|

市场调查报告书

商品编码

1406186

零信任安全:市场占有率分析、产业趋势/统计、2024-2029 年成长预测Zero Trust Security - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

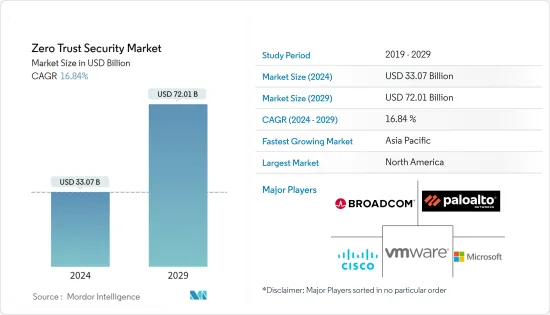

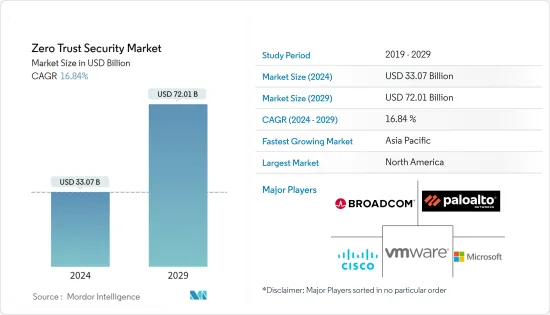

预计到 2024 年,零信任安全市场规模将达到 330.7 亿美元,预计到 2029 年将达到 720.1 亿美元,在预测期内(2024-2029 年)复合年增长率为 16.84%。

主要亮点

- 近年来,一种称为「零信任安全」的不断发展的网路安全策略获得了广泛的关注和接受。零信任方法的前提是「从不信任,始终检验」这句格言,并假设威胁可能来自内部和外部来源。随着企业越来越意识到需要在威胁环境更加复杂和动态的环境中保护其网路、应用程式和资料,对零信任安全解决方案的需求也在不断增长。

- 随着网路威胁的数量和复杂性不断增加,包括资料外洩、勒索软体攻击和内部威胁,组织越来越注重实施零信任等强大的安全措施。 COVID-19 的爆发加速了远距工作的普及,增加了攻击面。零信任是保护分散式远距劳动力的关键策略。

- 向云端运算的转变迫使组织重新考虑他们的安全状况。零信任支援安全存取云端基础的应用程式和资料,非常适合云端优先计划。组织必须开发强大的资料保护机制,以遵守 GDPR 和 CCPA 等严格的资料隐私法,而零信任可以实现合规性。企业越来越多地在各个领域利用零信任框架作为基本安全策略。传统的基于边界的范式正在被放弃。大型科技公司正在收购零信任安全业务,以改善其安全服务。

- 组织正在采用 DevOps 策略并将零信任概念纳入其 DevOps 管道中,以确保安全性成为开发过程的一部分。专注于安全远端存取的零信任网路存取 (ZTNA) 领域出现了显着成长。考虑到远端工作的普及以及安全存取公司资源的需要,这一点尤其重要。彻底实施零信任策略具有挑战性且耗时。身分和存取管理、网路安全和分析是组织需要规划和整合的一些要素。

- 零信任对于安全至关重要,但企业必须在严格的安全措施与流畅有效的使用者体验之间取得平衡。要找到理想的平衡是很困难的。许多公司继续使用过时的架构和系统,这使得实施零信任原则变得困难。从这些系统迁移需要时间和精力。使用者资讯外洩和内部威胁仍然是主要的安全问题。网路钓鱼和其他社会工程攻击仍然是常见的攻击方法。

- 不断变化的威胁情势和对彻底安全措施的需求正在导致全球零信任安全市场的显着扩张。然而,企业面临重大挑战,因为他们使用的是过时的作业系统、基础设施和应用程式。抵制这些组件采用零信任概念应该会提高更广泛的市场采用率。

- COVID-19大流行产生了积极影响,提供了非接触式付款模式,包括线上和实体交易。这包括广泛的数位基础设施,并使金融系统面临网路安全漏洞,从而对零信任安全等强大的安全模型产生了巨大的需求。例如,根据印度储备银行 (RBI) 的数据,2022 财年印度各地进行了约 710 亿笔数付款。这比前三年有显着成长。

零信任安全市场趋势

BFSI 部门成为最大的最终用户

- 国际货币基金组织 (IMF) 表示,银行、金融服务和保险 (BFSI) 领域内的金融和技术互连促进了网路攻击的迅速扩散,导致整个金融生态系统的广泛破坏和敏感资讯损失。它正在造成损失。网路安全对金融稳定构成重大威胁,尤其是在新兴经济体。

- 国际货币基金组织最近对 51 个国家进行的一项调查发现,新兴市场的大多数金融监督仍需要引入网路安全法规或建立资源来执行这些法规。调查发现,56%的央行机构需要国家网路战略,42%的机构缺乏专门的网路安全或风险管理法规,68%的机构缺乏专门的风险部门;特别强调的是,64%的机构不需要测试和演练网路安全措施。

- 根据 IBM 的《2022 年资料外洩成本》报告,2022 年资料外洩事件激增。同年平均资料外洩成本达 435 万美元,较 2021 年成长 2.6%。该报告还发现,包括银行在内的 83% 的组织将在 2022 年报告至少一起资料外洩事件。

- 随着银行和金融机构将其平台迁移到云端,云端的采用在全球银行和金融领域迅速普及。随着混合云的兴起,企业越来越多地评估跨多个云端供应商分发服务的好处。多重云端方法和互联网服务的激增正在推动更多消费者使用互联网和行动应用程式进行交易。

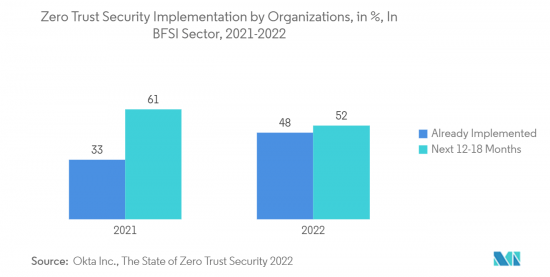

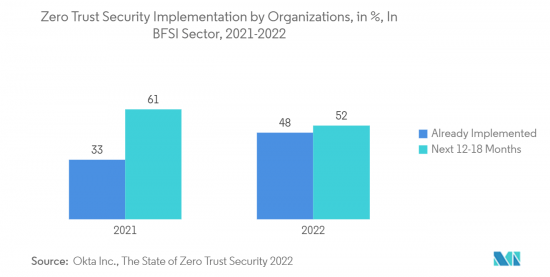

- BFSI 产业是全球经济最重要的部门之一,由大公司主导。几家领先的零售、商业和投资银行公司正在采用零信任网路安全方法,以确保现代企业的普遍存在并应对不断发展的商业模式的挑战。根据《2022 年零安全状况》,BFSI 领域组织对零信任安全的采用预计将大幅增加。

预计北美将占据较大市场占有率

- 美国是一个已开发经济体,强烈倾向于采用和拥抱先进技术、开拓网路自动化和激增云端基础的服务,为零信任安全市场做出贡献。此外,最终用户产业数位化程度的提高以及Cisco、IBM 公司、供应商 Palo Alto Networks 和 Akamai Technologies 的存在也为市场成长做出了贡献。

- 网路攻击者的典型目标是端点设备、云端基础的应用程式、网路和其他IT基础设施元件。此类攻击背后的主要动机是窃取重要资讯。此类攻击可能会导致业务中断、财务损失、知识产权被盗以及关键和敏感客户资讯的遗失。美国联邦政府正朝着「零信任」迈出重大步伐。 2023 年 1 月,管理与预算办公室发布了一份备忘录,强制联邦政府实施零信任架构(ZTA) 策略,指示各机构在 2024 财政年度结束前实现具体的网路安全措施和目标。这项倡议加强了政府对日益复杂和持续的威胁宣传活动的防御能力。

- 此外,新技术的快速采用以及该国对安全的日益重视正在推动对安全即服务(SaaS) 的需求。持有敏感资讯资料库的行业(例如银行、医疗保健和政府机构)由于包含大量资讯,因此很容易成为骇客的目标。信用卡资料和个人的社会安全号码是骇客攻击的目标资讯。为了保护此类关键资料,需要强大的云端入侵防护和安全解决方案以及适当的网路安全解决方案。为此,分析认为未来几年对零信任解决方案的需求将会增加。

- 2021 年,美国针对组织的勒索软体和网路钓鱼攻击增加,手动程度越来越低,自动化程度更高。根据 Emsisoft 2023 年 1 月发布的年终报告,儘管美国政府努力阻止这项威胁,但学校在 2022 年遭受的网路攻击数量几乎与 2021 年相同。国内市场供应商积极开展合作活动,为客户提供高效、强大的安全存取服务边际产品,以安全地加速其数位转型计划。例如,2023 年 7 月,安全存取服务边际(SASE) 供应商 Netscope 宣布与 Wipro Limited 开展新合作,为 Wipro 提供託管零信任网路存取(ZTNA) 和强大的云端原生託管安全交付存取服务边际(SASE)服务。广泛的全球企业客户组合。

- 总体而言,据分析,北美零信任市场在未来几年将显着增长,这主要是由于最终用户行业云端迁移的增加以及云端服务和零信任市场中供应商的增加。我是。此外,不断推出新的和增强的解决方案以及供应商之间活性化的合作伙伴关係活动将推动未来几年的市场成长。此外,该地区的其他行业领域,如製造业、能源和公共产业,已转向并开始了解数位化业务方式,因此存在巨大的成长潜力。

零信任安全产业概述

零信任安全市场的特点是竞争形势激烈,思科系统公司、帕洛阿尔托网路公司、VMware 公司、博通公司和微软公司等全球和区域参与者都在争夺市场占有率。进入壁垒很高,但一些新参与企业已成功在该行业站稳脚跟。

该市场的特点是产品差异化程度较高、产品普及不断提高、竞争激烈。解决方案通常捆绑在一起,以提供作为整体服务或产品一部分的整合服务。

许多用户选择年度合约来降低成本,而企业也越来越多地寻求提供更快安全更新的服务。这增加了对云端基础的服务的需求,这些服务允许即时更新,并且受到酒店业的青睐。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

- COVID-19 的影响

- 产业价值链分析

- 技术简介

- 零信任网络

- 零信任设备

- 零信任资料

- 零信任身份

- 零信任应用程式(可见性和分析)

第五章市场动态

- 市场驱动因素

- 资料外洩增加

- 您组织的安全范围不仅限于职场

- 市场抑制因素

- 遗留应用程式、基础架构和作业系统使得采用零信任模型变得困难

第六章市场区隔

- 按发展

- 本地

- 云

- 按组织规模

- 中小企业

- 大公司

- 按最终用户产业

- 资讯科技/通讯

- BFSI

- 製造业

- 卫生保健

- 能源/电力

- 零售业

- 政府机关

- 其他最终用户产业

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 世界其他地区

第七章竞争形势

- 公司简介

- Cisco Systems Inc.

- Palo Alto Networks, Inc.

- Vmware, Inc.

- Broadcom Inc.(Symantec Corporation)

- Microsoft Corporation

- IBM Corporation

- Google LLC(Alphabet Inc.)

- Check Point Software Technologies Ltd

- BlackBerry Limited

- Akamai Technologies Inc.

- DELINEA(Centrify Corporation)

- Okta Inc.

- Fortinet, Inc.

- Sophos Ltd.

- Cyxtera Technologies Inc.

第八章投资分析

第9章市场的未来

The Zero Trust Security Market size is estimated at USD 33.07 billion in 2024, and is expected to reach USD 72.01 billion by 2029, growing at a CAGR of 16.84% during the forecast period (2024-2029).

Key Highlights

- A developing cybersecurity strategy called zero trust security has attracted a lot of attention and acceptance in recent years. The zero trust approach is predicated on the maxim 'never trust, always verify,' which makes assumptions that threats might originate from internal and external sources. The need for zero-trust security solutions has increased as enterprises increasingly acknowledge the need to secure their networks, apps, and data in an environment with a more complex and dynamic threat landscape.

- Organizations are concentrating more on implementing strong security measures like Zero Trust due to the increased number and sophistication of cyber threats, including data breaches, ransomware attacks, and insider threats. The popularity of remote work was accelerated by the COVID-19 pandemic, increasing the attack surface. Zero trust is a crucial strategy for protecting distributed and remote workforces.

- Organizations have had to review their security postures due to the move toward cloud computing. Zero trust facilities secure access to cloud-based apps and data, which fits well with cloud-first plans. Organizations must develop robust data protection mechanisms to comply with strict data privacy laws like GDPR and CCPA, making zero trust a compliance enabler. Businesses use the zero trust framework in various sectors more widely as a fundamental security strategy. The conventional perimeter-based paradigm is being abandoned. Big technology corporations are buying zero trust security businesses to improve security services.

- Organizations are incorporating zero trust concepts into their DevOps pipelines as they adopt DevOps strategies to ensure security is a part of the development process. A significant increase has been observed in the secure remote access-focused zero trust network access (ZTNA) sector. This is particularly pertinent given the prevalence of remote work and the requirement for safe access to company resources. A thorough zero trust strategy's implementation can be challenging and time-consuming. Identity and access management, network security, and analytics are a few components that organizations need to plan and integrate.

- Zero trust is crucial for security, but businesses must strike a balance between strict security measures and a smooth, effective user experience. Finding the ideal balance is difficult. Many businesses continue to use outdated architectures and systems that make it difficult to implement zero-trust principles. Migrating away from these systems can take time and effort. The compromise of user credentials and insider threats remain major security worries. Phishing and other social engineering assaults are still common attack methods.

- The constantly changing threat landscape and the demand for thorough security measures have led to a major increase in the global zero-trust security market. However, enterprises have a big problem because of outdated operating systems, infrastructure, and applications. The wider market adoption needs to be improved by the resistance of these antiquated components to adopt the zero trust concept.

- The COVID-19 pandemic had a positive impact, providing a contactless payment mode, including online and in-person transactions. This has included the digital infrastructure extensively, exposing the financial system to cybersecurity vulnerabilities, which created considerable demand for fool-proof security models like zero trust security. For instance, according to RBI, approximately 71 billion digital payments were made throughout India in fiscal year 2022. This was a significant increase over the preceding three years.

Zero Trust Security Market Trends

BFSI Sector to be the Largest End User

- The International Monetary Fund (IMF) reveals that financial and technological interconnections within the banking, financial services, and insurance (BFSI) sector facilitate the rapid spread of cyberattacks, causing widespread disruption and loss of critical information throughout the entire financial ecosystem. Cybersecurity is a significant threat to financial stability, especially among the developing economies.

- A recent IMF survey of 51 countries states that most financial supervisors in emerging markets still need to introduce cybersecurity regulations or build resources to enforce them. The survey highlights that 56% of the central bank authorities need a national cyber strategy, 42% lack a dedicated cybersecurity or risk-management regulation, 68% lack a specialized risk unit, and 64% do not mandate testing and exercising cyber security measures.

- According to IBM's 'Cost of a Data Breach 2022' report, 2022 witnessed a surge in data breaches. The average data breach cost reached USD 4.35 million in the same year, marking a 2.6% increment from 2021. The report also states that 83% of organizations, including banks, reported more than one data breach in 2022.

- Cloud deployments are gaining rapid popularity in the global banking and financial sector as banks and financial institutions migrate their platforms to the cloud. With the rise of hybrid cloud, businesses increasingly appreciate the advantages of diversifying their services across multiple cloud providers. A multi-cloud approach and rapid increase of internet services enable more and more consumers to use the internet and mobile applications for transactions.

- Large enterprises dominate the BFSI industry, one of the most important sectors of the global economy. Several large retail banking, commercial banking, and investment banking organizations are taking a zero-trust approach to cybersecurity to help secure the ubiquitous nature of modern enterprises and meet the challenges caused by evolving business models. As per The State of Zero Security 2022, the implementation of zero trust security by organizations in the BFSI sector is expected to increase significantly.

North America is Expected to Hold Significant Market Share

- The United States is a developed economy with a significant inclination towards implementing and accepting advanced technology, development in network automation, and the surge in cloud-based services, thereby contributing to the zero trust security market. Moreover, the growing digitization among end-user industries, coupled with the presence of prominent market vendors Cisco Systems, Inc., IBM Corporation, Vmware Inc., Palo Alto Networks, and Akamai Technologies, contribute to the market's growth.

- Cyber attackers with a typical target go after end-point devices, cloud-based applications, networks, and other IT infrastructure components. The primary motive behind such attacks is to steal critical information. These attacks can result in business disruptions, financial loss, intellectual property theft, and critical and sensitive customer information loss. The US federal government is making a big push toward zero trust. In January 2023, the Office of Management and Budget released a memorandum that mandates a federal zero trust architecture (ZTA) strategy, directing agencies to meet specific cyber security measures and objectives by the end of the fiscal year 2024. This initiative reinforces the government's defenses against increasingly sophisticated and persistent threat campaigns.

- Further, the rapid adoption of new technology in the country and growing focus on security is pushing the demand for security-as-a-service forward. Industries, such as banking, healthcare, and government organizations, which hold databases of sensitive information, are preferred targets for hackers owing to the huge amount of information contained. Credit card data and social security numbers of individuals are the targeted information attacked by the hackers. To safeguard such critical data, there is a need for robust cloud intrusion protection and security solutions, along with suitable network security solutions. This is analyzed to boost the demand for zero-trust solutions in the coming years.

- The United States marked the increase of ransomware and phishing attacks targeted at organizations that involved less manual effort and were highly automated in 2021. According to Emsisoft's year-end report published in January 2023, Schools sustained almost the same number of cyberattacks in 2022 as in 2021, despite the US government's efforts to thwart the threat. Market vendors in the country are indulging in partnership activities to provide customers with an efficient and robust secure access service edge offering to secure and accelerate their digital transformation projects. For instance, in July 2023, Netskope, a Secure Access Service Edge (SASE) provider, announced a new collaboration with Wipro Limited to deliver Managed Zero Trust Network Access (ZTNA) and robust cloud-native Managed Secure Access Service Edge (SASE) services to Wipro's extensive global enterprise client portfolio.

- Overall, the zero trust market in North America is analyzed to witness substantial growth in coming years, primarily governed by the increasing cloud migration in end-user industries, coupled with the growing presence of cloud service and Zero Trust market vendors. In addition, the continuous launch of new solutions with enhanced features and growing partnership activities among market vendors will drive the growth of the market in the coming years. Moreover, there is huge growth potential from other industry segments in the Region, such as manufacturing, energy, and utilities, as they have already migrated to digital-transformed methods of operations and are now beginning to get a better understanding.

Zero Trust Security Industry Overview

The zero trust security market features a competitive landscape with global and regional players such as Cisco Systems Inc., Palo Alto Networks Inc., Vmware Inc., Broadcom Inc., and Microsoft Corporation vying for market share. Despite significant barriers to entry, some new entrants have managed to gain a foothold in this space.

This market is characterized by a moderate to high degree of product differentiation, a growing level of product adoption, and intense competition. Typically, solutions are bundled together, creating a consolidated offering that appears integral to the overall service or product.

Many users opt for annual contracts to reduce costs, and there is a growing trend of companies seeking services that offer faster security updates. This has fueled a rising demand for cloud-based services, which enable real-time updates and are favored by service-based industries.

For instance, in July 2023, Microsoft Entra made significant strides in the Security Service Edge (SSE) arena, introducing two innovative products: Microsoft Entra Internet Access and Microsoft Entra Private Access. These cloud-based services are known for their agility, easy management, and cost-effectiveness when compared to traditional on-premises systems. They adhere to Zero Trust principles, verifying each user's identity and employing risk-based contextual information to grant access only to the necessary applications, resources, and destinations, ensuring optimal security without compromising productivity.

In June 2023, Cisco Systems expanded its security portfolio by unveiling a new Security Service Edge (SSE) solution called Cisco Secure Access. This solution facilitates an efficient hybrid work environment, simplifying access across different locations, devices, and applications. Cisco Secure Access offers frictionless access to all applications, fostering secure hybrid work settings. The solution streamlines security operations by consolidating multiple functions into a user-friendly solution that safeguards all traffic. This not only enhances efficiency and reduces costs but also adds flexibility to the IT environment.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHT

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of COVID-19

- 4.4 Industry Value Chain Analysis

- 4.5 Technology Snapshot

- 4.5.1 Zero Trust Networks

- 4.5.2 Zero Trust Devices

- 4.5.3 Zero Trust Data

- 4.5.4 Zero Trust Identities

- 4.5.5 Zero Trust Applications (Visibility and Analytics)

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Number of Data Breaches

- 5.1.2 Security Perimeter of an Organization not Being Limited to Workplace

- 5.2 Market Restraints

- 5.2.1 Legacy Applications, Infrastructure, and Operating Systems Not Likely to Adopt Zero Trust Model

6 MARKET SEGMENTATION

- 6.1 By Deployment

- 6.1.1 On-premise

- 6.1.2 Cloud

- 6.2 By Organization Size

- 6.2.1 Small and medium Enterprises

- 6.2.2 Large Enterprises

- 6.3 By End-user Industry

- 6.3.1 IT and Telecom

- 6.3.2 BFSI

- 6.3.3 Manufacturing

- 6.3.4 Healthcare

- 6.3.5 Energy and Power

- 6.3.6 Retail

- 6.3.7 Government

- 6.3.8 Other End-user Industries

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia Pacific

- 6.4.4 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles*

- 7.1.1 Cisco Systems Inc.

- 7.1.2 Palo Alto Networks, Inc.

- 7.1.3 Vmware, Inc.

- 7.1.4 Broadcom Inc. (Symantec Corporation)

- 7.1.5 Microsoft Corporation

- 7.1.6 IBM Corporation

- 7.1.7 Google LLC (Alphabet Inc.)

- 7.1.8 Check Point Software Technologies Ltd

- 7.1.9 BlackBerry Limited

- 7.1.10 Akamai Technologies Inc.

- 7.1.11 DELINEA (Centrify Corporation)

- 7.1.12 Okta Inc.

- 7.1.13 Fortinet, Inc.

- 7.1.14 Sophos Ltd.

- 7.1.15 Cyxtera Technologies Inc.