|

市场调查报告书

商品编码

1406100

汽车外饰化学品-市场占有率分析、产业趋势与统计、2024年至2029年成长预测Automotive Appearance Chemicals - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

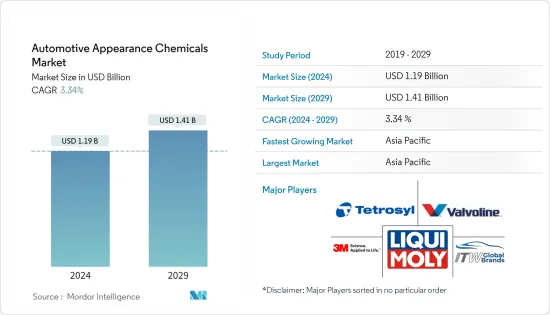

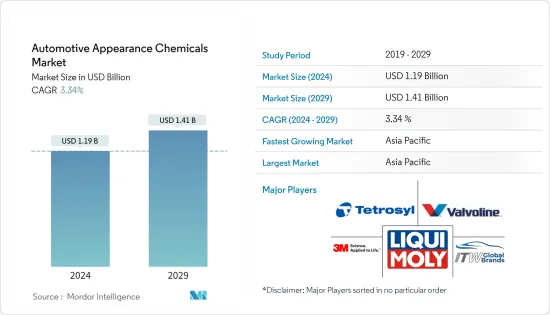

预计2024年汽车外饰化学品市场规模为11.9亿美元,2029年达14.1亿美元,预测期间(2024-2029年)复合年增长率为3.34%。

COVID-19 的爆发影响了全球汽车外观化学品市场。由于全球汽车产量在此期间放缓,2020 年市场成长温和。然而,市场已经从大流行中恢復并正在显着增长。

主要亮点

- 短期内,电动车(EV)产量的增加和消费者对汽车维护的意识是推动所研究市场成长的关键因素。

- 然而,政府对蜡和被覆剂等石油产品的严格监管可能会限制所研究市场的成长。

- 然而,专业汽车保养服务和专业应用中越来越多地采用现代技术可能会为全球市场提供利润丰厚的成长机会。

- 亚太地区是最大的市场。由于中国、印度和日本等国家的消费量不断增加,预计该市场也将成为预测期内成长最快的市场。

汽车外观化学品市场趋势

电动车产量增加

- 由于电动车(EV) 的需求,汽车外观化学品市场不断成长。

- 由于环保意识和满足未来能源需求的需要,电动车市场正在经历显着成长。实现永续交通的需求在推动电动车需求方面发挥关键作用。

- 此外,电动车产量的增加可能会增加所研究市场的需求。例如,根据 CleanTechnica 的数据,2022 年 7 月的国际插电式汽车註册量较 2021 年 7 月增加了 61%,达到 778,000 辆。

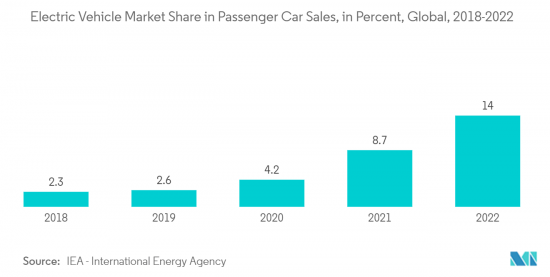

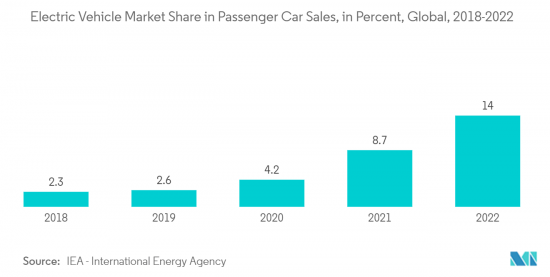

- 根据国际能源总署(IEA)预测,2022年电动车将占全球小客车销量的约14%,与前一年同期比较增加5.3个百分点。

- 根据世界经济论坛 (WEF) 的数据,2022 年上半年全球售出约 430 万辆新型纯电动车 (BEV) 和插电式混合动力汽车(PHEV)。此外,纯电动车销量每年成长约75%,插电式混合动力车销量成长37%。此外,2022年1月至8月全球电动车销量突破570万辆大关,插电式电动车市场占有率上升至近15%。

- 各国政府对电动车的采用和电动车製造基础设施的扩张采取了优惠政策。能源成本上升和新兴能源效率技术之间的竞争预计也将推动市场成长。

- 近年来,汽车製造商宣布了许多普及电动车的计划和时间表。丰田计划在 2025 年之前其一半销量来自电动车。该公司将于 2021 年与中国电池製造商比亚迪合作生产电动车。大众汽车宣布,2023年将斥资超过300亿美元开发电动车。此外,到 2030 年,我们的目标是让全球 40% 的持有为电动车。

- 目前,电动的焦点集中在小客车上,但这种趋势预计很快就会改变并蔓延到其他类别的车辆。

- 所有上述因素预计将在预测期内增加汽车外装化学品的需求。

亚太地区主导市场

- 预计在预测期内,亚太地区将成为汽车外部保护剂的最大市场。

- 亚太地区是世界上一些最有价值的汽车製造商的所在地。中国、印度、日本和韩国等新兴国家正在努力加强製造基础并建立高效的供应链以提高盈利。

- 根据中国工业协会统计,中国是全球最大的汽车生产基地,预计2022年汽车产量将达到2,700万辆,比去年的2,600万辆成长3.4%。

- 根据SIAM India统计,2022年印度汽车总产量约2,290万辆,较前上年度成长。

- 此外,据印度品牌股权基金会 (IBEF) 称,到 2025 年,印度电动车(EV) 市场规模预计将达到 5,000 亿印度卢比(70.9 亿美元)。

- 根据日本经济产业省、日本小客车製造商协会的数据,2022 年日本乘用车产量约 657 万辆,低于前一年的约 662 万辆。此外,包括小客车、客车和卡车在内的国内生产总值约为784万辆。

- 因此,上述因素可能会在预测期内影响市场。

汽车外观化学品产业概况

汽车外观化学品市场较为分散。主要参与者(排名不分先后)包括 3M、LIQUI MOLY GmbH、ITW Global Brands、Valvoline 和 Tetrosyl Ltd。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 电动车(EV) 产量增加

- 提高消费者车辆保养意识

- 其他司机

- 抑制因素

- 政府对蜡和被覆剂等石油产品实施严格的法规

- 其他阻碍因素

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场区隔(市场规模)

- 产品类别

- 蜡

- 抛光

- 保护剂

- 车轮/轮胎清洁剂

- 窗户清洗液

- 皮革护理产品

- 其他的

- 目的

- 小客车

- 轻型商用车

- 大型商用车

- 其他的

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 欧洲其他地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东/非洲

- 沙乌地阿拉伯

- 南非

- 其他中东/非洲

- 亚太地区

第六章 竞争形势

- 併购、合资、联盟、协议

- 市场占有率分析(%)**/排名分析

- 主要企业策略

- 公司简介

- 3M

- SONAX GmbH

- Dow

- General Chemical Corp.

- ITW Global Brands

- Guangzhou Biaobang Car Care Industry Co. Ltd

- LIQUI MOLY GmbH

- Niteo Products, Inc.

- Nuvite Chemical Compounds

- Tetrosyl Ltd

- Turtle Wax, Inc.

- Valvoline Chemicals

第七章 市场机会及未来趋势

- 更多采用专业汽车护理服务

- 在特殊应用中更多采用尖端技术

The Automotive Appearance Chemicals Market size is estimated at USD 1.19 billion in 2024, and is expected to reach USD 1.41 billion by 2029, growing at a CAGR of 3.34% during the forecast period (2024-2029).

The COVID-19 pandemic affected the global automotive appearance chemicals market. The slowdown in global automobile production during the period resulted in minimal market growth in 2020. However, the market recovered from the pandemic and is growing significantly.

Key Highlights

- Over the short term, the increase in the production of electric vehicles (EV) and consumer awareness toward vehicle maintenance are major factors driving the growth of the market studied.

- However, stringent government regulations on petroleum products such as waxes and coatings are likely to restrain the growth of the studied market.

- Nevertheless, the increasing adoption of professional auto care services and modern technology in specialized applications will likely create lucrative growth opportunities for the global market.

- The Asia-Pacific region represents the largest market. It is also expected to be the fastest-growing market over the forecast period, owing to the increasing consumption in countries such as China, India, and Japan.

Automotive Appearance Chemicals Market Trends

Increase in the Production of Electric Vehicles

- The automotive appearance chemical market is growing due to the demand for electric vehicles (EVs).

- The EV market witnessed significant growth due to environmental awareness and the need to address future energy requirements. The need to attain sustainable transportation plays a significant role in driving the demand for EVs.

- Furthermore, the rising production of electric vehicles will likely enhance the market demand for the studied market. For instance, according to CleanTechnica, international plug-in vehicle registrations increased by 61% in July 2022 compared to July 2021, reaching 778,000 units.

- As per the International Energy Agency (IEA), in 2022, electric vehicles accounted for around 14% of worldwide passenger car sales, a 5.3% point increase year on year.

- As per the World Economic Forum (WEF), nearly 4.3 million new battery-powered EVs (BEVs) and plug-in hybrid electric vehicles (PHEVs) were sold globally in the first half of 2022. Additionally, BEV sales grew by around 75% yearly and PHEVs by 37%. Moreover, global electric car sales crossed the 5.7 million units mark in the first eight months of 2022, and the market share of plug-in electric cars increased to nearly 15%.

- The governments of various countries adopted favorable policies toward adopting electric vehicles and expanding the manufacturing infrastructure of electric vehicles. Rising energy costs and competition among emerging energy efficiency technologies are also expected to fuel market growth.

- In recent years, automotive manufacturers announced many plans and timelines for bringing more EVs. Toyota plans to generate half of its sales from electrified vehicles by 2025. The company partnered with Chinese battery manufacturer BYD in 2021 to manufacture electric cars. Volkswagen said it will spend more than USD 30 billion developing EVs by 2023. The manufacturer also aims for EVs to make up 40% of its global fleet by 2030.

- Currently, much attention is being given to passenger vehicles for electrification, but this trend is expected to change soon and spread to other classes of vehicles.

- All the factors above are expected to enhance the demand for automotive appearance chemicals during the forecast period.

The Asia-Pacific Region to Dominate the Market

- The Asia-Pacific region is expected to account for the largest market for automotive appearance chemicals during the forecast period.

- The Asia-Pacific region is home to some of the world's most valuable vehicle manufacturers. Developing countries such as China, India, Japan, and South Korea are working hard to strengthen the manufacturing base and develop efficient supply chains for greater profitability.

- According to the China Association of Automobile Manufacturers (CAAM), China includes the largest automotive production base in the world, with a total vehicle production of 27 million units in 2022, registering an increase of 3.4 % compared to 26 million units produced last year.

- According to SIAM India, in the financial year 2022, the total production volume of vehicles in India was around 22.9 million units, an increase from the previous year.

- Additionally, according to the Indian Brand Equity Foundation (IBEF), the electric vehicle (EV) market is estimated to reach INR 50,000 crore (USD 7.09 billion) in India by 2025.

- In 2022, according to METI (Japan); JAMA, approximately 6.57 million passenger cars were produced in Japan, down from about 6.62 million units in the previous year. The total domestic production volume reached approximately 7.84 million units, which includes buses and trucks next to passenger cars.

- Therefore, the above factors will likely impact the market in the forecasted period.

Automotive Appearance Chemicals Industry Overview

The automotive appearance market is fragmented in nature. The major players (not in any particular order) include 3M, LIQUI MOLY GmbH, ITW Global Brands, Valvoline, and Tetrosyl Ltd., among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Dynamics

- 4.1 Drivers

- 4.1.1 Increase in the Production of Electric Vehicles (EV)

- 4.1.2 Increase in Consumer Awareness Toward Vehicle Maintenance

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Stringent Government Regulations on Petroleum Products like Waxes and Coatings

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Product Type

- 5.1.1 Waxes

- 5.1.2 Polishes

- 5.1.3 Protectants

- 5.1.4 Wheel and Tire Cleaners

- 5.1.5 Windshield Washer Fluids

- 5.1.6 Leather Care Products

- 5.1.7 Others

- 5.2 Application

- 5.2.1 Passenger Cars

- 5.2.2 Light Commercial Vehicles

- 5.2.3 Heavy Commercial Vehicles

- 5.2.4 Others

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share Analysis (%) **/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 3M

- 6.4.2 SONAX GmbH

- 6.4.3 Dow

- 6.4.4 General Chemical Corp.

- 6.4.5 ITW Global Brands

- 6.4.6 Guangzhou Biaobang Car Care Industry Co. Ltd

- 6.4.7 LIQUI MOLY GmbH

- 6.4.8 Niteo Products, Inc.

- 6.4.9 Nuvite Chemical Compounds

- 6.4.10 Tetrosyl Ltd

- 6.4.11 Turtle Wax, Inc.

- 6.4.12 Valvoline Chemicals

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Adoption of Professional Auto Care Services

- 7.2 Increasing Adoption of Modern Technology in Specialized Application