|

市场调查报告书

商品编码

1406249

白云石:市场占有率分析、产业趋势与统计、2024年至2029年成长预测Dolomite - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

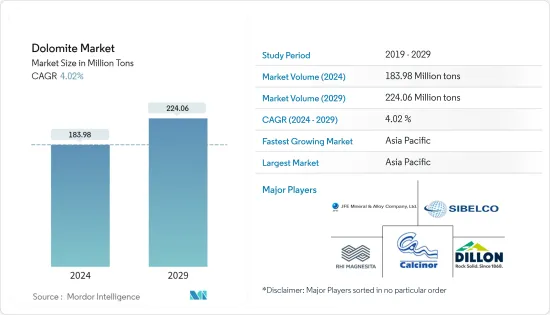

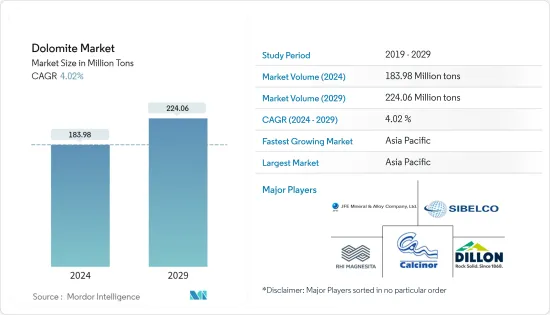

预计2024年白云石市场规模为18398万吨,预计2029年将达22406万吨,在预测期内(2024-2029年)复合年增长率为4.02%。

2020年,市场受到COVID-19大流行的负面影响,导致生产和运输放缓,水泥、陶瓷等行业因遏制措施和经济中断而被迫推迟生产。目前市场正从疫情中恢復。预计2022年市场将达到疫情前水准并持续稳定成长。

主要亮点

- 亚太地区建筑业应用的扩大和钢铁产量的扩大正在推动市场成长。

- 然而,以含有橄榄石矿物的火成岩取代原料白云石可能会阻碍勘探市场需求。

- 此外,预计使用白云石作为钙和镁补充品将在製药行业创造市场机会。

- 亚太地区主导了全球市场需求,其中中国、印度和日本等国家是最大的消费者。

白云石市场趋势

建设产业需求增加

- 白云石用作波特兰水泥混凝土的骨料,用于道路、建筑物和其他结构。白云石也与沥青材料结合用于道路和类似建筑。白云石土由于其强度和在精製过程中的相容性而在钢铁工业中得到了广泛的应用。

- 在水泥生产中,白云石被煅烧并切割成特定尺寸的块。建设产业是水泥最大的消费者之一。因为商业和工业建筑在全球范围内蓬勃发展。

- 美国人口普查局的数据显示,2023年1月至9月建筑支出年增约4.6%,达1.46兆美元。

- 亚太地区建筑业是世界上最大的建筑业,在中国和印度住宅建筑市场扩张的推动下,预计将成长最快。

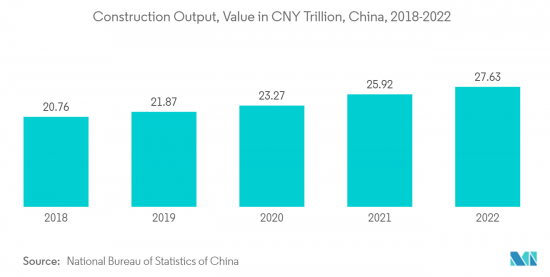

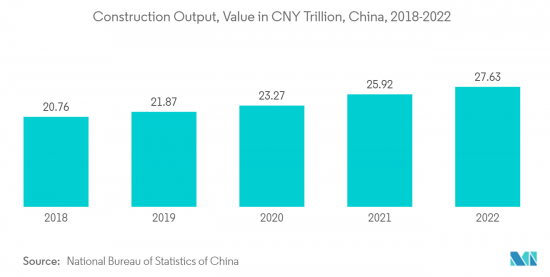

- 根据中国国家统计局数据,2022年国内建筑业产值达到高峰约4.11兆美元。

- 此外,印度正在扩大其商业部门。该国正在进行多个计划。例如,价值9亿美元的CommerzIII商业办公室综合大楼于2022年第一季动工。本计划位于孟买戈尔冈,兴建一栋43层商业办公大楼,占地面积2,60,128平方公尺。该计划预计将于 2027 年第四季完成,同时将在预测期内使所研究的市场受益。

- 由于上述因素,建设产业的白云石消费量预计在预测期内将以健康的速度成长。

亚太地区主导市场

- 由于中国、印度和日本等主要国家的建筑和医疗保健等工业部门的扩张,预计亚太地区在预测期内将占据全球白云石市场的最大份额。

- 中国拥有庞大的建筑业,近两年基础设施和住宅领域的发展支撑了建筑业的整体成长,无论是数量或金额。

- 中国是世界上最大的水泥生产国,在快速成长的建设产业的支持下,对水泥的需求不断增加。例如,根据中国国家统计局(NBS)的数据,2023年上半年水泥产量将从2022年同期的9.79亿吨增加到9.8亿吨,支撑市场成长。

- 此外,根据中国国家统计局的数据,2022年中国付加约8.3兆元(约1.23兆美元),与前一年同期比较成长3%以上。

- 此外,医疗保健行业的扩张预计将推动市场成长。根据 IBEF 的数据,印度的製药业按数量排名世界第三,按金额排名第 14 位。印度製药业占国内生产总值(GDP)的近1.72%。

- 因此,由于上述趋势,亚太地区预计将在预测期内主导白云石市场。

白云石产业概况

白云石市场因其性质而部分分散。研究市场的主要企业包括(排名不分先后)Sibelco、Calcinor、RHI Magnesita、JFE Mineral & Alloy Company, Ltd、Dillon 等。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 扩大亚太地区的建设活动

- 扩大钢铁生产

- 其他司机

- 抑制因素

- 用火成岩取代原料白云石

- 其他阻碍因素

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场区隔(市场规模)

- 矿物类型

- 集聚

- 射击

- 烧结

- 最终用户产业

- 农业

- 陶瓷/玻璃

- 水泥

- 采矿/冶金

- 药品

- 水处理

- 其他最终用户产业(例如饲料)

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 欧洲其他地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东/非洲

- 沙乌地阿拉伯

- 南非

- 其他中东/非洲

- 亚太地区

第六章 竞争形势

- 併购、合资、联盟、协议

- 市场占有率(%)**/排名分析

- 主要企业策略

- 公司简介

- Calcinor

- Carmeuse

- Dillon

- Imerys

- JFE Mineral & Alloy Company,Ltd.

- Lhoist

- Omya AG

- Raw Edge Industrial Solutions Limited

- RHI Magnesita

- Sibelco

第七章 市场机会及未来趋势

- 对钙和镁补充品的需求增加

- 其他机会

The Dolomite Market size is estimated at 183.98 Million tons in 2024, and is expected to reach 224.06 Million tons by 2029, growing at a CAGR of 4.02% during the forecast period (2024-2029).

The market was negatively impacted by the COVID-19 pandemic in 2020 as there was a slowdown in production and mobility, wherein industries such as cement, ceramics, etc., were forced to delay their production due to containment measures and economic disruptions. Currently, the market has recovered from the pandemic. The market reached pre-pandemic levels in 2022 and is expected to grow steadily in the future.

Key Highlights

- The increasing applications in construction industries and expanding steel production in the Asia-Pacific region have been driving the market growth.

- However, the substitution of raw dolomites with igneous rock containing olivine minerals may hamper the demand for the studied market.

- Furthermore, the use of dolomite as a calcium and magnesium supplement is predicted to generate a market opportunity in the pharmaceutical industry.

- Asia-Pacific region dominated the market demand around the world, with countries like China, India, and Japan, being the biggest consumers.

Dolomite Market Trends

Increasing Demand from Construction Industry

- Dolomite is used as aggregate in Portland cement concrete, which is used for roads, buildings, and other structures. Dolomite is also used in combination with bituminous materials for roads and similar construction. Dolomite ground finds a huge application in the iron and steel industry due to its strength and compatibility in the process of purifying iron and steel.

- In the production of cement, dolomite is calcined, and then it is cut into blocks of a specific size. The construction industry is one of the largest consumers of cement. The growing commercial and industrial construction activities are experiencing a boom globally.

- According to the U.S. Census Bureau, the construction spending over the first 9 months of 2023 increased by about 4.6% to USD 1.46 trillion, compared to the same period in 2022.

- The construction sector in the Asia-Pacific region is the largest in the world, and the highest growth for housing is expected to be registered in the Asia-Pacific region, owing to the expanding housing construction markets in China and India.

- According to the National Bureau of Statistics of China, the domestic construction output peaked in 2022 at a value of about USD 4.11 trillion.

- Furthermore, India is expanding its commercial sector. Several projects have been going on in the country. For instance, the CommerzIII Commercial Office Complex construction worth USD 900 million started in Q1 2022. The project involves the construction of a 43-story commercial office complex with a permissible floor area of 2,60,128 square meters in Goregaon, Mumbai. The project is expected to be completed in Q4 2027, thus benefitting the studied market simultaneously during the forecast period.

- Owing to the factors mentioned above, the consumption of dolomite is expected to rise at a healthy rate from the construction industry over the forecast period.

Asia-Pacific to Dominate the Market

- The Asia-Pacific region is expected to account for the largest share of the global dolomite market during the forecast period owing to expanding industrial sectors, such as construction and healthcare, in major countries such as China, India, Japan, etc.

- China hosts a vast construction sector, and the developments in the infrastructure and residential sectors in the past two years have supported the growth of the construction sector at large, both in terms of volume and value.

- China is the largest cement producer globally, and the demand for cement is constantly increasing, supported by the rapidly growing construction industry. For instance, according to the National Bureau of Statistics (NBS) of China, cement output in the first half of 2023 increased to 980 million metric tons from 979 million metric tons in the same period in 2022, thus supporting the growth of the market.

- Also, according to the National Bureau of Statistics of China, the construction industry in China generated an added value of approximately CNY 8.3 trillion (~ USD 1.23 trillion) in 2022, reflecting an increase of more than 3% compared to the previous year.

- Also, the expanding healthcare sector is expected to fuel the market's growth. For instance, India is a global pharmaceutical hub, according to IBEF, the Indian Pharmaceutical industry is the third largest in the world in terms of volume and 14th largest in terms of value. The Indian Pharma sector contributes to nearly 1.72% of the country's GDP.

- Therefore, owing to such trends mentioned above, the Asia-Pacific region is expected to dominate the dolomite market during the forecast period.

Dolomite Industry Overview

The dolomite market is partially fragmented in nature. The major players in the studied market (not in any particular order) include Sibelco, Calcinor, RHI Magnesita, JFE Mineral & Alloy Company, Ltd., and Dillon, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Construction Activities in Asia-Pacific

- 4.1.2 Expanding Steel Production

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Substitution of Raw Dolomite With Igneous Rock

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Mineral Type

- 5.1.1 Agglomerated

- 5.1.2 Calcined

- 5.1.3 Sintered

- 5.2 End-user Industry

- 5.2.1 Agricuture

- 5.2.2 Ceramics and Glass

- 5.2.3 Cement

- 5.2.4 Mining and Metellurgy

- 5.2.5 Pharmaceuticals

- 5.2.6 Water Treatment

- 5.2.7 Other End-user Industries (Animal Feed, etc.)

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers & Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share(%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Calcinor

- 6.4.2 Carmeuse

- 6.4.3 Dillon

- 6.4.4 Imerys

- 6.4.5 JFE Mineral & Alloy Company,Ltd.

- 6.4.6 Lhoist

- 6.4.7 Omya AG

- 6.4.8 Raw Edge Industrial Solutions Limited

- 6.4.9 RHI Magnesita

- 6.4.10 Sibelco

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increase in Demand for Calcium And Magnesium Supplements

- 7.2 Other Opportunities