|

市场调查报告书

商品编码

1406577

5G物联网-市场占有率分析、产业趋势与统计、2024年至2029年成长预测5G IoT - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

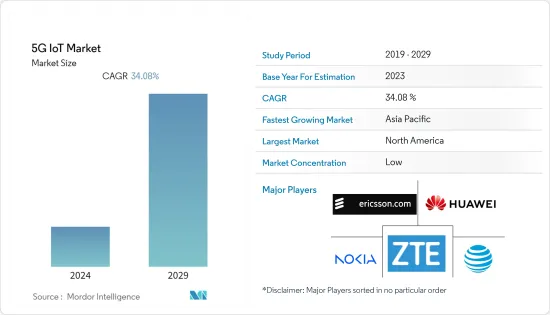

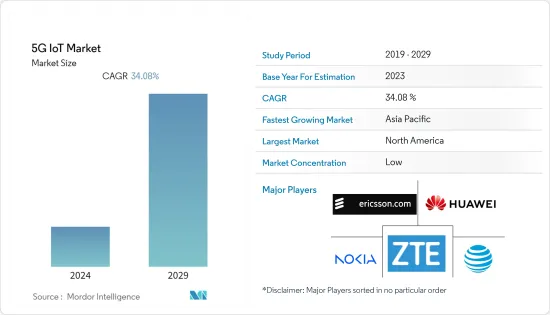

今年5G物联网市场规模预估为95.4亿美元。

预计五年内市场规模将达到 558.6 亿美元,预测期内复合年增长率为 34.08%。 5G 对于物联网至关重要,因为它需要大容量、高速网路来满足连接需求。 5G频谱提高了蜂窝技术传输资料的频率。这种广泛的频宽增加了行动网路的整体频宽,允许更多设备连接。

主要亮点

- 5G 物联网网路旨在同时支援大量连接装置。此功能在物联网应用中非常重要,其中许多感测器、摄影机和其他设备需要有效地通讯和交换资料。据Cisco称,到 2022 年,北美连网穿戴装置数量预计将达到 4.39 亿台,高于 2021 年的 3.788 亿台。此外,爱立信预计,2022年全球智慧型手机行动网路用户数将达到近66亿,2028年将超过78亿人。

- 随着物联网的扩展和更多设备的互连,对可靠且强大的通讯基础设施来支援这种大规模连接的需求日益增长。因此,5G 物联网市场预计将大幅成长,更多产业和部门将利用 5G 的潜力来实现其物联网雄心。

- 5G 相对于 LTE 在低延迟和关键应用方面的优势使其成为需要即时资料处理和可靠连接的行业和部门的有吸引力的选择。随着对低延迟、关键物联网应用的需求不断增加,在这些使用案例中采用 5G 将推动 5G 物联网市场的成长,改变各个行业并创造新的创新服务和解决方案。这将成为现实。

- 将基础设施从 LTE 升级到 5G 的成本正在限制市场成长。虽然 5G 为物联网应用提供了许多优势,包括更低的延迟、更高的容量和更快的资料速度,但部署5G 网路和升级现有基础设施的相关成本对于某些产业和地区来说尤其具有挑战性。

- COVID-19 大流行凸显了智慧城市解决方案对公共和城市管理的重要性。接触者追踪、人群监控、智慧基础设施等5G物联网应用受到关注。疫情期间,不少企业加快数位转型步伐,适应新常态。这包括采用 5G 支援的物联网解决方案来提高效率、生产力和自动化。

5G 物联网 (IoT) 市场趋势

汽车产业预计将经历显着的成长。

- 汽车产业是5G物联网市场最重要的细分市场之一。 5G的超高速和低延迟能力可实现车辆与云端的无缝连接,实现即时资料交换。连网型汽车可以收集有关交通状况、天气和道路危险的资讯,以提高安全性、改善导航并改善驾驶员辅助系统。

- 5G IoT 支援 V2X通讯,车辆可与其他车辆 (V2V)、基础设施 (V2I)、行人 (V2P) 和网路 (V2N)通讯。这种连接改善了道路安全和交通管理,并为自动驾驶奠定了基础。

- 5G物联网将透过即时追踪和监控车辆零件来改善供应链管理,从而改善库存管理并减少停机时间。

- 自动驾驶汽车的成功部署高度依赖强大而可靠的网路基础设施。 5G 的低延迟和高资料传输速度对于自动驾驶汽车和其他连接设备之间的即时通讯至关重要,使其成为自动驾驶汽车的关键推动者。

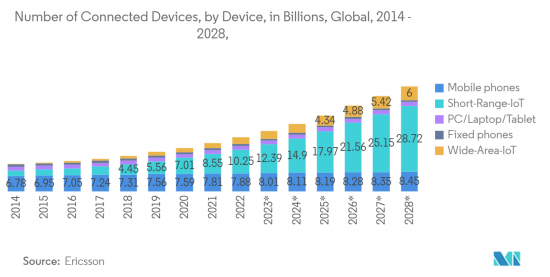

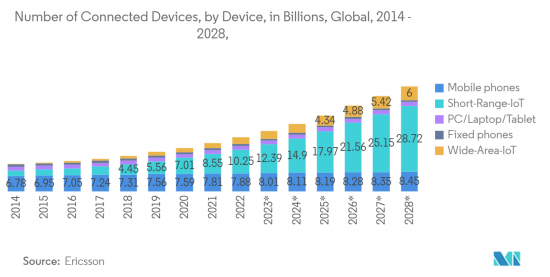

- 据爱立信称,全球连网型设备的数量将在五年内增加一倍。这一成长预计将由短程 IoT(物联网)设备的增加所推动,预计五年内此类设备将达到 287.2 亿台。连网型设备包括穿戴式装置、联网汽车、智慧感测器等。

预计北美将占据较大市场占有率

- 北美是最早商业性部署5G网路的地区之一,各大电信业者大力投资5G基础设施。 5G 的早期推出使该地区能够为各种物联网应用开发强大的生态系统。蓬勃发展

- 国内 5G 部署可能会增加对 5G 基础设施的需求,以支援已部署的 5G 功能和服务。例如,爱立信预计,三年内5G用户数将超过1.95亿,而在美国,六年内5G将占美国行动市场总量的约71.5%。

- 该地区的工业IoT(IIoT) 解决方案在製造业、能源和公共产业等多个领域的采用日益增加。 5G的高速、低延迟连线将增强IIoT能力,实现即时资料分析和远端监控。 CTIA表示,快速成长为美国5G经济创造了平台。预计将带来2,750亿美元的投资,创造300万个新就业岗位,并带来5,000亿美元的经济成长。

- 北美多个城市正在进行智慧城市计划,利用 5G 物联网技术改善城市基础设施、交通、公共安全和公民服务。

- 北美是汽车产业的中心,连网型汽车解决方案正在蓬勃发展。 5G IoT 支援先进的 V2X(车对万物)通讯,促进更安全、更有效率的交通。

5G物联网(IoT)产业概况

5G IoT 市场高度分散,主要企业包括诺基亚公司、AT&T 公司、华为科技公司、Telefonaktiebolaget LM Ericsson 和中兴通讯公司。市场参与者正在采取联盟和收购等策略来加强其产品供应并获得永续的竞争优势。

2023年6月,爱立信和Ooredoo卡达公司在Ooredoo卡达公司访问位于瑞典希斯塔的爱立信总部期间签署了将5G协议延长五年,以加强无线接取网路(RAN)产品和服务的合作。透过提供先进的5G RAN解决方案和服务,实现更快的资料通讯,爱立信将帮助卡达Oredoo为其用户开拓新的5G用例和连接机会,并加速物联网(探索人工智慧(AI)和机器学习等新技术)学习(ML)以优化网路效能和使用者体验。

2023 年 2 月,思科和 NEC 宣布计划扩大合作范围,涵盖 5G xHaul 和专用 5G 领域的系统整合解决方案和潜在商机。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家/消费者的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

- 技术简介

第五章市场动态

- 市场驱动因素

- 5G 技术能够处理数百万个物联网连接设备

- 5G 相对于 LTE 在低延迟和关键应用方面的优势

- 市场抑制因素

- 现有 4G LTE 技术足以满足某些物联网使用案例。

- 将基础设施从 LTE 升级到 5G 的成本

第六章市场区隔

- 依技术

- 超可靠低延迟通讯(URLLC)

- 低功耗广域网路 (LPWAN)

- 按最终用户产业

- 製造业

- 供应链

- 卫生保健

- 零售

- 智慧城市

- 车

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 北美其他地区

- 欧洲

- 德国

- 英国

- 法国

- 俄罗斯

- 西班牙

- 欧洲其他地区

- 亚太地区

- 印度

- 中国

- 日本

- 其他亚太地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东/非洲

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 非洲

- 北美洲

第七章 竞争形势

- 公司简介

- Nokia Corporation

- AT&T Inc.

- Huawei Technologies Co Ltd

- Telefonaktiebolaget LM Ericsson

- ZTE Corporation

- Cisco Systems Inc

- Deutsche Telekom AG(T-Mobile)

- Verizon Communication Inc

- Sprint Corp

- Vodafone Group PLC

第八章 市场机会及未来趋势

The 5G IoT Market was valued at USD 9.54 billion in the current year. The market is expected to reach USD 55.86 billion in five years, registering a CAGR of 34.08% during the forecast period. 5G is essential to the Internet of Things because of the need for a faster network with higher capacity that can serve connectivity needs. The 5G spectrum increases the frequencies on which cellular technologies will transfer data. This broader spectrum for use increases the overall bandwidth of mobile networks, allowing additional devices to connect.

Key Highlights

- 5G IoT networks are designed to support many connected devices simultaneously. This capability is critical in IoT applications, where many sensors, cameras, and other devices need to communicate and exchange data efficiently. According to Cisco Systems, the number of connected wearable devices in North America is expected to reach 439 million by 2022 from 378.8 million in 2021. Moreover, Ericsson says the number of smartphone mobile network subscriptions globally reached almost 6.6 billion in 2022 and is forecast to exceed 7.8 billion by 2028. this is expected to drive the market further.

- As the Internet of Things expands and more devices become interconnected, there is a growing need for reliable and robust communication infrastructure to support this massive scale of connectivity. As a result, the 5G IoT market is expected to experience substantial growth, with an increasing number of industries and sectors leveraging the potential of 5G to realize their IoT ambitions.

- The advantage of 5G over LTE for low latency and critical applications makes it a compelling choice for industries and sectors that require real-time data processing and reliable connectivity. As the demand for low latency and critical IoT applications increases, the adoption of 5G for such use cases will drive the growth of the 5G IoT market, transforming various industries and enabling new innovative services and solutions.

- The cost of upgrading infrastructure from LTE to 5G restrains the market growth. While 5G offers numerous advantages for IoT applications, including low latency, increased capacity, and higher data speeds, the expenses associated with deploying 5G networks and upgrading existing infrastructure can pose challenges, especially for certain industries and regions.

- The COVID-19 pandemic underscored the importance of smart city solutions for public safety and urban management. 5G IoT applications like contact tracing, crowd monitoring, and smart infrastructure gained attention. Many businesses accelerated digital transformation initiatives during the pandemic to adapt to the new normal. This includes adopting IoT solutions enabled by 5G for improved efficiency, productivity, and automation.

5G Internet of Things (IoT) Market Trends

Automotive Industry is Expected to Witness Significant Growth Rate

- The Automotive industry was one of the most significant segments in the 5G IoT market. 5G's ultra-fast and low-latency capabilities allow for seamless connectivity between vehicles and the cloud, enabling real-time data exchange. Connected cars can gather information on traffic conditions, weather, and road hazards, enhancing safety, better navigation, and improved driver assistance systems.

- 5G IoT enables V2X communication, which allows vehicles to communicate with other vehicles (V2V), infrastructure (V2I), pedestrians (V2P), and network (V2N). This connectivity improves road safety and traffic management, creating a foundation for autonomous driving.

- 5G IoT can improve supply chain management by enabling real-time tracking and monitoring of vehicle components and parts, leading to better inventory management and reduced downtime.

- The successful deployment of autonomous vehicles heavily relies on a robust and reliable network infrastructure. 5G's low latency and high data transfer rates are crucial for real-time communication between autonomous vehicles and other connected devices, making it a key enabler for self-driving cars.

- According to Ericsson, the number of connected devices globally is set to approximately double within five years. This growth is expected to be driven by an increase in short-range IoT (Internet of Things) devices, with 28.72 billion such devices forecast in five years. Connected devices include wearables, connected cars, and smart sensors.

North America is Expected to Hold Significant Market Share

- North America was among the first regions to deploy 5G networks commercially, with significant telecommunication companies investing heavily in 5G infrastructure. The early rollout of 5G has enabled the region to develop a robust ecosystem for various IoT applications. The booming

- 5G deployments in the country will increase the demand for 5g infrastructure to support the 5G features and services being rolled out. For instance, according to Ericsson, there will be more than 195 million 5G subscriptions in three years, and in six years, in the United States, 5G will account for about 71.5% of the entire U.S. mobile market.

- The region has seen significant adoption of Industrial IoT (IIoT) solutions in various sectors, including manufacturing, energy, and utilities. 5G's high-speed, low-latency connectivity enhances the capabilities of IIoT, enabling real-time data analytics and remote monitoring. According to CTIA, rapid growth creates a platform for the United States' 5G economy. It will lead to USD 275 billion in investment and 3 million new jobs, creating USD 500 billion in economic growth.

- Several cities in North America have embarked on smart city initiatives, using 5G IoT technologies to improve urban infrastructure, transportation, public safety, and citizen services.

- North America is a hub for the automotive industry and has witnessed rapid growth in connected vehicle solutions. 5G IoT enables advanced V2X (Vehicle-to-Everything) communication, facilitating safer and more efficient transportation.

5G Internet of Things (IoT) Industry Overview

The 5G IoT Market is highly fragmented, with major players like Nokia Corporation, AT&T Inc., Huawei Technologies Co Ltd, Telefonaktiebolaget LM Ericsson, and ZTE Corporation. Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

In June 2023, Ericsson and Ooredoo Qatar signed a five-year extension of their 5G deal during Ooredoo Qatar's visit to Ericsson's headquarters in Kista, Sweden, to increase collaboration on radio access network (RAN) products and services. Ericsson will deliver advanced 5G RAN solutions and services that enable faster data speeds, allowing Ooredoo Qatar to explore new 5G use cases and connectivity opportunities for subscribers, leverage the potential of Internet of Things (IoT) applications, and explore emerging technologies like artificial intelligence (AI), and machine learning (ML) for optimizing network performance and user experience.

In February 2023, Cisco and NEC Corporation announced plans to expand their collaboration efforts to include system integration solutions and potential opportunities in 5G xHaul and private 5G to help consumer transform their architecture and connect more people and things.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Defnition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Technology Snapshot

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 The Ability of 5G Technology to Handle Millions of IoT Connected Devices

- 5.1.2 Advantages of 5G over LTE for Low Latency and Critical Applications

- 5.2 Market Restraints

- 5.2.1 Existing 4G LTE Technology is Sufficient for Certain IoT Use Cases

- 5.2.2 Costs Involved in the up-gradation of the Infrastructure from LTE to 5G

6 MARKET SEGMENTATION

- 6.1 By Technology

- 6.1.1 Ultra-Reliable Low-Latency Communications (URLLC)

- 6.1.2 Low-Power Wide-Area Network (LPWAN)

- 6.2 By End-User Industry

- 6.2.1 Manufacturing

- 6.2.2 Supply Chain

- 6.2.3 Healthcare

- 6.2.4 Retail

- 6.2.5 Smart Cities

- 6.2.6 Automotive

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.1.3 Mexico

- 6.3.1.4 Rest of North America

- 6.3.2 Europe

- 6.3.2.1 Germany

- 6.3.2.2 United Kingdom

- 6.3.2.3 France

- 6.3.2.4 Russia

- 6.3.2.5 Spain

- 6.3.2.6 Rest of Europe

- 6.3.3 Asia Pacific

- 6.3.3.1 India

- 6.3.3.2 China

- 6.3.3.3 Japan

- 6.3.3.4 Rest of Asia Pacific

- 6.3.4 South America

- 6.3.4.1 Brazil

- 6.3.4.2 Argentina

- 6.3.4.3 Rest of South America

- 6.3.5 Middle East and Africa

- 6.3.5.1 UAE

- 6.3.5.2 Saudi Arabia

- 6.3.5.3 Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Nokia Corporation

- 7.1.2 AT&T Inc.

- 7.1.3 Huawei Technologies Co Ltd

- 7.1.4 Telefonaktiebolaget LM Ericsson

- 7.1.5 ZTE Corporation

- 7.1.6 Cisco Systems Inc

- 7.1.7 Deutsche Telekom AG (T-Mobile)

- 7.1.8 Verizon Communication Inc

- 7.1.9 Sprint Corp

- 7.1.10 Vodafone Group PLC