|

市场调查报告书

商品编码

1408096

暖气设备-市场占有率分析、产业趋势与统计、2024年至2029年成长预测Heating Equipment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

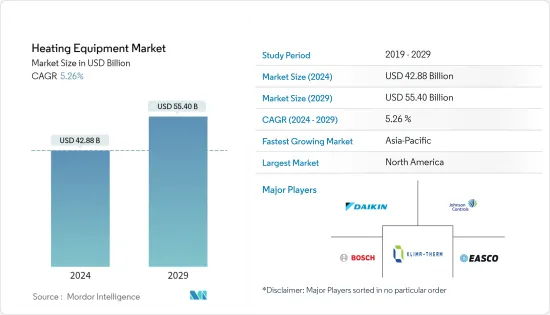

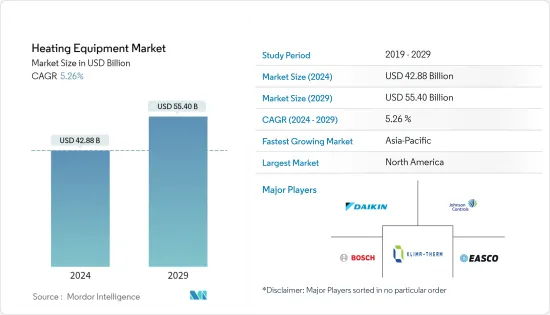

暖气设备市场规模预计到2024年为428.8亿美元,预计到2029年将达到554亿美元,在预测期内(2024-2029年)复合年增长率为5.26%。

对节能供暖设备的需求导致了能够提供经济高效供暖的机械设备的开拓,从而推动了市场的扩张。快速的技术进步为减少碳排放提供了具有成本效益的选择,从而推动了暖气设备市场的发展。这些系统分为自足式单元包和核心系统。

主要亮点

- 全球建设产业的大幅扩张是支撑市场良好前景的关键原因之一。此外,对节能供暖系统日益增长的需求正在推动市场扩张。暖气设备广泛用于温度结冰的地方,以提高周围区域的温度,同时减少对环境的影响。物联网以及设备与人工智慧的整合等技术突破也在推动成长。这些技术允许用户使用智慧型手机或穿戴式装置远端控制加热设备。产品开发商也正在为住宅和小型商业综合体开发新的自足式暖气设备装置。

- 印度、中国等开发中国家的石化和化学工业正在迅速扩张,工业锅炉的需求预计将增加。由于全球大型发电工程投资增加,市场需求可能进一步上升。这些容器经常用于化学和石化行业,并构成该应用领域工业锅炉的大部分。据美国环保署称,新的锅炉法规旨在大规模减少环境排放。目前,作为重要排放源的锅炉,超过88%可以每年进行调整以满足排放法规,而其余12.0%则需要维修或更换以减少有害排放。

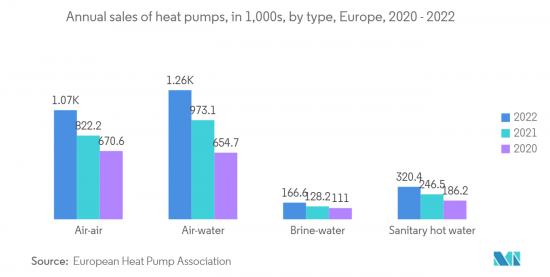

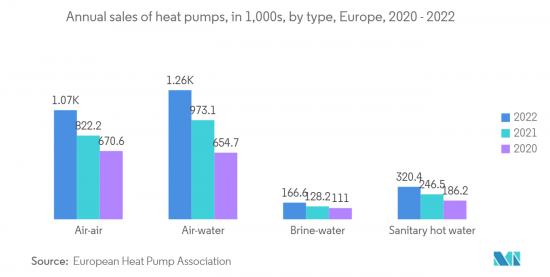

- 对节能设备不断增长的需求正在推动热泵等技术的部署,这些技术为最终用户提供了巨大的潜力,可以为世界各地的可再生能源和气候目标做出贡献。热泵将供应方脱碳与需求方技术协同效应的能力正在被利用,为减少二氧化碳排放做出重大贡献。热泵是一种高度通用的技术,并且具有很高的能源效率,因为它们可以在一个装置中提供加热、冷却和热水。此外,这些设备可用于传统/混合可再生系统,以使用主动热感质量储存剩余电力。也已知整合电网内的各种能源并优化其性能。

- 另一方面,已开发国家政府制定了严格的排放要求,以控制排放排放环境中的污染物,影响供热设备效率、营业成本和市场成长。据美国环保署称,美国政府已颁布法规规范工业锅炉的粒状物、二氧化硫和氮氧化物排放。此外,国际能源总署(IEA)透过其清洁能源技术计划,正在引进选择性催化还原(SCR)、排烟脱硫(FGD)、布袋除尘器等技术来减少工业锅炉的排放,我们鼓励其使用。此外,工业锅炉製造商面临的关键问题之一是需要提高效率和蒸汽品质以满足市场需求。这些严格的监管可能会在短期内阻碍市场的成长。

- 建设产业常被认为是一个国家经济发展的重要指标,因此GDP成长、通货膨胀、利率、政府支出等宏观经济指标的变化都能对建设产业产生直接影响。通货膨胀导致原物料成本上涨、利率上升导致建筑公司借款减少等因素预计将对预测期内所研究市场的成长产生负面影响。

暖气设备市场趋势

热泵预计将占据主要市场占有率

- 能源是家庭、医院和学校的重要动力来源。然而,它们的生产和使用排放大量温室气体。因此,世界主要经济体正在向再生能源来源转型,以限制温室气体排放,同时尽量减少对非可再生能源来源的排放。热泵技术是减少温室气体排放的有效手段。空气热热泵和地热热泵提供节能的加热解决方案。

- 北美地区,尤其是美国,热泵的部署正在稳定增加。造成这种情况的原因各不相同,包括设备提供的便利性、气候条件、政府税额扣抵优惠和法规。此外,热泵由于其能源效率而受到该地区政府的监管。例如,能源部宣布了风扇能源评级,为住宅炉子中的风扇设定了最低空气效率标准。

- 根据新的 FER 标准,美国能源部估计,到2030 年,炉风机新标准将节省约3.99 夸脱的能源,减少3,400 万吨碳污染,并为美国人节省超过90 亿美元的电费。我们估计,我们将提供它。根据一项新的州法律,未来五年内,缅因州各城市将招募安装人员,以实现安装 10 万台热泵的目标。此外,新安布勒热泵计划旨在大幅降低村庄的柴油成本。

- 此外,东欧气候寒冷,捷克、波兰和保加利亚等国家对暖气解决方案的需求很高。与该地区其他国家一样,提高暖气和冷气产业能源效率的措施正在增加。根据欧盟智慧能源欧洲计画共同创立的 Stratego 的说法,2010 年至 2050 年间投资 500 亿欧元可以节省足够的燃料,从而最大限度地降低能源系统成本。此外,该投资的一部分将包括 50 亿欧元用于区域供暖和 150 亿欧元用于独立热泵。

- 2022年7月,新加坡国家环境局(NEA)报告称,正在考虑在高层住宅(公寓和组屋单位)中使用热泵热水器。热泵热水器仅耗电 210 瓦,而典型的电或燃气热水器耗电量约为 3,000 瓦。采用热泵节省的能源可能会显着减少用户每月的电费支出。

预计亚太地区市场将出现高成长

- 中国广阔的地理区域被正式划分为五个主要气候区,具有不同的热设计要求。我国北方是两个最寒冷的气候区,冬季需要暖气。都市区依赖集中供热系统,而农村地区主要依赖自营供暖系统。另一个供暖需求增加的气候区是夏季炎热、冬季寒冷的气候区。由于历史原因,该气候区的建筑物没有提供区域供暖系统的公共基础设施或服务,建筑物普遍缺乏有效的供暖服务。因此,中国北方和南方面临的暖气挑战不同,需要量身订製的解决方案。

- 亚太地区可能占据最高的销售份额。这主要是由于中国和印度等国家建筑业的成长,这些国家正在进行大规模的基础设施投资,特别是在零售空间、商业办公大楼、製造设施和地铁线路方面。此外,火力发电行业对锅炉的需求不断增加正在推动市场扩张。

- 许多中国家庭仍依赖小煤炉取暖,造成空气污染,损害健康。为了解决这些问题,中国政府于 2017 年启动了一项为期五年的清洁供暖计划,旨在使北方 70% 的家庭摆脱煤炭,转向更清洁的供暖方式。 2022 年,即该计画的最后一年,普林斯顿大学研究人员进行的一项开创性研究提供了政策指南:增加农村家庭对热泵的使用。在调查的选项中,研究人员发现空气对空气热泵提供的空气品质、健康和气候效益最大。

- 中国的目标是到2060年实现碳中和,并在减少空气污染方面做出了成功的努力。土木与环境工程及国际关係教授丹尼斯·莫塞拉尔表示,用清洁取暖器取代都市区住宅的煤炉将显着改善中国北方冬季的空气质量,据说过早死亡的人数也有所减少。此外,中国计划在2060年实现碳中和,电网和供电系统的「脱碳」极为重要。实现这一目标的方法之一是放弃煤炭,转向更多非化石能源。

- 区域参与企业正在开发新产品以满足不同的客户需求。例如,2022年3月,松下在日本宣布了新设备。 EcoCute解决方案由热泵和热水储存槽组成,透过保持浴缸内的水温恆定来节省能源。它还利用家中洗澡水的热量在夜间节省电力。此外,该设备还节省能源和水。配备太阳能充电功能,利用太阳能发电和储存的剩余电力。您可以在白天或晚上的任何时间使用电力来加热水。

供热设备产业概况

由于竞争激烈,全球暖气设备市场上竞争公司之间的竞争呈现零碎化。由于 Easco Boiler Corporation、Robert Bosch GmbH、Daikin Industries ltd、Klima-Therm、Johnson Controls 等主要企业的入驻。

- 2023 年 4 月 Kanthal 和 Rath 宣布建立战略合作伙伴关係,扩大双方在工业加热技术方面的联合提案,Kanthal 负责工业电加热技术,Rath 负责高温耐火材料产品。透过两家公司的密切合作,我们将支持钢铁、石化等产业实现生态转型。这种合作关係结合了两家公司的互补优势,为市场提供了最广泛的永续工业加热解决方案选择。客户可以受益于 Kanthal 在加热组件和加热系统方面的经验以及 Rath 卓越的隔热材料和耐火材料解决方案,为他们的工业加热需求提供独特的组合。

- 2023 年 4 月,造纸公司 UPM 选择在其位于德国和芬兰的工厂建造新的电锅炉来产生热量和蒸汽。该公司将安装八台新锅炉。这项倡议将使 UPM 能够阶段在其工厂中使用石化燃料。第一台 50 兆瓦电锅炉已在芬兰 Valkeakoski 的 UPM Tervasaari 造纸厂安装并运作。该锅炉从芬兰贾姆萨的 UPM Kaipola 工厂搬迁至 Valkeakoski。为了提高效率,该公司计划今年稍后在该工厂再建造一座 60 兆瓦的电锅炉。这种大容量锅炉为工厂生产蒸汽和热量,并支持这两个过程。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

- 供应链分析

- 政府法规政策

- 宏观经济走势对产业的影响

第五章市场动态

- 促进因素

- 抑制因素

第六章市场区隔

- 产品类别

- 热泵

- 炉

- 单元式加热器

- 锅炉

- 最终用户

- 住宅

- 商业的

- 工业的

- 地区

- 北美洲

- 美国

- 加拿大

- 其他的

- 欧洲

- 德国

- 英国

- 法国

- 俄罗斯

- 西班牙

- 其他的

- 亚太地区

- 印度

- 中国

- 日本

- 其他的

- 其他的

- 北美洲

第七章 公司简介

- Daikin Industries Ltd

- Klima-Therm

- Robert Bosch GmbH

- Carrier Global Corporation(United Technologies Corp.)

- Panasonic Corporation

- Johnson Controls

- Lennox International, Inc.

- Easco Boiler Corporation

- Ariston Thermo Group

- Danfoss A/S

第八章投资分析

第九章 市场机会及未来趋势

The Heating Equipment Market size is estimated at USD 42.88 billion in 2024, and is expected to reach USD 55.40 billion by 2029, growing at a CAGR of 5.26% during the forecast period (2024-2029).

The requirement for energy-efficient heating equipment has resulted in the development of mechanical devices that can deliver cost-effective heating, assisting the market's expansion. With quick technological advancement, heating equipment provides cost-effective choices for lowering carbon emissions, boosting the heating equipment market forward. These systems are classified as either self-contained packages of units or core systems.

Key Highlights

- Significant expansion in the global construction industry is one of the important reasons driving the market's favorable outlook. Furthermore, the growing need for energy-efficient heating systems is propelling market expansion. Heating equipment is extensively utilized in places with freezing temperatures to raise ambient temperatures with low environmental impact. Technological breakthroughs, like integrating linked devices with the Internet of Things and artificial intelligence, are also driving growth. These technologies allow users to regulate heating equipment remotely via smartphones and wearable devices. Product developers are also creating new and self-contained heating equipment units for residential and small business complexes.

- The rapidly expanding petrochemical and chemical industries in developing nations such as India and China are expected to increase demand for industrial boilers. The market demand is likely to climb further due to increased investment in mega power projects worldwide. These vessels are frequently employed in the chemical and petrochemical sectors, which account for the majority of industrial boilers in this application area. According to the US Environmental Protection Agency, new boiler restrictions are intended to reduce environmental emissions on a massive scale. Currently, more than 88 percent of significant source boilers can fulfill emission regulations with annual tune-ups, but the remaining 12.0 percent will require refurbishment or replacement to reduce harmful emissions, which is expected to offer opportunities for manufacturers throughout the forecast period.

- The growing demand for energy-efficient devices has been driving the deployment of technology, such as heat pumps, to provide end users with significant potential to contribute to renewable energy and climate targets across various regions in the world. The ability of the heat pump to provide a synergy between the decarbonization on the supply side and the technology on the demand side is being exploited to make a significant contribution to reducing the emission of CO2. Heat pumps, being a versatile technology, can provide space heating, cooling, and warm water, all from one integrated unit, thus, providing energy efficiency. Furthermore, these devices can be used in conventional/hybrid renewable systems and accumulate surplus electricity with the help of active thermal mass elements. They are also known to integrate and optimize the performance of various energy resources in the electricity grid.

- On the flip side, governments in developed countries have enacted stringent emission requirements to control pollutants discharged into the environment, influencing heating equipment efficiency, operating costs, and market growth. According to the Environmental Protection Agency, the United States government has established rules for controlling particulate matter, sulfur dioxide, and nitrogen oxide emissions from industrial boilers. Furthermore, the International Energy Agency encourages the usage of technology such as selective catalytic reduction (SCR), flue gas desulfurization (FGD), and fabric filters to reduce emissions from industrial boilers through its Clean Energy Technology Programme. Furthermore, one of the significant issues that industrial boiler manufacturers confront is the necessity to enhance efficiency and steam quality to meet market demand. Such stringent regulations could hinder the market's growth in the short run.

- The construction industry is often considered a key indicator of a country's economic development, and therefore, fluctuations in macroeconomic indicators such as GDP growth, inflation, interest rates, and government spending can have a direct impact on the construction industry. Factors like rising raw material costs due to inflation, higher interest rates leading to less borrowing by builders are anticipated to negatively impact the growth of the studied market during the forecast period.

Heating Equipment Market Trends

Heat Pump is Expected to Hold a Major Market Share

- Energy is a critical power source in homes, hospitals, and schools. However, its manufacturing and use result in significant greenhouse gas emissions. As a result, major economies worldwide are attempting to minimize their reliance on nonrenewable energy sources while progressively shifting toward renewable energy sources to limit greenhouse gas emissions. Heat pump technology is a viable way to reduce greenhouse gas emissions. Aerothermal and geothermal heat pumps offer an energy-efficient solution to space heating.

- The deployment of heat pumps has increased steadily in the North American region, especially in the United States, due to varied reasons, like the convenience of offering the equipment, climatic conditions, government tax credit benefits, and regulations. Furthermore, the heat pumps have been regulated by the governments in the region for their energy efficiency. For instance, the Department of Energy announced Fan Energy Rating, which sets a minimum airflow efficiency standard for residential furnace fans.

- With the new FER standards, the US DOE estimates that the new standard for furnace fans might save approximately 3.99 quads of energy, minimize carbon pollution by 34 million metric tons, and provides American citizens with savings of more than USD 9 billion in electric bills by 2030. According to new state law,over the next five years, the city of Maine seeks installers to help fulfill the goal of 100,000 heat pumps. Furthermore, the New Ambler heat pump project aims to drastically reduce diesel costs in the villages.

- Furthermore, Eastern Europe has colder climatic conditions in the region, and the demand for heating solutions is significant in these countries such as the Czech Republic, Poland, Bulgaria, and others. Similar to other countries in the region, measures to increase energy efficiency in the heating and cooling sector are on the rise. According to Stratego, which is co-founded by the Intelligent Energy Europe Programme of the EU, an investment of EUR 50 billion during the span of 2010-2050 will save enough fuel to minimize the costs of the energy system. Moreover, as part of this investment, district heating's share amounted to EUR 5 billion, and individual heat pumps at EUR 15 billion.

- In July 2022, the National Environment Agency (NEA) Singapore reported they are exploring using heat pump water heaters in high-rise residences - condominiums and HDB units. Heat pump water heaters use only 210 watts of power, compared to the approximately 3000 watts used by typical electric or gas water heaters. A user's monthly power expenditures would be significantly reduced by the energy savings from employing a heat pump.

The Asia Pacific Region is Expected to Witness a High Market Growth

- China's vast geographic area is officially divided into five primary climate zones with different thermal design requirements. Northern China, which comprises the two coldest climate zones, requires space heating in winter. The urban areas depend on district heating systems, whereas rural regions mainly utilize individual household heating systems. Another climate zone with rising demand for heating is the hot summer and cold winter climate zone. Due to historical reasons, there is no public infrastructure or services to provide district heating systems for buildings in this climate zone, and buildings generally lack effective heating services. Therefore, China's northern and southern regions face different heating challenges and need tailored solutions.

- The Asia Pacific will have the highest revenue share. This is primarily due to the rising construction sector in nations such as China and India, which are witnessing substantial infrastructure investments, particularly in retail spaces, commercial office buildings, manufacturing facilities, and metro train lines. Additionally, increased demand for boilers in the thermal power industry is driving market expansion.

- Many of China's households still depend on small coal stoves for heat, which causes air pollution that damages health. To address these problems, the Chinese government launched a five-year "Clean Heating Plan" in 2017 to transition 70 percent of northern households away from coal and toward cleaner heating options. In 2022, as the plan reaches its final year, a novel study by Princeton University researchers offered policy guidance: Increase the usage of heat pumps in rural households. Among the options studied, the researchers found air-to-air heat pumps provide the most air quality, health, and climate benefits.

- China aims for carbon neutrality by 2060 and has engaged in a successful effort to reduce air pollution. According to Denise Mauzerall, professor of civil & environmental engineering & international affairs, replacing coal stoves in urban and rural residences with clean heaters dramatically improves air quality throughout northern China in winter while decreasing premature deaths. Also, given that China plans to be carbon neutral by 2060, "decarbonizing" their power grid or the system that delivers electricity is critical. One way to achieve this is by moving away from coal and toward more non-fossil energy.

- The regional players are developing new products to cater to a diverse range of customers' requirements. For instance, in March 2022, Panasonic introduced a new device in Japan. The Eco Cute solution comprises a heat pump and a hot water storage tank to save energy by maintaining consistent bathwater temperatures. It also saves electricity at night by utilizing the heat from a household's bathwater. Furthermore, the device conserves energy and water. The product includes a solar charging capability that uses extra power generated and stored by PV sources. It can boil water at any time of day or night using electricity.

Heating Equipment Industry Overview

The competitive rivalry in the Global Heating Equipment Market is fragmented in nature due to high competition. The high owing to the presence of some key players such as Easco Boiler Corporation, Robert Bosch GmbH, Daikin industries ltd, Klima-Therm, Johnson Controls and many more.

- April 2023: Kanthal and Rath, players in their respective fields - Kanthal in industrial electric heating technology and Rath in high-temperature refractory products, announced a strategic alliance to extend their joint offering in industrial heating technology. Their services will help industries such as steel and petrochemical to make the green transition through close collaboration. The collaboration combines the complementing qualities of both firms, resulting in the market's most extensive choice of sustainable industrial heating solutions. Customers will benefit from Kanthal's experience in heating components and systems and Rath's superior insulation and refractory solutions in a one-of-a-kind combination offering for their industrial heating needs.

- April 2023: UPM, a paper mill company, opted to build new electric boilers to produce heat and steam at its plants in Germany and Finland. The company will install eight new boilers. This effort will enable UPM to phase out the usage of fossil fuels in its mills. The first 50MW electric boiler at the company's UPM Tervasaari paper mill in Valkeakoski, Finland, has already been commissioned. The boiler had been relocated to Valkeakoski from the UPM Kaipola mill in Jamsa, Finland. To improve efficiency, the business plans to build another 60MW electric boiler at the mill later this year. This large-capacity boiler will produce steam and heat for the mill, assisting in both processes.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes Products and Services

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Supply Chain Analysis

- 4.4 Government Policies and Regulations

- 4.5 Impact of Macro Economic Trends on the Industry

5 MARKET DYNAMICS

- 5.1 Drivers

- 5.2 Restraints

6 MARKET SEGMENTATION

- 6.1 Product Type

- 6.1.1 Heat Pumps

- 6.1.2 Furnaces

- 6.1.3 Unitary Heaters

- 6.1.4 Boilers

- 6.2 End User

- 6.2.1 Residential

- 6.2.2 Commercial

- 6.2.3 Industrial

- 6.3 Geography

- 6.3.1 North America

- 6.3.1.1 US

- 6.3.1.2 Canada

- 6.3.1.3 Others

- 6.3.2 Europe

- 6.3.2.1 Germany

- 6.3.2.2 UK

- 6.3.2.3 France

- 6.3.2.4 Russia

- 6.3.2.5 Spain

- 6.3.2.6 Others

- 6.3.3 Asia Pacific

- 6.3.3.1 India

- 6.3.3.2 China

- 6.3.3.3 Japan

- 6.3.3.4 Others

- 6.3.4 Rest of the World

- 6.3.1 North America

7 Company Profiles

- 7.1 Daikin Industries Ltd

- 7.2 Klima-Therm

- 7.3 Robert Bosch GmbH

- 7.4 Carrier Global Corporation [United Technologies Corp.]

- 7.5 Panasonic Corporation

- 7.6 Johnson Controls

- 7.7 Lennox International, Inc.

- 7.8 Easco Boiler Corporation

- 7.9 Ariston Thermo Group

- 7.10 Danfoss A/S