|

市场调查报告书

商品编码

1406207

EaaS(能源即服务):市场占有率分析、产业趋势与统计数据、2024年至2029年的成长预测Energy As A Service - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

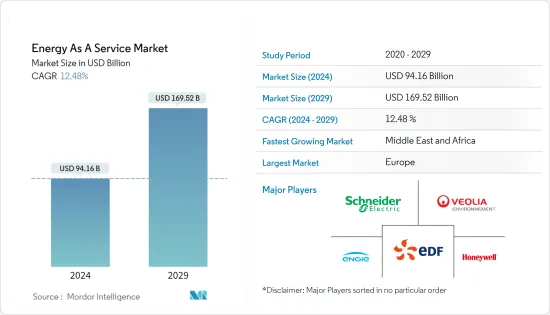

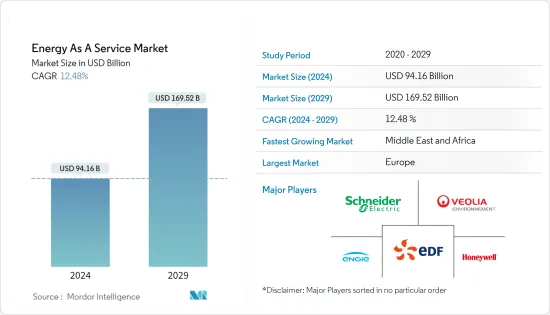

2024年EaaS(能源即服务)市场规模预计为941.6亿美元,预计2029年将达到1695.2亿美元,复合年增长率预计为12.48%。

主要亮点

- 从中期来看,商业和工业领域越来越多地采用分散式能源发电、严格的能源效率法规以及政府的支持措施预计将在预测期内推动市场发展。

- 另一方面,开发中国家缺乏意识和技术成本高昂预计将阻碍预测期内的市场成长。

- 然而,EaaS的概念仍处于起步阶段,特别是在开发中国家。然而,在已开发国家,服务是按需提供的。印度、越南和印尼等能源消费量较高的开发中国家预计将在预测期内为EaaS市场创造充足的机会。

- 北美主导市场,并可能在预测期内实现最高的复合年增长率。

EaaS(能源即服务)市场趋势

主导市场的商业领域

- 由于人均收入的增加、人口的成长和电器产品的增加,全球商业建筑领域的用电量正在迅速增加。住宅和商业部门的能源使用对于节能宣传活动至关重要。

- 商业领域包括教育机构、企业办公室、资料中心、医院、机场、银行等作为EaaS产业的商业最终使用者。

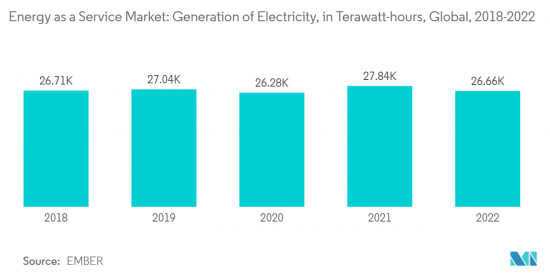

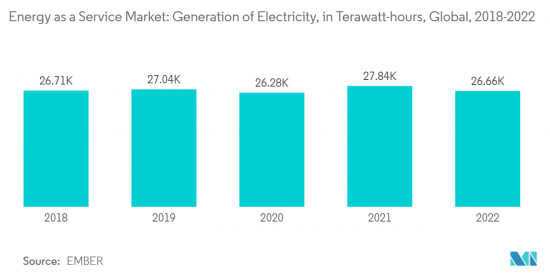

- 各类商业建筑包含区域能源系统、商业/服务等能源应用,消费量较高。世界各地的电力需求正在显着增加。 2022年,发电量约为26,662.7太瓦时。全球商业部门的电力需求也在增加。

- 到目前为止,能源效率措施一直是商业部门面临的主要挑战。缺乏认知和高资本要求往往是商业部门广泛采用能源效率倡议的重大障碍。

- EaaS 等各种能源模式消除了资本障碍,并提供了多种节省能源和成本的方法。该服务提供高效商业空间的完整设置,从安装电气组件到建造微电网。

- EaaS 使业主和企业能够将其能源系统升级为清洁、永续的技术,例如屋顶太阳能。消费者可以节省电力公司的电费。

- 2022年1月,法国电信业者Orange SA与电力公司Engie SA签署EaaS协议,在其位于西非象牙海岸共和国的资料中心安装355kW太阳能板。作为协议的一部分,Engie 将在屋顶和车库安装面板,帮助 Orange 位于非洲的主要资料中心每年发电 527 兆瓦时。

- 此外,2021年12月,Schneider Electric宣布推出GREENext。该合资企业将透过混合太阳能和电池微电网技术向商业和工业客户提供能源即服务。

- 随着人口的增加,能源需求和能源节约对于长期永续性至关重要。私人营业单位在政府的支持下,正在专注于商业领域,以扩大未来的服务范围。

北美正在经历显着的成长

- 北美是各个领域实施 EaaS 的重要地区之一。特别是在商业领域,正在采用各种计划来提高能源效率并有助于降低营运成本。

- 美国引入了按绩效付费的方法来实现能源效率。据估计,这种方法可以帮助减少近15%的能源消耗。这种方法为各种能源和公共产业公司创造了扩大服务范围以提供节能服务的机会。

- 例如,在加州,能源效率政策规定,强制计画中实现的至少 60% 的节电量必须由第三方服务供应商提供。因此,该地区的此类测量可能会促进预测期内的市场成长。

- 此外,美国和加拿大的能源服务供应商正在投资智慧电网和智慧电錶系统,以利用先进的资料分析来帮助消费者优化能源消耗。根据能源效率研究所的数据,预计2021年美国将安装1.15亿个智慧电錶,比2018年增加27.7%。因此,该地区智慧电錶投资的增加可能会推动市场走向更分散和数数位化的电网网络,从而促进该地区 EaaS 市场的成长。

- 综上所述,未来北美EaaS市场很可能会显着成长。

EaaS(能源即服务)产业概述

EaaS 市场正在整合。该市场的主要企业包括(排名不分先后)施耐德电气公司、Engie SA、霍尼韦尔国际公司、威立雅环境公司和法国电力公司(EDF)SA。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 研究场所

第 2 章执行摘要

第三章调查方法

第四章市场概况

- 介绍

- 2028年之前的市场规模与需求预测

- 最新趋势和发展

- 政府法规政策

- 市场动态

- 促进因素

- EaaS 需求不断成长

- 商业和工业领域更多地采用分散式能源发电

- 抑制因素

- 开发中国家缺乏意识且技术成本高

- 促进因素

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章市场区隔

- 最终用户

- 商业的

- 工业的

- 地区

- 北美洲

- 美国

- 加拿大

- 其他北美地区

- 欧洲

- 德国

- 法国

- 英国

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 亚太地区其他地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东/非洲

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 南非

- 中东和非洲其他地区

- 北美洲

第六章竞争形势

- 併购、合资、联盟、协议

- 主要企业策略

- 公司简介

- Schneider Electric SE

- Engie SA

- Honeywell International Inc.

- Veolia Environnement SA

- Electricite de France(EDF)SA

- Johnson Controls International PLC

- Bernhard

- Enel SpA

- Spark Community Investment Co.

第七章 市场机会及未来趋势

- 印度、越南、印尼等高消费量开发中国家对EaaS的需求不断增加

简介目录

Product Code: 70377

The Energy As A Service Market size is estimated at USD 94.16 billion in 2024, and is expected to reach USD 169.52 billion by 2029, growing at a CAGR of 12.48% during the forecast period (2024-2029).

Key Highlights

- Over the medium term, the increasing adoption of distributed energy generation in commercial and industrial sectors, stringent energy efficiency regulations, and supportive government initiatives are expected to drive the market during the forecast period.

- On the other hand, the lack of awareness in developing economies and high technological costs will likely hinder the market's growth during the forecast period.

- Nevertheless, the Energy as a service concept is still nascent, especially in developing countries. However, in developed countries, the service is on-demand. Developing countries like India, Vietnam, and Indonesia with high energy consumption will likely create ample opportunities for the Energy as a service market during the forecast period.

- North America dominates the market and will likely witness the highest CAGR during the forecast period, with most of the demand coming from countries like the United States and Canada.

Energy as a Service (EaaS) Market Trends

Commercial Segment to Dominate the Market

- Electricity use in the global commercial building sector is increasing rapidly due to increasing per capita income, the growing population, and the increasing number of electrical appliances. Energy use in the residential and commercial sectors is essential for energy conservation campaigns.

- The commercial segment includes educational institutions, corporate offices, data centers, hospitals, airports, and banks as commercial end users of the energy as a service (EaaS) industry.

- Different commercial buildings include energy applications, such as district energy systems and mercantile and service, with higher energy consumption. The electricity demand is increasing significantly across the world. In 2022, around 26,662.7 TWh was generated. The demand for electricity across the commercial sector is also increasing worldwide.

- Historically, energy-efficiency initiatives posed a significant challenge for the commercial sector. Lack of awareness and high capital requirements are often substantial barriers to the widespread adoption of energy-efficiency initiatives in the commercial sector.

- Various energy models like the energy as a service (EaaS) removed the capital barrier and provided multiple methods to save energy and costs. The service offers the complete set-up for efficient commercial space, from installing electrical components to building microgrids.

- EaaS allows owners and companies to upgrade their energy systems to clean and sustainable technologies such as rooftop solar PV. The consumers may save electricity bills from the utility company.

- In January 2022, French telecommunications company Orange SA signed an EaaS contract with utility Engie SA to install 355 kW solar panels at its data center in Cote d'Ivoire, West Africa. Engie will install the panels on rooftops and carports as part of the agreement to help Orange's main African data center generate 527 MWh of electricity annually.

- Moreover, in December 2021, Schneider Electric announced the launch of GREENext. This joint venture will provide energy-as-a-service to commercial and industrial customers through solar and battery hybrid microgrid technology.

- With a growing population, energy requirements and energy conservation are essential to maintain sustainability for a longer duration. Private entities, with government support, are concentrating on the commercial segment to expand their services in the future.

North America to Witness Significant Growth

- North America is one of the prominent regions implementing EaaS in various sectors. Especially in the commercial industry, the region adopted various projects to increase energy efficiency and help reduce operating expenses.

- The United States inducted a pay-for-performance approach to achieve energy efficiency. The approach is estimated to help reduce energy consumption by nearly 15%. This approach created an opportunity for various energy or utility companies to extend a service line that can provide services to save electricity.

- For instance, in California, energy efficiency policies mandated that at least 60% of the savings achieved in obligation schemes need to be delivered by third-party service providers. Thus, such measurement in the region will likely help the market grow during the forecast period.

- Furthermore, energy service providers in the United States and Canada are investing in smart grid and smart metering systems, as they use advanced data analytics to enable consumers to optimize energy consumption. According to the Institute of Energy Efficiency, in 2021, an estimated 115 million units of smart meters were installed in the United States, an increase of 27.7% compared to 2018. Thus, increasing investments in smart meters in the region may drive the market toward a more decentralized and digitalized grid network, which may aid the growth of the EaaS market in the region.

- Owing to the points mentioned above, North America is likely to witness significant growth in the energy as a service market in the future.

Energy as a Service (EaaS) Industry Overview

The energy as a service market is consolidated. Some of the key players in the market (in no particular order) include Schneider Electric SE, Engie SA, Honeywell International Inc., Veolia Environnement SA, and Electricite de France (EDF) SA., among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD million, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Growing Demand for Energy As A Service

- 4.5.1.2 Increasing Adoption of Distributed Energy Generation in Commercial and Industrial Sectors

- 4.5.2 Restraints

- 4.5.2.1 Lack of Awareness in Developing Economies and High Technological Costs

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 End User

- 5.1.1 Commercial

- 5.1.2 Industrial

- 5.2 Geography

- 5.2.1 North America

- 5.2.1.1 United States

- 5.2.1.2 Canada

- 5.2.1.3 Rest of North America

- 5.2.2 Europe

- 5.2.2.1 Germany

- 5.2.2.2 France

- 5.2.2.3 United Kingdom

- 5.2.2.4 Rest of Europe

- 5.2.3 Asia-Pacific

- 5.2.3.1 China

- 5.2.3.2 India

- 5.2.3.3 Japan

- 5.2.3.4 South Korea

- 5.2.3.5 Rest of Asia-Pacific

- 5.2.4 South America

- 5.2.4.1 Brazil

- 5.2.4.2 Argentina

- 5.2.4.3 Rest of South America

- 5.2.5 Middle-East and Africa

- 5.2.5.1 Saudi Arabia

- 5.2.5.2 United Arab Emirates

- 5.2.5.3 South Africa

- 5.2.5.4 Rest of Middle-East and Africa

- 5.2.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Schneider Electric SE

- 6.3.2 Engie SA

- 6.3.3 Honeywell International Inc.

- 6.3.4 Veolia Environnement SA

- 6.3.5 Electricite de France (EDF) SA

- 6.3.6 Johnson Controls International PLC

- 6.3.7 Bernhard

- 6.3.8 Enel SpA

- 6.3.9 Spark Community Investment Co.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Rising Demand for EaaS in Developing countries like India, Vietnam, and Indonesia with High Energy Consumption

02-2729-4219

+886-2-2729-4219