|

市场调查报告书

商品编码

1689962

人工智慧基础设施:市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)AI Infrastructure - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

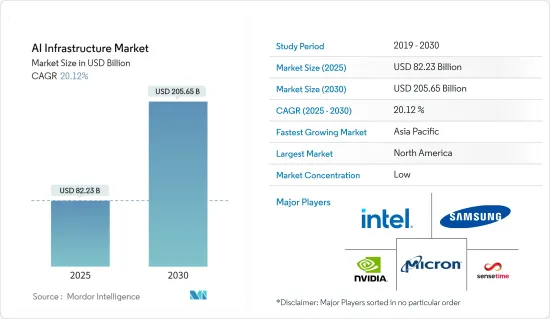

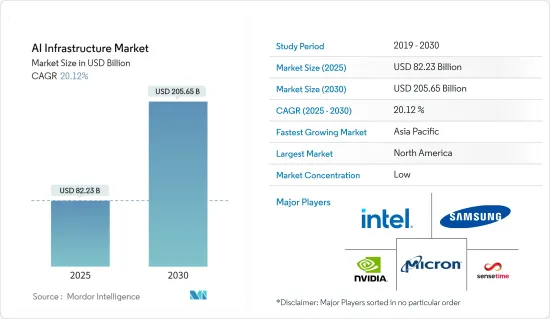

2025年AI基础设施市场规模预估为822.3亿美元,预估至2030年将达2,056.5亿美元,预测期间(2025-2030年)复合年增长率为20.12%。

促进AI基础设施市场的创新和效率

主要亮点

- 高效能运算资料中心需求激增:AI基础设施市场正在经历指数级成长,这得益于高效能运算(HPC)资料中心对AI硬体的需求不断增加。企业正在意识到人工智慧的变革潜力,并正在推动跨产业投资。

- Nvidia 的 BlueField-3 DPU:世界上第一个 400GbE资料处理单元 (DPU),该技术比传统 DPU 快 10 倍,标誌着 AI 硬体的重大进步。

- Google Cloud 与英特尔合作:这些科技巨头已合作开发旨在增强资料中心的 AI 功能、安全性和生产力的晶片,这表明双方正朝着战略伙伴关係的方向发展。

- AMD 的 MI300X 系列:AMD 发布其 MI300X 晶片系列,可执行高达 800 亿个参数的生成式 AI 模型,展示了 AI 模型日益复杂的特性。

- 工业物联网(IIoT)和自动化技术推动成长:工业物联网(IIoT)和自动化技术的整合正在显着推动人工智慧基础设施市场的发展。这些技术创新正在提高效率、优化流程并产生有价值的资料。

- AFCOM 2021 调查结果:超过 40% 的参与公司计划在 2024 年在资料中心监控和维护中实施机器人和自动化,这标誌着自动化的快速崛起。

- 研华和 Actility Integration:这两家公司推出了基于人工智慧的机器预后诊断和健康管理解决方案,实现了即时机器状况监控。

- TD SYNNEX Data-IoTSolv:此解决方案套件为合作伙伴提供利用资料分析和物联网的工具,凸显了对人工智慧物联网解决方案日益增长的需求。

- 机器学习和深度学习推动创新:机器学习和深度学习技术是人工智慧基础设施成长的关键驱动力,使企业能够从大量资料集中获得有价值的见解。

- TAZI.AI资金筹措成功:TAZI.AI 已筹集 460 万美元,用于在医疗保健、保险和製药领域部署机器学习解决方案,重点关注特定行业的 AI 采用。

- 在政府部门:机器学习可用于业务自动化和资料分析,从而释放人力资源以用于核心职能。

- 疫情时代的加速:疫情加速了人工智慧和机器学习在网路自动化中的应用,网路供应商意识到人工智慧在简化营运方面的关键作用。

- 汽车和医疗保健领域的资料爆炸式增长:汽车和医疗保健等行业的资料量正在增加,对先进的人工智慧技术的需求也随之增加,以便有效地管理和分析资料。

- Alpine Health Systems 的人工智慧平台:该平台简化了患有复杂疾病的患者的出院流程,展示了人工智慧在医疗管理方面的潜力。

- Intangles Lab 的电动车环境感知 AI:这项创新解决了电动车,特别是在商用电动车领域的续航里程焦虑问题。

- 医疗保健应用中的人工智慧:人工智慧越来越多地被用于临床决策、疾病诊断和患者资料管理,展示了其在医疗保健领域的多功能性。

- 市场现状及未来展望:在科技巨头、新兴企业、云端供应商等提供尖端解决方案的推动下,AI基础设施市场预计将持续成长。

- 云端细分市场的成长:AI基础设施云市场预计在2022年价值161.2亿美元,到2028年将达到492.9亿美元,复合年增长率为20.22%。

- 北美市场领导地位 北美将在 2022 年以 195.7 亿美元的规模领先 AI 基础设施市场,预计到 2028 年将达到 565.9 亿美元,复合年增长率为 19.10%。

- 新兴技术:量子运算、6G 连接和先进机器人等创新将突破人工智慧基础设施能力的界限,并支援新的应用和使用案例。

AI基础设施市场趋势

硬体部分:AI基础设施的关键

- 市场规模与成长:硬体部分是AI基础设施市场的支柱。 2022年占73.70%的市场占有率,价值345.2亿美元。预计到 2028 年将以 19.19% 的复合年增长率成长,达到 1,002.9 亿美元。

- 处理器子区隔领先:处理器的价值将在 2022 年达到 207.3 亿美元,预计到 2028 年将达到 575.6 亿美元,这得益于需要更强大处理能力的人工智慧演算法的复杂性不断增加。

- 客製化趋势:企业正在转向自订AI晶片,例如华为的Ascend 910 AI处理器,它使用TensorFlow展示了比通用卡快两倍的训练速度。

- 边缘运算的影响:边缘运算的兴起正在塑造人工智慧处理器的发展。製造商正专注于能够在使用点进行即时资料处理的处理器,尤其是对于物联网应用。

- 混合处理器:该公司正在开发混合 AI 处理器,将 CPU 与 GPU 或 NPU(神经处理单元)结合,以提高各种 AI 应用的多功能性和效率。

北美占据主要市场占有率

云端部分:人工智慧民主化的催化剂

- 快速成长轨迹:云端领域预计将从 2022 年的 161.2 亿美元成长到 2028 年的 492.9 亿美元,复合年增长率为 20.22%。这一成长超过了整体市场的复合年增长率,并证明了云端解决方案在人工智慧基础设施中的重要作用。

- 人工智慧民主化:云端基础的人工智慧基础设施降低了采用的门槛,使得各种规模的企业都可以使用人工智慧技术。这种民主化加速了数位转型并促进了创新。

- 扩充性和灵活性:云端平台提供无与伦比的可扩展性,使企业能够轻鬆管理资料密集型模型训练和推理等人工智慧工作负载。

- 人工智慧即服务的兴起:人工智慧即服务 (AIaaS) 的兴起使企业能够使用预先训练的模型和工具集。例如,Nvidia 的 DGX Cloud 提供用于训练 AI 模型的超级运算服务,而 Salesforce 的 AI Cloud 提供企业级 AI 工具。

- 策略合作:AI 硬体供应商和云端平台之间的合作,例如 Google Cloud 与新加坡智慧国家倡议的合作,正在创建特定领域的 AI 云端解决方案。

- 市场展望:AI基础设施市场将随着硬体和云端两部分的协同发展而持续演进。随着人工智慧应用越来越广泛,对可扩展且强大的基础设施的需求将会成长,从而刺激人工智慧硬体和云端原生解决方案的专业化。

AI基础设施产业概览

科技巨头引领市场 AI基础设施市场由英特尔、Nvidia、IBM、微软和三星等科技巨头主导。这些公司凭藉丰富的资源、全面的人工智慧解决方案和全球影响力占据了相当大的市场占有率。

NVIDIA DGX 云端服务:这项 AI 超级运算服务使企业能够训练先进的生成式 AI 模型,彰显了该公司在提供端到端 AI 基础设施解决方案方面的领导地位。

IBM 和微软混合解决方案:两家公司正在开发整合 AI 功能的混合云端解决方案,帮助企业在多种环境中有效部署 AI。

大量研发投入:领先的公司在研发方面投入大量资金,以保持竞争力并确保其处于人工智慧技术进步的前沿。

创新和专业化驱动市场成功AI基础设施市场的成功取决于持续的创新和特定产业的专业化。

思科的生成式人工智慧解决方案思科推出了由生成式人工智慧驱动的全新网路、安全性和可观察性解决方案,强调了创新对于获得竞争优势的重要性。

Mphasis.ai 的行业重点:Mphasis 专注于将 AI 功能整合到现有技术环境中,以优化特定领域的业务效率。

策略伙伴关係:Google Cloud 对 AI 咨询服务的扩展说明了公司如何利用策略联盟来扩大其产品范围并进入新市场。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 消费者议价能力

- 供应商的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- COVID-19 市场影响

第五章 市场动态

- 市场驱动因素

- 高效能运算资料中心对人工智慧硬体的需求不断增加

- 扩大工业物联网和自动化技术的应用

- 拓展机器学习与深度学习技术的应用

- 汽车和医疗保健等行业会产生大量资料

- 市场限制

- 业界缺乏熟练的专业人才

第六章 市场细分

- 按产品

- 硬体

- 处理器

- 贮存

- 记忆

- 软体

- 硬体

- 按部署

- 本地

- 云

- 杂交种

- 按最终用户

- 企业

- 政府

- 云端服务供应商

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 亚洲

- 中国

- 印度

- 韩国

- 日本

- 澳洲和纽西兰

- 拉丁美洲

- 巴西

- 墨西哥

- 中东和非洲

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 卡达

- 以色列

- 南非

- 北美洲

第七章 竞争格局

- 公司简介

- Intel Corporation

- Nvidia Corporation

- Samsung Electronics Co. Ltd

- Micron Technology Inc.

- Sensetime Group Inc.

- IBM Corporation

- Google LLC

- Microsoft Corporation

- Amazon Web Services Inc.

- Cisco Systems Inc.

- Arm Holdings

- Dell Inc.

- Hewlett Packard Enterprise Development LP

- Advanced Micro Devices

- Synopsys Inc.

第八章投资分析

第九章:市场的未来

The AI Infrastructure Market size is estimated at USD 82.23 billion in 2025, and is expected to reach USD 205.65 billion by 2030, at a CAGR of 20.12% during the forecast period (2025-2030).

AI Infrastructure Market: Driving Innovation and Efficiency

Key Highlights

- Demand Surge in High-Performance Computing Data Centers: The AI Infrastructure market is experiencing exponential growth, driven by increasing demand for AI hardware in high-performance computing (HPC) data centers. Businesses are realizing the transformative potential of artificial intelligence, fueling investments across various industries.

- Nvidia's BlueField-3 DPU: This technology, the world's first 400GbE data processing unit (DPU), is ten times faster than its predecessor, underscoring significant advancements in AI hardware.

- Google Cloud and Intel Collaboration: These tech giants jointly developed a chip designed to enhance AI capabilities, security, and productivity in data centers, marking a trend of strategic partnerships.

- AMD's MI300X Series: Advanced Micro Devices Inc. introduced the MI300X chip series, enabling the execution of generative AI models with up to 80 billion parameters, demonstrating the escalating complexity of AI models.

- IIoT and Automation Technologies Propelling Growth: The integration of Industrial Internet of Things (IIoT) and automation technologies is significantly boosting the AI Infrastructure market. These innovations are enhancing efficiency, optimizing processes, and generating valuable data.

- AFCOM 2021 Study Results: Over 40% of participants plan to deploy robotics and automation in data center monitoring and maintenance by 2024, signaling a sharp rise in automation.

- Advantech and Actility Integration: These companies launched an AI-based solution for machine prognostics and health management, enabling real-time machine status monitoring.

- TD SYNNEX's Data-IoTSolv: This solution suite equips partners with tools for leveraging data analytics and IoT, illustrating the growing demand for AI-powered IoT solutions.

- Machine Learning and Deep Learning Driving Innovation: Machine learning and deep learning technologies are critical drivers of AI infrastructure growth, empowering companies to extract valuable insights from massive datasets.

- TAZI.AI's Funding Success: The startup secured $4.6 million to roll out machine learning solutions in healthcare, insurance, and pharmaceuticals, highlighting sector-specific AI adoption.

- Government Sector Utilization: Machine learning is increasingly used in government sectors to automate operations and analyze data, freeing human resources for core functions.

- Pandemic-Era Acceleration: The pandemic sped up AI and ML adoption for network automation, with network providers recognizing the essential role of AI in operational streamlining.

- Data Explosion in Automotive and Healthcare Sectors: The growing volume of data in industries like automotive and healthcare is propelling the need for advanced AI technologies to manage and analyze data efficiently.

- Alpine Health Systems' AI-Powered Platform: This platform simplifies hospital discharge processes for patients with complex medical conditions, demonstrating AI's potential in healthcare management.

- Intangles Lab's Ambient Cognitive AI for EVs: This innovation addresses range anxiety in electric vehicles, particularly in the commercial EV sector.

- AI in Healthcare Applications: AI is increasingly used for clinical decision-making, disease diagnosis, and patient data management, showcasing its versatility in healthcare.

- Market Landscape and Future Outlook: The AI Infrastructure market is poised for sustained growth, led by a mix of tech giants, startups, and cloud providers delivering cutting-edge solutions.

- Cloud Segment Growth: The AI Infrastructure cloud market, valued at $16.12 billion in 2022, is forecasted to reach $49.29 billion by 2028, reflecting a CAGR of 20.22%.

- North American Market Leadership: North America led the AI infrastructure market in 2022 with $19.57 billion in value, projected to hit $56.59 billion by 2028, growing at a 19.10% CAGR.

- Emerging Technologies: Innovations like quantum computing, 6G connectivity, and advanced robotics are expected to push the boundaries of AI infrastructure capabilities, enabling new applications and use cases.

AI Infrastructure Market Trends

Hardware Segment Cornerstone of AI Infrastructure

- Market Size and Growth: The hardware segment is the backbone of the AI Infrastructure market. In 2022, it accounted for 73.70% of the market share, valued at $34.52 billion. It is expected to grow at a CAGR of 19.19%, reaching $100.29 billion by 2028.

- Processor Subsegment Leads: Processors were valued at $20.73 billion in 2022 and are forecasted to reach $57.56 billion by 2028, driven by the increasing complexity of AI algorithms requiring more powerful processing.

- Customization Trend: Companies are shifting towards custom AI chips, like Huawei's Ascend 910 AI processor, which demonstrated twice the training speed of common cards using TensorFlow.

- Edge Computing Influence: The rise of edge computing is shaping AI processor development. Manufacturers are focusing on processors that enable real-time data processing at the point of use, particularly in IoT applications.

- Hybrid Processors: Companies are developing hybrid AI processors that combine CPUs with GPUs or Neural Processing Units (NPUs), enhancing versatility and efficiency for diverse AI applications.

North America to Hold Major Market Share

Cloud Segment: Catalyst for AI Democratization

- Rapid Growth Trajectory: The cloud segment, valued at $16.12 billion in 2022, is projected to grow at a 20.22% CAGR, reaching $49.29 billion by 2028. This growth is outpacing the overall market CAGR, signaling the critical role of cloud solutions in AI infrastructure.

- Democratization of AI: Cloud-based AI infrastructure lowers adoption barriers, making AI technologies accessible to businesses of all sizes. This democratization accelerates digital transformation and fosters innovation.

- Scalability and Flexibility: Cloud platforms offer unmatched scalability, enabling enterprises to easily manage AI workloads, such as model training and inference, which are data-intensive.

- AI-as-a-Service Proliferation: The rise of AI-as-a-Service (AIaaS) allows companies to access pre-trained models and toolsets. For example, Nvidia's DGX Cloud offers supercomputing services for AI model training, while Salesforce's AI Cloud delivers enterprise-ready AI tools.

- Strategic Collaborations: Collaborations between AI hardware providers and cloud platforms, such as Google Cloud's partnership with Singapore's Smart Nation initiative, are creating sector-specific AI cloud solutions.

- Market Outlook: The AI Infrastructure market will continue to evolve with the hardware and cloud segments developing synergistically. As AI applications proliferate, the demand for scalable, robust infrastructure will grow, spurring further specialization in AI hardware and cloud-native solutions.

AI Infrastructure Industry Overview

Tech Giants Lead the Market: The AI Infrastructure market is dominated by tech giants like Intel, Nvidia, IBM, Microsoft, and Samsung. These companies hold significant market share due to their extensive resources, comprehensive AI solutions, and global reach.

Nvidia's DGX Cloud Service: This AI supercomputing service enables businesses to train sophisticated generative AI models, showcasing the company's leadership in providing end-to-end AI infrastructure solutions.

IBM and Microsoft Hybrid Solutions: Both companies have developed hybrid cloud solutions that integrate AI capabilities, empowering enterprises to deploy AI across various environments efficiently.

Substantial R&D Investments: Leading players invest heavily in research and development to maintain their competitive edge, ensuring they stay at the forefront of AI technology advancements.

Innovation and Specialization Drive Market Success: Success in the AI Infrastructure market hinges on continuous innovation and industry-specific specialization.

Cisco's Generative AI Solutions: Cisco introduced new network, security, and observability offerings powered by generative AI, highlighting the importance of innovation in gaining a competitive edge.

Mphasis.ai's Industry Focus: Mphasis focuses on integrating AI capabilities into existing technological environments, optimizing operational efficiency in specific sectors.

Strategic Partnerships: Google Cloud's expansion of AI consulting services exemplifies how companies can leverage strategic collaborations to broaden their offerings and tap into new markets.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Consumers

- 4.2.2 Bargaining Power of Suppliers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand for AI Hardware in High-performance Computing Data Centers

- 5.1.2 Increasing Applications of IIoT and Automation Technologies

- 5.1.3 Rising Application of Machine Leaning and Deep Learning Technologies

- 5.1.4 Huge Volume of Data Being Generated in Industries such as Automotive and Healthcare

- 5.2 Market Restraints

- 5.2.1 Lack of Skilled Professionals in the Industry

6 MARKET SEGMENTATION

- 6.1 By Offering

- 6.1.1 Hardware

- 6.1.1.1 Processor

- 6.1.1.2 Storage

- 6.1.1.3 Memory

- 6.1.2 Software

- 6.1.1 Hardware

- 6.2 By Deployment

- 6.2.1 On-premise

- 6.2.2 Cloud

- 6.2.3 Hybrid

- 6.3 By End User

- 6.3.1 Enterprises

- 6.3.2 Government

- 6.3.3 Cloud Service Providers

- 6.4 By Geography

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.2 Europe

- 6.4.2.1 United Kingdom

- 6.4.2.2 Germany

- 6.4.2.3 France

- 6.4.2.4 Italy

- 6.4.2.5 Spain

- 6.4.3 Asia

- 6.4.3.1 China

- 6.4.3.2 India

- 6.4.3.3 South Korea

- 6.4.3.4 Japan

- 6.4.4 Australia and New Zealand

- 6.4.5 Latin America

- 6.4.5.1 Brazil

- 6.4.5.2 Mexico

- 6.4.6 Middle East and Africa

- 6.4.6.1 Saudi Arabia

- 6.4.6.2 United Arab Emirates

- 6.4.6.3 Qatar

- 6.4.6.4 Israel

- 6.4.6.5 South Africa

- 6.4.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Intel Corporation

- 7.1.2 Nvidia Corporation

- 7.1.3 Samsung Electronics Co. Ltd

- 7.1.4 Micron Technology Inc.

- 7.1.5 Sensetime Group Inc.

- 7.1.6 IBM Corporation

- 7.1.7 Google LLC

- 7.1.8 Microsoft Corporation

- 7.1.9 Amazon Web Services Inc.

- 7.1.10 Cisco Systems Inc.

- 7.1.11 Arm Holdings

- 7.1.12 Dell Inc.

- 7.1.13 Hewlett Packard Enterprise Development LP

- 7.1.14 Advanced Micro Devices

- 7.1.15 Synopsys Inc.