|

市场调查报告书

商品编码

1406129

汽车废热回收系统:市场占有率分析、产业趋势/统计、成长预测,2024-2029Automotive Exhaust Heat Recovery System - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

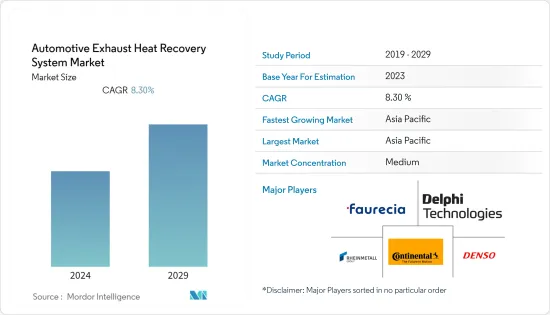

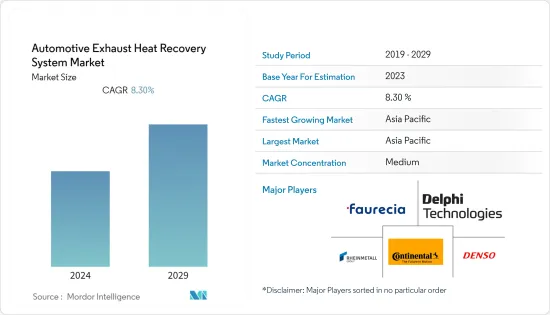

目前汽车废热回收系统市场规模估计为237亿美元。

预计预测期内复合年增长率为 8.3%,到预测期结束时将达到 354 亿美元。

汽车废热回收系统市场是汽车产业快速发展的领域。它的重点是利用和利用车辆排气系统产生的废热,以提高整体效率、减少排放气体并提高燃油效率。由于环境问题、严格的排放法规以及对提高燃油效率的持续追求,该技术受到了极大的关注和重视。

随着排放法规的收紧迫使汽车製造商优化燃烧并减少有害排放气体,全球范围内越来越多地采用废热回收系统。此外,高温合金和陶瓷等先进材料的开发正在提高这些零件的效率和耐用性。

汽车废热回收系统市场的另一个主要驱动因素是小客车和商用车的销售。小客车销量从 2021 年的 5,640 万美元成长到 2022 年的 5,740 万美元,推动了汽车废热回收系统市场的成长。

汽车废热回收系统市场趋势

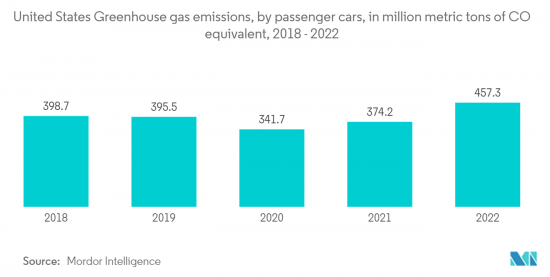

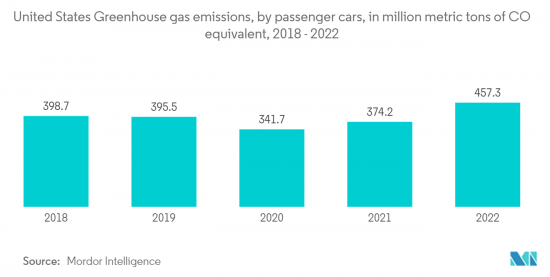

严格的废气法规推动市场成长

2023 年 4 月,美国环保署 (EPA) 公布了标准更新,旨在进一步减少轻型和中型车辆有害空气污染物的排放。该提案以 EPA 2023 年至 2026 年小客车和轻型卡车联邦温室气体排放标准为基础。它利用清洁汽车技术的进步,为美国人提供各种好处。这包括减少气候污染、改善公共卫生以及透过减少燃料和维护成本来节省成本。

提案的标准预计将要求汽车製造商进一步优化燃烧并大幅减少排放气体。为了满足这些严格的标准,汽车製造商越来越多地转向废热回收系统(EHRS)。这是一项有效的技术,可以回收废热以提高引擎整体效率并最终减少排放气体。

作为这些标准的一部分,重点是提高燃油效率。 EHRS 透过回收和利用废热来完成有用功并降低车辆燃油消费量,在实现更好的燃油效率方面发挥重要作用。

亚太地区预计成长最快

2022年,亚太地区将占全球汽车销售的大部分,达到58%,反映出汽车产业快速技术创新带来的需求大幅成长。

亚太地区人口占全球近60%,预计在预测期内该地区的汽车需求量最高。该地区的政府法规也变得更加严格。例如,印度政府制定了BS-VI标准来控制车辆排放的污染物。这是因为废热回收系统不仅降低了汽车排放污染物的比例,而且还提高了汽车的燃油效率。随着当地污染水平的上升,人们的环保意识越来越强,并担心他们购买的汽车的排放气体。

中国排放法规的快速发展和收紧,迫使製造商进一步永续地减少颗粒物和氮氧化物排放,以符合现行的中国 6a 排放法规。因此,公路和非公路领域的商用车需要采取额外的废气再循环措施。

汽车废热回收系统产业概况

汽车废热回收系统是一个分散且竞争激烈的市场,由于市场上存在多个製造商,并且采取了密集的研发活动、新产品开发和收购等各种策略。

- 2022年8月,博世收购了两台SLM500机组,并为其进军增材製造领域提供了重大推动力。这项策略性投资将增强博世采用3D列印技术的能力,进一步推动汽车产业的发展。

- 2023年1月,通用汽车宣布将投资9.18亿美元在美国的四家工厂增加V8汽油引擎的产量。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场驱动因素

- 市场抑制因素

- 波特五力分析

- 供应商的议价能力

- 买家/消费者的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章市场区隔

- 科技

- 废气再循环(EGR)

- 涡轮增压器

- 车辆类型

- 小客车

- 商用车

- 地区

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 德国

- 英国

- 法国

- 其他欧洲国家

- 亚太地区

- 印度

- 中国

- 日本

- 韩国

- 其他亚太地区

- 其他地区

- 巴西

- 阿拉伯聯合大公国

- 其他的

- 北美洲

第六章 竞争形势

- 供应商市场占有率

- 公司简介

- Delphi Technologies

- Valeo Service

- Denso

- Faurecia

- Mahle

- Rheinmetall Automotive

- Mitsubishi Electric

- Calsonic Kansai

- Continental AG

- Borgwarner

第七章 市场机会及未来趋势

The Automotive Exhaust Heat Recovery market is estimated to be valued at USD 23.7 billion in the current year. It is expected to reach USD 35.4 billion by the end of the forecast period, registering a CAGR of 8.3% during the forecast period.

The Automotive exhaust heat recovery market is a rapidly evolving sector within the automotive industry. It focuses on harnessing and utilizing waste heat generated by a vehicle's exhaust system to enhance overall efficiency, reduce emissions, and improve fuel economy. This technology gained significant attention and importance due to environmental concerns, stricter emission regulations, and the continuous quest for improved fuel efficiency.

The adoption of exhaust heat recovery systems is on the rise globally as stricter emission standards push automakers to optimize combustion and reduce harmful emissions. Furthermore, the development of advanced materials, like heat-resistant alloys and ceramics, is enhancing the efficiency and durability of these components. Also, governments and regulatory bodies incentivize automakers through credits for adopting fuel-saving technologies, including exhaust heat recovery systems.

Another major driver for the Automotive Exhaust Heat recovery systems market is the sales of passenger cars and commercial vehicles. The increase in passenger car sales from USD 56.4 million in 2021 to USD 57.4 million in 2022 is contributing to the growth of the automotive exhaust heat recovery market.

Automotive Exhaust Heat Recovery System Market Trends

Strict Emission Regulations Driving the Market Growth

In April 2023, the Environmental Protection Agency (EPA) revealed updated standards aimed at further decreasing harmful air pollutant emissions from light-duty and medium-duty vehicles, with the initial implementation set for model year 2027. This proposal is built upon EPA's previous federal greenhouse gas emissions standards for passenger cars and light trucks covering model years 2023 through 2026. It harnesses the advancements in clean car technology to deliver a range of benefits to the American population. It includes reduced climate pollution, enhanced public health, and cost savings for drivers due to reduced fuel and maintenance expenses.

The proposed standards are expected to require automakers to further optimize combustion and reduce emissions significantly. To meet these stringent standards, automakers may increasingly turn to exhaust heat recovery systems (EHRS). It is an effective technology to recover waste heat and improve overall engine efficiency, ultimately leading to lower emissions.

As part of these standards, there is an emphasis on improving fuel economy. EHRS can play a crucial role in achieving better fuel efficiency by capturing and utilizing exhaust heat to perform useful work, thus reducing the fuel consumption of vehicles.

Asia-Pacific is Expected to be the fastest growing region

In 2022, Asia-Pacific accounted for the majority of global vehicle sales at 58%, reflecting a significant surge in demand owing to rapid technological innovations in the automotive industry.

Asia-Pacific accounts for almost 60 % of the world's population, and the demand for vehicles is expected to be the highest in the region for the forecasted period. Also, government regulations are becoming strict in the region. For example, BS-VI standards are enforced by Govt. of India to regulate the expelled pollutants from motor vehicles. With the addition of environmental norms, exhaust heat recovery systems will be more in demand as these systems not only reduce the percentage of pollutants coming out from the vehicles but also increase the fuel efficiency of the vehicle. With the growing pollution levels in the region, people are becoming more aware of the environment and more concerned about the emissions from the cars they purchase.

The rapidly progressing and tightening of exhaust emission standards in China is forcing manufacturers to achieve a further sustained reduction in particulate and nitrogen oxide emissions in order to comply with the current Chinese 6a emissions standard. Additional exhaust-gas recirculation measures are thus mandatory for commercial vehicles in the on and off-highway sector.

Automotive Exhaust Heat Recovery System Industry Overview

Key exhaust heat recovery system participants are Continental AG, Delphi Technologies, Denso, Faurecia, Rheinmetall Automotive, and others. The automotive exhaust heat recovery system is a fragmented and competitive market due to the presence of several manufacturers in the market, owing to various strategies such as focused research and development activities, new product developments, acquisitions, etc. For instance,

- In August 2022, Bosch acquired two SLM500s, a move that significantly boosted its expansion into the additive manufacturing sector. This strategic investment further propels the automotive industry by strengthening Bosch's capabilities in adopting 3D printing technologies.

- In January 2023, General Motors announced a substantial investment of USD 918 million across four US plants to bolster the production of V8 gasoline engines.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Technology

- 5.1.1 Exhaust Gas Recirculation (EGR)

- 5.1.2 Turbocharger

- 5.2 Vehicle Type

- 5.2.1 Passenger Car

- 5.2.2 Commercial Vehicle

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 India

- 5.3.3.2 China

- 5.3.3.3 Japan

- 5.3.3.4 South Korea

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 Rest of the World

- 5.3.4.1 Brazil

- 5.3.4.2 United Arab Emirates

- 5.3.4.3 Other Countries

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Delphi Technologies

- 6.2.2 Valeo Service

- 6.2.3 Denso

- 6.2.4 Faurecia

- 6.2.5 Mahle

- 6.2.6 Rheinmetall Automotive

- 6.2.7 Mitsubishi Electric

- 6.2.8 Calsonic Kansai

- 6.2.9 Continental AG

- 6.2.10 Borgwarner