|

市场调查报告书

商品编码

1407066

汽车保险丝:市场占有率分析、产业趋势与统计、2024-2029 年成长预测Automotive Fuse - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

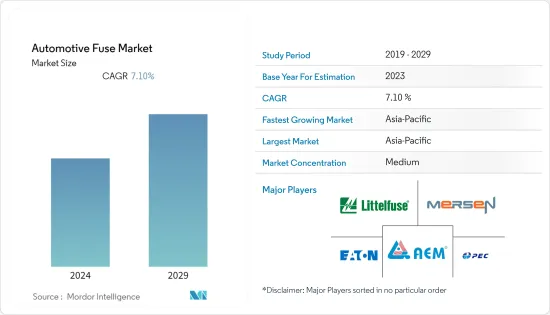

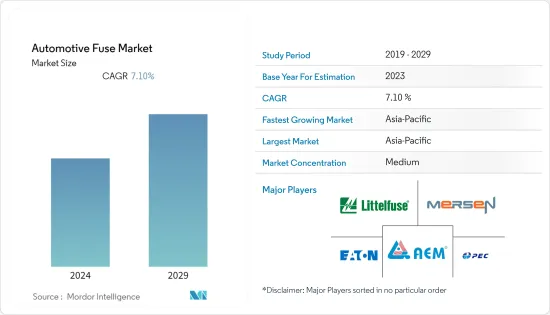

上一年汽车保险丝市场规模为203亿美元,预计未来五年将达306.4亿美元,预测期内复合年增长率为7.1%。

由于汽车产量增加、电动程度提高以及小客车安全性和舒适性日益重要等多种因素,该市场预计在不久的将来会扩大,所有这些都将导致每辆车安装的保险丝数量将会增加,电动和混合动力汽车的销量将会增加。

保险丝装置是汽车中最常用的电气元件,需求量很大。这可能是由于对高技术品质汽车的需求迅速增长。汽车製造商正在提高这些车辆的产量,以满足日益增长的消费者需求。

此外,不断上涨的燃油价格和环境问题正在加速最新的汽车创新。电子功能越来越整合的电动车越来越普及,熔断器在发展中发挥越来越重要的作用。新兴国家对汽车的需求不断增长,正在推动汽车製造商开发更好的系统,从而增加了对可靠的汽车保险丝市场的需求。例如,根据 IBEF 的数据,到 2025 年,印度电动车市场预计将达到 70.9 亿美元。

此外,每个国家的电动车销量也大幅增加。根据中国汽车工业协会统计,2022年4月中国新能源汽车销量29.9万辆,其中电动小客车销量28万辆,商用车销量1.9万辆。搭乘用纯电动车(BEV)销量为21.2万辆,插电式混合(PHEV)销量为6.8万辆。

此外,2022年8月,通用汽车签订了三份新的电动车电池材料采购协议。与 LG Chem、POSCO Chemical 和 Rivent 签订的多年协议将为通用汽车提供关键材料,包括锂、镍、钴和正极活性材料 (CAM)。电动车产业价值链的这种扩张可能会进一步创造市场对汽车保险丝的巨大需求。

此外,由于汽车行业的不断增长,预计所研究的市场在预测期内将会成长。例如,在美国,小型可充电电动车的销量从一年前的 308,000 辆增加到 608,000 辆。目前,纯电动车占全国销售的所有充电式电动车的 73% 以上。

然而,低压熔断器领域的开拓有限以及汽车熔断器售后市场无组织等因素继续对研究市场的成长构成挑战。此外,原物料价格波动也是限制市场成长的主要阻碍因素之一。

汽车产业是受宏观经济因素影响较大的主要产业之一,汽车消费者通常在经济稳定时投资汽车。然而,疫情发生以来,全球经济面临不确定性,各地汽车需求持续放缓。例如,2022年美国轻型汽车销量从2019年的16,961,100辆下降至13,754,300辆。随着北美地区景气衰退的威胁迫在眉睫,这些趋势预计将持续至少几年,这也可能减缓所研究市场的成长。

汽车保险丝市场趋势

电动/混合动力汽车预计将显着成长

- 目前,汽车电动趋势正在加速。世界各国政府正在从火车头和混合动力汽车转向全电动汽车,这对电力系统的运作产生了影响。预计这将为未来的系统增强提供多种可能性,以减少污染物排放和对化石石化燃料的依赖。因此,汽车电动趋势预计将推动汽车保险丝盒等汽车零件的销售。

- IEA预计,2050年净零排放情境下,2030年电动车持有预计将超过3亿辆,电动车占新车销量的60%。中国和欧洲等国家在电动车竞赛中处于领先地位,其他地区的电动车普及也不断提高。

- 奖励和强制措施也刺激了电动车的需求。随着各国政府致力于减少汽车排放,他们正在提供多项奖励来鼓励电动车的销售。此外,EPA 和 NHTSA提案实施更安全、经济实惠的节能车辆 (SAFE) 规则(2021-2026 年)。这些法律可能为轻型商用车和小客车设定企业平均燃油经济性标准和温室气体(GHG)排放。零排放汽车计画要求OEM销售精确数量的清洁、零排放汽车(混合动力汽车、电动车、燃料电池动力商用车和小客车)。 ZEV计画的目标是到2030年营运1,200万辆ZEV。

- 因此,电动车市场的显着成长,以及营运模型中更多熔断器的集成,预计将在预测期内加速研究市场的需求。近年来,几大汽车製造商也纷纷宣布有意透过改造现有产能、建立新产品线,加速向纯电动车转型。例如,丰田宣布推出 30 款纯电动车 (BEV) 车型,并计划在 2030 年实现年销量 350 万辆电动车。雷克萨斯的目标是到 2035 年在全球销售 100% 纯电动车。大众汽车预测,到2030年,欧洲电动车销量将达到70%,中国达到50%,美国达到100%,到2040年几乎所有电动车都将达到零排放。这些趋势为所研究市场的成长创造了良好的前景。

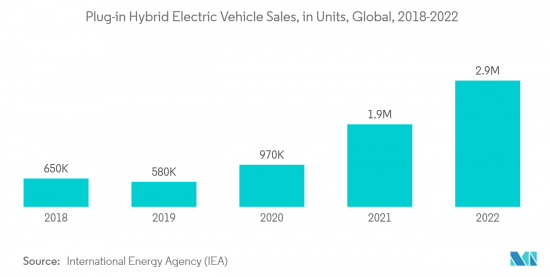

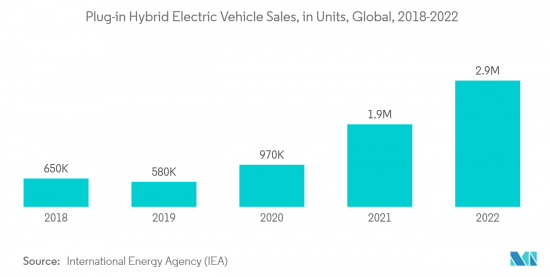

- 混合电动车的激增也支持了所研究的市场,因为普及更多的电气单元,显着增加了这些车辆中使用的汽车保险丝的数量。据 IEA 称,到 2022 年,全球将售出约 290 万辆现代插电混合动力汽车。 2022 年,插电式混合(PHEV) 销量约占电动车销量的 28.4%。同时,纯电动车占当年全球销售量的大部分。

亚太地区预计将录得强劲成长率

- 由于印度、中国和日本等国家的几家知名汽车製造商的存在,亚太地区在汽车保险丝市场中占据着重要地位,预计在预测期内将出现可观的成长率。该地区政府的措施也不断扩大,支持电动车市场的成长。例如,印度政府的《汽车使命计画2016-26》是印度政府和印度汽车企业共同製定的汽车工业发展蓝图。此外,印度政府预计到2023年汽车业将吸引80亿至100亿美元的国内外投资。

- 在这些趋势的推动下,印度汽车製造商也在加大力度,为该国整体电动车生态系统的发展做出贡献。例如,2022年12月,Mahindra & Mahindra投资12亿美元在普纳建造电动车製造厂。此外,2022年9月,Hero MotoCorp宣布将向总部位于加州的Zero Motorcycles投资6,000万美元,合作开发电动机车。

- 世界各国政府也采取类似倡议,敦促汽车製造商加大汽车电动的力道。例如,多家中国汽车製造商正在转型,以实现 2030 年碳达峰目标。中国主要汽车製造商东风公司计划在 2024 年使其新小客车100%电动化。 2022年,另一家中国车企比亚迪宣布未来将只生产纯电动车和插电式混合动力车。

- 此外,印度政府还推出了各种措施来促进电动车在印度的製造和普及,以减少排放气体并实现快速都市化带来的电动车。政府最近宣布将 FAME 计划第二阶段延长至 2024 年。这一阶段将重点放在大众交通工具和共用交通的电气化,透过对电动公车、电动三轮车、电动小客车和电动二轮车的补贴。

- 例如,斯柯达汽车最近宣布计划在印度生产电动车。然而,在致力于本地生产之前,该公司可能会将其首款电动车 Enyaq 作为 CBU 推向市场。 2023年5月,现代汽车宣布未来10年将在印度泰米尔纳德邦投资24.5亿美元,扩大该国的电动车产量。因此,预计这些趋势将在预测期内推动亚太地区对汽车保险丝的需求。

汽车保险丝产业概况

汽车保险丝市场适度分散,因为本土製造商在汽车保险丝市场占有很大份额。该市场的主要企业包括伊顿公司、Little Fuse Inc.、太平洋工程公司、美尔森电力公司和 AEM Components USA Inc.。

2023 年 7 月,Littelfuse, Inc. 推出了最新的符合 AEC-Q200 Rev E 标准的保险丝。这项新产品系列包括薄膜保险丝、PICO保险丝、Nano2保险丝和盒式保险丝,专为电动车和小型汽车电子应用的苛刻电路保护需求以及恶劣的汽车环境中使用而设计。所有产品均符合AEC-Q200 Rev E 合格,确保长期可靠性。

2022 年 12 月,Bel Group 旗下公司 Bel Power Solutions 宣布推出一系列全新的汽车保险丝,适用于电动车 (EV)、能源储存(EES) 和混合动力汽车等应用。该公司表示,该产品线的发布使其成为业内唯一提供完整500V和1000V产品的供应商。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 买方议价能力

- 供应商的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- 宏观经济走势对市场的影响

第五章市场动态

- 市场驱动因素

- 汽车新时代的演进—电动与自动化

- 汽车中安装的电气和电子装置数量的增加

- 市场抑制因素

- 低压熔断器在熔断器市场和无组织的售后市场开拓有限

第六章市场区隔

- 按类型

- 刀刃

- 玻璃

- 慢吹

- 高电压熔断器

- 其他类型

- 按车型

- 小客车(传统-ICE)

- 商用车(传统-ICE)

- 电动车/混合动力汽车

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 法国

- 德国

- 西班牙

- 欧洲其他地区

- 亚太地区

- 中国

- 日本

- 印度

- 其他亚太地区

- 拉丁美洲

- 巴西

- 墨西哥

- 其他拉丁美洲

- 中东/非洲

- 北美洲

第七章 竞争形势

- 公司简介

- Pacific Engineering Corporation

- Little Fuse Inc.

- Eaton Corporation

- Mersen Electrical Power

- AEM Components(USA), Inc.

- ETA ElektrotechnischeApparateGmbH

- OptiFuse

- Bel Fuse Inc.

第八章投资分析

第9章市场的未来

The Automotive Fuse Market was valued at USD 20.3 billion in the previous year and is expected to register a CAGR of 7.1 percent during the forecast period to reach USD 30.64 billion by the next five years. The market is expected to expand in the near future due to several factors, including increased vehicle production, elevated electrification, and the rising importance of safety and comfort features in passenger vehicles, all of which will lead to an increase in the number of fuses installed per vehicle and increased sales of electric and hybrid cars.

Fuse units are the most frequently used and demanded of all the electrical elements in a car. The surge in demand for vehicles with advanced technical qualities can be attributed to this. Automobile manufacturers are ramping up the production of these vehicles to satisfy increased consumer demand.

Furthermore, rising fuel prices and environmental concerns are hastening the latest automotive innovations. Electric vehicles with more integrated electronic features are becoming more popular, and fuses play an increasingly important role in their development. The increased demand for automobiles from emerging nations has prompted automakers to develop better systems, raising the requirement for a reliable automotive fuse market. For instance, according to IBEF, India's electric vehicle market is estimated to reach USD 7.09 billion by 2025.

There's also been a massive increase in the number of electric vehicles on sale in various countries. According to CAAM, in April 2022, China's new energy vehicle sales amounted to 299,000 units, of which 280,000 were electric passenger vehicles (EVs) and 19,000 were commercial electric vehicles. Sales of passenger battery electric vehicles (BEVs) and plug-in hybrid electric vehicles (PHEVs) were 212,000 and 68,000 units, respectively.

In addition, in August 2022, General Motors signed three new sourcing agreements for electric vehicle battery materials, which may help the automaker meet its goal of producing 1mm electric vehicles yearly. The multi-year contracts with LG Chem, POSCO Chemical, and Livent will supply GM with critical materials such as lithium, nickel, cobalt, and cathode active material (CAM). Such expansion in the EV industry value chain may further create significant demand for automotive fuse in the market.

Furthermore, the studied market is expected to grow in the forecasted period because the automotive sector is increasing. For instance, in the United States, sales of renewed light-duty chargeable electric cars increased to 608,000 recently compared to 308,000 in the previous year. Battery electric vehicles accounted for more than 73 percent of the total chargeable electric cars sold in the country recently.

However, factors such as limited development achieved in the field of low-voltage fuses and the presence of an unorganized aftermarket for automotive fuses continue to challenge the studied market's growth. Additionally, the fluctuating raw material prices is also among the major restraining factor for the growth of the studied market.

The automotive industry is among the leading industries wherein the influence of macroeconomic factors is high, as automobiles as consumers usually invest in automobiles in case of economic stability. However, economies across the world are facing uncertainty since the outbreak of the pandemic, which continues to slow down the demand for automobiles across various regions. For instance, in 2022, the sales of light vehicles in the United States reduced to 13,754.3 thousand units compared to 16,961.1 thousand units in 2019. With the threat of recession looming over the North American region, such trends are anticipated to sustain at least for a few years, which in turn may also slow down the growth of the studied market.

Automotive Fuse Market Trends

Electric/Hybrid Vehicles is Anticipated to Grow at Major Rate

- Currently, the trend toward vehicle electrification is attaining traction. Governments worldwide are transitioning from internal combustion and hybrid cars to all-electric vehicles, which impacts power system operations. This is anticipated to open up many possibilities in future system enhancements to decrease pollutant emissions and reliance on fossil fuels. As a result, the trend toward car electrification is anticipated to boost sales of automobile components, such as automotive fuse boxes.

- According to IEA, the net-zero emissions by 2050 Scenario sees an electric vehicle fleet of over 300 million in 2030 and electric vehicles accounting for 60 percent of new car sales. Countries such as China and the European region are leading the EV race, with other regions increasing their EV adoption rate.

- Incentives and mandates are also boosting the demand for EVs. Governments are delivering several incentives to boost electric car sales as nations focus on reducing vehicle emissions. Further, the EPA and NHTSA proposed implementing the Safer Affordable Fuel-Efficient (SAFE) vehicles rules (2021-2026). These laws may set corporate average fuel economy standards and greenhouse gas (GHG) emissions for light, commercial, and passenger vehicles. The Zero Emission Vehicles Program requires OEMs to sell exact numbers of clean and zero-emission automobiles (hybrid, electric, and fuel cell-powered commercial and passenger cars). The ZEV plan desires to put 12 million ZEVs on the road by 2030.

- Hence, the significantly growing electric vehicle market, alongside the integration of more fuses in the operational models, is anticipated to accelerate the demand in the studied market during the forecast period. Several major automakers have also stated in recent years that they intend to expedite the transition to a fully electric future by converting existing manufacturing capacity and establishing new product lines. For instance, Toyota declared the launch of 30 battery electric vehicle (BEV) models, aiming to reach 3.5 million annual EV sales by 2030. Lexus desired to sell 100% BEVs globally by 2035. By 2030, Volkswagen anticipated all-electric car sales to approach 70 percent in Europe, 50 percent in China, and 100 percent in the United States, with nearly all zero-emission motorcars by 2040. Such trends create a favorable outlook for the growth of the studied market.

- The growing proliferation of hybrid electric vehicles also supports the studied markets, as the inclusion of more electrical units significantly enhances the number of automotive fuses used in these vehicles. According to IEA, about 2.9 million of the latest plug-in hybrid electric cars were sold worldwide in 2022. Plug-in hybrid electric vehicle (PHEV) sales accounted for approximately 28.4 percent of EV sales in 2022. Meanwhile, battery electric cars accounted for most of the global sales that year.

Asia-Pacific is Expected to Register a Significant Growth Rate

- Asia-Pacific is expected to hold a significant automotive fuse market, with a considerable growth rate over the forecasted period, owing to the presence of several prominent car manufacturers in nations such as India, China, and Japan. The region's expanding government efforts are also aiding the electric vehicle market's growth. For instance, the Indian government's Automotive Mission Plan 2016-26 is a joint initiative by the Government of India and the Indian automotive firms to lay down the roadmap for the development of the industry. Further, the government of India expects the automobile sector to attract USD 8-10 billion in local and foreign investments by 2023.

- Driven by such trends, Indian automotive manufacturers are also extending their efforts, which is contributing to the overall development of the EV ecosystem in the country. For instance, in December 2022, Mahindra & Mahindra invested USD 1.2 billion in an EV manufacturing plant in Pune. Further, in September 2022, Hero MotoCorp announced an investment of USD 60 million in California-based Zero Motorcycles to collaborate on developing electric motorcycles.

- Governments across various countries are taking similar initiatives, encouraging automobile manufacturers to enhance their efforts towards the electrification of vehicles. For instance, several automakers in China are making changes to match the 2030 carbon peaking aim. By 2024, Dongfeng, a leading automobile manufacturer in China, intends to electrify 100 percent of its new passenger car models. BYD, another Chinese automotive company in 2022, announced that they will only produce BEVs and PHEVs in the future.

- Furthermore, the government of India has launched various initiatives to facilitate the manufacturing and adoption of electric cars in India to reduce emissions and create e-mobility in the wake of rapid urbanization. The government recently announced an extension of phase two of the FAME scheme through 2024. This phase focuses on electrifying public and shared transportation through subsidizing e-buses, electric three-wheelers, electric passenger vehicles, and electric two-wheelers.

- For instance, Skoda Auto recently announced its plan to manufacture electric vehicles in India. However, before committing to local manufacture, the company might bring its first EV, the Enyaq, to market as a CBU. In May 2023, Hyundai announced a USD 2.45 billion investment in the state of Tamil Nadu, India, over the next ten years to drive the production growth of EVs in the country. Hence, such trends are anticipated to drive the demand for automotive fuse in the Asia Pacific region during the forecast period.

Automotive Fuse Industry Overview

The Automotive Fuse Market is moderately fragmented due to local manufacturers' availability in large numbers in the automotive fuse market landscape. The significant players in the market include Eaton Corporation, Little Fuse Inc., Pacific Engineering Corporation, Mersen Electric Power, and AEM Components USA Inc., among others.

In July 2023, Littelfuse, Inc. released its latest AEC-Q200 Rev E Qualified Fuses. Designed specifically for the demanding circuit protection needs of electric vehicles and compact automotive electronics applications, the new product portfolio includes a range of thin film fuses, PICO fuses, Nano2 fuses, and cartridge fuses, all certified to meet the AEC-Q200 Rev E qualifications to ensure the long-term reliability in harsh automotive environments.

In December 2022, Bel Power Solutions, a Bel group company, announced the availability of a new line of automotive fuses suitable for applications in electric vehicles (EVs), electrical energy storage (EES), and hybrid vehicles. According to the company, the release of this line makes the company the only supplier in the industry showing a complete 500V and 1000V offering.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definitions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Buyers

- 4.3.2 Bargaining Power of Suppliers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Impact of Macroeconomic Trends on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Evolution of New Automotive Era -Electrification and Autonomy

- 5.1.2 Increasing Incorporation of Electrical and Electronic Units in Automobiles

- 5.2 Market Restraints

- 5.2.1 Limited Development in the Field of Low-Voltage Fuses and Unorganized Aftermarket in the Fuse Market

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Blade

- 6.1.2 Glass

- 6.1.3 Slow Blow

- 6.1.4 High-Voltage Fuses

- 6.1.5 Other Types

- 6.2 By Type of Vehicle

- 6.2.1 Passenger Cars (Traditional -ICE)

- 6.2.2 Commercial Vehicles (Traditional -ICE)

- 6.2.3 Electric/Hybrid Vehicles

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 France

- 6.3.2.2 Germany

- 6.3.2.3 Spain

- 6.3.2.4 Rest of Europe

- 6.3.3 Asia-Pacific

- 6.3.3.1 China

- 6.3.3.2 Japan

- 6.3.3.3 India

- 6.3.3.4 Rest of the Asia-Pacific

- 6.3.4 Latin America

- 6.3.4.1 Brazil

- 6.3.4.2 Mexico

- 6.3.4.3 Rest of the Latin America

- 6.3.5 Middle-East and Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Pacific Engineering Corporation

- 7.1.2 Little Fuse Inc.

- 7.1.3 Eaton Corporation

- 7.1.4 Mersen Electrical Power

- 7.1.5 AEM Components (USA), Inc.

- 7.1.6 E-T-A ElektrotechnischeApparateGmbH

- 7.1.7 OptiFuse

- 7.1.8 Bel Fuse Inc.