|

市场调查报告书

商品编码

1406167

道德标籤:市场占有率分析、产业趋势/统计、成长预测,2024-2029Ethical Label - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

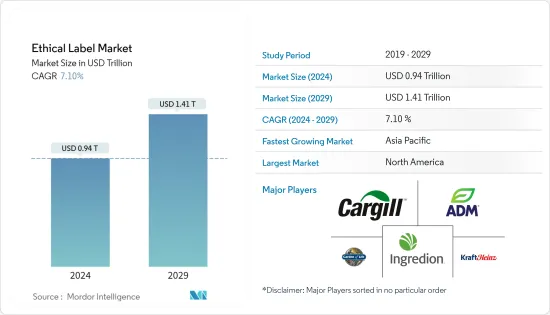

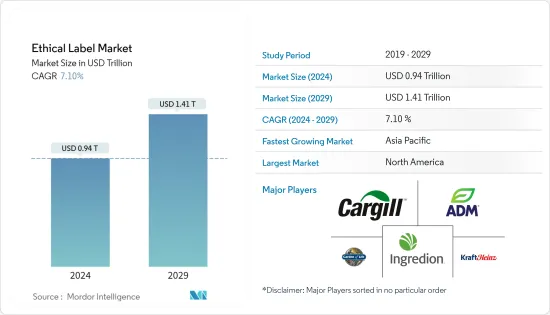

道德标籤市场规模预计到 2024 年将达到 9,400 亿美元,预计到 2029 年将达到 1.41 兆美元,预测期内(2024-2029 年)复合年增长率为 7.10%。

对正确食品消费的高度认识和关注正在推动食品和饮料公司提高透明度并为其产品采用道德标籤。

主要亮点

- 消费者对永续实践、公平贸易和道德采购的兴趣日益浓厚,正在推动道德标籤市场的发展。随着消费者越来越想知道个别食品如何影响环境,这个市场正在不断成长。道德标籤市场是由某些食品和食品和饮料的接受程度以及消费者消费习惯的变化所推动的。犹太和穆斯林消费者的贡献归功于犹太洁食和清真道德认证产品的兴起。

- 在生产和消费中倡导高道德标准越来越影响公司选择道德标籤,以促进遵守环境永续性、动物福利、社会正义、平等、更有前途的职场和工人素质,从而提振市场。

- 许多人群,尤其是千禧世代,在提高对健康、清洁和认证产品的意识方面具有很大影响力。这种趋势也蔓延到婴儿潮世代。消费者正逐渐转向更有营养的饮食习惯。根据《世界有机贸易指南》,2022 年日本健康与保健 (HW) 包装食品和饮料的零售达到约 563 亿美元。该行业正在稳步增长,预计到 2025 年将超过 573 亿美元。

- 然而,道德标籤通常需要额外的认证和合规措施,这可能会导致製造商和供应商的成本增加。这些额外成本可以转嫁给消费者,使得道德产品比不道德的替代品相对更昂贵。

- 研究市场的另一个抑制因素是某些地区和市场上带有道德标籤的产品的供应有限。这可能是由于多种因素造成的,包括产能有限、分销挑战以及某些地区需求不足。标准化道德标籤法规和指南还可以提高市场的透明度和一致性。

道德标籤市场趋势

饮料占最高市场占有率

- 由于人们对酒精、碳酸和砂糖饮料消费的担忧日益加剧,预计饮料业将占据强劲的市场占有率。

- 此外,饮料行业在维持道德对待动物和确保安全方面的声誉方面面临挑战。包装椰子水和非乳类饮料等植物性饮料的出现也是纯素食者标籤市场的主要动力。

- 据 Kiln & Company 称,健康生活已发展到包括全面的自我护理方法。它鼓励吃健康的有机食品、服用补充品、使用清洁产品、运动和控制压力。为了寻求更环保、更卫生的生活方式,消费者选择被视为「清洁」或「天然」的饮料。声称无无麸质、非基因改造、不含人工色素和防腐剂、有机和草饲的产品正在零售货架上占据越来越多的空间。

- 从地区来看,亚太地区预计将提供巨大的成长机会,因为该地区的经济成长显着增加了消费者的可支配收入并改变了生活方式。预计这些因素将影响该地区包装饮料的需求。根据中国国家统计局数据,2022年11月,中国非酒精饮料产量约1,097万吨。

- 茶、咖啡、可可基饮料和包装水等传统饮料的普及很高。此外,获得清真认证和道德认证的产品用于包装饮用水,也得到了消费者的支持。此外,碳酸饮料等传统饮料中低热量产品的采用也影响了洁净标示的需求。

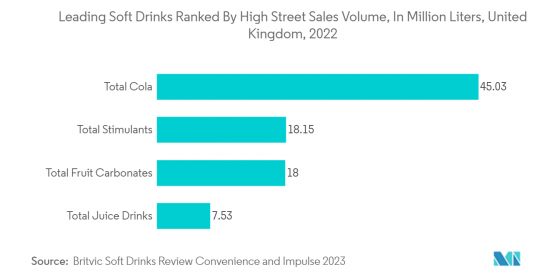

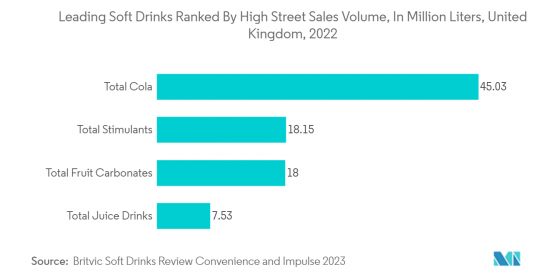

- 由于软性饮料的受欢迎程度和全球消费量的增加,软性饮料在调查市场中占据了很大份额。根据 UNESDA 统计,砂糖、低热量饮料目前占许多欧洲市场销售额的 30%。根据 Britvic Soft Drinks Review Convenience and Impulse 的数据,2022 年英国可乐总销量为 4,503 万公升。

- 此外,饮料行业的製造商正在选择足够利基的道德标籤,以将其与竞争品牌区分开来并吸引广泛的客户。这进一步推动了饮料行业道德标籤市场的成长。

亚太地区预计将出现强劲的市场成长率

- 不断变化的消费者需求和对一致食品品质的需求正在推动亚太地区对道德标籤解决方案的需求,以保持高品质和生产力。

- 亚太地区饮料生产和消费的增加可能为研究市场的成长提供利润丰厚的机会。例如,根据中国国家统计局的数据,2023年1月至2月,中国软性饮料产量约2,690万吨,年增0.5%。此外,2022年11月,中国饮料产量约1,100万吨。此外,2022年8月,中国软性饮料产量约1,885万吨。

- 此外,根据中国国家统计局的数据,2022年中国牛奶产量约3,930万吨,创近年来最高水准。

- 由于繁忙的工作安排、职业女性数量的增加以及向移动消费的转变,该地区对包装食品的大力支持,预计将利用整个食品行业创新和永续的道德标籤市场。增加。这可能会在预测期内推动市场成长。

- 根据加拿大农业和农业食品部统计,近期中国包装食品零售约2,980.1亿美元。此外,预计2025年包装食品零售额将达3,667亿美元。

- 此外,清真、有机和清洁认证等特定细分市场的大量供应商的出现减少了低端和高端产品之间的价格差异,从而软化了转换成本。预计有几家公司将在预测期内扩大其全球业务,特别是在亚太地区。

道德标籤产业概述

道德标籤市场由Archer-Daniels-Midland Company、Cargill Inc. 和 Garden of Life (Nestle SA) 等几家大公司整合并主导。供应商基于产品品质、干净和免费的标籤以及有竞争力的价格进行竞争。透过设计、技术和应用的创新可以获得永续的竞争优势。市场的主要发展包括:

2023 年 3 月,ingredion 在其功能性洁净标示成分解决方案系列中推出了两种柑橘纤维调质剂Fibertex CF 502 和 Fibertex CF 102。此举是为了满足消费者对含有他们认可和熟悉的成分、具有健康益处、食品和新鲜声称的食品日益增长的偏好。这款新型柑橘质调质剂是该公司为满足洁净标示食品日益增长的需求以及日益流行的营养、健康和保健趋势而做出的努力的一部分。

2022 年 3 月,帝斯曼开发了 DelvoGuard 菌种,以满足想要使用洁净标示成分的生产商的需求。该解决方案还有助于延长优格、起司和优酪乳乳製品的保质期。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

- 产业价值链分析

- 评估 COVID-19 对产业的影响

第五章市场动态

- 市场驱动因素

- 消费者健康和道德意识不断增强

- 透过线上零售和企业社会责任活动实现成长

- 减少肉类消费以保护环境

- 市场抑制因素

- 竞争加剧

第六章市场区隔

- 按标籤类型

- 清真

- 有机的

- 干净的

- 永续性和公平贸易标籤

- 动物福利标籤

- 纯素食者标籤

- 其他的

- 依产品类型

- 食品

- 饮料

- 按分销管道

- 离线

- 在线的

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 其他地区

第七章 竞争形势

- 公司简介

- Archer-Daniels-Midland Company

- The Hershey Company

- Cargill Inc

- Go Macro LLC

- Garden of Life(Nestle SA)

- Kerry Group PLC

- Koninklijke DSM NV

- PepsiCo Inc.

- The Kraft Heinz Company

- Ingredion Incorporated

第八章投资分析

第九章 市场机会及未来趋势

The Ethical Label Market size is estimated at USD 0.94 trillion in 2024, and is expected to reach USD 1.41 trillion by 2029, growing at a CAGR of 7.10% during the forecast period (2024-2029).

A high degree of awareness and concern regarding the right food consumption drives food and beverage companies toward transparency and adopting ethical labels for their products.

Key Highlights

- The increased consumer interest in sustainable practices, fair trade, and ethical sourcing drives the ethical labels market. The market is expanding because consumers are increasingly interested in learning how individual food products affect the environment. The ethical labels market is driven by the acceptance of certain foods & beverages and the shift in consumers' consumption habits. The contribution of Jewish and Muslim consumers can be attributed to the rise of kosher and halal ethical-certified products.

- The advocacy of high ethical standards for manufacturing and consumption increasingly influences companies to opt for ethical labels, which promote environmental sustainability, animal well-being, social justice, equality, and adherence to a more promising workplace and worker qualities, thereby boosting the market.

- A sizeable population, especially millennials, has been influential in increasing awareness toward healthy and clean-certified products. This trend is increasing in the baby boomer population as well. There is a gradual shift among consumers toward more nutritious eating habits. According to the Global Organic Trade Guide, in 2022, the retail sales value of health and wellness (HW) packaged food and beverages in Japan amounted to around USD 56.3 billion. The sector was forecast to grow steadily and exceed USD 57.3 billion in 2025.

- However, ethical labels often require additional certifications and compliance measures, which can lead to increased costs for manufacturers and suppliers. These additional costs may be passed on to the consumers, making ethical products relatively more expensive compared to non-ethical alternatives.

- Another restraint for the studied market is the limited availability of products with ethical labels in some regions or markets. This can be due to various factors like limited production capacity, distribution challenges, or lack of demand in certain areas. Also, standardized regulations or guidelines for ethical labeling can create clarity and consistency in the market.

Ethical Label Market Trends

Beverages To Occupy Highest Market Share

- The beverage industry is anticipated to occupy a robust market share as there is a growing concern over consuming alcoholic, carbonated, and sugar-based beverages; now, the focus has shifted toward non-alcoholic, plant-based alternative beverages among health-conscious consumers worldwide.

- Further, the beverage industry faces challenges in maintaining the reputation of ethical treatment of animals and ensuring safety. The emergence of plant-based beverages, like packaged coconut water and non-dairy milk beverages, is another primary driver for the vegan label market.

- According to Kilne & Company, healthy living has evolved to include a holistic approach to self-care. This encourages eating a healthy organic diet, taking supplements, using cleaner products, exercising, and managing stress. In their quest to live greener and more hygienic, consumers choose beverages they perceive as 'clean' or 'natural.' Products claiming to be gluten-free, non-GMO, free of artificial colors and preservatives, organic, and grass-fed are gaining more and more space on retail shelves.

- In terms of geography, the Asia-Pacific region is expected to offer significant growth opportunities as the economic growth of the region has significantly enhanced the disposable income of the consumers, along with a changing lifestyle. These factors are expected to influence the demand for packaged beverages in this region. According to the National Bureau of Statistics of China, in November 2022, about 10.97 million metric tons of non-alcoholic beverages were produced in China.

- Conventional beverages such as tea, coffee, cocoa-based, and packaged water are witnessing high adoption. Additionally, halal, ethical-certified products have found their way into packaged water, gaining consumer traction. Further, adopting low-calorie variants in conventional beverages, such as carbonated soft drinks, also influences the demand for clean labels.

- Soft drinks hold a substantial share of the market studied, owing to the popularity of such beverages and increasing consumption worldwide. Soft drinks offer various flavors and formats to suit every drinking occasion; according to UNESDA, sugar-free, low-calorie beverages currently account for up to 30 percent of sales in many European markets. According to Britvic Soft Drinks Review Convenience and Impulse, the total cola sales volume was 45.03 million liters in 2022 in the United Kingdom.

- Moreover, manufacturers in the beverage industry are choosing ethical label which is niche enough to differentiate them from other competitor brands and want to appeal to a broad base of customers. This is further fueling the growth of the ethical label market in the beverage industry.

The Asia Pacific Region is Anticipated to Register Robust Market Growth Rate

- The changing consumer demand and the need for consistent food quality have created the need for ethical labeling solutions to maintain high quality and productivity in the Asia Pacific region.

- The increasing beverage production and consumption in the Asia Pacific region is likely to offer lucrative opportunities for the growth of the studied market. For instance, according to the National Bureau of Statistics of China, in January and February 2023, around 26.9 million metric tons of soft drinks were produced in China, showing a 0.5 percent increase compared to the same period of the previous year. In addition, in November 2022, approximately 11 million metric tons of beverages were produced in China. Furthermore, in August 2022, approximately 18.85 million metric tons of soft drinks were produced in China.

- Further, according to the National Bureau of Statistics of China, in 2022, China had an output of approximately 39.3 million metric tons of cow's milk, the highest volume in recent years.

- In the region, packaged foods are gaining high traction owing to busy work schedules, the rising number of working women, and the shift toward on-the-go consumption, which is anticipated to increase the utilization of innovative and sustainable ethical label markets across the food sector. This is likely to fuel the market's growth during the forecast period.

- According to Agriculture and Agri-Food Canada, packaged food retail sales in China were about USD 298.01 billion recently. Further, the packaged food retail sales are expected to reach USD 366.7 billion in 2025.

- Additionally, the switching cost is becoming moderate due to the decreasing price differentiation of low-end and high-end products due to the emergence of numerous vendors in certain segments like halal, organic, and clean certifications. Several players are anticipated to expand their presence worldwide during the forecast period, especially in the APAC region.

Ethical Label Industry Overview

The ethical label market is consolidated and dominated by a few major players like Archer-Daniels-Midland Company, Cargill Inc., Garden of Life (Nestle S.A.), etc. The vendors compete based on product quality, clean, free tags, and competitive pricing. Sustainable competitive advantage can be gained through design, technology, and application innovation. Some of the key developments in the market are:

In March 2023, ingredion introduced two citrus fiber texturizers, Fibertex CF 502 and Fibertex CF 102, to its range of functional, clean-label ingredient solutions. This move is in response to the increasing consumer preference for food products containing ingredients they recognize and are familiar with and those that are beneficial to health and have natural, fresh claims. The new citrus-based texturizers are part of the company's effort to meet the accelerated demand for clean-label food and the rising popularity of nutrition, health, and wellness trends.

In March 2022, DSM developed DelvoGuard cultures to meet the needs of producers who want to use clean-label ingredients. This solution also helps to extend the storage life of dairy products like yogurt, cheese, and sour cream.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of the Impact of COVID-19 on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increased Consumer Conscious toward Health and Ethical Values

- 5.1.2 Growth due to Online Retailing and CSR Activities

- 5.1.3 Reduction in Meat Consumption for Environmental Sustainability

- 5.2 Market Restraints

- 5.2.1 Increasing Competition Among Players

6 MARKET SEGMENTATION

- 6.1 By Label Type

- 6.1.1 Halal

- 6.1.2 Organic

- 6.1.3 Clean

- 6.1.4 Sustainability and Fairtrade labels

- 6.1.5 Animal Welfare Labels

- 6.1.6 Vegan Labels

- 6.1.7 Other Label Types

- 6.2 By Product Type

- 6.2.1 Food

- 6.2.2 Beverages

- 6.3 By Distribution Channel

- 6.3.1 Offline

- 6.3.2 Online

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia-Pacific

- 6.4.4 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Archer-Daniels-Midland Company

- 7.1.2 The Hershey Company

- 7.1.3 Cargill Inc

- 7.1.4 Go Macro LLC

- 7.1.5 Garden of Life (Nestle S.A.)

- 7.1.6 Kerry Group PLC

- 7.1.7 Koninklijke DSM N.V

- 7.1.8 PepsiCo Inc.

- 7.1.9 The Kraft Heinz Company

- 7.1.10 Ingredion Incorporated