|

市场调查报告书

商品编码

1406909

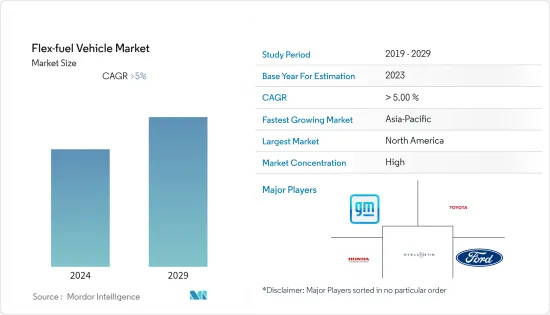

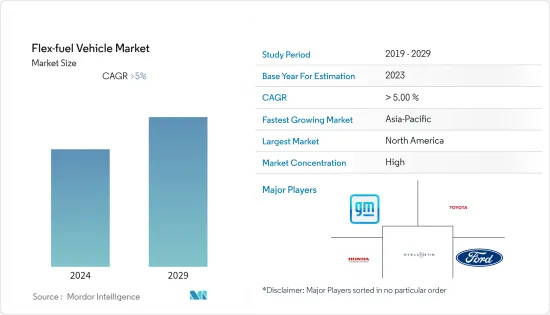

灵活燃料汽车 (FFV):市场占有率分析、产业趋势/统计、成长预测,2024-2029 年Flex-fuel Vehicle - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

灵活燃料汽车 (FFV) 市场价值 1,040 亿美元,预计五年内将达到 1,430 亿美元,预测期内复合年增长率超过 5%。

主要亮点

- 灵活燃料汽车(FFV)市场并没有像其他汽车产业那样受到严重影响。然而,市场上FFV的选择有限,考虑到世界各国政府实施的法规,销售量略有下降。然而,随着局势的缓和和生活恢復正常,FFV市场预计在预测期内将成长。

- 道路上的大多数汽车都使用传统石化燃料,导致有害废气排放增加。为了遏制汽车污染,一些地级市政府针对配备内燃机的车辆制定了废气法规。这些法规为灵活燃料汽车的研究提供了更大的空间。

- 市面上有不同类别和类型的FFV,从E10到E85以上。根据进行的测试,使用 E85 燃料的 FFV 排放量可减少 23% 的氮氧化物、30% 的二氧化碳和 4-6% 的二氧化碳。由于多种因素,包括废气排放减少、国内乙醇燃料生产能力以及对天然石化燃料使用的限制等,预计在预测期内,FFV 的需求将会增加。

- 美国和拉丁美洲对弹性燃料汽车的需求正在强劲成长。据估计,全球84%以上的乙醇是在美国和巴西生产的。

弹性燃料汽车市场趋势

批准严格的废气法规

- 使用石化燃料的各类车辆的排放不断增加,污染了空气。空气品质恶化导致严重呼吸道疾病增加。在欧洲,所有空气污染中30%以上,包括NOx、VOC、PM2.5、PM10等都是由汽车造成的。

- 为了控制排放,世界各地的机动车管理机构禁止车辆废气排放氮氧化物、硫氧化物等温室气体和其他有害污染物。

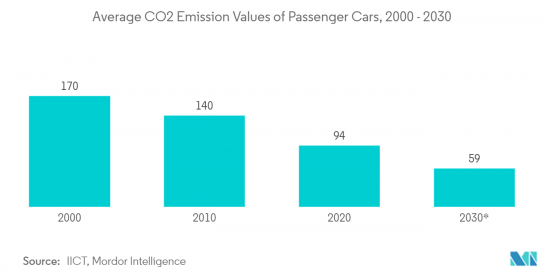

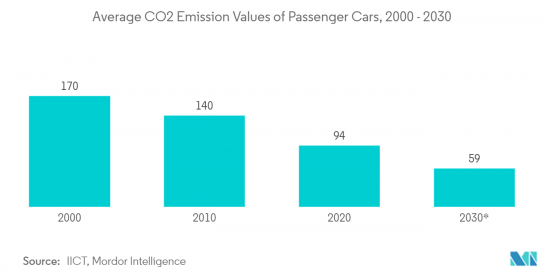

- 例如,在欧洲,废气法规逐年严格。根据监管机构欧洲环境署(EEA)的数据,2005年小客车实施的Euro4下的NOx标准为0.08g/km,但在2009年降低至0.06g/km。NOx标准没有变化。

- 同样,2015年标准小客车二氧化碳排放不得超过130克/公里,但2020年修订为95克/公里。欧盟委员会还计划在 2025 年将这一数字降低至 70 克/公里。

- 从长远来看,减少废气中的温室气体排放可能会对健康产生重大影响。预计未来几年灵活燃料市场的需求也会增加,因为与传统汽油和柴油相比,灵活燃料是更清洁的燃料。

亚太地区实现显着成长

- 目前,亚太地区70%以上的国家依赖进口石化燃料为其车辆提供动力。原油及其精製成本显着增加了消费者的燃料成本。在印度和中国等新兴市场的推动下,亚太地区预计将显着成长。

- 例如,在印度,道路运输和公路部 (MoRTH) 设定了在该国引入乙醇燃料的各种最后期限,以遏制石化燃料消耗并降低燃料成本。此外,印度的弹性燃料产量占全球的2%,不足以满足该国的需求。因此,未来几年国内乙醇产量的目标是从7,000万公升增加到1.5亿公升。

- 运输部计划分阶段扩大乙醇燃料的使用。 E10 计划于 2022 年 4 月开始生产,E20 计划于 2025 年开始生产。国内汽车製造商也被通知扩大研究范围,从2023年4月起允许汽车运行E10,从2025年4月起允许汽车运行E20。

- 由于弹性燃料可以使用甘蔗等可再生原料在国内生产,因此乙醇混合燃料减少了原燃料进口量,有助于降低最终用户的燃料成本。

- 随着乙醇基的弹性燃料供应增加,印度这个世界第二人口大国对弹性燃料汽车的需求可能会大幅增加。

Flex燃料汽车产业概况

灵活燃料汽车市场由多家公司组成,形成一个综合市场。由于使用弹性燃料的产品种类繁多,并且不断开拓替代燃料,市场上的五家主要企业占据了重要的市场占有率。例如,通用汽车公司营运约 13 款车型,福特汽车公司营运 11 款车型,Stallintis NV 营运 7 款使用乙醇混合燃料的车型。

排名前五的公司包括通用汽车公司、福特汽车公司、丰田汽车公司、Stellantis NV、本田汽车工业和现代汽车公司。其他参与者包括日产汽车有限公司、斯巴鲁公司和大众汽车公司。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场驱动因素

- 批准严格的废气法规

- 市场抑制因素

- 电动车销量的增加可能是抑制因素

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章市场区隔

- 乙醇混合型

- E10~E25

- E25~E85

- E85或更高

- 车辆类型

- 小客车

- 商用车

- 汽油种类

- 汽油

- 柴油引擎

- 地区

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 德国

- 法国

- 西班牙

- 英国

- 其他欧洲国家

- 亚太地区

- 中国

- 印度

- 韩国

- 日本

- 其他亚太地区

- 世界其他地区

- 南美洲

- 中东/非洲

- 北美洲

第六章 竞争形势

- 供应商市场占有率

- 公司简介

- General Motors

- Toyota Motor Corporation

- Honda Motor Company

- Stellantis NV

- Ford Motor Company

- Hyundai Motor Company

- Nissan Motor Company

- Subaru Corporation

- Volkswagen AG

- BMW AG

- Volvo Car Corporation

第七章 市场机会及未来趋势

The solid-state battery market was valued at USD 104 billion, and it is expected to reach USD 143 billion over the period of five years, registering a CAGR of over 5% during the forecast period.

Key Highlights

- The market for flex-fuel vehicles (FFV) was not impacted by the COVID-19 pandemic as severely as other automotive industries. However, with limited options for an FFV in the market, it did witness a slight decline in sales, considering the restrictions imposed by the respective governments. However, with the situation easing and life returning to normalcy, the FFV market is anticipated to grow during the projected period.

- Most of the vehicles running are fueled using conventional fossil fuels, which has led to an increase in toxic exhaust gas emissions. To control vehicular pollution, multiple county governments have put forth several emission restrictions for IC (internal combustion) engine-powered vehicles. These restrictions have opened the scope for research on vehicles running on flex fuels.

- In the market, there are various categories and types of FFV from E10 to E85 and above. According to the tests conducted, FFVs running on E85 fuel produce 23% less NOx, 30% less CO, and 4-6% lower CO2. Due to numerous factors, including reduced tailpipe emissions, domestic production capabilities of ethanol-based fuels, and limiting the use of naturally occurring fossil fuels, the demand for FFVs is expected to increase during the forecast period.

- The demand for flex-fuel vehicles is growing significantly in the United States and the Latin American region. It is estimated that more than 84% of the world's ethanol is produced by the United States and Brazil.

Flex-fuel Vehicle Market Trends

Ratification of Stringent Exhaust Emission Regulations

- The increase in vehicle exhaust emissions from all types of vehicles using fossil fuels has contaminated the atmosphere. The poor air quality has led to an increase in a plethora of serious respiratory diseases. In Europe, vehicular pollution contributes to over 30% of total air pollution, including NOx, VOCs, PM2.5, PM10, and others.

- To bring exhaust emissions under control, country-specific vehicle authorities have barricaded the production of greenhouse gasses like NOx, SOx, and other harmful pollutants from vehicle tailpipes.

- For instance, in Europe, exhaust emission norms have become even more strict over the years. According to the regulatory authority European Environmental Agency (EEA), in Euro 4, launched in 2005, the NOx standards were affixed at 0.08g/km, whereas in 2009, it got reduced to 0.06g/km, and it has remained the same for light passenger cars since.

- Similarly, for CO2 emissions in 2015, standard passenger cars were not allowed to exceed 130g/km of CO2. In 2020, it was revised to 95g/km. The European Commission also targets to reduce this number to 70g/km by 2025.

- The reduced amount of greenhouse gases from the exhaust will have a significant impact on health in the long run. Alongside, this will also allow the flex-fuel market to witness an increase in demand in the upcoming years as it is a clean-burning fuel as compared to conventional gasoline or diesel.

Asia-Pacific to Witness Significant Growth

- More than 70% of the countries in the Asia-Pacific region currently rely upon the import of fossil fuels to run vehicles. The cost of crude oil and its refinement significantly increases the consumer cost of fuel. With emerging markets like India and China, the Asia-Pacific region is expected to witness significant growth.

- For instance, in India, to curb the consumption of fossil fuels and tone down fuel costs, MoRTH (Ministry of Road Transport and Highways) has put forward various deadlines to introduce ethanol-based fuel in the country. Additionally, India accounts for 2% of the global flex-fuel production, which is not enough to fulfill the country's requirements. Hence, the domestic production of ethanol is targeted to rise from 70 to 150 million liters in the next few years.

- The transport ministry is planning to roll out the use of ethanol-based fuel in phases. E10 production is expected to be in motion from April 2022 and E20 from 2025. Various vehicle manufacturers in the country have also been notified to scale up the research to run vehicles on E10 from April 2023 and E20 from April 2025.

- As flex fuels can be manufactured domestically using renewable materials like sugar cane, the ethanol-blended fuel will reduce the quantity of raw fuel imported, helping reduce the fuel cost for end users.

- With the increase in the availability of ethanol-based flex-fuel, the demand for flex-fuel vehicles may witness significant growth as India is the world's second-most populated country.

Flex-fuel Vehicle Industry Overview

The flex-fuel vehicle market constitutes various players accounting for a consolidated market. Owing to a wide range of products running on flex fuels and constant developments to find an alternative fuel, the top five players in the market account for a significant market share. For instance, General Motors has about 13 vehicle models, Ford Motor Co. has 11 vehicle models, and Stallintis NV has seven vehicle models running on ethanol blend fuel.

The top five players include General Motors, Ford Motor Co., Toyota Motor Corp., Stellantis NV, Honda Motor Co., and Hyundai Motor Co. Other players include Nissan Motor Company, Subaru Corporation, and Volkswagen AG.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Ratification of Stringent Exhaust Emission Regulations

- 4.2 Market Restraints

- 4.2.1 Increase Sales of Electric Vehicle May Restraint the Growth of the Market

- 4.3 Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products and Services

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Ethanol Blend Type

- 5.1.1 E10 to E25

- 5.1.2 E25 to E85

- 5.1.3 E85 and Above

- 5.2 Vehicle Type

- 5.2.1 Passenger Cars

- 5.2.2 Commercial Vehicles

- 5.3 Fuel Type

- 5.3.1 Petrol

- 5.3.2 Diesel

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 France

- 5.4.2.3 Spain

- 5.4.2.4 United Kingdom

- 5.4.2.5 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 India

- 5.4.3.3 South Korea

- 5.4.3.4 Japan

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 Rest of the World

- 5.4.4.1 South America

- 5.4.4.2 Middle East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 General Motors

- 6.2.2 Toyota Motor Corporation

- 6.2.3 Honda Motor Company

- 6.2.4 Stellantis NV

- 6.2.5 Ford Motor Company

- 6.2.6 Hyundai Motor Company

- 6.2.7 Nissan Motor Company

- 6.2.8 Subaru Corporation

- 6.2.9 Volkswagen AG

- 6.2.10 BMW AG

- 6.2.11 Volvo Car Corporation