|

市场调查报告书

商品编码

1406991

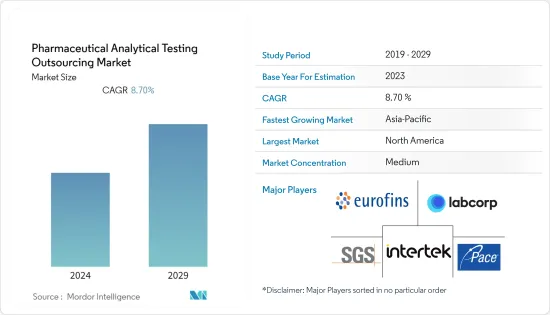

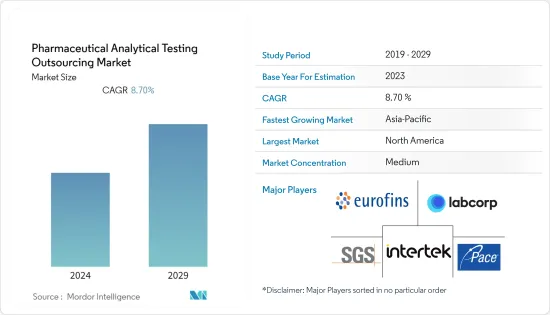

药物分析测试外包 -市场占有率分析、产业趋势/统计、成长预测,2024-2029 年Pharmaceutical Analytical Testing Outsourcing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

预计基准年药品分析测试外包市场规模为71亿美元,预测期间内复合年增长率为8.7%。

主要亮点

- COVID-19 对药物分析测试外包产生了重大影响。这缩短了核准流程并增加了临床试验地点的监管核准。例如,Ronan Brow 博士于 2021 年 3 月在《欧洲药物评论》上发表的一篇论文发现,在大流行期间,製药业和监管机构密切合作,以极快的速度提供诊断测试、治疗方法和疫苗接种。此外,在製药领域,临床实验场所的许可正在从地方当局转移到中央当局。

- 同样,市场主要企业的倡议(例如协议)也有望促进市场成长。例如,2021 年 11 月,Alcami Corporation, Inc. 与 Novavax 签订了主实验室服务协议。透过这项协议,Novavax 立即获得了全职等效 (FTE) 资源,为使用 Matrix-M 佐剂的基于重组奈米颗粒蛋白的 COVID-19 候选疫苗提供分析测试支援。因此,所有这些因素都可能对大流行期间的市场成长产生积极影响。

- 此外,推动该市场成长的因素包括研发费用的增加、对监管、安全和品质的日益关注、外包的价格优势以及对生物仿製药、生物製药和分析试剂的需求。技术、动力学方法和电化学技术。

- 药物分析测试外包提供者之间的收购和联盟增加可能会推动该市场的成长。例如,2021 年 12 月,为製药、生物技术和医疗技术领域提供专业服务的 PharmaLex Group 与 Pharmasol 合併,药物安全检测一家专门为药物警戒提供 IT 和业务支援的生命科学公司。此外,SGS SA 于 2021 年 12 月收购了英国创新製剂研发服务供应商 Quay Pharmaceuticals Limited (Quay Pharma)。透过此次收购,SGS 将把 Quay Pharmaceuticals 的服务加入其全面的分析服务组合中。

- 此外,对生物相似药和生物製药的需求不断增长将显着推动市场成长。例如,2021 年9 月发表在《伊朗医学科学杂誌》上的一项研究发现,到2025 年,新型生物相似药的开发可为消费者节省高达2500 亿美元,并帮助超过120 万名患者。预计将有更多机会获得生物疗法。这使得生物相似药产品可供慢性病患者使用,对于以前不得不停止治疗或依赖效果较差的药物的患者来说,它们成为更便宜的选择。生物相似药生产的增加将增加药物测试服务的外包,从而促进市场成长。因此,由于上述因素,预计市场在预测期内将会成长。

- 然而,对不稳定的委託製造组织绩效的日益依赖、对药品製造中敏感资料的隐私/盗窃的日益担忧以及公司的各种委託成本预计将阻碍所研究市场的成长。

药物分析测试外包市场趋势

製药和生物製药公司预计将在预测期内占据主要市场份额

- 从最终用户来看,製药和生物製药公司预计在预测期内将占据主要份额。其他活动,例如产品开发活动的活性化、公司研发支出的增加以及开发新治疗方法的需要,预计将推动该细分市场的成长。

- 此外,主要市场参与者之间不断增加的併购预计将进一步推动该领域的成长。

- 例如,2022 年 2 月,Labcorp 收购了 Personal Genome Diagnostics Inc. (PGDx),这是主要企业,拥有全系列液体活体组织切片和基于组织的解决方案。 PGDx 的技术补充并加速了 Labcorp 目前的液体活体组织切片能力,并扩展了 Labcorp 基于次世代定序(NGS) 的基因组分析能力的核心肿瘤学产品组合。这使得 Labcorp 处于改善肿瘤学患者治疗效果的前线。

- 此外,2021 年 12 月,Eurofins Scientific 与 Transgenic Inc. 签订了股票购买协议,收购 Genetic Lab,这是一家基于分子生物学的诊断、生物标誌物开发和药物研发测试提供者。透过此次收购,Eurofins 网路将透过扩大其在日本的生物製药和临床测试服务范围,进一步巩固其在日本市场的地位。

- 因此,由于上述因素,预计该细分市场在预测期内将显着成长。

北美占据主要份额,预计在预测期内保持不变

- 在预测期内,北美占据药物分析测试外包市场的主要份额。

- 促进该地区成长的因素包括技术进步、主要市场参与者的强大立足点、慢性病盛行率的上升以及药品研发和资金筹措的增加。

- 例如,2021 年 10 月,Pace Analytical Services, LLC 收购了 Velesco Pharmaceutical Services, Inc.。 Velesco 是一家专门从事液体、半固态和口服固态剂型开发的 CDMO。此次收购增加了 Pace 在临床前和临床液体、固态和口服固态製剂开发方面的丰富经验和专业知识,使 Pace 能够在药物开发过程中为越来越多的客户提供支援。

- 此外,2021 年 7 月,Pace Analytical Services 收购了 Drug Delivery Experts, LLC (DDE)。 DDE 也是一家 CDMO,专门从事复杂注射製剂和药物器械组合产品的开发。透过此次收购,Pace 将能够为越来越多在整个药物开发过程中需要服务的客户提供支持,并且还将能够贡献在药物-器械组合产品和缓释性注射技术方面的经验。

- 同样,总部位于新罕布夏州塞勒姆的符合 cGMP 的分析实验室 Boston Analytical 将于 2021 年 1 月在北卡罗来纳州莫里斯维尔开设第二个实验室。该地点提供的服务是取样和测试服务。此类新兴市场的开拓预计将导致该地区更多地采用药物分析测试外包服务,并成为市场成长的驱动力。

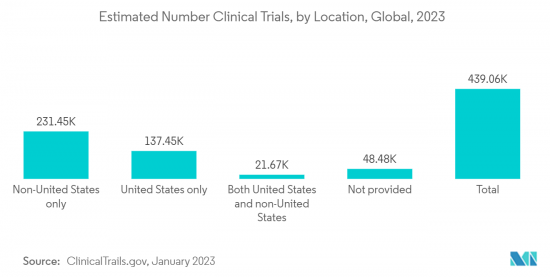

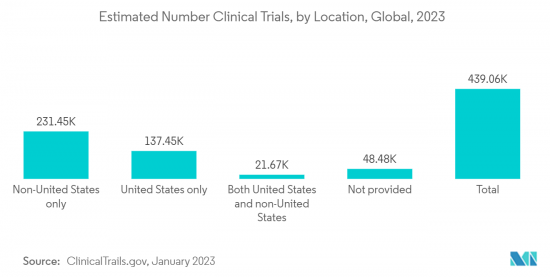

- 此外,美国临床试验和支持活动的研究经费增加预计也将有助于预测期内的市场成长。例如,根据美国美国卫生研究院(NIH)2022年6月发布的资料,2021年和2022年美国用于临床试验和支持活动的研究支出将分别为450亿美元和510亿美元。美元。因此,增加此类活动的研究经费将导致更多采用药物分析测试外包服务,从而推动区域市场的成长。

- 因此,由于上述因素,预计北美地区市场将会成长。

药物分析测试外包产业概况

药物分析测试外包的市场竞争温和。由于市场参与企业关键市场策略的兴起(例如与製药和生物製药公司的联盟以及公司之间的併购)等因素,该市场预计将成长。该市场的一些主要企业包括 SGS SA、Labcorp (Toxikon, Inc.)、Eurofins Scientific、Pace Analytical Services, Inc.、Intertek Group Plc、WuXi AppTec 和 Boston Analytical。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 市场驱动因素

- 日益关注监管、安全和品质

- 外包的定价优势

- 对生物相似药、生物製药和分析药物的需求不断增加

- 市场抑制因素

- 对製药生产中的隐私和敏感资料窃取的担忧日益增加

- 企业外包支出多元化

- 波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章市场区隔

- 按服务

- 生物分析测试

- 临床试验

- 非临床研究

- 方法开发和验证

- 可萃取性/溶解度

- 杂质法

- 技术咨询

- 其他方法开发和验证

- 稳定性测试

- 药用物质

- 稳定性指标验证

- 加速稳定性测试

- 光稳定性测试

- 其他稳定性测试

- 其他服务

- 生物分析测试

- 按最终用户

- 製药公司/生物製药公司

- 受託製造厂商

- 其他最终用户

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 其他亚太地区

- 中东/非洲

- GCC

- 南非

- 其他中东/非洲

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 北美洲

第六章 竞争形势

- 公司简介

- SGS SA

- Labcorp(Toxikon, Inc)

- Eurofins Scientific

- Pace Analytical Services, Inc.

- Intertek Group Plc

- Thermofischer Scientific(Pharmaceutical Product Development, LLC)

- WuXi AppTec

- Boston Analytical

- Charles River Laboratories International, Inc

- West Pharmaceutical Services Inc.

- Element Group(Exova Group PLC)

- Merck KGaA

第七章 市场机会及未来趋势

The pharmaceutical analytical testing outsourcing market has a market size of 7.1 billion in the base year and is expected to register a CAGR of 8.7% during the forecast period.

Key Highlights

- COVID-19 significantly impacted pharmaceutical analytical testing outsourcing due to the rise in the testing process to develop novel therapies for the disease. This has led to a rise in approvals from regulatory agencies on clinical trial sites by decreasing the time for the approval process. For instance, according to the article published in the European Pharmaceutical Review by Dr. Ronan Brow in March 2021, during the outbreak, the pharmaceutical sector and regulatory authorities worked closely together to create and provide diagnostic tests, treatments, and vaccinations at breakneck speed. In addition, the sector had seen a shift in site permissions from local to centralized.

- Similarly, the initiative by key market players, such as agreements, was expected to increase market growth. For instance, in November 2021, Alcami Corporation, Inc. signed a master laboratory services agreement with Novavax. With this agreement, Novavax immediately secured full-time equivalent (FTE) resources to provide analytical testing support for its recombinant nanoparticle protein-based COVID-19 vaccine candidate with Matrix-M adjuvant. Thus, all these factors are likely to have a positive impact on the market growth over the pandemic phase.

- Further, the factors driving the growth of this market include a rise in research and development expenditures, increasing focus on regulation, safety, and quality, pricing benefits of outsourcing, and a rise in the demand for biosimilars and biopharmaceutical products as well as for analytical drugs, availability of advanced analytical testing techniques such as hyphenated techniques; kinetic method of analysis, electrochemical techniques, among others.

- Rising acquisitions and partnerships among pharmaceutical analytical testing outsourcing providers will drive the growth of this market. For instance, in December 2021, PharmaLex Group, a provider of specialist services for the pharmaceutical, biotech, and MedTech sectors, merged with Pharmasol, a life sciences corporation specializing in pharmacovigilance IT and business support. In addition, in December 2021, SGS SA acquired Quay Pharmaceuticals Limited (Quay Pharma), a UK-based provider of innovative formulation research and development services. With this acquisition, SGS will add Quay Pharmaceuticals services to its comprehensive portfolio of analytical services.

- Furthermore, the rising demand for biosimilars and biopharmaceuticals will drive the market's growth significantly. For instance, the study published in the Iranian Journal of Medical Sciences in September 2021 stated that it is expected that the development of new biosimilars would save consumers up to USD 250 billion and make biological therapies more accessible to an extra 1.2 million patients by 2025. This increases the availability of such products to patients with chronic conditions and provides a more affordable option for those who previously had to discontinue therapy or rely on less effective medications. Such an increase in biosimilar manufacturing will increase the outsourcing of drug testing services, thereby boosting market growth. Therefore, owing to the aforementioned factors, the market is expected to grow over the forecast period.

- However, a rise in the reliance on the performance of unstable outsourced manufacturing organizations, an increase in the concerns regarding the privacy/theft of confidential data for manufacturing pharmaceuticals, and varied outsourcing expenditures by companies, among others, are expected to hamper the growth of the market studied.

Pharmaceutical Analytical Testing Outsourcing Market Trends

Pharmaceutical and Biopharmaceutical Companies Segment is Expected to Garner a Major Share During the Forecast Period

- By end user, the pharmaceutical and biopharmaceutical companies segment is expected to hold a significant share in the market studied over the forecast period. Factors such as the rise in product development activities, growing research and development expenditures by companies, and the need to develop novel therapies, among others, are expected to drive the growth of this segment.

- In addition, rising mergers and acquisitions among the key market players are further expected to drive the growth of this segment studied.

- For instance, in February 2022, Personal Genome Diagnostics Inc. (PGDx), a key player in cancer genomics with a range of complete liquid biopsy and tissue-based solutions, was acquired by Labcorp. PGDx's technology complements and accelerates Labcorp's current liquid biopsy capabilities, as well as expands Labcorp's leading oncology portfolio of next-generation sequencing (NGS)-based genomic profiling capabilities. This puts Labcorp at the forefront of improving patient outcomes in oncology.

- Furthermore, in December 2021, Eurofins Scientific entered into a share purchase agreement with Transgenic Inc. to acquire Genetic Lab Co., Ltd., a molecular biology-based testing provider for diagnostics, biomarker development, and drug discovery. With this acquisition, the Eurofins network will further strengthen its position in the Japanese market by extending its service offering in biopharmaceutical services and clinical testing in Japan.

- Therefore, owing to the above-mentioned factors, the segment is expected to witness significant growth over the forecast period.

North America Holds a Major Share and Expected to do Same in the Forecast Period

- North America holds a major share in the pharmaceutical analytical testing outsourcing market during the forecast period.

- The factors contributing to the growth of this region include advancements in technologies, the strong foothold of key market players, the rise in chronic cases, and the rise in pharmaceutical research and development and funding, among others.

- For instance, in October 2021, Pace Analytical Services, LLC acquired Velesco Pharmaceutical Services, Inc. Velesco is a CDMO that specializes in liquid, semi-solid, and oral solid dose product development. This acquisition adds significant experience and expertise in the development of liquid, semi-solid, and oral solid dose products for pre-clinical and clinical use, allowing Pace to support a growing number of clients throughout the drug development process.

- In addition, in July 2021, Pace Analytical Services acquired Drug Delivery Experts, LLC (DDE). DDE, also a CDMO, specializes in complex injectable drug formulations and combination drug-device product development. As a result of the acquisition, Pace will be able to assist a growing number of clients who require services throughout the drug development process, as well as contribute experience in drug-device combo products and extended-release injectable technologies.

- Similarly, in January 2021, Boston Analytical, a cGMP-compliant analytical laboratory headquartered in Salem, NH, is now opening its second location in Morrisville, North Carolina. Services provided at this location will be sampling and testing services. Such developments in the United States will lead to increased adoption of pharmaceutical analytical testing outsourcing services in this region, thereby driving market growth.

- Furthermore, a rise in research funding for clinical trials and supportive activities in the United States is also expected to contribute to the market growth over the forecast period. For instance, according to the National Institute of Health (NIH) data published in June 2022, the funding in the United States for clinical trials and supportive activities for 2021 and 2022 were USD 45 billion and USD 51 billion, respectively. Therefore, the rise in research funding for such activities will lead to increased adoption of pharmaceutical analytical testing outsourcing services, driving regional market growth.

- Therefore, owing to the aforementioned factors, the market is anticipated to grow in the North American region.

Pharmaceutical Analytical Testing Outsourcing Industry Overview

The market for pharmaceutical analytical testing outsourcing is moderately competitive. The market is expected to grow due to factors such as a rise in key market strategies by the market players, such as partnerships with pharmaceutical and biopharmaceutical companies and mergers and acquisitions among the players. Some of the major players operating in this market include SGS SA, Labcorp (Toxikon, Inc.), Eurofins Scientific, Pace Analytical Services, Inc., Intertek Group Plc, WuXi AppTec, and Boston Analytical, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing focus on Regulation, Safety and Quality

- 4.2.2 Pricing Benefits of Outsourcing

- 4.2.3 Rise in the Demand for Biosimilars and Biopharmaceutical Products as well as for Analytical Drugs

- 4.3 Market Restraints

- 4.3.1 Increase in the Concerns Regarding Privacy/Theft of Confidential Data of Manufacturing Pharmaceuticals

- 4.3.2 Varied Outsourcing Expenditures by Companies

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market size in USD)

- 5.1 By Services

- 5.1.1 Bioanalytical Testing

- 5.1.1.1 Clinical

- 5.1.1.2 Non-clinical

- 5.1.2 Method Development and Validation

- 5.1.2.1 Extractable & Leachable

- 5.1.2.2 Impurity Method

- 5.1.2.3 Technical Consulting

- 5.1.2.4 Other Method Development and Validations

- 5.1.3 Stability Testing

- 5.1.3.1 Drug Substance

- 5.1.3.2 Stability Indicating Method Validation

- 5.1.3.3 Accelerated Stability Testing

- 5.1.3.4 Photostability Testing

- 5.1.3.5 Other Stability Testings

- 5.1.4 Other Services

- 5.1.1 Bioanalytical Testing

- 5.2 By End-User

- 5.2.1 Pharmaceutical And Biopharmaceutical Companies

- 5.2.2 Contract Manufactuing Organizations

- 5.2.3 Other End-Users

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.2.5 Spain

- 5.3.2.6 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 Australia

- 5.3.3.5 South Korea

- 5.3.3.6 Rest of Asia-Pacific

- 5.3.4 Middle-East and Africa

- 5.3.4.1 GCC

- 5.3.4.2 South Africa

- 5.3.4.3 Rest of Middle-East and Africa

- 5.3.5 South America

- 5.3.5.1 Brazil

- 5.3.5.2 Argentina

- 5.3.5.3 Rest of South America

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 SGS SA

- 6.1.2 Labcorp (Toxikon, Inc)

- 6.1.3 Eurofins Scientific

- 6.1.4 Pace Analytical Services, Inc.

- 6.1.5 Intertek Group Plc

- 6.1.6 Thermofischer Scientific (Pharmaceutical Product Development, LLC )

- 6.1.7 WuXi AppTec

- 6.1.8 Boston Analytical

- 6.1.9 Charles River Laboratories International, Inc

- 6.1.10 West Pharmaceutical Services Inc.

- 6.1.11 Element Group (Exova Group PLC)

- 6.1.12 Merck KGaA

![药物分析测试外包市场 - 按服务(生物分析测试[临床、非临床]、方法开发和验证、稳定性测试)产品类型(API、添加剂、成品)、最终用户和预测,2024 年 - 2032 年](/sample/img/cover/42/default_cover_gmi.png)