|

市场调查报告书

商品编码

1692508

空气调节机(AHU) -市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Air Handling Units (AHU) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

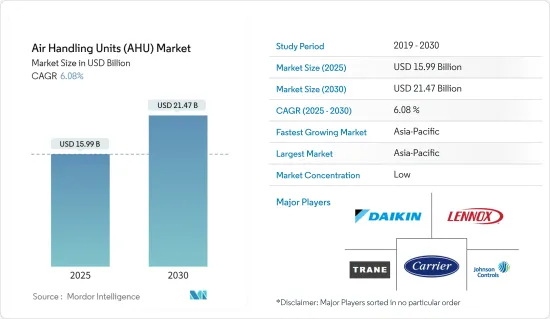

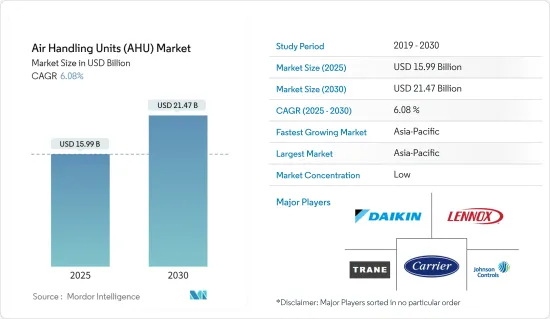

空气调节机市场规模预计在 2025 年为 159.9 亿美元,预计到 2030 年将达到 214.7 亿美元,预测期内(2025-2030 年)的复合年增长率为 6.08%。

主要亮点

- 空气调节机(AHU) 通常用于大型、繁忙的设施,例如购物中心。这是因为这些人经常光顾的设施受到有关二氧化碳排放和空气净化的严格规定。在大型设施中,需要将足够量的空气吸入建筑物内,并使用多个通风风扇或其他方式使空气循环。空气调节机将室外空气引入房间,大大减少了所需的鼓风机数量。

- 全球快速的工业化和都市化是推动市场成长的主要因素之一。世界各地各种商业和住宅建筑的建设大大增加了对用于空间供暖和製冷的空气调节机的需求。例如,根据CIArb的预测,到2030年,全球整体建筑业产出预计将成长约85%,达到15.5兆美元。

- 根据欧盟委员会统计,欧盟地区的建筑物约占温室气体排放的36%和能源消费量的40%,主要透过其建造、使用、重建和拆除产生。在这些建筑物中,暖通空调系统占据了能源使用量的很大一部分。因此,预计在预测期内,对节能 HVAC 系统(包括空气调节机)的需求将会增加。

- 此外,包括空气处理机组在内的暖通空调设备市场严重依赖建筑、政府法规以及地方政府为促进基础设施、工业和製造业发展而采取的新措施等领域。商业和工业部门成长的任何波动都必然会对该设备的需求产生直接影响。

- 此外,地缘政治问题和北美和欧洲地区近期的经济不稳定等宏观经济因素也有望影响所研究市场的成长。例如,由于俄罗斯和乌克兰之间的战争导致能源价格上涨,预计欧洲对空气处理机组的需求将减缓,因为这些设备的能源消耗很高。

空气调节机(AHU)市场趋势

商业部分占很大份额

- 空气调节机用于所有商业设施,如餐厅、资料中心、医院、学校、饭店和办公大楼,为居住者提供舒适的环境。例如,空气调节机(AHU) 用于中型到大型工业和商业建筑,以调节和输送整个建筑内的新鲜空气。 AHU 是大型 HVAC 系统的一个组成部分,它可以引入新鲜的室外空气,对其进行清洁、调节,并根据需要加热或冷却。

- 空气处理机组具有多种尺寸和功能,可用于单一空间或整栋建筑物。空气处理机组通常安装在商业建筑的地下室或屋顶上。空气处理机组可以分配到建筑物的特定区域,以根据需要提供暖气或冷气。

- 对环保节能 HVAC 系统日益增长的需求正在推动这一领域的扩张。对节能、经济的 HVAC 解决方案的需求正在推动对空气处理系统的需求增加。空气调节机相对于其他类型的 HVAC 系统具有多种优势,包括高能源效率、低运行成本和更好的室内空气品质。

- 商业部门消耗了北美大部分的能源。根据环境服务公司 Carbon Reform 的数据,美国商业领域由约 600 万栋建筑组成,总占地面积达 970 亿平方英尺。此外,商业建筑中超过 90% 的占地面积都采用某种形式的机械加热和冷却系统。此外,不断扩大的建筑业预计将推动市场发展并增加商业建筑的整体能源需求。

- 根据美国能源资讯署 (EIA) 预测,2022 年美国商业部门将消耗约 4.9 兆英热单位的初级能源。根据美国能源资讯署 (EIA) 的数据,2022 年美国商业部门将消耗约 4.9 兆英热单位的初级能源。因此,预计在预测期内,能源消耗的增加将推动该国对节能空气处理机组的需求。

亚太地区预计将创下最快成长

- 预计预测期内,空气调节机(AHU) 市场在亚太地区成长最快。这主要是由于该地区基础设施和建筑计划的投资不断增加,以及对节能技术的需求不断增加。由于智慧 AHU 等技术的发展,预计该市场在整个预测期内将会成长。

- 印度和中国等国家正迅速崛起成为亚太地区的製药製造地。在製药过程中,空气调节机主要用于维持药品和其他物品的受控环境,并具有高卫生标准,特别用于防止污染。由于丽水硝基苯製造厂和大士生物医药园区新疫苗生产设施等新化学和製药设施的发展,该地区的空气处理系统市场预计将成长。

- 亚洲工业部门的快速成长是其占最大份额的主要原因之一。此外,该地区开发中国家(包括印度、日本、中国和韩国)的都市化和商业化进程预计将推动对空气处理系统的需求。此外,可支配收入的增加和生活方式的改变也推动了对舒适生活空间的需求,这是决定市场方向的关键因素。

- 亚太地区对于全球实现净零排放和向绿色能源转型的努力至关重要。随着许多政府制定国家和地区的倡议和计划来推动节能工作,「绿色」潮流正在亚太地区蓬勃发展。政府措施为暖通空调和大楼自动化系统绿色能源效率领域的工程师提供了良好的前景。

- 此外,环境立法在亚太地区也越来越普遍,例如澳洲的最低能源性能标准(MEPS)、中国的绿色建筑评价标籤(GBEL)以及印度的能源效率标准和标籤计画局(BEE标籤计画)。因此,HVAC 产业的这一部分正在转向具有低全球暖化潜势 (GWP) 且更节能的环保型 AHU。

空气调节机(AHU)市场概况

AHU 市场由一些拥有成熟分销网络和主导市场占有率份额的大型供应商主导,竞争对手之间的竞争十分激烈。然而,不断增长的需求正在鼓励新进入者,市场正在走向分散的阶段。许多製造商都将能源效率作为关注的重点。此外,市场研究中涉及的领先供应商都参与了併购活动和伙伴关係,以获得更高的渗透率和市场占有率。主要市场参与者包括DAIKIN INDUSTRIES、开利公司、特灵公司和江森自控。

2023 年 5 月,Colmac Coil Manufacturing, Inc. 推出了最新的 HygenAir A+H 卫生空气处理机。根据该公司介绍,该空气处理机旨在改善卫生至关重要的加工室的卫生状况,并采用客自订设计,帮助食品加工商提高工人的安全性并保持高质量,以满足美国农业部的严格要求。

2023 年 5 月,Edgetech Air Systems Pvt.有限公司是一家中央空调先进空气处理系统的供应商,在印度 Central Vista计划中安装了智慧空气处理机组。据该公司介绍,安装的空气处理机组将配备先进的分析和监控系统,以提供即时运行情报并提高能源效率。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概览

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 产业价值链分析

- 宏观趋势如何影响市场

第五章市场动态

- 市场驱动因素

- 人口成长与都市化推动市场需求

- 对节能 HVAC 系统的需求不断增加

- 市场挑战

- 依赖宏观经济经济状况

- 竞争加剧限制利润率

第六章市场区隔

- 按类型

- 封装类型

- 模组化的

- 自订

- 其他类型

- 按最终用户

- 住宅

- 商业的

- 工业的

- 按地区

- 北美洲

- 欧洲

- 亚洲

- 澳洲和纽西兰

- 拉丁美洲

- 中东和非洲

第七章竞争格局

- 公司简介

- Daikin Industries Ltd.

- Carrier Corporation

- TRANE Inc.(Trane Technologies PLC)

- Lennox International Inc.

- Johnson Controls International PLC

- Systemair AB

- TROX GmbH

- Swegon Group AB(Investment AB Latour)

- Hitachi Ltd

- Blue Star Limited

第八章投资分析

第九章:市场的未来

The Air Handling Units Market size is estimated at USD 15.99 billion in 2025, and is expected to reach USD 21.47 billion by 2030, at a CAGR of 6.08% during the forecast period (2025-2030).

Key Highlights

- Air handling units (AHUs) are commonly used in large facilities visited by many people, such as shopping malls, as such facilities frequented by people are subjected to strict regulations regarding the exhaustion of carbon dioxide and air cleanliness. A large facility must let adequate amounts of air into the building and use multiple blower fans and other equipment to circulate the air. As the air handling units deliver outside air into the rooms, they can significantly reduce the number of required blower fans.

- The rapid rise in industrialization and urbanization around the world is one of the primary factors driving market growth. The significant increase in the construction of different commercial and residential buildings worldwide creates considerable demand for Air Handling Units as a space cooling and heating system. For instance, as per CIArb, the volume of construction output is anticipated to grow by about 85 percent globally to USD 15.5 trillion by 2030.

- According to the European Commission, buildings in the EU region are responsible for around 36 percent of GHG emissions and 40 percent of energy consumption, mainly from construction, usage, renovation, and demolition. HVAC systems account for a considerable share of energy usage in these buildings. Hence, the demand for energy-efficient HVAC systems, including air handling units, is anticipated to gain traction during the forecast period.

- Furthermore, the HVAC equipment market, including air handler units, is highly dependent on sectors such as construction, government regulations, and new initiatives by the governments of various regions to boost the infrastructure and industrial and manufacturing sectors. Any fluctuations in the growth in the commercial and industrial sectors are bound to impact the demand for this equipment directly.

- Additionally, macroeconomic factors such as geo-political issues and the recent economic instability witnessed in the North American and European regions are also anticipated to influence the studied market's growth. For instance, the growing energy prices, owing to the Russia-Ukraine war, are anticipated to slow down the demand for air handling units in Europe as energy consumption by these devices is higher.

Air Handling Units (AHU) Market Trends

Commercial Segment to Occupy a Significant Share

- Air Handling Units are used in any commercial structure, such as restaurants, data centers, hospitals, schools, hotels, and office buildings, to provide inhabitants with a comfortable environment. For instance, an air handling unit (AHU) is used in medium- and large-sized industrial or commercial buildings to condition and transport fresh air throughout the structure. AHUs are a component of the bigger HVAC system; they draw fresh outdoor air in, clean and condition it, and then heat or cool it as necessary.

- Air handler units can be utilized for either a single space or an entire building due to their wide range of size and functionality. They are frequently located in the basement or on the roof of commercial-sized buildings. The air handler unit can then be allocated to particular regions of a building to deliver heating or cooling as needed.

- The increasing demand for environmentally friendly and energy-efficient HVAC systems is credited with driving the segment's expansion. The need for energy-efficient and cost-effective HVAC solutions is driving the increased demand for air handling systems. Air handling units provide several advantages over other types of HVAC systems, including higher energy efficiency, cheaper running costs, and better indoor air quality.

- The commercial sector consumes a large portion of North America's overall energy consumption. There are approximately 6 million buildings in the business sector of the United States, totaling 97 billion square feet of floor space, according to the environmental services firm Carbon Reform. Additionally, mechanical heating and cooling systems are used in some capacity on more than 90 percent of the total commercial floor space. Additionally, it is anticipated that the expanding construction sector will drive the market and contribute to the overall energy requirements for commercial buildings.

- Considering a large commercial sector, the sector is also among the leading consumer of electricity in the United States; according to EIA, in 2022, about 4.9 quadrillion British thermal units of primary energy was consumed by the commercial sector in the United States. Hence, the growing energy consumption is anticipated to drive the demand for energy-efficient air handling units in the country during the forecast period.

Asia-Pacific is Expected to Register the Fastest Growth

- The air handling unit (AHU) market is anticipated to grow fastest in the Asia-Pacific region during the projected period, primarily due to the expanding infrastructure and building project investments and increased demand for energy-efficient technologies in the area. This market is anticipated to rise throughout the projected period due to technological developments such as intelligent AHUs.

- Countries like India and China are fast emerging as the pharmaceutical manufacturing hub in the Asia Pacific region. In the pharmaceutical business, air handling units are primarily used to maintain a regulated atmosphere for medicines and other items with high sanitation standards to prevent contamination, among other things. Due to the development of new chemical and pharmaceutical facilities like the Yeosu Mononitrobenzene Manufacturing Plant and Tuas Biomedical Park New Vaccine Production Facility, the market for air handling systems is anticipated to grow in the region.

- The fast-increasing industrial sector in Asia is one of the primary causes responsible for the most significant share. It is also anticipated that growing urbanization and commercialization in this region's developing nations, including India, Japan, China, and South Korea, will raise demand for air handling systems. Additionally, the rising disposable income and changing lifestyle also drive demand for pleasant living spaces, which is a significant element driving the market's direction.

- The Asia-Pacific region is crucial to global efforts to attain net zero and a transition to green energy. The "green" trend is exploding throughout Asia-Pacific due to numerous governments establishing national or regional initiatives and programs to promote energy conservation efforts. The government's initiatives provide enormous prospects for technologists in the green and energy efficiency sectors of HVAC and building automation systems.

- Moreover, environmental laws are becoming more prevalent in Asia-Pacific, including the Australian Minimum Energy Performance Standards (MEPS), China's Green Building Evaluation Label (GBEL), and India's Bureau of Energy Efficiency Standards and Labeling Program (BEE Labeling Program), among others. As a result, the HVAC industry in this area is turning toward environmentally friendly AHUs with low Global Warming Potential (GWP) and energy-efficient technology.

Air Handling Units (AHU) Market Overview

The competitive rivalry in the AHU market is growing, as the market comprises many large vendors that command a prominent market share besides having access to well-established distribution networks. However, the growing demand is encouraging new players to enter the market, shifting its landscape towards a fragmented stage. Many manufacturers are focusing on energy efficiency as one of the key concerns. Moreover, major vendors in the market studied are involved in both M&A activities and partnerships to gain higher penetration and market share. Some key market players include Daikin Industries, Carrier Corporation, TRANE Inc., and Johnson Controls, among others.

In May 2023, Colmac Coil Manufacturing, Inc. launched its latest HygenAir A+H Hygienic Air Handler. According to the company, the air handler is designed to improve hygiene inside processing room environments wherein sanitation is critical and is custom-engineered to help food processors increase worker safety and meet the strict requirements of the USDA by maintaining high quality.

In May 2023, Edgetech Air Systems Pvt. Ltd., a provider of advanced air handling systems used in central air conditioning, installed Smart Air Handling Units in India's Central Vista Project. According to the company, the installed air handlers are equipped with advanced analytics and monitoring and analytics systems to provide real-time operational intelligence and contribute to energy efficiency.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of Macro Trends on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Population and Urbanization is Driving Market Demand

- 5.1.2 Increasing Demand for Energy-efficient HVAC Systems

- 5.2 Market Challenges

- 5.2.1 Dependence on Macroeconomic Conditions

- 5.2.2 Growing Competition to Limit Margins

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Packaged

- 6.1.2 Modular

- 6.1.3 Custom

- 6.1.4 Other Types

- 6.2 By End User

- 6.2.1 Residential

- 6.2.2 Commercial

- 6.2.3 Industrial

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia

- 6.3.4 Australia and New Zealand

- 6.3.5 Latin America

- 6.3.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Daikin Industries Ltd.

- 7.1.2 Carrier Corporation

- 7.1.3 TRANE Inc. (Trane Technologies PLC)

- 7.1.4 Lennox International Inc.

- 7.1.5 Johnson Controls International PLC

- 7.1.6 Systemair AB

- 7.1.7 TROX GmbH

- 7.1.8 Swegon Group AB (Investment AB Latour)

- 7.1.9 Hitachi Ltd

- 7.1.10 Blue Star Limited