|

市场调查报告书

商品编码

1406277

IT 连接器:市场占有率分析、产业趋势/统计、成长预测,2024-2029 年IT Connector - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

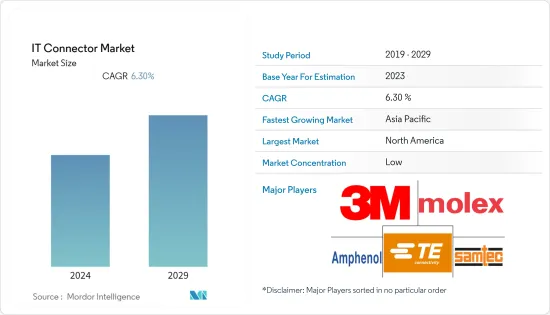

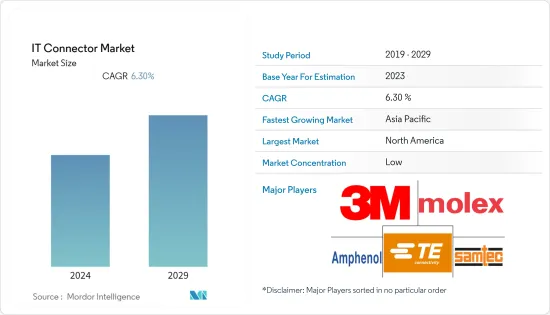

IT 连接器市场预计在预测期内复合年增长率为 6.3%。

对高速连接的需求、汽车行业的扩张以及水下电缆和军事系统投资的大幅增加等因素预计将在研究期间推动 IT 连接器市场的发展。

由于世界数位转型,IT 连接器市场正在蓬勃发展。可靠的连接、高效能和效率是推动市场成长的关键因素。高效能网路对于商业、製造、安全和媒体至关重要。新兴国家对媒体和娱乐的需求不断增长,网路普及不断提高,导致电视和网路用户数量以及智慧型手机、PDA 和平板电脑设备用户数量大幅增加。这些因素创造了对连接器适配器的巨大需求。

对连接和网路存取的需求不断增长,积极推动了市场的成长。对更快的互联网速度和改进的连接的需求不断增长,最终需要光纤技术实现强大而高效的布线连接。连接器有助于保护光纤,因此正在积极推动市场成长。国际电信联盟预测,到 2022 年,将有 53 亿人(即世界人口的 66%)使用网路。这比 2019 年成长了 24%,2019 年预计将有 11 亿人连接到网路。固定宽频连线数量的增加正在促进所研究市场的成长。据国际电联称,过去五年固定宽频用户数量每年增长约 9%。据国际电信联盟称,到 2021 年,全球每 100 人固定宽频连线将达到 17 个活跃连线。宽频连线的增加需要连接器,因此预计将为所研究的市场带来成长机会。

由于 COVID-19 爆发,中国在 2020 年前几个月宣布封锁并实施社会隔离。结果,各种设备和机械的製造和生产暂停了数週。 IT 连接器产业在直接支援对抗 COVID-19 方面处于独特的地位。连接产品对于电脑、周边设备和商业设备等电子设备的製造至关重要。在一些地区,电子公司被认为是重要的企业。在严格的限制下,他们正在製造製造保护和照顾感染 COVID-19 的人所需的产品所需的零件,同时采取预防措施保护其员工。提供给OEM。

IT连接器市场趋势

IT/通讯预计将占据很大份额

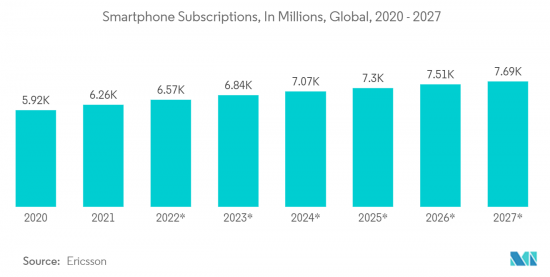

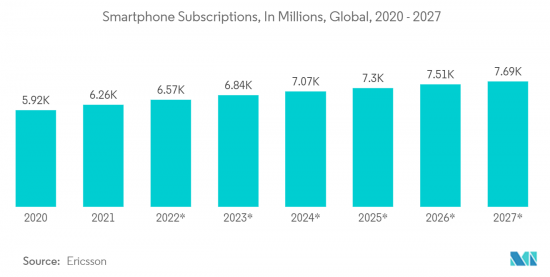

- 由于消费者对智慧型手机设备和下一代技术的偏好不断变化,推动该业务的关键驱动力之一是增加 5G 网路安装支出。

- 业务扩张的其他潜在驱动因素包括智慧型手机用户的增加、高速网路连线需求的激增以及付加管理服务需求的增加。例如,据美国农业部(USDA)部长称,2022年7月,该机构将斥资4.01亿美元,为11个州的31,000名农村人口和企业提供高速宽频接入,并加强农村基础设施建设。

- 全球领先公司增加对通讯的投资预计将有助于预测期内的市场成长。例如,2022年8月,全球客户数量最大的供应商中国移动2022年上半年在5G市场投资587亿元人民币(约85亿美元)。此外,中国移动表示,目前正在与中国广播网路公司推动5G基础设施的联合开发和部署,该基础设施使用700MHz频段。

- 2020 年 4 月,射频连接解决方案供应商 Cinch Connectivity Solutions 宣布推出采用 Johnson 连接器和 Semflex 低损耗 PTFE 电缆这两个 Cinch 品牌的 2.92mm、40GHz 电缆组件。最新的 40GHz 测试电缆组件采用 Johnson 的 2.92mm 连接器和 76% Vp(传播速度)Semflex HP160S 电缆,为您的测试和测量环境提供高效能。这些电缆组件提供 40GHz 工作性能和高达 1.25 的 VSWR。理想的应用与公司支援通讯、电讯以及测试和测量行业的 5G/毫米波产品开发一致。

亚太地区预计将经历最快的成长

- 通讯技术的不断进步是推动IT连接器市场成长的主要因素,而这恰恰带动了亚太地区消费性电子产品的需求和生产。例如,诺基亚在2021年10月宣布,其5G核心现在透过利用MOCN接入5G RAN的能力,支援APT的即时5G非独立(NSA)和VoLTE服务,我明确表示。

- 此外,工业应用中自动化流程的 IT 和通讯支援也促进了製造商的采用。感测器组件、更快的网路、具有高可靠性和安全分层存取的灵活介面以及纠错选项可提高该地区的生产力,确保持续的质量,并降低製造成本。

- 该地区的政府机构实施了许多措施和法规来改善网路基础设施。倡议的扩展预计将增加对高速资料传输电缆和连接器的需求。例如,2022年9月,印度IT部长宣布,政府将斥资约300亿美元在偏远地区建立强大的数位网络,并在全国每个村庄提供4G和5G最后一哩网路连线。

- 工业、商业和消费性电子产业的成长预计将对亚太地区产生积极影响。政府加强现有通讯网路的努力将进一步补充全国的连结性。

IT连接器产业概况

全球IT连接器市场较为分散,由于需求不断增长且所需资本投资较低,参与者可以快速进入该市场。此外,市场参与企业不断宣布或更新产品系列。主要参与者包括 A3M 公司、Molex Inc. (Koch)、TE Connectivity Limited、Ampheno Corporation 和 Samtec Inc.。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 市场驱动因素

- 通讯领域不断进步,改善连结性的需求不断增加

- 高频宽的需求不断增长

- 市场挑战

- 原物料价格波动

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- COVID-19 对 IT 连接器产业的影响

第五章市场区隔

- 按类型

- PCB连接器

- IDC连接器

- IO连接器

- 其他(圆形/长方形)

- 最终用户产业

- 资讯科技/通讯

- 消费性电子产品(包括电脑、周边设备和商业设备)

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 韩国

- 其他亚太地区

- 拉丁美洲

- 中东/非洲

- 北美洲

第六章 竞争形势

- 公司简介

- 3M Company

- Molex Inc.(Koch)

- TE Connectivity Limited

- Amphenol Corporation

- Samtec Inc.

- Almita Co. Limited

- Harwin Group

- Conec Electronische GmbH

- Harting Technology Group

- JST Connectors

- Wurth Elektronik GmbH & Co. KG

- Cixi Lanling Electronic Group

- Hon Hai Precision Industry Co., Ltd.

- WAGO Group

- Phoenix Contact GmbH & Co KG

- Fischer Connectors SA

第七章 投资分析

第八章市场的未来

The IT Connector Market is expected to register a CAGR of 6.3% over the forecast period. Factors, such as the need for high-speed connections, the automobile sector's expansion, and a significant increase in investment in underwater cables and military systems, are among the drivers expected to propel the IT connector market over the study period.

The market for IT connectors is booming due to the global digital transition. Reliable connectivity, high performance, and efficiency are the major factors boosting the market's growth. High-performance networks are essential for business, manufacturing, security, and media. The growing demand for media and entertainment and the increasing internet penetration across emerging economies significantly multiplied the number of television and internet subscribers and users of smartphones, PDAs, and tablets. These factors created an immense demand for connector adapters.

Growing demand for connectivity and internet access is positively driving the market's growth. The growing need for higher internet speed and better connectivity eventually requires robust and efficient cable connectivity, fulfilled by fiber optic technology. The connectors are helpful in the protection of optic fiber, which drives the market's growth positively. In 2022, the ITU predicted that 5.3 billion people, or 66% of the world's population, will be utilizing the internet. This marks a 24% growth from 2019, with an expected 1.1 billion individuals joining the internet throughout that time. The rising number of fixed broadband connections has enabled the growth of the market studied. According to ITU, fixed-broadband subscriptions increased by around 9% annually in the last five years. According to ITU, in 2021, fixed broadband subscriptions reached 17 active subscriptions per 100 inhabitants of the world population. This increase in broadband connections is expected to provide an opportunity for the growth of the market studied, as installing such connections requires connectors.

The outbreak of COVID-19 led China to announce a lockdown and practice social isolation in the initial months of 2020. This factor halted manufacturing and the production of various equipment and machinery for several weeks. The IT connector industry was uniquely positioned to aid directly in the fight against COVID-19. Connectivity products are crucial for manufacturing electronics, such as computers, peripherals, and business equipment. Electronics companies have been considered essential businesses in several regions. Amid severe constraints, they provided OEMs with the parts necessary to manufacture the products required for protecting and offering care for people affected by COVID-19, while taking precautions to protect their employees.

IT Connector Market Trends

IT and Telecom is Expected to Hold Significant Share

- One of the main drivers propelling this business is the increased expenditure on installing 5G networks due to the shift in consumer preference toward smartphone handsets and next-generation technology.

- Other possible drivers of business expansion include an increase in smartphone subscribers, skyrocketing high-speed internet connection demand, and increased demand for value-added management services. For instance, in July 2022, according to the Secretary of the US Department of Agriculture (USDA), the Department spent USD 401 million, providing 31,000 rural people and businesses in 11 states access to high-speed broadband, thus boosting rural infrastructure.

- Increasing investments by major companies worldwide in telecommunication are expected to contribute to market growth over the forecast period. For instance, in August 2022, China Mobile, the biggest provider in the world by the number of customers, spent CNY 58.7 billion (around USD 8.5 Billion) in the 5G market in the first half of 2022. Additionally, China Mobile stated that it was still promoting the joint development and deployment of its 5G infrastructure, with China Broadcasting Network Corporation utilizing spectrum in the 700 MHz range.

- In April 2020, Cinch Connectivity Solutions, a provider of RF connectivity solutions, announced the release of 2.92 mm, 40 GHz cable assemblies, utilizing two Cinch brands, connectors from Johnson, and low-loss PTFE cables from Semflex. The latest 40 GHz Test Cable Assemblies uses 2.92 mm connectors from Johnson, coupled with Semflex HP160S cable with Vp (velocity of propagation) of 76%, offering high performance for test and measurement environments. These cable assemblies provide 40 GHz operating performance and a VSWR max of 1.25. Ideal applications align with the company's 5G/mm-wave product development to support communications, telecom, and test & measurement industries.

Asia-Pacific is Expected to Witness Fastest Growth

- The continuous advancements in communication technologies are the major factors boosting the growth of the IT connectors market, precisely the demand for and the production of consumer electronics in the Asia-Pacific region. For instance, in October 2021, Nokia revealed that its 5G Core was currently supporting APT's live 5G Non-Standalone (NSA) and VoLTE service by leveraging the MOCN's ability to access the 5G RAN.

- Moreover, IT and communications support for automated processes in industrial applications facilitated easier adoption among the manufacturers. Sensor components, faster networks, and flexible interfaces with high levels of reliability and secured hierarchical access, as well as error-correction options, added productivity, continued quality deliveries, and minimized manufacturing costs in the region.

- The government organizations in the region have undertaken many initiatives and regulations to improve the network infrastructure. Growing initiatives are expected to augment the demand for high-speed data transmission cables and connectors. For instance, in September 2022, India's IT Minister announced that the government is spending nearly USD 30 billion to create a strong digital network in remote regions and provide last-mile network connectivity for 4G and 5G in each village nationwide.

- The growing industrial, commercial, and household electronics sectors are expected to impact the Asia Pacific region positively. The installation of connections around the country will be further complemented by government initiatives to enhance the current telecommunications networks.

IT Connector Industry Overview

The global IT connector market is fragmented, as the players can quickly enter the market owing to the rising demand and low capital investment required. Moreover, the companies in the market have been continually launching or updating their product portfolio. Some of the key players include A3M Company, Molex Inc. (Koch), TE Connectivity Limited, Amphenol Corporation, and Samtec Inc.

In December 2021, Phoenix Contact, a producer of industrial automation solutions, introduced a few new PCB-to-Cable connections for use in applications involving the coupling of signal, data, and power.

In October 2021, CommScope released its new protected connector, Prodigy, which is meant to expedite and improve field deployment for future fiber networks. For compatibility across various fiber terminals and wire assemblies, the Prodigy system uses universal and compact form toughened connections. Smaller, higher-density terminal layouts are made possible by the small footprint, and the self-aligning connections reduce the possibility of connection mistakes.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Advancements in the Telecom Sector Coupled With Greater Demand for Improved Connectivity

- 4.2.2 Increasing Demand for High Bandwidth

- 4.3 Market Challenges

- 4.3.1 Volatile Prices of Raw Material

- 4.4 Industry Value Chain Analysis

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Consumers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Impact of COVID-19 on the IT Connector Industry

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 PCB Connectors

- 5.1.2 IDC Connectors

- 5.1.3 IO Connectors

- 5.1.4 Other Types (Circular/Rectangular)

- 5.2 By End-user Vertical

- 5.2.1 IT and Telecom

- 5.2.2 Consumer Electronics (including Computer, Peripherals, and Business Equipment)

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.2 Europe

- 5.3.2.1 United Kingdom

- 5.3.2.2 Germany

- 5.3.2.3 France

- 5.3.2.4 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 South Korea

- 5.3.3.4 Rest of Asia-Pacific

- 5.3.4 Latin America

- 5.3.5 Middle East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 3M Company

- 6.1.2 Molex Inc. (Koch)

- 6.1.3 TE Connectivity Limited

- 6.1.4 Amphenol Corporation

- 6.1.5 Samtec Inc.

- 6.1.6 Almita Co. Limited

- 6.1.7 Harwin Group

- 6.1.8 Conec Electronische GmbH

- 6.1.9 Harting Technology Group

- 6.1.10 JST Connectors

- 6.1.11 Wurth Elektronik GmbH & Co. KG

- 6.1.12 Cixi Lanling Electronic Group

- 6.1.13 Hon Hai Precision Industry Co., Ltd.

- 6.1.14 WAGO Group

- 6.1.15 Phoenix Contact GmbH & Co KG

- 6.1.16 Fischer Connectors SA