|

市场调查报告书

商品编码

1406283

超宽频-市场占有率分析、产业趋势与统计、2024年至2029年成长预测Ultra-Wideband - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

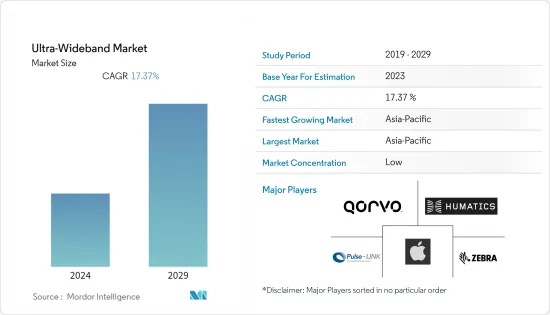

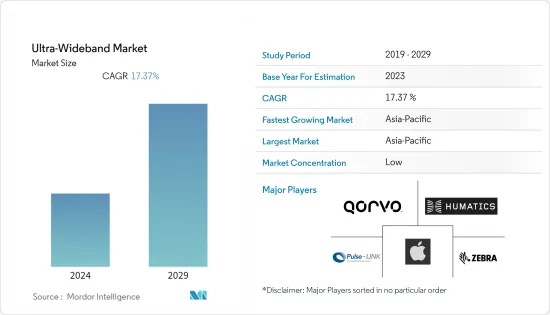

超宽频市场规模预计将从2024年的18.2亿美元成长到2029年的40.5亿美元,预测期间(2024-2029年)复合年增长率为17.37%。

行动电话手机等家用电子电器的普及和渗透是市场成长的驱动力。 UWB 技术在无线感测器网路中的新兴应用直接影响着市场的成长。

主要亮点

- 工业物联网(IIoT)需求的不断成长是超宽频市场成长的主要原因。 IIoT 使用智慧感测器来改进製造和其他工业应用。它透过减少劳动力和实现流程自动化来提高工业营运效率。由于其各种应用,即时定位系统 (RTLS) 对 UWB 技术的需求显着增加。

- 都市化、现代化和全球化的不断发展正在推动市场成长。工业基础设施的成长、提高半导体工具可操作性的技术进步以及全球医疗保健和零售业数位化的提高也是推动市场成长的因素。此外,UWB 技术的新应用预计将推动市场成长。

- 由于 UWB 技术比 Wi-Fi 和 RFID 更准确,因此许多使用 RTLS 的行业正在从 Wi-Fi 和 RFID 转向 UWB 技术,以提高效率、缩短交货时间并降低成本。这些也推动了对超宽频技术的需求,并将推动未来几年的市场发展。

- UWB 市场正面临来自蓝牙、GPS 和 Wi-Fi 等替代产品的激烈竞争。与蓝牙和Wi-Fi相比,UWB具有许多优点,例如高安全性、低功耗、宽频宽和双向通讯,使其在许多应用中都有用处。然而,由于 UWB 比其替代品更昂贵,因此其在最终用户行业的使用可能受到限制。

- 超宽频是一种无线技术,可以测量设备内部或外部几公分的位置。这使得比以往更准确地即时追踪设备的位置和距离成为可能。各国已采取了 COVID-19 接触者追踪和社交疏远措施,以阻止大流行的进一步传播。在大流行期间,基于 UWB 的设备因其高精度而为这些应用创造了机会。

超宽频 (UWB) 市场趋势

消费性电子产品占据主要市场占有率

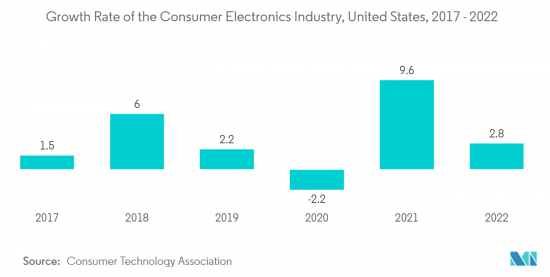

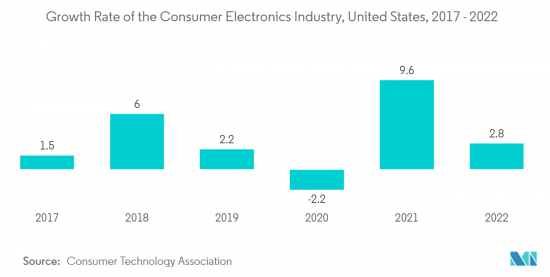

- 近年来,超宽频(UWB)技术已被应用于许多消费性电子产品中,因为它允许以无线方式传输和接收高速资料。超宽频技术广泛应用于苹果、三星和谷歌的 Pixel 高阶智慧型手机、部分高阶笔记本(联想)、扬声器(HomePod Mini)和穿戴式装置。它也越来越多地应用于智慧家庭应用,家用电器的UWB市场在未来几年有显着成长的空间。

- 近年来,UWB技术在智慧型手机中开始普及。 2023 年 3 月,三星发布了具有 UWB 功能的 Exynos Connect U100 晶片。这款新型三星晶片将快闪记忆体、射频、基频和电源管理技术整合在一个晶片中,使其适用于下一代 Galaxy SmartTag+ 等紧凑型装置。该晶片还具有加扰时间戳排序 (STS) 功能,这是一种实体加密技术,可在装置层级加密资料包的时间戳记。

- UWB 技术也作为在各种消费应用中追踪个人财产的一种方式进行销售。带有UWB标籤的钱包、钥匙和其他个人物品可以在配备超宽频晶片的智慧型手机上找到。 UWB 标籤提供高精度、定向和低延迟定位。

- 智慧型手机在中国、印度和美国国家很普及,因此它们很可能拥有最高的出货份额。虽然并非所有智慧型手机都搭载UWB技术,但自2019年9月iPhone 11发布以来,Google、三星、小米等多家公司都发表了搭载UWB技术的产品。

- 例如,2023 年 6 月,NOVELDA 宣布推出全球功耗最低的超宽频 (UWB) 雷达感测器。该雷达设计为依靠电池供电运行,功耗极低,低于 100 微瓦。最终产品预计将于 2024 年中期推出。 NOVELDA 也将在 709 号展位展示革命性的 NOVELDA UWB接近感测器和 NOVELDA UWB 占用感测器。由于相容于 UWB 的智慧型手机销量很大,因此出货货量可能会高于物联网装置。

在物联网中,我们可以想到空气标籤、空气舱、智慧家庭市场等。

亚太地区预计成长最快

- 亚太地区拥有中国、印度、台湾、日本、越南和韩国等许多新兴经济体。该地区开发中国家的工业正在快速成长。据 GSMA 称,许多亚太国家已製定计划在本国市场支持工业 4.0。此外,製造业和医疗保健是预计将立即受益于工业 4.0 的首要产业。

- 几家本地公司正在生产低功耗 UWB 无线收发器 IC,可实现新型短距离无线连接应用,例如无电池物联网感测器。与蓝牙低功耗或 ZigBee 相比,UWB 无线收发器的能源效率更高几个数量级,具有更高的延迟和吞吐量,可提供连续、丰富的资料流以及准确的范围和位置。这是因为 UWB 技术允许感测器等无线设备在没有电池的情况下运行,并且与能量收集技术相结合,可以大大延长电子设备的电池寿命。因此,UWB技术在亚太地区越来越受欢迎,该地区的公司都注重节能策略。

- 市场上连网型和电动车的到来为本地超宽频技术解决方案供应商提供了机会。各公司正在合作开发支援 UWB 的汽车产品,这正在推动亚太地区市场的发展。例如,2022年7月,恩智浦半导体与台湾鸿海科技有限公司签署了一份谅解备忘录,将建构新一代智慧连网型汽车平台,该平台由结合了UWB技术的NXP S32域提供支援。

- 随着物联网设备对 UWB 技术的需求不断增长,物联网在製造业和汽车行业的使用正在创造市场机会。此外,台湾和中国大陆是晶片製造的重要地点,印度的晶片製造使命可能有助于该地区的UWB技术晶片市场。

超宽频 (UWB) 产业概览

超宽频 (UWB) 市场竞争激烈,主要是由于国际和国内市场上存在各种主要供应商。该市场似乎适度集中,主要参与者采取合併、收购和产品创新等策略来扩大产品系列扩大其地理覆盖范围。该市场的主要参与者包括德州仪器(德克萨斯)、DecaWave Limited 和恩智浦半导体 (NXP Semiconductors)。

2023 年 4 月,Link Labs 推出了 Ultra,这是一款结合了 UWB 和取得专利的Xtreme Low Energy (XLE) 技术的新型资产追踪产品。 Ultra 的定位精度高达 30 厘米,可满足需要更高精度的室内和现场使用案例。这种精度水准使製造业务能够有效地区分用于 WIP 和工具追踪等应用的登机工作站。

2022年7月,Humatics在义大利那不勒斯的日立铁路1.5公里测试轨道和一辆测试车辆上安装了HRNS,并将HRNS的位置和速度性能与真实感测器和日立铁路的CBTC里程计标准进行比较和评估。此外,HRNS还连接到基于通讯的列车控制(CBTC)模拟器,并进行了各种测试,包括超宽频(UWB)和惯性测量单元(IMU)等感测器以及Humatics提供的GNSS技术。

2022年7月,恩智浦与ING和三星合作,试办第一个基于UWB的点对点付款应用。该试验旨在透过利用 ING 的付款专业知识和恩智浦的超宽频技术来提高点对点付款的可用性和无缝性。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- COVID-19 市场影响评估

第五章市场动态

- 市场驱动因素

- 对 RTLS 应用的需求不断增长

- 工业物联网 (IIoT) 的采用率不断提高

- 市场挑战/抑制因素

- 替代产品的竞争

第六章市场区隔

- 按用途

- RTLS

- 影像处理

- 通讯

- 按行业分类

- 卫生保健

- 汽车与运输

- 製造业

- 消费性电子产品

- 按主要应用分類的 UWB 相容设备的全球出货

- 按地区分類的 UWB 相容智慧型手机设备的指示性份额

- 亚太地区各国 UWB 相容智慧型手机的指示性份额

- 洞察智慧型手机、物联网和穿戴式装置的关键应用

- 监管变化对消费性设备中 UWB 采用的影响

- 智慧型手机公司的主要UWB供应商

- 零售

- 其他最终用户产业

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东/非洲

第七章 竞争形势

- 公司简介

- Qorvo Inc.

- Humatics Corporation

- Pulse LINK Inc.

- Apple Inc.

- Zebra Technologies Corporation

- NXP Semiconductors NV

- Texas Instruments Incorporated

- Johanson Technology Inc.

- Alereon Inc.

- Fractus SA

第八章投资分析

第9章市场的未来

The Ultra-Wideband Market size is expected to grow from USD 1.82 billion in 2024 to USD 4.05 billion by 2029, registering a CAGR of 17.37% during the forecast period (2024-2029). The increasing popularity and penetration of consumer electronic devices, such as mobile phones and smartphones, drive the market's growth. The ongoing advancements in new applications of UWB technology in wireless sensor networks directly impact the market's growth.

Key Highlights

- The demand for the Industrial Internet of Things (IIoT), which is increasing, is a big reason why the ultra-wideband market is growing. IIoT uses smart sensors to improve manufacturing and other industrial applications. Reducing labor and enabling industries to automate processes increases the efficiency of industrial operations. The demand for UWB technology in the real-time location system (RTLS) increased significantly due to its various applications.

- Increasing urbanization, modernization, and globalization are driving the market's growth. Growing industrial infrastructure, technological advancements to improve the operation of semiconductor tools, and increasing digitization in the healthcare and retail sectors across the world are other factors driving the market's growth. New applications of UWB technology are also expected to boost the market's growth.

- Because UWB technology is more accurate than Wi-Fi and RFID, many industries that use RTLS have switched from Wi-Fi and RFID to UWB technology to increase efficiency, shorten lead times, and lower costs. These things also boosted the demand for ultra-wideband technology, driving the market over the next few years.

- The UWB market is getting stiff competition from substitute products such as Bluetooth, GPS, and Wi-Fi. UWB is better than Bluetooth and Wi-Fi in many ways, such as high security, low power, high bandwidth, two-way communication, etc., making it useful for many applications. However, UWB may be used less by end-user industries because it is more expensive than alternatives.

- Ultra-wideband is a wireless technology that can measure a device's location to within a few centimeters inside and outside. This makes it possible to track a device's position and distance in real-time with more accuracy than ever before. Applications for COVID-19 contact tracing and social distancing were made in many different countries to stop the pandemic from spreading further. This created an opportunity for UWB-based devices during the pandemic because of their accuracy, making them a good fit for these apps.

Ultra Wideband (UWB) Market Trends

Consumer Electronics to Hold Significant Market Share

- Ultra-wideband (UWB) technology has been used in a lot of consumer electronics in the past few years because it can send and receive high-speed data wirelessly. Ultra-wideband technology is used a lot in Apple, Samsung, and Google Pixel high-end smartphones, some high-end laptops (Lenovo), speakers (HomePod Mini), and wearable devices. It is also being used more and more in smart home applications, which gives the UWB market in consumer electronics a lot of room to grow in the next few years.

- In the past few years, UWB technology has become more popular in smartphones. In March 2023, Samsung launched the Exynos Connect U100 chip for UWB capabilities. The new Samsung chip combines flash memory, radio frequency, a baseband, and power management technology onto a single chip, making it suitable for compact devices, like the next generation of the Galaxy SmartTag+. The chip also has an onboard scrambled timestamp sequence (STS) function, a physical cryptographic technique allowing device-level encryption for the time stamps of data packets.

- UWB technology is also being marketed as a way to track personal items for different consumer applications. Wallets, keys, and other personal items with a UWB tag can be found with a smartphone that has an ultra-wideband chip built in. UWB tags provide highly accurate, directional, and low-latency positioning.

- Smartphones are thought to have the largest share of shipments because they are so popular in places like China, India, the United States, and other places. Even though not all smartphones have UWB technology, many companies, including Google, Samsung, and Xiaomi, have released products with UWB technology since the iPhone 11 came out in September 2019.

- For instance, in June 2023, NOVELDA unveiled the world's lowest-power ultra-wideband (UWB) radar sensor. This radar is designed to operate on batteries with an astonishingly low power consumption below 100 microwatts. The final product will launch in mid-2024. NOVELDA will also demonstrate its groundbreaking NOVELDA UWB Proximity Sensor and NOVELDA UWB Occupancy Sensor at Booth 709. Since there are a lot of sales of UWB-enabled smartphones, the shipments are thought to be higher than for IoT devices.

In the IoT, devices such as air tags, airpods, and those in the smart home market are considered.

Asia-Pacific is Expected to Witness Fastest Growth

- In the Asia-Pacific region, there are a lot of developing economies, like China, India, Taiwan, Japan, Vietnam, South Korea, and others. The region has been witnessing rapid industrial growth in developing countries. According to the GSMA, many Asia-Pacific countries have developed plans to assist Industry 4.0 in their marketplaces. Additionally, manufacturing and healthcare are the top sectors expected to immediately experience the benefits of Industry 4.0.

- Several local businesses have made low-power UWB wireless transceiver ICs that allow a new class of short-range wireless connectivity applications, such as IoT sensors that don't need batteries. UWB wireless transceivers offer continuous, rich data streaming as well as precise range and location with orders of magnitude more energy efficiency, latency, and throughput than Bluetooth Low Energy or ZigBee.This is because UWB technology lets wireless devices like sensors work without batteries and dramatically increases the battery life of electronic gadgets when combined with energy-harvesting technologies. This is why UWB technology is becoming more popular in the APAC region, where companies are putting an emphasis on energy-saving strategies.

- As the number of connected cars and electric vehicles on the market grows, regional UWB technology solution providers will have a chance to do business. Companies are partnering to develop UWB-enabled automobile products, which drive the APAC market. For instance, in July 2022, NXP Semiconductors and Taiwan's Hon Hai Technology Grove signed a memorandum of understanding to build platforms for a new generation of smart, connected automobiles that feature the NXP S32 domain embedded with UWB technology.

- Due to the growing need for UWB technologies in IoT devices, the use of IoT in the manufacturing and auto industries is creating an opportunity for the market. Also, Taiwan and China are important places for making chips, and India's mission to make chips would help the market for UWB technology chips in the region.

Ultra Wideband (UWB) Industry Overview

The market for Ultra-Wideband is exceptionally competitive, mainly due to the presence of various critical vendors in the market operating in both international and domestic markets. The market appears to be moderately concentrated, with the significant players adopting strategies such as mergers, acquisitions, and product innovation to widen their product portfolio and extend their geographic reach. Some vital players in the market are Texas Instruments, DecaWave Limited, and NXP Semiconductors, among others.

In April 2023, Link Labs launched Ultra, a new asset-tracking product that combines UWB with their patented Xtreme Low Energy (XLE) technology to provide greater precision for indoor location tracking at the exact low cost. Ultra has achieved location accuracy of up to 30 centimeters, enabling indoor and on-site use cases requiring more granular precision. With this level of accuracy, manufacturing operations can effectively distinguish between boarding workstations for applications such as WIP and tool tracking.

In July 2022, Humaticsset up the HRNS on a single test vehicle and 1.5 km of the Hitachi Rail test track in Naples, Italy, to evaluate the HRNS's position and speed performance compared to real-world sensors and Hitachi Rail's CBTC odometry criteria. Additionally, the HRNS was connected to a Communication-Based Train Control (CBTC) simulator, and various tests were run, which included Ultra-Wideband (UWB) and sensors like Inertial Measurement Units (IMU) and GNSS technology provided by Humatics.

In July 2022, NXP collaborated with ING and Samsung to test the first peer-to-peer payment application based on UWB. The pilot intends to improve the usability and seamlessness of peer-to-peer payments by leveraging ING's payment expertise and NXP's ultra-wideband technology.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of the Impact of COVID-19 on the market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing demand for RTLS applications

- 5.1.2 Increased Adoption of the Industrial Internet of Things (IIoT)

- 5.2 Market Challenge/Restraint

- 5.2.1 Competition from the Substitute Products

6 MARKET SEGMENTATION

- 6.1 By Application

- 6.1.1 RTLS

- 6.1.2 Imaging

- 6.1.3 Communication

- 6.2 By End-user Vertical

- 6.2.1 Healthcare

- 6.2.2 Automotive and Transportation

- 6.2.3 Manufacturing

- 6.2.4 Consumer Electronics

- 6.2.4.1 Global UWB-enabled Device Shipments by Major Application

- 6.2.4.2 Indicative Share of UWB-enabled Smartphone Devices by Region

- 6.2.4.3 Indicative Share of UWB Smartphones - Asia Pacific Country Level

- 6.2.4.4 Key Applications Insights in Smartphone, IoT, and Wearables

- 6.2.4.5 Impact of Regulatory Changes on the Adoption of UWB in Consumer Devices

- 6.2.4.6 Major UWB Suppliers for Smartphone Companies

- 6.2.5 Retail

- 6.2.6 Other End-user Verticals

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia-Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Qorvo Inc.

- 7.1.2 Humatics Corporation

- 7.1.3 Pulse LINK Inc.

- 7.1.4 Apple Inc.

- 7.1.5 Zebra Technologies Corporation

- 7.1.6 NXP Semiconductors NV

- 7.1.7 Texas Instruments Incorporated

- 7.1.8 Johanson Technology Inc.

- 7.1.9 Alereon Inc.

- 7.1.10 Fractus SA