|

市场调查报告书

商品编码

1406191

聚乙烯呋喃酸酯 (PEF):市场占有率分析、产业趋势与统计、2024-2029 年成长预测Polyethylene Furanoate (PEF) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

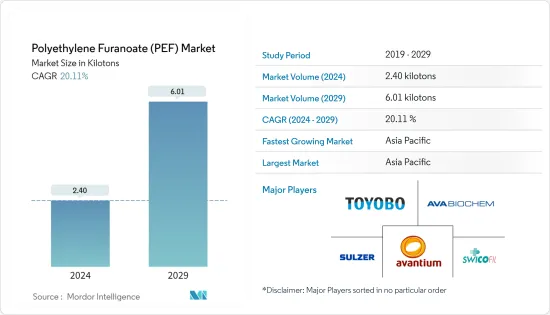

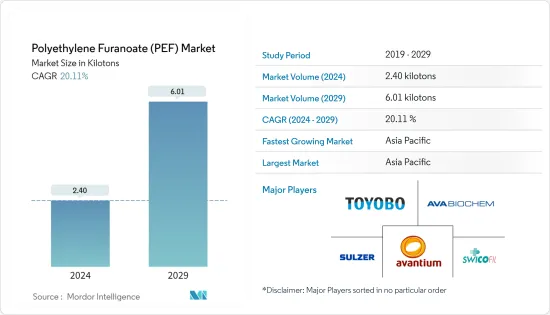

聚乙烯呋喃酸酯(PEF)市场规模预计到2024年为2.40千吨,预计到2029年将达到6.01千吨,在预测期内(2024-2029年)复合年增长率为20.11%。

市场受到 COVID-19 的负面影响。 COVID-19大流行已导致世界上多个国家进入封锁状态,以遏制病毒的传播。许多公司和工厂停止运营,扰乱了全球供应链,损害了全球生产、交货时间和产品销售。目前,市场已从 COVID-19大流行中恢復并正在显着增长。

主要亮点

- 推动市场的主要因素是用于瓶子製造的聚呋喃甲酸乙二醇酯的需求增加以及纺织业的需求增加。

- 另一方面,生物PET、生物PE、生物PP等其他生物塑胶的存在以及原材料的缺乏是预计阻碍市场成长的主要抑制因素。

- 医疗领域对生物基聚合物的需求不断增长,预计将为市场成长提供各种利润丰厚的机会。

- 全球聚呋喃甲酸乙二醇酯市场以亚太地区为主,其中中国和印度等国的消费量最高。

聚乙烯呋喃酸酯(PEF)市场趋势

瓶子产业的需求增加

- 由于其高强度、穿刺韧性和优异的耐热性,聚乙烯呋喃酸酯越来越多地用于瓶子等应用。

- 聚乙烯呋喃酸酯还可以增加对氧气和二氧化碳的抵抗力,防止食品氧化。食品和饮料业对聚呋喃甲酸乙二醇酯的需求不断增加,推动了市场成长。

- 食品和饮料行业是欧洲最大的製造商之一,也是其生产的瓶子的主要消费者。根据FoodDrinkEurope统计,2022年季度食品和饮料产业销售额较上季成长2.3%,2021年第四季较上季度成长19.2%。

- 此外,2022年季度欧盟食品和饮料出口额达483亿欧元(约509亿美元),较2021年季度成长17.5%。食品和饮料出口的成长对该行业对瓶子的需求产生了重大影响。

- 根据环境、食品和饮料、饮料和农村事务部统计,英国有1610家中小型饮料公司,其中大型饮料公司30家。随着公司的发展,对永续材料製成的瓶子的需求也将增加,从而影响聚呋喃甲酸乙二醇酯市场。

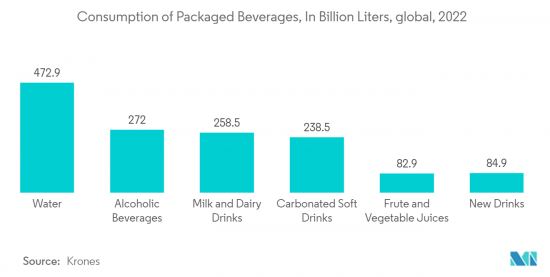

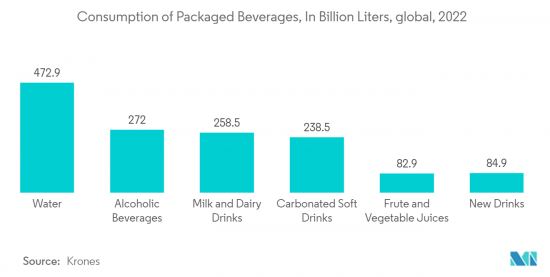

- 因此,在预测期内,水、无酒精饮品、果汁和酒精饮料等饮料包装瓶的需求增加可能会推动聚呋喃甲酸乙二醇酯市场。

亚太地区主导市场

- 预计亚太地区将在预测期内主导聚乙烯呋喃酸酯市场。由于食品和饮料、包装、纺织和汽车等各个最终用户行业的需求不断增加,中国、印度和日本等国家对聚呋喃甲酸乙二醇酯的需求正在增加。

- 由于对环境问题的日益关注,人们对生物基瓶、薄膜和纤维的趋势和认识不断增强,正在推动该地区的聚乙烯呋喃酸酯市场,预计这是一种从植物中提取的100% 生物基可回收聚合物。

- 根据中国国家统计局统计,2023年1月至4月,中国非酒精饮料产量5,912万吨。 4月份非酒精饮料产量1455万吨,年增约3%。预计 PEF 瓶的需求在预测期内最终将增加。

- 此外,根据日本朝日集团控股公司的数据,2022年期间,大部分软性饮料市场占有率将被即饮茶(30%)占据,其次是即饮咖啡(18%)、碳酸饮料(15%)和矿泉水(14%)紧随其后。剩余份额分布在果汁饮料、乳製品饮料等领域。

- 聚乙烯呋喃酸酯纤维从基于聚乙烯呋喃糖的瓶子中回收,用于加工 100% 生物基 T 恤。这些纤维用于肥料和农药等工业产品的包装。它也用于地毯、服装类和运动服。

- 根据中国国家统计局月报显示,2023年4月中国服饰纤维产量约27.5亿(立方公尺)。报告显示,1-4月中国纺织品总产量刚超过108亿公尺。

- 因此,上述因素加上政府的支持正在推动预测期内聚呋喃甲酸乙二醇酯需求的增加。

聚乙烯呋喃酸酯(PEF)产业概况

聚乙烯呋喃酸酯市场高度整合,主要企业占据重要的市场占有率。市场的主要企业包括 Avantium、Toyobo、Sulzer Ltd.、AVA Biochem AG 和 Swicofil AG。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 瓶子製造中对聚乙烯呋喃酸酯的需求增加

- 纺织业需求增加

- 其他司机

- 抑制因素

- 替代品的存在

- 原料可得性有限

- 价值链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场区隔(市场规模)

- 目的

- 瓶子

- 电影

- 纤维

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 亚太地区其他地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 欧洲其他地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东/非洲

- 沙乌地阿拉伯

- 南非

- 中东和非洲其他地区

- 亚太地区

第六章竞争形势

- 併购、合资、联盟、协议

- 市场占有率(%)/排名分析

- 主要企业策略

- 公司简介

- AVA Biochem AG

- Avantium

- Sulzer Ltd

- Swicofil AG

- Toyobo Co., Ltd.

第七章 市场机会及未来趋势

- 医疗领域对生物基聚合物的需求不断增长

- 其他机会

The Polyethylene Furanoate Market size is estimated at 2.40 kilotons in 2024, and is expected to reach 6.01 kilotons by 2029, growing at a CAGR of 20.11% during the forecast period (2024-2029).

The market was negatively impacted due to COVID-19. Owing to the pandemic, several countries worldwide went into lockdown to curb the spread of the virus. The shutdown of numerous companies and factories disrupted worldwide supply networks and harmed global production, delivery schedules, and product sales. Currently, the market recovered from the COVID-19 pandemic and is increasing significantly.

Key Highlights

- Major factors driving the market studied are the increasing demand for polyethylene furanoate for bottle manufacturing and the rising demand from the fibers segment.

- On the flip side, the presence of other bioplastics such as bio-PET, bio-PE, bio-PP, etc., and the unavailability of raw materials are the major restraints expected to hinder the market's growth.

- Growing demand for bio-based polymers in the medical sector is expected to offer various lucrative opportunities for market growth.

- The Asia-Pacific region dominated the global polyethylene furanoate market, with the largest consumption from countries such as China and India.

Polyethylene Furanoate (PEF) Market Trends

Increasing Demand from Bottles Segment

- Polyethylene furanoate is increasingly used in applications such as bottles due to its high strength, puncture toughness, and good heat resistance.

- Polyethylene furanoate also increases oxygen and carbon dioxide resistance, preventing food products from oxidizing. It is increasing the demand for polyethylene furanoate in the food & beverage industry and consequently boosting its market growth.

- The food and beverage sector is one of the largest manufacturing industries in Europe and the major consumer of bottles manufactured. According to FoodDrinkEurope, the food and beverage industry turnover increased by 2.3% in Q4 2022, compared to the previous quarter, and increased by 19.2% Y-o-Y compared to Q4 2021.

- Furthermore, European Union exports of food and drinks were valued at EUR 48.3 billion (~USD 50.9 billion) in Q4 2022, registering a growth rate of 17.5% compared to Q4 2021. This growth in food and drink exports greatly impacted the industry's bottle demand.

- According to the Department for Environment, Food, and Rural Affairs, the number of beverage-manufacturing SMEs in the United Kingdom accounted for 1.61 thousand, along with 30 large beverage businesses. With the growing companies, the demand for bottles made from sustainable material would also increase, thereby affecting the polyethylene furanoate market.

- Therefore, growing demand for bottles in the packaging of beverages such as water, soft drinks, fruit juices, and alcoholic beverages is likely to propel the polyethylene furanoate market during the forecast period.

Asia-Pacific Region to Dominate the Market

- Asia-Pacific region is expected to dominate the market for polyethylene furanoate during the forecast period. In countries like China, India, and Japan, owing to the rising demand from various end-user industries, including food and beverage, packaging, textile, and automotive, the demand for polyethylene furanoate is increasing in the region.

- Due to rising environmental concerns, the growing trend and awareness of bio-based bottles, films, and fibers are anticipated to propel the polyethylene furanoate market in the region as it is a 100% bio-based recyclable polymer extracted from plants.

- According to the National Bureau of Statistics of China, 59.12 million metric tons of non-alcoholic beverages were produced in China during the first four months of 2023. The production of non-alcoholic beverages in April amounted to 14.55 million metric tons, approximately 3% more than the previous year's production for the same period. It would eventually enhance the demand for bottles made from PEF during the forecast period.

- Moreover, according to the Asahi Group Holdings in Japan, during 2022, the majority of the market share of soft drinks was acquired by ready-to-drink tea (30%), followed by ready-to-drink coffee (18%), carbonated drinks (15%) and mineral water (14%). The rest of the share was distributed among fruit juice, lactic drinks, and others.

- Polyethylene furanoate fibers are recycled from polyethylene furanose-based bottles and are used in processing 100% biobased t-shirts. These fibers are used in packaging industrial products like fertilizers and pesticides. They are also used in carpets, clothing, and sports apparel.

- According to the National Bureau of Statistics of China's monthly report, the country produced around 2.75 billion m of clothing fabric in April 2023. The overall textile production in the nation from January to April was little more than 10.8 billion, as stated in the report.

- Thus, the factors above, coupled with government support, are contributing to the increasing demand for polyethylene furanoate during the forecast period.

Polyethylene Furanoate (PEF) Industry Overview

The polyethylene furanoate market is highly consolidated, with top players accounting for a major market share. Some of the key companies in the market include Avantium, Toyobo Co., Ltd., Sulzer Ltd., AVA Biochem AG, and Swicofil AG.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand of Polyethylene Furanoate for Bottles Manufacturing

- 4.1.2 Rising Demand from Fibers Segment

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Presence of Substitutes

- 4.2.2 Limited Raw Material Availability

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Application

- 5.1.1 Bottles

- 5.1.2 Films

- 5.1.3 Fibers

- 5.2 Geography

- 5.2.1 Asia-Pacific

- 5.2.1.1 China

- 5.2.1.2 India

- 5.2.1.3 Japan

- 5.2.1.4 South Korea

- 5.2.1.5 Rest of Asia-Pacific

- 5.2.2 North America

- 5.2.2.1 United States

- 5.2.2.2 Canada

- 5.2.2.3 Mexico

- 5.2.3 Europe

- 5.2.3.1 Germany

- 5.2.3.2 United Kingdom

- 5.2.3.3 Italy

- 5.2.3.4 France

- 5.2.3.5 Rest of Europe

- 5.2.4 South America

- 5.2.4.1 Brazil

- 5.2.4.2 Argentina

- 5.2.4.3 Rest of South America

- 5.2.5 Middle-East and Africa

- 5.2.5.1 Saudi Arabia

- 5.2.5.2 South Africa

- 5.2.5.3 Rest of Middle-East and Africa

- 5.2.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 AVA Biochem AG

- 6.4.2 Avantium

- 6.4.3 Sulzer Ltd

- 6.4.4 Swicofil AG

- 6.4.5 Toyobo Co., Ltd.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing demand for Bio-based Polymers in Medical Sector

- 7.2 Other Opportunities