|

市场调查报告书

商品编码

1406101

氟化钡:市场占有率分析、产业趋势/统计、成长预测,2024-2029 年Barium Fluoride - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

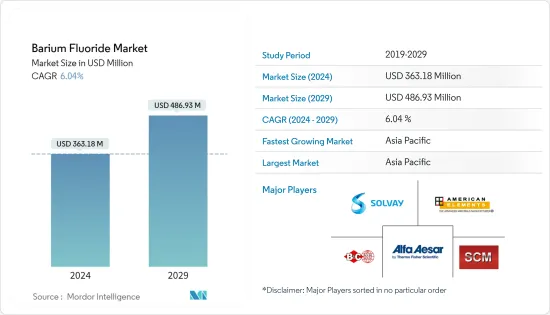

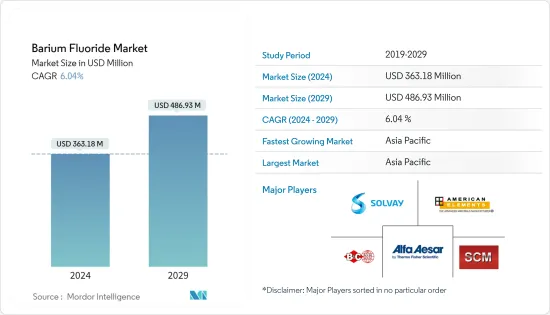

氟化钡市场规模预计2024年为3.6318亿美元,预计2029年将达到4.8693亿美元,在预测期内(2024-2029年)复合年增长率为6.04%,预计。

推动市场成长的主要因素是氟化钡在光学应用中的使用不断增加。此外,氟化钡也用作铝精製製程生产中的添加剂。由于 BaF2 含有致癌性并对人类健康产生有害影响,环境问题预计将阻碍市场成长。此外,COVID-19 爆发造成的不利条件预计将限制产品需求。

主要亮点

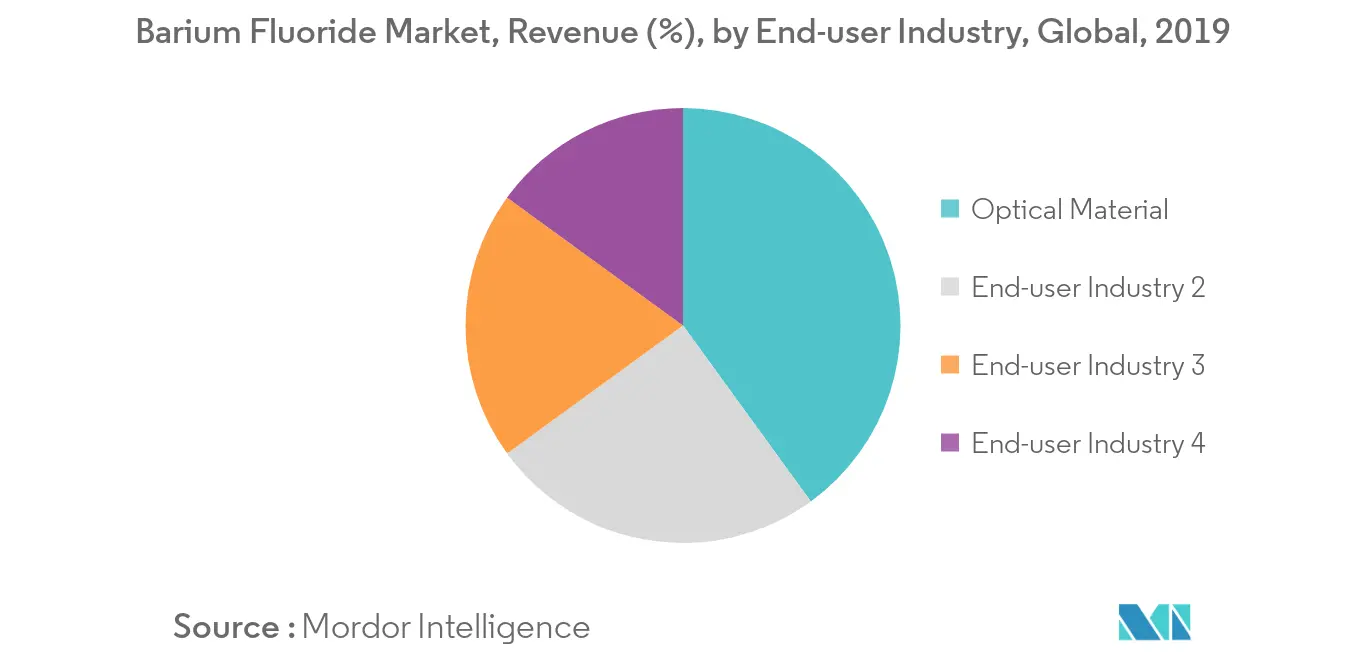

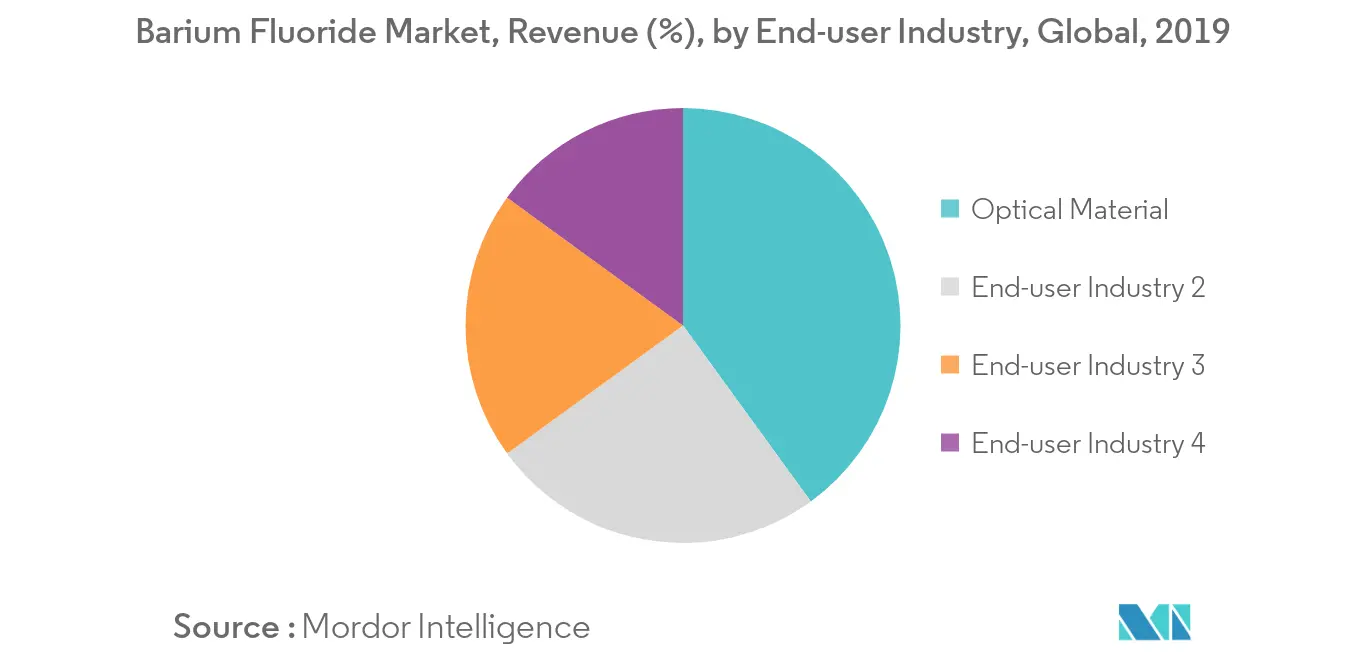

- 光学材料预计将在近红外线、可见光和中波红外频谱应用中主导氟化钡市场。

- 预计亚太地区将成为预测期内最大的氟化钡市场。

氟化钡市场趋势

光谱学推动氟化钡市场成长

- 氟化钡在光谱元件中的广泛使用预计将扩大所研究的市场。它适用于被动红外线波段的应用。

- 氟化钡适合製造可见光窗口,可传输从红外线到紫外光频谱中的辐射。由于其耐水性,它也用于生产用于紫外线雷射的氟化钡钇 (BaY2F8)结晶,以及许多环境设备的生产。

- 对于需要对伽马射线和 X 射线具有高辐射抗性的 VUV 窗口,BaF2 非常适合。

- 所有上述因素预计将在预测期内推动氟化钡市场。

亚太地区主导氟化钡市场

- 由于该地区对光谱组件的高需求和铝提炼的增加,预计亚太地区将主导氟化钡市场。

- 截至年终,最大的两个铝生产国中国和印度来自亚太地区,产量分别为3,600万吨和370万吨。

- 虹桥集团(中国)、中国铝业(中国)和信发(中国)等主要铝生产公司在该地区的存在,加上亚太地区铝的高产能,推动了该地区氟化钡市场的发展。预计如此。

- 因此,预计上述因素将在预测期内推动该地区的市场。

氟化钡产业概况

氟化钡市场得到整合。开展业务的公司包括 Solvay、American Elements、Barium & Chemicals, Inc.、Alfa Chemical Corp 和 Triveni Interchem Private Limited。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 光谱需求不断成长

- 广泛用于铝精製

- 抑制因素

- 高致癌性

- COVID-19 疫情造成的不利情况

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场区隔

- 目的

- 光谱成分

- 焊接剂

- 添加剂

- 其他的

- 最终用户产业

- 铝製造

- 光学材料

- 油和气

- 其他的

- 地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 其他欧洲国家

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东/非洲

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 南非

- 其他中东/非洲

- 北美洲

第六章 竞争形势

- 併购、合资、联盟、协议

- 市场占有率分析

- 主要企业策略

- 公司简介

- Alfa Chemical Corp

- American Elements

- Barium & Chemicals Inc.

- Harshil Industries

- PARTH INDUSTRIES

- Solvay

- Super Conductor Materials, Inc

- SB Chemicals

第七章 市场机会及未来趋势

The Barium Fluoride Market size is estimated at USD 363.18 million in 2024, and is expected to reach USD 486.93 million by 2029, growing at a CAGR of 6.04% during the forecast period (2024-2029).

The major factor driving the growth of the market is the increasing use of barium fluoride in optical applications. Moreover, barium fluoride is used as an additive in the manufacturing of aluminum refining process. Environmental concerns regarding BaF2 as it contains carcinogenic content and its harmful effect on human health is expected to impede the growth of the market studied. Moreover, unfavorable conditions arising due to the COVID-19 outbreak is anticiapted to restrict the product demand.

Key Highlights

- Optical Material is anticipated to dominate the barium fluoride market owing to its application in NIR, VIS and MWIR spectrum.

- Asia-Pacific region is expected to be the largest market for the barium fluoride during the period of forecast.

Barium Fluoride Market Trends

Optical Spectroscopy to Fuel the Growth of Barium Fluoride Market

- Broad use of Barium Fluoride in spectroscopic components is expected to grow the market studied. It is suitable for application in the passive IR band.

- Barium Fluoride is suitable in the fabrication of optical windows transmitting radiation in the spectrum from infrared to ultra-violet rays. It is also used to produce Barium Yttrium Fluoride (BaY2F8) crystals used in UV lasers and for a number of environmental instruments due to its resistance to water damage.

- It is used in the VUV window where high radiation resistance is needed from gamma and x-ray which is perfectly catered by BaF2.

- All the aforementioned factors are expected to drive the Barium Fluoride market during the forecast period.

Asia-Pacific to Dominate Barium Fluoride Market

- Asia-Pacific region is forecasted to dominate the barium fluoride market owing to the high demand for spectroscopic components and an increase in the aluminum refining in the region.

- The top two aluminum producing countries China and India come from the Asia-Pacific region with 36 million metric tons and 3.7 million metric tons respectively by the end of 2019.

- Presence of some major aluminum producing players in the region like Hongqiao Group (China), Chalco (China), Xinfa (China) along with the high production capacity of aluminum in the Asia-Pacific region is expected to propel the Barium Fluoride market in the region.

- Thus, the aforementioned factors are expected to drive the market in the region during the forecast period.

Barium Fluoride Industry Overview

The barium fluoride market is consolidated. Some of the companies operating in the business are Solvay, American Elements, Barium & Chemicals, Inc., Alfa Chemical Corp, and Triveni Interchem Private Limited.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand In Optical Spectroscopy

- 4.1.2 Extensive Usage in Aluminum Refining

- 4.2 Restraints

- 4.2.1 High Carcinogenic Content

- 4.2.2 Unfavorable Conditions Arising Due to COVID-19 Outbreak

- 4.3 Industry Value-Chain Analysis

- 4.4 Porters Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION

- 5.1 Applications

- 5.1.1 Spectroscopic Components

- 5.1.2 Welding Agents

- 5.1.3 Additives

- 5.1.4 Others

- 5.2 End-user Industry

- 5.2.1 Aluminum Manufacturing

- 5.2.2 Optical Material

- 5.2.3 Oil & Gas

- 5.2.4 Others

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 Italy

- 5.3.2.4 France

- 5.3.2.5 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Japan

- 5.3.3.4 South Korea

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East & Africa

- 5.3.5.1 United Arab Emirates

- 5.3.5.2 Saudi Arabia

- 5.3.5.3 South Africa

- 5.3.5.4 Rest of Middle-East & Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers & Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Alfa Chemical Corp

- 6.4.2 American Elements

- 6.4.3 Barium & Chemicals Inc.

- 6.4.4 Harshil Industries

- 6.4.5 PARTH INDUSTRIES

- 6.4.6 Solvay

- 6.4.7 Super Conductor Materials, Inc

- 6.4.8 S. B. Chemicals