|

市场调查报告书

商品编码

1406218

汽车无真空煞车:市场占有率分析、产业趋势/统计、成长预测,2024-2029Automotive Vacuumless Braking - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

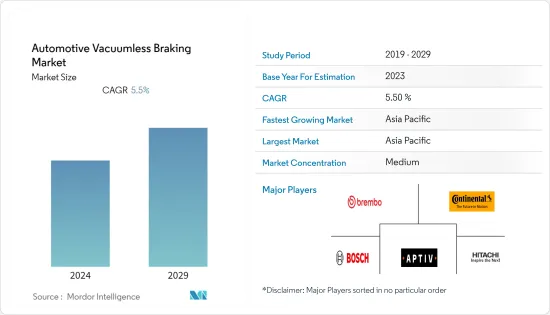

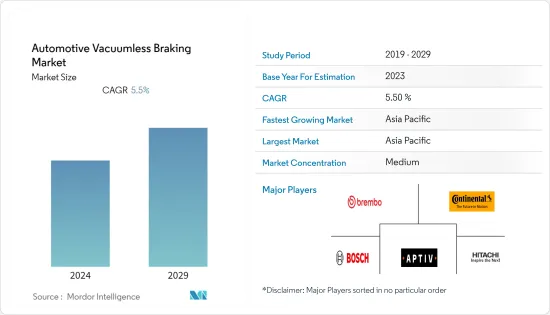

汽车无真空煞车市场目前的市场规模为28.5亿美元,预计未来五年将成长至39.3亿美元,预测期内收益复合年增长率为5.5%。

从中期来看,推动煞车技术发展的主要因素将是减轻每个车轮重量的需求,以提高效率并透过再生煞车来回收和散发热量。自动驾驶汽车的成长需要密集且聪明地使用煞车和转向技术,预计将对市场产生积极影响。

除了驾驶辅助系统之外,混合和电动驱动器相对于传统引擎的出现也需要煞车系统的无真空煞车解决方案。由于小客车、卡车、公共汽车和其他商用车产量的增加,该行业正在不断发展。市场价值受到道路条件改善、新建和扩大基础设施发展倡议的正面影响。

电动辅助煞车正在支持自动驾驶的发展。随着汽车的自动化程度越来越高,电动煞车可以提供精确的煞车操作。电动增压可以更快地形成液压,因此,市场在预测期内可能会显着成长。

汽车无真空煞车市场趋势

小客车预计将占据无真空煞车市场的主要份额

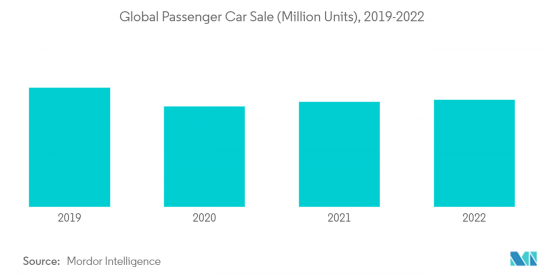

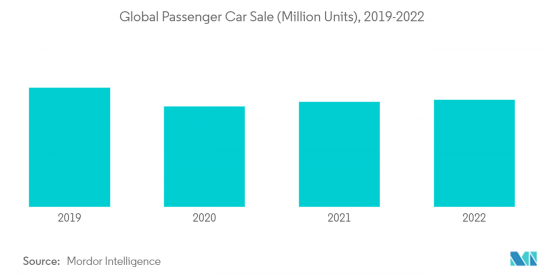

全球小客车销量不断增加,全球对小客车的需求也可能增加。 2022年,全球小客车销量约5,748万辆,较2021年成长2%。

此外,可支配收入的增加和技术创新正在推动所研究市场的成长。豪华车数量的大幅增加以及消费者对轿车和 SUV偏好的下降正在推动全球对小客车及其豪华设施的需求。

此外,为了应对日益严重的环境问题和不断上涨的汽油价格,顶级豪华汽车製造商正在推出电动车型。预计这也将有助于扩大市场。

汽车製造商和邦政府正在共同努力加强印度的混合动力汽车技术。因此,印度混合动力汽车市场在评估期间获得了巨大的吸引力。例如

- 2022 年 8 月,丰田宣布将投资 360 亿卢比(432,946 美元)在卡纳塔克邦的 Bidai 工厂生产混合动力汽车。此外,这项投资计画是在州政府允许开始生产混合动力汽车后宣布的。

印度公司也正在进行研发活动,以开发新产品,这将对预测期内目标市场的成长产生正面影响。例如

- 2022年8月,印度最大汽车製造商马鲁蒂SUZUKI宣布将于年终推出首款电动车。母公司SUZUKI汽车公司还将在古吉拉突邦投资 10,400 卢比(1,250,768 美元)建造一座生产电动车的製造工厂。

由于上述全球发展,小客车市场可能在预测期内显着成长。

快速成长的亚太市场

预计在预测期内,亚太地区的汽车无真空煞车市场将出现成长。中国、印度和日本是该区域市场的主要经济体,预计在全球市场中将以更快的速度成长。中国是全球最大的汽车市场之一。

中国不断增长的人口和不断增长的可支配收入正在推动汽车需求。此外,中国较低的生产成本支撑着中国汽车製造业的成长。 2022年,中国小客车和商用车产量达2,686万辆。

汽车无真空煞车製造商正在与市场参与企业合作,为未来车辆开发下一代煞车系统。

随着中阶可支配收入的增加,印度经济正在扩张。这对汽车需求的成长产生了积极影响。印度较低的生产成本导致过去五年汽车产量快速成长。随着汽车製造业的增加,汽车感测器市场也越来越受到关注。

随着国家不断实现车辆现代化,安全标准不断提高,与国际标准接轨,该国汽车的平均车龄不断增加,预计将增加售后市场对真空煞车的需求。

汽车无真空煞车产业概况

汽车无真空煞车市场由多家公司主导,包括罗伯特·博世有限公司、布雷博公司、大陆集团和安波福公司。先进技术、研发计划投资增加以及电动和自动驾驶汽车市场不断增长等因素是市场的主要驱动力。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场驱动因素

- 市场抑制因素

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家/消费者的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章市场区隔

- 按车型分类

- 小客车

- 商用车

- 按电动汽车类型

- 纯电动车(BEV)

- 插电式混合动力汽车(PHEV)

- 其他的

- 按销售管道

- OEM

- 售后市场

- 按地区

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 德国

- 英国

- 法国

- 其他欧洲国家

- 亚太地区

- 印度

- 中国

- 日本

- 韩国

- 其他亚太地区

- 其他地区

- 巴西

- 墨西哥

- 阿拉伯聯合大公国

- 其他的

- 北美洲

第六章 竞争形势

- 供应商市场占有率

- 公司简介

- Continental AG

- Robert Bosch GmbH

- Brembo SpA

- LSP Innovative Automotive Systems GmbH

- Aptiv PLC(Delphi)

- Disc Brakes Australia(DBA)

- Hitachi Automotive Systems

- Advics Co. Ltd.

- Performance Friction Corporation(PFC)Brakes

- Meritor Inc.

- Haldex AB

- Knorr-Bremse AG

第七章 市场机会及未来趋势

The automotive vacuumless braking market was valued at USD 2.85 billion in the current year and is projected to grow to USD 3.93 Billion by the next five years, registering a CAGR of 5.5% in terms of revenue during the forecast period.

Over the medium term, the major factor propelling the development of brake technology is the demand for weight reduction per wheel for improved efficiency and recovery and dissipation of heat through regenerative braking. The growth in autonomous vehicles that will need intensive smart use of brake and steering technology is expected to positively affect the market.

The emergence of hybrid and electric drives over conventional engines, in addition to driver assistance systems, has the requirement of vacuumless braking solutions for the braking system. The industry is growing due to the increased manufacturing of passenger cars, trucks, buses, and other commercial vehicles. The market value is positively impacted by increasing road conditions and the construction of new ones, as well as expanding infrastructure development initiatives.

The electric-assist braking is supporting the growth of automated driving. As cars are becoming automated, electric brake operates the brakes precisely. An electric boost can form hydraulic pressure more quickly, which in turn is likely to witness major growth for the market during the forecast period.

Automotive Vacuumless Braking Market Trends

Passenger Cars is expected to hold the major share in Vacuumless Braking Market

A rise in the sale of passenger car sales across the globe is likely to enhance the demand for passenger cars across the globe. In 2022, around 57.48 million passenger cars were sold across the globe, which witnessed a 2% growth in sales as compared to 2021.

Additionally, an increase in disposable income and technological innovation drives growth in the market studied. The significant increase in the number of luxury vehicles and the decrease in consumer preference for sedans and SUVs have boosted the global demand for passenger cars and their premium amenities.

Furthermore, in response to growing environmental concerns and rising gasoline prices, top luxury automobile manufacturers are launching electrified models of their vehicles. This will also likely aid in the expansion of the market studied.

OEM and state government are working together to robust the hybrid vehicle technology in India. This has helped India's hybrid vehicles market gain significant traction during the assessment period. For instance,

- In August 2022, Toyota Motors announced that it was to invest Rs. 3,600 crores (USD 432946) for manufacturing a hybrid vehicle facility in Karnataka at the Bidai facility. Moreover, the investment plan came out after the State government provided a green signal to start the production of hybrid vehicles.

Indian companies are also working on research and development activities to develop new products that would positively impact the target market growth during the forecast period. For instance,

- In August 2022, India's largest automaker, Maruti Suzuki, confirmed that it shall soon introduce its first electric vehicle by 2025 end. In addition, Its parent firm, Suzuki Motor Corporation, is looking forward to investing Rs 10,400 crore (USD 1250768) in Gujarat to build a manufacturing plant to produce electric vehicles.

With the development mentioned above across the globe, the passenger cars market is likely to witness major growth during the forecast period.

Asia-Pacific being the Fastest Growing Market

In the automotive vacuumless braking market, the growth of the Asia-Pacific region is expected to be more during the forecast period. China, India, and Japan are the major economies in the regional market that are anticipated to grow at a faster rate in the global market. China is one of the biggest automotive markets in the world.

The growing population and rising disposable incomes of people in China have increased the demand for vehicles in the country. Additionally, the low production costs in China have favored the growth of vehicle manufacturing in China. In 2022, China produced 26.86 million passenger and commercial vehicles.

The automotive vacuumless braking manufacturers are doing partnerships with other market participants to develop next-generation braking systems for their future vehicles. For instance,

- In June 2021, Bosch announced at its annual press conference that it would start manufacturing the "iBooster' electric brake booster in Japan in the latter half of 2022. 2021 marked the 110th anniversary of Bosch's business start in Japan. iBooster is a modern braking system that realizes high-performance braking functions such as compatibility with vacuumless systems, customized pedal feeling, improved collision damage mitigation braking performance, and redundancy under automated driving.

The Indian economy is expanding as there is a rise in the disposable income of middle-class consumers. This, in turn, has a favorable impact on the increasing demand for automobiles. Vehicle manufacturing has increased rapidly over the last five years as a result of the country's cheap production costs. The automotive sensor market is gaining traction as vehicle manufacturing increases.

With the growing modernization of vehicles in the country and the rise in safety standards in line with international standards, the average age of vehicles in the country is increasing, which would enhance the demand for vacuumless brakes in the aftermarket segment.

Automotive Vacuumless Braking Industry Overview

The automotive vacuumless braking market is consolidated and majorly dominated by a few players, such as Robert Bosch Gmbh, Brembo S.p.A., Continental AG, and Aptiv PLC, amongst others. Factors like advanced technology, growing investment in R&D projects, and a growing market of electric and autonomous vehicles highly drive the market. To provide more quicker brake response to the driver, major automotive vacuumless braking manufacturers are developing future brake technology and expanding their market reach. For instance,

In September 2022, Robert Bosch started production of the iBooster electric brake booster began at the Tochigi Plant. The company invested USD 0.022 billion (JPY 3 billion) in the Tochigi Plant, which manufactures ABS (antilock braking system) and ESC (electronic stability control), to install production facilities and set up a dedicated production line for the iBooster. iBooster realizes high-performance braking functions such as compatibility with vacuumless systems.

In July 2022, BMW introduced a vacuumless braking system in BMW M models. Through this system, the company enhanced its vehicle performance.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Vehicle Type

- 5.1.1 Passenger Cars

- 5.1.2 Commercial Vehicles

- 5.2 By Electric Vehicle Type

- 5.2.1 Battery Electric Vehicle (BEV)

- 5.2.2 Plug-in Hybrid Electric Vehicle (PHEV)

- 5.2.3 Other Electric Vehicle Types

- 5.3 By Sales Channel Type

- 5.3.1 OEM

- 5.3.2 Aftermarket

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 India

- 5.4.3.2 China

- 5.4.3.3 Japan

- 5.4.3.4 South Korea

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 Rest of the World

- 5.4.4.1 Brazil

- 5.4.4.2 Mexico

- 5.4.4.3 United Arab Emirates

- 5.4.4.4 Other Countries

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles*

- 6.2.1 Continental AG

- 6.2.2 Robert Bosch GmbH

- 6.2.3 Brembo S.p.A.

- 6.2.4 LSP Innovative Automotive Systems GmbH

- 6.2.5 Aptiv PLC (Delphi)

- 6.2.6 Disc Brakes Australia (DBA)

- 6.2.7 Hitachi Automotive Systems

- 6.2.8 Advics Co. Ltd.

- 6.2.9 Performance Friction Corporation (PFC) Brakes

- 6.2.10 Meritor Inc.

- 6.2.11 Haldex AB

- 6.2.12 Knorr-Bremse AG