|

市场调查报告书

商品编码

1406227

iPaaS(整合平台即服务):市场占有率分析、产业趋势与统计资料、2024 年至 2029 年的成长预测Integration Platform-as-a-Service - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

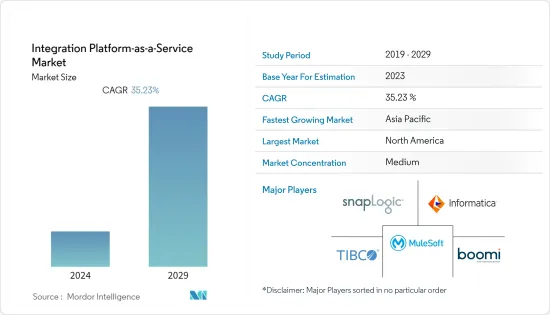

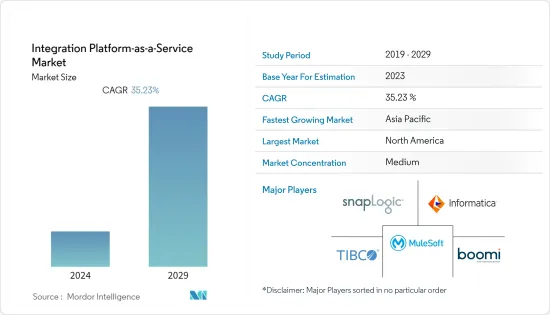

iPaaS(整合平台即服务)市场规模将从 2024 年的 129.8 亿美元增长到 2029 年的 587.2 亿美元,预测期内(2024-2029 年)复合年增长率为 35.23%。 。全球对先进系统的需求迅速增长,以改善开发、管理和部署企业应用程式的整个流程,从而推动了市场的发展。

主要亮点

- 此外,巨量资料、云端运算和物联网在组织流程中的最新进展也推动了 iPaaS 解决方案的扩展。根据英国广播公司报道,微软、亚马逊网路服务、阿里云和谷歌云端平台等云端供应商的收益正在成长 25% 至 100%。这种成长正在展示变革性成果,包括推动规模和速度持久业务转型的效率和创新。

- 市场形势中的强大参与者正在不断增强他们的平台,包括被认为是下一代整合技术,例如 API 管理、资料中心、B2B 整合和工作流程自动化。 iPaaS 供应商的目标是在企业应用程式架构中定位自己。

- 此外,云端基础的整合正在纳入,因为越来越多地考虑以资料为中心和物联网特定的整合、即时同步和行动性等关键因素。现今的公司越来越多地使用 CRM 系统来整合其客户服务系统。然而,这些 CRM 系统与 ERP 和 BI/Analytics 的整合仍然存在差距。 iPaaS 解决方案为企业提供 360 度客户视图,协助他们存取敏感资讯并实现业务流程自动化。

- 2022年11月,Qlik推出了新的云端基础的资料整合平台服务。 Qlik Cloud Data Integration 是一个企业整合平台即服务,主要供资料工程师使用,专门为资料驱动的决策准备和培养组织的资料。新的整合平台即服务将资料编目和准备功能整合到一个地方,使组织能够准备资料以进行即时分析。该平台还包含一组服务,旨在形成资讯结构,组织可以使用该资讯结构来整合资料来源,以获得资料的全新视图。

- 然而,iPaaS解决方案的实施需要高额投资,这可能会限制预测期内的整体市场成长。

- 冠状病毒大流行也影响了云端产业,多家供应商应对需求的突然激增和对云端基础设施日益增长的兴趣。此外,在 COVID-19 爆发后,各行业的公司意识到云端运算的好处超出了 COVID-19 爆发带来的直接需求。因此,公司热衷于提供广泛的云端基础的解决方案和服务。

iPaaS(整合平台即服务)市场趋势

零售和电子商务将经历显着成长

- 电子商务的快速发展涉及B2B和B2C平台,要求企业处理线上销售、库存管理和订购等多个领域。 iPaaS解决方案可提供无缝的电子商务整合解决方案,主要整合后端流程、ERP系统和网站。此外,这些整合工具可实现前端和后端系统之间的资料自由流动,同时大幅降低 IT 支出。此外,2022 年 11 月,Aditya Birla Fashion & Retail 与老佛爷百货公司建立策略合作伙伴关係,在印度推出豪华百货公司和专用的电子商务平台。

- 此外,2022年1月,沃尔玛宣布已邀请多家印度供应商加入沃尔玛市场,该市场在美国每月有超过1.2亿人使用。该公司在印度拥有 Flipkart,目标是到 2027 年每年从印度出口 100 亿美元。此外,据美国贸易代表办公室称,2022 年 2 月,腾讯控股有限公司和阿里巴巴集团控股有限公司的电子商务网站被添加到美国政府最新的「恶名市场」名单中。电子商务行业的此类开拓可能会进一步推动所研究市场的成长。

- 此外,这些创新的整合工具允许零售商将其线上市场与其行动和网路销售入口网站 ERP 解决方案集成,而无需使用传统的遗留整合工具。对于越来越需要改进内部资料管道的电子商务公司来说,或者即使您是第一次建立资料管道,iPaaS 技术也可以证明是一项非常强大的资产。

- 2022年11月,技术服务与顾问公司Wipro Limited宣布推出以零售云端为基础的新零售解决方案Microsoft Cloud,作为加州的新零售创新体验。这种虚拟、实体和混合体验加深了 Wipro 和 Microsoft 的合作,并加强了新解决方案的交付,使零售商能够发展和扩展其业务并建立更牢固的客户关係。

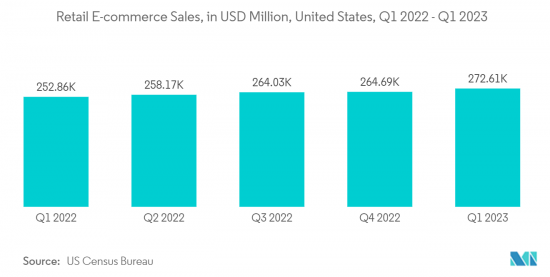

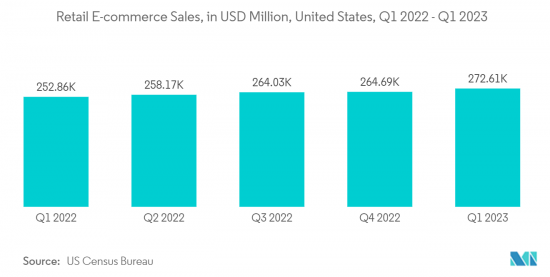

- 根据美国人口普查局的数据,2023年1月至3月美国零售电商销售额达到约2,730亿美元,较上季成长。美国零售电子商务销售额的成长预计将显着提振市场成长率。因此,预计在预测期内将面临广泛的成长机会。

北美地区预计将实现显着成长

- 预计北美地区在预测期内将出现显着成长。这主要是由于多个行业参与者的存在以及该地区各个组织对云端基础的服务的快速采用。此外,预计有许多因素将推动对 iPaaS 解决方案的需求,包括对高度整合服务的需求不断增长以及工作负载日益向云端环境转移。

- 此外,根据思科最新报告《视觉网路指数》,智慧家庭预计将成为未来几年物联网连接成长的主要驱动力之一。到 2022 年,285 亿个设备连接中约 50% 将基于 IoT/M2M(机器对机器)。

- 据美国医疗补助服务中心称,到 2026 年,美国的医疗保健和医疗保险支出预计每年将增加 5.5%。如果支出以这种速度增长,到 2026 年医疗保健成本预计将达到 5.7 兆美元,这表明医疗保健提供者之间的竞争加剧。

- 云端处理和巨量资料分析的快速成长也推动了该地区对 iPaaS 解决方案的需求。此外,伺服器价格的下降也促进了全部区域云端运算业务的采用,预计将在预测期内推动对 iPaaS 解决方案的需求。

- 2022 年 12 月 - 总部位于美国的通路管理平台和合作伙伴关係管理(PRM) 供应商Impartner 宣布,领先的通路管理平台和合作伙伴关係管理(PRM) 供应商Syncari, Inc. 将与Syncari 合作,推动内部连接企业生态系统并消除不准确的合作伙伴资料。 ,已与 Tray.io 等 iPaaS 供应商合作。 Impartner 是 Microsoft Dynamics 365 和 Salesforce 的长期整合合作伙伴,但最近的整合弥补了公司其他直销系统与 Impartner PRM 之间的差距。

iPaaS(整合平台即服务)产业概述

iPaaS(整合平台即服务)市场已进入半固体,各种规模的供应商纷纷进入该市场。在市场流动性适度的情况下,领导企业正在采取产品创新和併购等策略来增加其解决方案组合併扩大其地理覆盖范围。该市场的主要企业包括 Dell Boomi, Inc.、Informatica Corporation 和 Mulesoft。

- 2022 年 8 月 - 行动优先库存解决方案 Cloud Inventory 和智慧型连接和自动化公司 Boomi 宣布扩大合作,为客户提供更快、更轻鬆的整合。此次合作的主要目的是使使用任何 ERP 平台的公司能够快速连接应用程式、资料、人员和设备。这优化了会计、订单管理、库存和采购等关键流程。

- 2022 年 7 月 - 企业资料供应商 TIBCO Software Inc. 宣布对 TIBCO Cloud Integration 进行重大增强,其 iPaaS 由 TIBCO Cloud 提供支援。这扩大了在各种混合环境中整合资料、应用程式和设备的可能性,帮助客户应对瞬息万变的商业世界,从而改善业务成果。此外,TIBCO Cloud Integration 不仅可让您整合公司内的 IT 资产,还可以极为快速地实现所有业务流程的自动化。透过简化应用程式开发,公司可以快速回应不断变化的市场条件并为其客户提供优势。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买方议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- 产业价值链分析

- 宏观经济走势对市场的影响

第五章市场动态

- 市场驱动因素

- 物联网与人工智慧技术融合

- 组织对简化业务流程的需求不断增长

- 市场挑战

- 初始投资高

第六章市场区隔

- 按部署模型

- 公共云端

- 私有云端

- 混合云

- 按行业分类

- BFSI

- 零售/电子商务

- 医疗保健与生命科学

- 製造业

- 资讯科技/通讯

- 媒体与娱乐

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东/非洲

第七章竞争形势

- 公司简介

- Dell Boomi, Inc.

- Informatica Corporation

- Mulesoft, Inc.

- Snaplogic, Inc.

- TIBCO Software Inc.

- IBM Corporation

- Jitterbit, Inc.

- Oracle Corporation

- Celigo, Inc.

- SAP SE

第八章投资分析

第9章市场的未来

The Integration Platform-as-a-Service Market size is expected to grow from USD 12.98 billion in 2024 to USD 58.72 billion by 2029, at a CAGR of 35.23% during the forecast period (2024-2029). The rapidly increasing requirement for advanced systems to improve the overall process of development, management, and deployment of enterprise applications across the globe has been driving the market.

Key Highlights

- Moreover, the recent advancements in big data, cloud computing, and the Internet of Things within organizational processes have also driven the expansion of iPaaS solutions. According to British Broadcasting Corporation, cloud providers such as Microsoft, Amazon Web Services, Alicloud, and Google Cloud Platform have grown their revenues between 25% and 100%. This growth has shown transformative results, including efficiencies and innovations that drive enduring business change at scale and speed.

- The robust players in the market landscape have continuously enhanced their platforms by including API management, data hubs, b2b integration, and workflow automation, among others believed to be the next-generation integration technologies. The iPaaS vendors aim to position themselves in the enterprise application architecture.

- Furthermore, with the increasing considerations of crucial elements such as data-centric and IoT-focused integrations, real-time synchronization, and mobility, cloud-based integration is incorporated. Enterprises today increasingly use CRM systems to integrate their customer service systems. However, there is still a gap in integrating these CRM systems with the ERP and BI/Analytics. The IPaaS solutions give enterprises a 360-degree view of their customers, help them access sensitive information, and automate their business processes.

- In November 2022, Qlik launched a cloud-based new data integration platform service that combines data from disparate sources in real-time. Qlik Cloud Data Integration is mainly an enterprise integration platform as a service developed for use by data engineers who prepare and cultivate their organization's data, especially for data-informed decision-making. The new integration platform as a service joins data cataloging and preparation capabilities in one place, allowing organizations to ready their data in real time for analysis. The Platform also comprises a set of services, which are primarily designed to form an information fabric and can be used by the organisation in order to make it possible to bring together data sources so that they can gain a complete new view of their data.

- However, the high investment involvement initially in deploying IPaaS solutions could restrain the overall market's growth throughout the forecast period.

- The coronavirus pandemic affected the cloud industry; hence, multiple providers responded to this sudden surge in demand and increased interest in cloud infrastructure. Furthermore, during the post-COVID-19, companies from various industries have realized the benefits of cloud computing beyond the immediate need generated by the COVID-19 pandemic. Hence, they are well-indulged in bringing out a broad spectrum of cloud-based solutions and services.

Integration Platform-as-a-Service Market Trends

Retail & E-commerce to Witness Significant Growth

- The rapid advancement of e-commerce that deals in B2B and B2C platforms has demanded that businesses handle multiple areas such as online selling, inventory management, and placing orders. The IPaaS solutions can provide a seamless e-commerce integration solution primarily to merge the back-end processes, ERP systems, and the website. Moreover, these integration tools also enable the free flow of data across front-end and back-end systems while significantly reducing IT outlays. Additionally, in November 2022, Aditya Birla Fashion and Retail Ltd. joined a strategic partnership with the Galeries Lafayette to open luxury department shops and a dedicated e-commerce platform in India.

- Further, in January 2022, Walmart announced that it had invited a few Indian vendors to join its Walmart Marketplace, which has over 120 million monthly visitors in the United States. The company owns Flipkart in India and aims to export USD 10 billion annually from India by 2027. Also, in February 2022, Tencent Holdings Ltd and Alibaba Group Holding Ltd.'s e-commerce sites were added to the US government's latest "notorious marketplaces" list, according to the US Trade Representative. Such developments in the e-commerce industries may further propel the studied market growth.

- Moreover, these innovative integration tools have also enabled retailers to navigate their online marketplace to be linked up with their ERP solutions to their mobile and web sales portals without using traditional legacy integration tools. For e-commerce organizations, an increasing need to improve their internal data conduits, or even if it is being established for the first time, IPaaS technology can prove to be an immensely powerful asset.

- In November 2022, Wipro Limited, a technology services and consulting company, declared new retail solutions created on the and Cloud for Retail, Microsoft Cloud a new Retail Innovation Experience in California. This virtual, physical, and hybrid Experience would deepen collaboration between Wipro and Microsoft to augment the delivery of new solutions, further allowing retailers to grow and expand their business and build stronger customer relationships.

- As per US Census Bureau, from January to March 2023, U.S. retail e-commerce sales amounted to nearly 273 billion U.S. dollars, marking an increase compared to the previous quarter. This increase in U.S. retail e-commerce sales will drive the market's growth rate significantly. Hence, it is expected to face a broad spectrum of growth opportunities throughout the forecast period.

North America is Expected to Witness Significant Growth

- The North American region is expected to have significant growth during the forecast period, primarily owing to the presence of multiple industry players and the rapid adoption of cloud-based services among various organizations in the region. Numerous factors, such as the increased need for advanced integration services and the increased shift of workloads to the cloud environment, are also expected to drive the demand for IPaaS solutions.

- Moreover, according to Cisco's latest Visual Networking Index report, smart homes are expected to be one of the key drivers of IoT connectivity growth during the next few years. In 2022 the company reached around 50% of the 28.5 billion device connections based on IoT/machine-to-machine (M2M).

- According to the US Centers for Medicaid Services, healthcare and Medicare spending acorss the United States is also projected to increase by 5.5% annually from recent through 2026. If the expenditure increases at this rate, by 2026, healthcare spending is projected to reach USD 5.7 trillion, which indicates stronger competition among healthcare providers, creating the need to embrace new technologies to sustain.

- Cloud computing and big data are rapidly growing analytics also drives the demand for IPaaS solutions in the region. Moreover, the declining prices of servers have also improved the adoption of cloud computing businesses across the North American region, which is expected to fuel the demand for IPaas solutions over the forecast period.

- In December 2022 - Impartner, headquartered in the United States, a channel management platform and partner relationship management (PRM) provider, partnered with iPaaS providers such as Syncari, Tray.io, and others to facilitate connections in a company's ecosystem and eliminate inaccurate partner data. While Impartner has been a longstanding integrated partner with Microsoft Dynamics 365 and Salesforce, the recent integrations bridge the gap between a corporation's additional direct sales systems and Impartner PRM.

Integration Platform-as-a-Service Industry Overview

The Integration Platform-as-a-Service Market is semi-consolidated owing to the presence of various small and large vendors working in the markets. The market is moderately Fragemented, with the influential players adopting strategies like product innovation and mergers and acquisitions to increase their solutions portfolio and extend their geographic reach. Some of the major players in the market are Dell Boomi, Inc., Informatica Corporation, and Mulesoft, among others.

- August 2022 - Cloud Inventory, a provider of mobile-first inventory solutions, and Boomi, an intelligent connectivity and automation player, announced an expanded collaboration to provide faster, easier integration for customers. The partnership mainly empowers companies using any ERP platform to quickly connect applications, data, people, and devices. This optimizes critical processes, including accounting, order management, inventory, and procurement.

- July 2022 - TIBCO Software Inc., a provider of enterprise data, TIBCO Cloud Integration, its industry recognized iPaaS offering, powered by TIBCO Cloud, has announced significant enhancements. This expands the overall potential for integrating data, applications, and devices across various hybrid environments, helping customers grapple with a volatile business world to enhance business outcomes. Also, a remarkably rapid automation of all business processes as well as the integration of IT assets within an enterprise is achieved through TIBCO Cloud Integration. Businesses can react to changing market conditions more quickly and provide their customers with an edge by simplifying the development of applications.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definitions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of Macroeconomic Trends on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Convergence of IoT and AI Technologies

- 5.1.2 Increasing Demand From Organizations to Streamline Business Processes

- 5.2 Market Challenges

- 5.2.1 High Initial Investment

6 MARKET SEGMENTATION

- 6.1 By Deployment Model

- 6.1.1 Public Cloud

- 6.1.2 Private Cloud

- 6.1.3 Hybrid Cloud

- 6.2 By End-user Vertical

- 6.2.1 BFSI

- 6.2.2 Retail & E-commerce

- 6.2.3 Healthcare and Life Science

- 6.2.4 Manufacturing

- 6.2.5 IT & Telecom

- 6.2.6 Media & Entertainment

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East & Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Dell Boomi, Inc.

- 7.1.2 Informatica Corporation

- 7.1.3 Mulesoft, Inc.

- 7.1.4 Snaplogic, Inc.

- 7.1.5 TIBCO Software Inc.

- 7.1.6 IBM Corporation

- 7.1.7 Jitterbit, Inc.

- 7.1.8 Oracle Corporation

- 7.1.9 Celigo, Inc.

- 7.1.10 SAP SE