfactants Application to Dominate the Market

- Fatty alcohols are mainly used in the production of detergents and surfactants. Due to their amphipathic nature, fatty alcohols behave as nonionic surfactants.

- Fatty alcohol is primary alcohol from C6 to C22, usually straight-chain, which is the type used by the detergent industry. Modern detergents were initially based on surfactants made from fatty alcohol raw materials. These include natural fats, oils, and waxes, and more recently, high molecular weight alcohols have been produced synthetically from various hydrocarbon sources.

- A substantial majority of fatty alcohols worldwide are converted into surfactants or surface active agents, the basic materials used to produce laundry detergent, dishwashing detergent, and other household cleaning products.

- According to the International Trade Centre, Germany stands out as the largest exporter of soap and organic surface-active products, witnessing a substantial increase in export value from USD 11.82 billion in 2019 to USD 14.54 billion in 2022. This growth signifies a growing demand for these products in international markets, translating to increased demand for fatty acids as key components in producing surfactants.

- The output from the Chinese chemical industry is essential in various products, which include soaps, detergents, cosmetics, etc. The presence of over 60 washing, care, and cleaning agent manufacturers underscores this sector's competitive nature. Furthermore, with approximately 98.7 washing machines per one hundred households in China, there is a growing consumer base for cleaning products. The rise of Chinese household appliance producers and their focus on affordable products have increased access to washing machines, resulting in a higher demand for detergents.

- Moreover, India is one of the largest producers of soaps in the world. The per capita consumption of toilet/bathing soaps in the country is around 800 grams. The per capita consumption of toilet/bathing soaps, averaging around 800 grams, further indicates the country's steady demand for soap products. Additionally, the household and personal care segment accounts for around 50% share of the FMCG market in India. The consistent increase in the production of synthetic detergent intermediates, from 714.68 thousand metric tons in 2019 to over 780 thousand metric tons in FY 2022, indicates the rising demand for detergent products. Consequently, the demand for fatty acids as raw materials in surfactant production experiences growth alongside the expansion of the detergent market in India.

- These factors are expected to enhance the demand for fatty alcohol over the coming years.

Asia-Pacific Region to Dominate the Market

- The high demand from various industries, like surfactants, personal care and cosmetics, pharmaceuticals, and others, in major economies, such as China, India, and Japan, is estimated to boost the market studied during the forecast period.

- China is the second-largest consumer of cosmetic products across the world. According to a report by L'Oreal, the country generated a total of USD 55.3 billion in the beauty and personal care market in 2022. The country's beauty market witnessed a strong rebound in 2022 after facing a slowdown due to economic uncertainties, numerous lockdowns, and other pandemic policy changes.

- In China, the production of synthetic detergents is mainly concentrated in Guangdong, Zhejiang, and Sichuan, with an annual production capacity of 3.25 million tons, 1.14 million tons, and 1.09 million tons, respectively.

- The pharmaceutical industry in China is one of the largest in the world. The country is involved in the production of generics, therapeutic medicines, active pharmaceutical ingredients, and traditional Chinese medicine. More than 90% of the drugs registered in the country are generic. As of 2022, the country has a large and diverse domestic drug industry comprising around 5,000 manufacturers, many of which are small or medium-sized companies.

- According to the National Investment Promotion and Facilitation Agency (Invest India), India stands 8th in the beauty and personal care (BPC) market. Factors such as growing awareness, easier access, and changing lifestyles are driving the market. The personal hygiene market in India is expected to reach a value of USD 15 billion by the end of this year.

- The fatty acid methyl esters used in shampoos effectively remove soils, such as sebum and solid particulates, from the hair. According to the National Investment Promotion and Facilitation Agency (Invest India), the Indian hair care market is expected to reach a value of USD 4.89 billion with a CAGR of 6.6% in the next two years.

- To facilitate the growth of the Japanese cosmetic industry, the Japan Cosmetic Industry Association (JCIA) was established in April 2023 by integrating the Tokyo Cosmetic Industry Association, the Japan Cosmetic Industry Federation, the West Japan Cosmetic Industry Association, and the Chubu Cosmetic Industry Association. According to a report published by Kao Corporation, one of the key players in the Japanese cosmetic industry, the overall market in Japan grew by over 3% last year, with further growth anticipated in the upcoming years.

- With the rapidly growing end-user industries in the region, the demand for fatty alcohol is also expected to increase over the forecast period.

Fatty Alcohol Industry Overview

The global fatty alcohol market is fragmented in nature, with the presence of several large-scale and medium-scale companies in the market. Some of the major companies in the market (not in any particular order) include PT. Ecogreen Oledochemicals, Shell PLC, Kao Corporation, Wilmar International Ltd, and Sinarmad Cepsa Pte. Ltd, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Growing Demand from Pharmaceutical Industry

- 4.1.2 Increasing Usage of Fatty Alcohol in Personal Care and Cosmetics Products

- 4.2 Market Restraints

- 4.2.1 High Volatility in Raw Material Prices

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 By Type

- 5.1.1 Natural Sources

- 5.1.2 Petrochemical Sources

- 5.2 By Application

- 5.2.1 Surfactants

- 5.2.2 Pharmaceuticals

- 5.2.3 Lubricants

- 5.2.4 Personal Care

- 5.2.5 Foods

- 5.2.6 Other Applications

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Arkema

- 6.4.2 Croda International PLC

- 6.4.3 Godrej Industries Limited

- 6.4.4 Kao Corporation

- 6.4.5 KLK OLEO

- 6.4.6 Musim Mas

- 6.4.7 Procter & Gamble

- 6.4.8 PT. Ecogreen Oledochemicals

- 6.4.9 SABIC

- 6.4.10 Sasol

- 6.4.11 Shell PLC

- 6.4.12 Sinarmad Cepsa Pte. Ltd

- 6.4.13 VVF LLC

- 6.4.14 Wilmar International Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Demand for Bio-Based Fatty Alcohol Products

- 7.2 Other Opportunities