|

市场调查报告书

商品编码

1408006

医疗保健卫星连结:市场占有率分析、产业趋势与统计、2024-2029 年成长预测Healthcare Satellite Connectivity - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

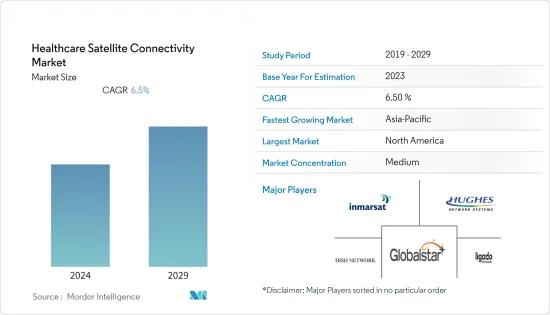

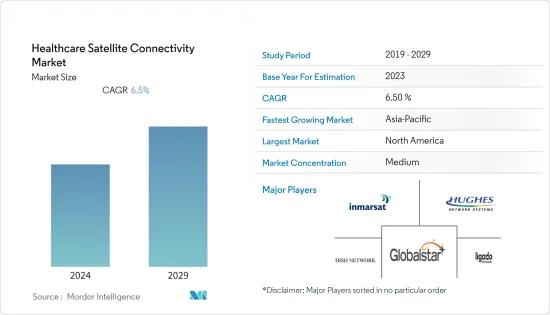

医疗保健卫星连接市场规模预计将从 2024 年的 79.3 亿美元增长到 2029 年的 108.6 亿美元,预测期内复合年增长率为 6.50%。

主要亮点

- COVID-19 大流行对世界各地的各个行业产生了重大影响,包括医疗保健和卫星连接市场。这场大流行引发了医疗保健领域卫星连接解决方案的采用和开发。对远距医疗、改进的连接基础设施、远端资源管理、资料交换以及对卫星医疗解决方案的投资的日益依赖可能会改变医疗卫星连接市场,并且即使在大流行之后也会产生长期影响。由于封锁、社会隔离措施和医疗系统超负荷,对远距医疗服务的需求激增。远距医疗依赖卫星连线进行远端咨询和监控,在大流行期间需求激增。医疗保健提供者越来越多地使用卫星技术来弥合患者和医生之间的差距,从而实现虚拟咨询、远距离诊断和病患监测。例如,根据 BioMed Central Ltd 于 2022 年 9 月发表的报导,自大流行爆发以来,远距医疗保健大幅增加,特别是在医院住院服务以及私人诊所和门诊机构。此外,根据 Cures 于 2023 年 3 月发表的一篇论文,患者正在寻求远距医疗保健,因为在 COVID-19 大流行期间提供医疗保健服务是有利且适当的。据同一资讯来源称,患者愿意尝试远距医疗保健,这使得疫情后更有可能被接受。因此,从整体情况来看,疫情增加了远距医疗保健卫星连接服务的采用,预计在预测期内将保持不变。

- 市场高成长的关键因素包括用于开发电子医疗、远距医疗、远端保健和其他行动医疗解决方案的医疗支出不断增加,以及政府倡议促进和发展卫星连接。我可以列出来。

- 此外,预计在预测期内,远距医疗中越来越多地采用人工智慧来改善患者的医疗保健结果也将推动市场成长。例如,亚利桑那州远距医疗保健计划于 2022 年 6 月发表的报导指出,近年来,人工智慧在远距医疗领域的采用有所增加,整个医疗保健领域的医生更有可能从虚拟护理替代方案中受益。做出资料驱动的即时决策,以改善健康结果和患者体验。因此,人工智慧整合的远距医疗允许医生和患者透过卫星网路进行远端通讯,进行检查、诊断和远端手术,从而扩大市场成长。

- 此外,政府在医疗保健领域采用卫星连结的倡议不断增多,预计也将在预测期内推动市场成长。例如,2021年3月,卫星电信业者与卢森堡政府启动了2024年第二阶段的SATMED远距医疗计划。 SATMED 旨在使用卫星通讯将偏远地区的医生和护士与外部医疗保健世界连接起来,并提供一个用于电子培训、虚拟咨询、医疗资料记录管理和储存、视讯会议等的平台。提供对云端应用程式的访问。

- 此外,主要企业不断产品推出也促进了市场成长。例如,2023年1月,Senet和Telli Health推出了首款配备LoRaWAN技术的远端患者监护(RPM)硬体。 LoRaWAN 是一种用于低功耗设计的开放式协定。这种广域无线通讯网路将使提供者能够接触到更多偏远和服务欠缺地区的患者,例如世界各地的土着社区,并改善医疗保健公平性。可以增加性别和整体性。

- 因此,在预测期内,人工智慧整合远距医疗的日益采用、各种政府倡议以及产品发布数量的增加预计将促进医疗保健卫星连接市场的成长。然而,偏远地区的频宽问题和网路服务的低普及预计将限制所研究市场的开拓。

医疗保健卫星连线市场趋势

预计远距医疗产业将在预测期内占据主要份额

- 医疗保健服务的增加、连接性的改善、成本和时间效率、人口趋势和技术进步等综合因素预计将推动医疗保健卫星连接市场中远距医疗领域的成长。

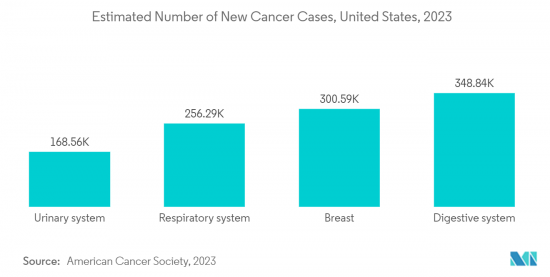

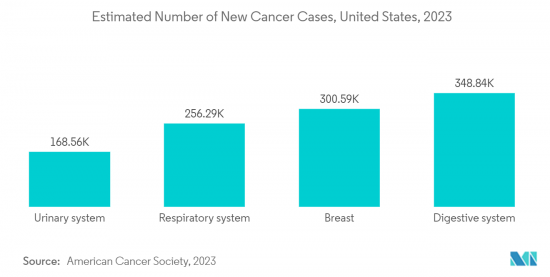

- 此外,影像处理量的增加、 IT基础设施的改善、医疗保健支出的增加以及骨关节炎和慢性病盛行率的上升也推动了该行业的成长。例如,根据美国癌症协会杂誌2022年1月发表的一篇论文,预计2022年美国将新增约190万名癌症患者。癌症等慢性病盛行率的上升正在推动诊断影像手术率的上升。因此,诊断成像病例数量的增加预计将推动对可靠、高效的远端成像解决方案的需求,从而导致市场的快速成长。

- 此外,医疗保健支出的增加对整体市场成长产生了积极影响。例如,根据《2023-2024 年国家医疗支出预测》,到 2023 年和 2024 年,美国医疗保健支出预计将分别成长 5% 和 5.1%。远距医疗保健解决方案已证明能够改善医疗保健结果并降低成本。远距医疗保健正在降低医疗保健成本,同时透过改善慢性病管理、减少旅行时间以及越来越短的住院时间来提高效率。

- 此外,主要企业积极参与推出各种远端影像诊断平台也促进了市场成长。例如,2022 年 8 月,5C Network 宣布推出 Prodigi,这是一个人工智慧驱动的平台,可直接从云端解读放射影像。这个尖端平台可实现大规模远端影像诊断,使诊断中心和医院能够提交扫描和存取报告。因此,主要企业的此类发展预计将在预测期内加速该领域的成长。

- 因此,由于上述因素,医疗保健卫星连接市场的远距医疗部分预计将在预测期内显着增长。

预计北美地区将在预测期内占据医疗保健卫星连接市场的主要份额

- 根据医疗保健卫星连接市场的区域分析,北美在全球市场中占据主要份额。这是由于网路用户数量不断增加、慢性病盛行率不断上升、医疗基础设施发达以及地区知名参与企业采取的各种策略。

- 例如,根据美国疾病管制与预防中心 (CDC) 2022 年 12 月更新的资料,目前美国每 10 名成年人中有 6 名患有慢性病。同一资讯来源称,目前该国约十分之四的成年人患有两种或多种慢性病。因此,由于美国患有慢性病的人数如此之高,对远距医疗服务的需求预计将激增,从而推动医疗保健卫星连接市场的成长。

- 此外,预计该地区政府机构在各个医疗保健领域增加投资也将推动预测期内的市场成长。例如,根据美国美国卫生研究院 (NIH) 2023 年 3 月更新的资料,美国在生物医学影像方面的医疗保健支出将从 2021 年的 27.74 亿美元增加到 2022 年的 31.01 亿美元。因此,该国医疗保健支出的增加预计将推动该地区与远距医疗相关的新发展,并预计将在预测期内推动市场成长。此外,该地区主要企业之间的协议数量不断增加正在推动市场成长。例如,总部位于美国的 Monogoto 于 2023 年 3 月与地面电波网路(NTN)服务营运商 Skylo Technologies 签署了协议。这项新协议降低了开发人员将卫星连接添加到 Monogoto 云端现有公共和专用网路的障碍。 Monogoto 的技术将美国医疗保健领域的感测器和设备连接起来。

- 因此,由于慢性病盛行率上升、医疗保健成本上升以及各种协议,预计该地区的市场成长将在预测期内显着增长。

医疗保健卫星连接产业概述

医疗保健卫星连接市场竞争适中,由几个主要企业组成。从市场占有率来看,目前该市场由少数大公司主导。然而,随着技术进步和产品创新的出现,中小企业正在利用新技术来扩大市场。医疗保健卫星连接市场的一些主要市场参与企业包括 Expedition Communications、Globalstar、SES SA、Hughes 和 Inmarsat Plc。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 市场驱动因素

- 政府促进和发展卫星连结的倡议

- 电子医疗采用率的提高

- 市场抑制因素

- 偏远地区网路服务普及不足

- 频宽问题

- 波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章市场区隔(以金额为准的市场规模 - 美元)

- 按成分

- 医疗保健设备

- 软体

- 服务

- 按用途

- 远距医疗保健

- 临床业务

- 连网型影像

- 透过连接

- 行动卫星服务

- 固定卫星服务

- 按最终用户

- 临床研究所

- 医院/诊所

- 研究和诊断实验室

- 其他最终用户

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 法国

- 英国

- 义大利

- 西班牙

- 欧洲其他地区

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 其他亚太地区

- 中东/非洲

- 海湾合作委员会国家

- 南非

- 其他中东/非洲

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 北美洲

第六章 竞争形势

- 公司简介

- Inmarsat Global Limited

- Hughes Network Systems, LLC

- SES SA

- X2NSat

- Expedition Communications

- Globalstar

- Eutelsat Communications SA

- AT&T Intellectual Property

- DISH Network LLC

- Ligado Networks

第七章 市场机会及未来趋势

The healthcare satellite connectivity market size is expected to grow from USD 7.93 billion in 2024 to USD 10.86 billion by 2029, at a CAGR of 6.50% during the forecast period.

Key Highlights

- The COVID-19 pandemic significantly impacted various industries worldwide, including the healthcare and satellite connectivity markets. The pandemic acted as a catalyst for adopting and developing satellite connectivity solutions in the healthcare sector. The increased reliance on telemedicine, improved connectivity infrastructure, remote resource management, data exchange, and investment in satellite healthcare solutions have transformed the healthcare satellite connectivity market and are likely to have long-lasting effects beyond the pandemic. The need for remote healthcare services has surged with lockdowns, social distancing measures, and overwhelmed healthcare systems. Telemedicine, which relies on satellite connectivity to provide remote consultations and monitoring, has experienced a sharp rise in demand during the pandemic. Healthcare providers have increasingly turned to satellite technology to bridge the gap between patients and doctors, enabling virtual consultations, remote diagnostics, and patient monitoring. For instance, as per the article published by BioMed Central Ltd in September 2022, telemedicine has increased substantially, particularly for hospital-based in-patient services and in private clinics and ambulatory settings since the onset of the COVID-19 pandemic. Furthermore, as per the article published by Cureus in March 2023, patients sought telemedicine as advantageous and appropriate for providing healthcare services during the COVID-19 pandemic. As per the same source, the patients are more willing to try telemedicine, resulting in higher acceptability during the post-pandemic period. Therefore, looking at the overall scenario, the pandemic has increased the adoption of telemedicine healthcare satellite connectivity services and is expected to do the same during the forecast period.

- The major factors responsible for the high market growth include rising healthcare expenditure toward developing eHealth, telemedicine, telehealth, and other mHealth solutions and increasing government initiatives for promoting and developing satellite connectivity.

- In addition, the rising adoption of AI in telemedicine to improve patient healthcare outcomes is also projected to drive market growth during the forecast period. For instance, as per the article published by the Arizona Telemedicine Program in June 2022, in the recent few years, there has been an increase in the adoption of AI in telemedicine to allow doctors to make more data-driven, real-time decisions for the improvement of the health outcomes and patient experience by enabling them to work more toward virtual care alternatives throughout the care continuum. Therefore, with AI-integrated telemedicine, doctors and patients can communicate remotely via satellite internet for consultations, diagnoses, and distance surgeries, thereby increasing the market growth.

- Furthermore, the rising government initiatives toward adopting healthcare satellite connectivity in healthcare are also projected to drive market growth during the forecast period. For instance, in March 2021, the Satellite telecommunications company and Luxembourg Government launched the second phase of the SATMED telemedicine project in 2024. SATMED is enabled by satellite and is designed to connect doctors and nurses from remote locations to the outside medical world, providing access to the platform's cloud applications for e-training, virtual consultations, management and storage of medical data records, and video conferencing.

- Moreover, the rising product launches by prominent players are also burgeoning the market growth. For instance, in January 2023, Senet and Telli Health launched the first remote patient monitoring (RPM) hardware powered by LoRaWAN technology. LoRaWAN is an open protocol for designing low-power. These wide-area wireless telecommunication networks will allow providers to reach more patients in remote and underserved areas like indigenous communities worldwide, boosting healthcare equity and inclusivity.

- Therefore, the rising adoption of AI-integrated telemedicine, various government initiatives, and an increasing number of product launches are projected to augment healthcare satellite connectivity market growth during the forecast period. However, bandwidth problems and low penetration of internet services in remote areas are expected to restrain the development of the studied market.

Healthcare Satellite Connectivity Market Trends

Telemedicine Segment is Expected to Hold Significant Share Over The Forecast Period

- The combination of increased access to healthcare, improved connectivity, cost and time efficiency, demographic trends, and technological advancements are certain factors that are projected to drive the growth of the telemedicine segment in the healthcare satellite connectivity market.

- In addition, the rising number of imaging procedures, the development of IT infrastructure, the rise in healthcare expenditure, and the increasing prevalence of osteoarthritis and chronic diseases are also increasing the segment growth. For instance, as per the article published by the American Cancer Society Journal in January 2022, approximately 1.9 million new cancer cases were projected to occur in the United States in 2022. The rising prevalence of chronic conditions, such as cancer, is increasing the diagnostic imaging procedural rate. Hence, the rising number of imaging procedures is projected to boost the demand for reliable and efficient teleradiology solutions, resulting in high growth in the market.

- Additionally, the increasing healthcare expenditure is positively influencing the overall market growth. For instance, as per the National Health Expenditure Projections 2023-2024, growth rates in United States health expenditures are projected to be 5% and 5.1% throughout 2023 and 2024, respectively, as patient care patterns are assumed to revert to pre-pandemic levels. Telemedicine solutions have demonstrated the ability to enhance health outcomes and reduce costs. Telemedicine has been decreasing the cost of healthcare while increasing efficiency through improved management of chronic diseases, reduced travel times, and fewer and shorter hospital stays.

- Moreover, the active participation of prominent players in the launch of various teleradiology platforms is also increasing the market growth. For instance, in August 2022, 5C Network launched its artificial intelligence-powered platform Prodigi to interpret radiology images directly from the cloud. This state-of-the-art platform enables teleradiology at a massive scale and makes it possible for diagnostic centers and hospitals to submit scans and access reports. Thus, such developments made by prominent players are projected to burgeon segment growth during the forecast period.

- Therefore, due to the above-mentioned factors, the telemedicine segment in the healthcare satellite connectivity market is projected to grow significantly during the forecast period.

North America Region is Expected to Occupy a Major Share in the Healthcare Satellite Connectivity Market Over the Forecast Period

- The geographical analysis of the healthcare satellite connectivity market shows that North America holds a significant market share in the global market. This is due to the rising number of Internet users, the increasing prevalence of chronic diseases, the well-developed healthcare infrastructure, and various strategies prominent regional players perform.

- For instance, as per the data updated by the Center for Disease Control and Prevention (CDC) in December 2022, 6 in 10 adults in the United States currently have a chronic disease. The same source mentioned that approximately 4 in 10 adults in the country now suffer from two or more chronic conditions. Therefore, such a large proportion of people suffering from chronic diseases in the country is projected to create a massive demand for telemedicine services, thereby increasing the healthcare satellite connectivity market growth.

- In addition, the increasing investments by government organizations in the region in various health sectors are also projected to increase market growth during the forecast period. For instance, as per the data updated by the National Institutes of Health (NIH), in March 2023, the United States healthcare expenditure in biomedical imaging rose from USD 2,774 million in 2021 to USD 3,101 million in 2022. Thus, increasing healthcare expenditure in the country is estimated to drive new developments related to telemedicine in the region, which is projected to drive market growth during the forecast period. Furthermore, rising agreements between prominent regional players drive market growth. For instance, in March 2023, Monogoto, the United States-based company, signed an agreement with Non-Terrestrial Network (NTN) service operator Skylo Technologies. This new agreement lowers developers' barriers to adding satellite connectivity to existing public and/or private networks already available on Monogoto Cloud. Monogoto's technology connects sensors and devices in the United States in the healthcare sector.

- Therefore, due to the rising prevalence of chronic diseases, increasing healthcare expenditure, and various agreements, the regional market growth is projected to grow significantly during the forecast period.

Healthcare Satellite Connectivity Industry Overview

The healthcare satellite connectivity market is moderately competitive and consists of a small number of major players. In terms of market share, a small number of major players are currently dominating the market. However, with technological advancements and product innovations, mid-size to smaller companies are increasing their market by using new technologies. Major market players operating in the healthcare satellite connectivity market include Expedition Communications, Globalstar, SES S.A., Hughes, and Inmarsat Plc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Government Initiatives for Promotion and Development of Satellite Connectivity

- 4.2.2 Rising Adoption of eHealth

- 4.3 Market Restraints

- 4.3.1 Insufficient Penetration of Internet Services in Remote Areas

- 4.3.2 Bandwidth problems

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - USD)

- 5.1 By Component

- 5.1.1 Medical Device

- 5.1.2 Software

- 5.1.3 Services

- 5.2 By Application

- 5.2.1 Telemedicine

- 5.2.2 Clinical Operations

- 5.2.3 Connected Imaging

- 5.3 By Connectivity

- 5.3.1 Mobile Satellite Services

- 5.3.2 Fixed Satellite Services

- 5.4 By End-User

- 5.4.1 Clinical Research Organization

- 5.4.2 Hospitals and Clinics

- 5.4.3 Research and Diagnostic Laboratories

- 5.4.4 Other End-Users

- 5.5 Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canda

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 France

- 5.5.2.3 United kingdom

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of Asia Pacific

- 5.5.4 Middle East and Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East and Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Inmarsat Global Limited

- 6.1.2 Hughes Network Systems, LLC

- 6.1.3 SES S.A.

- 6.1.4 X2NSat

- 6.1.5 Expedition Communications

- 6.1.6 Globalstar

- 6.1.7 Eutelsat Communications SA

- 6.1.8 AT&T Intellectual Property

- 6.1.9 DISH Network L.L.C.

- 6.1.10 Ligado Networks