|

市场调查报告书

商品编码

1406911

电动自行车灯:市场占有率分析、产业趋势/统计、成长预测,2024-2029E-bike Lights - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

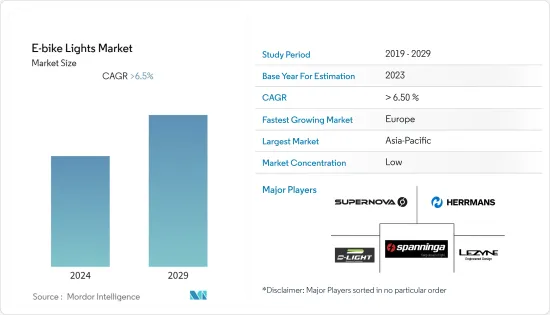

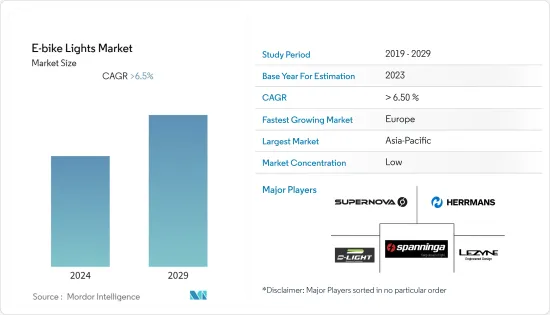

本财年电动自行车灯市场价值为 4.0295 亿美元,预计未来五年将成长至 5.9797 亿美元,预测期内收益复合年增长率为 6.8%。

主要亮点

- COVID-19 大流行和持续停工阻碍了电动自行车灯的生产。随着生活正常化,电动自行车产量预计在预测期内将会增加。由于电动自行车灯市场高度依赖电动自行车的销售和生产,预计电动自行车灯市场在预测期内也将成长。

- 从中期来看,由于这种新常态的健康风险,人们将开始避免使用大众交通工具,而更喜欢交通途径公共交通工具上下班。此外,除了休閒用途外,电动自行车也开始应用于其他领域,例如电动自行车租赁服务和物流。预计这些因素将在预测期内推动电动自行车灯市场的发展。

- 亚太地区是目前最大的电动自行车灯市场,捷安特自行车和美利达工业等高端用户在台湾设立了製造地。由于欧洲对绿色出行的需求不断增长,欧洲成为电动自行车市场成长最快的地区。

- 流动性在现代发挥着重要作用。随着人们对为子孙后代保护和维持环境的兴趣日益浓厚,保护环境已成为世界各地社会和政府面临的重大挑战,特别是由于自然资源稀缺和环境问题日益严重。

- 因此,为了克服上述问题,电动自行车的采用有所增加,并且预计将继续下去。

电动自行车灯市场趋势

电动自行车的需求不断增长

- 电动自行车灯市场的成长驱动因素是全球对电动自行车的需求不断增长。随着生活恢復正常节奏,职场正在转变为在办公室工作,以便每天通勤。大众交通工具不安全,因此现在必须拥有汽车。因此,电动自行车是一种相对便宜的通勤方式。

- 此外,喜欢休閒和健身用途的客户数量的增加可能会导致电动自行车销量的增加。世界各地的一些政府也正在采取必要措施来促进电动自行车的采用。例如,2022年3月,第一家盈利的微型旅游公司Veo推出了美国微型旅游产业首款油门辅助的2级电动自行车。 Cosmo-e 是一款带有油门辅助功能的 2 级电动自行车,已发布,适合在无法踩踏、爬坡时需要支撑或需要助力从静止状态加速时使用。他们需要去哪里。

- 2022年3月,Yamaha汽车(美国)发表了两款全新的Class 3电动辅助自行车,包括Wabash RT和CrossCore RC。这些电动自行车采用全新雅马哈 PWS 系列 ST 驱动单元、车架和内部整合电池从头开始建造。

- 2021年5月,法国政府推出了一项财政奖励措施,居民报废旧车将获得2,500欧元。这是一项到 2030 年减少温室气体排放的倡议。

- 2021年4月,美国国会推出了鼓励购买电动自行车的製度。政府将为美国人提供购买电动自行车费用 30% 的退税。但上限为 1,500 美元。

- 此外,燃料价格上涨预计将显着增加全球电动自行车的销售数量,这反过来又将有助于电动自行车车灯市场在预测期内的成长。

亚太地区和欧洲是最受追捧的市场

- 电动自行车製造工厂是库存电动自行车车灯的最终用户,许多主要电动自行车製造工厂都位于亚太地区。库存电动自行车灯要么在组装电动自行车时安装,要么随电动自行车组装套件一起提供。

- Giant Bicycles 和 Marida 等主要企业在台湾设有製造地。同样,一些电动自行车製造商在中国和印度设有工厂。该地区拥有许多生产设施,预计电动自行车灯的需求将会增加。这使得印度和中国成为亚太地区最大的电动自行车出口国。全球电动机车需求的增加可能会增加电动自行车灯的消耗。

- 过去两年,中国占了亚太地区电动自行车市场超过50%的份额,原因是为了应对交通拥堵和车辆污染加剧,电动机车的高消费量。由于中国市场购买电动自行车的成本正在下降,预计预测期内电动自行车的消费将继续增长。

- 根据中国自行车协会统计,近年来我国电动自行车年销量已突破3,000万辆,社会持有逼近3亿辆,千元以上自行车的生产数量不断增加。 2021 年的年产量将达到 3,370 万台,在预测期内市场可能会出现利润丰厚的机会。

- 中国的电动自行车产业在很大程度上受到支持使用电动自行车等绿色技术的多项政府措施和法律的推动。这些活动增加了对配备智慧电池和应用平台的电动自行车的需求。中国製造商的目标客户范围广泛,从低收入到中产阶级再到上层阶级客户,因此其产品的定价各不相同。因此,未来几年对电动自行车灯的需求可能会增加。

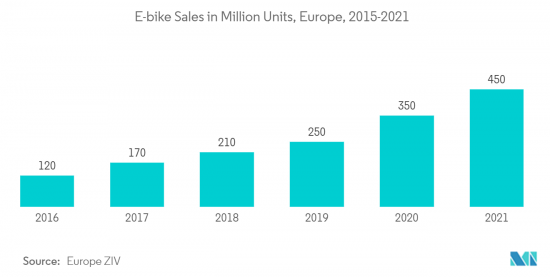

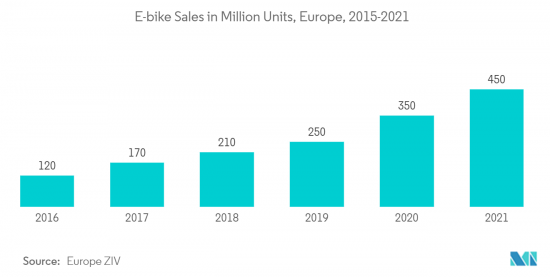

- 另一方面,欧洲则是一个快速成长的电动自行车灯售后市场。售后电动自行车灯作为配件购买,不包含在自行车价格中。 2021年,欧洲国家约占全球电动自行车市场的40%。

- 其中,德国的销售占压倒性优势,其次是法国和义大利。欧洲地区电动机车的需求和销售量正在增加,电动自行车售后车灯市场预计在研究期间将显着成长。

电动自行车轻工业概况

电动自行车灯市场由 D-light、Lezyne、Spanninga Metal BV、Hermans OY AB、Supernova Design GmbH 等主要企业主导。大多数主要企业向捷安特自行车和美利达工业等最畅销的电动自行车製造商供应电动自行车灯,占据了电动自行车灯市场的很大份额。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场驱动因素

- 电动自行车销量增加

- 市场抑制因素

- 波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章市场区隔(市场规模-美元)

- 透过灯座

- 头灯

- 后安全灯

- 按销售管道

- 线下商店

- 网路商店

- 按最终用户

- 售后市场

- 库存配件

- 按地区

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 德国

- 英国

- 法国

- 俄罗斯

- 西班牙

- 其他欧洲国家

- 亚太地区

- 印度

- 中国

- 日本

- 韩国

- 其他亚太地区

- 世界其他地区

- 南美洲

- 中东/非洲

- 北美洲

第六章 竞争形势

- 供应商市场占有率

- 公司简介

- D-light

- Lezyne

- Spanninga Metaal BV

- Herrmans OY AB

- Supernova Design GmbH

- Gaciron Technology

- Lord Benex

- Limeforge Ltd.

- Magicshine

第七章 市场机会及未来趋势

The e-bike lights market was valued at USD 402.95 million in the current year and is expected to grow to USD 597.97 million by the next five years, registering a CAGR of 6.8% in terms of revenue during the forecast period.

Key Highlights

- The Covid-19 global pandemic and successive lockdowns hampered the production of e-bike lights production. With life coming to normalcy, the production of e-bikes is expected to rise in the forecasted period. As the e-bike light market heavily depends on the sales and production of e-bikes, the e-bike light market is also expected to witness growth during the forecast.

- Over the medium term, due to the health risks in this new normal, people have started avoiding using public transport and are preferring their means of transport for their commute. Additionally, not just for recreational use, several other sectors, like e-bike rental services and logistics, have started adopting the use of e-bikes. These factors are expected to drive the e-bike light market in the forecasted period.

- Currently, Asia-Pacific is the largest e-bike light market, as top-end users like Giant Bicycles Co. Ltd and Merida Industry Co. Ltd have their manufacturing units in Taiwan. Because of the growing demand for green mobility in Europe, it is the fastest-growing region for the e-bikes market.

- Mobility plays a vital role in the current era. With the increasing concern for preserving and sustaining the environment for future generations, protecting it poses a great challenge for society and governments across the world, especially due to the increasing scarcity of natural resources and environmental concerns.

- As a result, to overcome the above-mentioned issue, increased adoption of e-bikes is taking place and is expected to continue, which in turn is likely to witness major growth for the market during the forecast period.

E-bike Lights Market Trends

Growing Demand for E-bikes

- The major driver of the growth of the e-bike lights market is the increasing demand for e-bikes across the globe. As life is returning to its normal pace, workplaces are switching back to work from the office, enabling the daily commute. It has now become a necessary affair to own a vehicle, as public transport isn't safe. Hence, e-bikes are a relatively inexpensive choice of commuting vehicle.

- Additionally, an increase in customer preference for recreational and fitness use will result in the increased sale of e-bikes. Several governments across the globe have also taken necessary measures to promote the adoption of e-bikes. For instance, in March 2022, Veo, the first profitable micro-mobility company, launched the first Class 2 e-bike with throttle assist in the United States micro-mobility industry. The Cosmo-e class2 e-bike with throttle assist launched would allow the riders to get where they need to go if they cannot pedal, need support traveling up hills, or want a boost to get up to speed from a stopped position.

- In March 2022, Yamaha Motor Corp., USA, introduced two all-new, class 3 power assist bicycles, including the Wabash RT and the CrossCore RC. These e-bikes are built from the ground up with a new Yamaha PWSeries ST drive unit, frame, and internally integrated batteries.

- In May 2021, the French government launched a financial incentive wherein the residents could scrap their old vehicles, and they'd be offered EUR 2,500. The initiative is to reduce the production of greenhouse gases by the year 2030.

- In April 2021, Congress in the United States put forward a scheme to encourage people to buy e-bikes. The government would offer Americans a refundable tax benefit of 30% of the cost of the e-bike. But the amount is capped at USD 1,500.

- Also, the rise in fuel prices will significantly boost the number of e-bikes sold across the globe and, in turn, aid the e-bike lights market growth in the forecasted period.

Asia-Pacific and European Region are the Most Demanding Markets

- The e-bike manufacturing facilities are the end-users of the stock-type e-bike light, and many major e-bike manufacturing facilities are situated in the Asia-Pacific region. Stock e-bike lights are those that are installed on the e-bikes as they are assembled or arrive with the e-bike assembly kit.

- The top players, like Giant Bicycles and Marida, have their manufacturing units in Taiwan. Similarly, other multiple e-bike manufacturers are having their plants in China and India. Having many production facilities, the demand for e-bike lights is expected to increase in this region. This makes India and China the largest e-bike exporters in the Asia-Pacific region. The increase in the global demand for electric bikes will increase the consumption of e-bike lights.

- China has contributed to more than 50% of the Asia-Pacific e-bike market over the past two years, owing to its high consumption of electric bikes to tackle heavy traffic conditions, as well as growing vehicle pollution in the country. During the forecast period, the consumption of e-bikes is likely to continue to grow due to the decreasing purchase cost of e-bikes in the Chinese market.

- According to the China Bicycle Association, yearly electric bicycle sales in China have surpassed 30 million units in recent years, with social e-bike ownership approaching 300 million units, and the output of bikes exceeding 1,000 yuan continues to rise. Annual production for 2021 is recorded at 33.7 million units., which in turn is likely to create a lucrative opportunity for the market during the forecast period.

- The Chinese e-bike industry is largely driven by several government efforts and legislation supporting the use of green technology like e-bikes. These activities have resulted in the demand for e-bikes with smart batteries and application platforms. As Chinese manufacturers serve a wide spectrum of clientele, from the low-income to the middle-class and upper-class, their items come at a variety of pricing. This is likely to enhance the demand for e-bike lights in the coming years.

- On the other hand, the fastest-growing market for aftermarket e-bike lights is the European region. Aftermarket e-bike lights are those which are purchased as an accessory and are not included in the bike's price. The European countries hold about 40% of the global e-bike market in 2021.

- Among the countries, Germany dominates the sales numbers, followed by France and then Italy. With the demand and sales of electric bikes on the rise in the European region, the e-bike aftermarket lights market will witness a significant increase in the studied period.

E-bike Lights Industry Overview

The E-bike lights market is dominated by several key players such as D-light, Lezyne, Spanninga Metaal B.V., Hermans OY AB, Supernova Design GmbH, and Others. Most of the top players supply e-bike lights to the top-selling e-bike manufacturers like Giant Bicycles and Merida Industry Co Ltd. Hence, they hold a significant share of the e-bike light market.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Rise in Sales of E-bikes

- 4.2 Market Restraints

- 4.3 Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size in Value - USD)

- 5.1 By Light Mounting

- 5.1.1 Headlight

- 5.1.2 Rear Safety Light

- 5.2 By Sales Channel

- 5.2.1 Offline Stores

- 5.2.2 Online Stores

- 5.3 By End-User

- 5.3.1 Aftermarket

- 5.3.2 Stock Fitting

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Russia

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 India

- 5.4.3.2 China

- 5.4.3.3 Japan

- 5.4.3.4 South Korea

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 Rest of the World

- 5.4.4.1 South America

- 5.4.4.2 Middle-East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles*

- 6.2.1 D-light

- 6.2.2 Lezyne

- 6.2.3 Spanninga Metaal B.V.

- 6.2.4 Herrmans OY AB

- 6.2.5 Supernova Design GmbH

- 6.2.6 Gaciron Technology

- 6.2.7 Lord Benex

- 6.2.8 Limeforge Ltd.

- 6.2.9 Magicshine