|

市场调查报告书

商品编码

1408166

云端运算 -市场占有率分析、产业趋势与统计、2024-2029 年成长预测Cloud Computing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

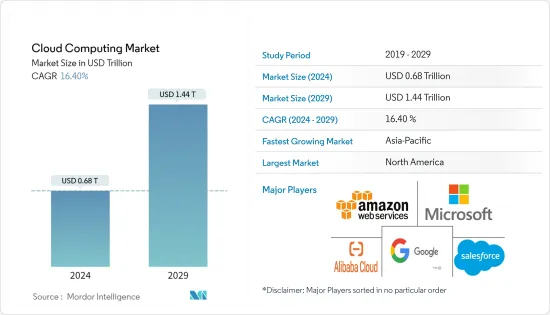

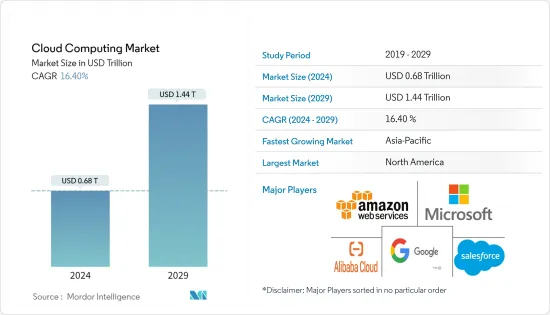

预计2024年云端运算市场规模将达到6,800亿美元,预计2029年将达到1.44兆美元,在预测期内(2024-2029年)复合年增长率为16.40%。

企业路由器是每个企业日常使用的必备产品。巨量资料、人工智慧和机器学习 (ML) 等新兴技术正在推动全球对云端运算的需求。越来越关注以客户为中心的应用程式以提高消费者满意度也是影响新兴技术崛起的因素之一。

主要亮点

- 云端基础设施提供了对支援这些新数位业务解决方案的资源的灵活的按需存取。此技术可用于企业资源规划 (ERP)、线上事务处理 (OLTP) 和供应链管理 (SCM) 领域。 2022 年 11 月,亚马逊网路服务公司宣布推出一款供应链管理应用程序,使企业无需利用多个系统和供应商来存取关键网路资料。 AWS Supply Chain 是一款由机器学习提供支援的应用程序,可自动组合和分析多个供应链系统中的资料以建立统一的资料湖。

- 企业正在努力在其业务环境中实施混合云。混合云的一个主要优势是敏捷性。您希望整合公共、私人公司和本地资源,以获得敏捷性和竞争优势。因此,IBM 在 2023 年 5 月发布了 IBM 混合 Cloud Mesh,这是一款旨在协助企业管理混合多重云端基础架构的 SaaS。 IBM Hybrid Cloud Mesh 透过以应用程式为中心的连接,自动公共云端云和私有云端中应用程式连接的流程、管理和可观察性,帮助现代企业跨混合多重云端和异质环境部署基础架构,使其更易于操作。

- 市场还确定了几项将显着促进云端处理采用的投资。例如,亚马逊的云端运算部门亚马逊网路服务公司于2023年5月宣布,计画在2030年在印度的云端基础设施上投资127亿美元。目的是满足国家对云端服务日益增长的需求。据AWS称,这项投资预计每年将为印度企业平均创造131,700个全职同等就业机会。 AWS 预计 2016 年至 2022 年对印度国内生产总值的整体贡献将超过约 46 亿美元。

- 组织越来越需要能够让员工安全、有效率地远距工作的解决方案。为了使普通员工、客服中心代理和创新专业人士能够进行远距工作,提供者提供了安全、及时且经济实惠的专业的基于云端的解决方案。然而,由于云端处理是一种按需提供平台、软体和基础设施的技术,因此很容易遭受各种类型的资料外洩。如果安全措施到位,客户可能会对将资料外包给公有云服务产生安全性疑虑。云端服务供应商努力保护客户的资料,但许多资料外洩事件甚至为最知名的公司带来问题。例如,根据 Verizon 统计,2022 年全球金融业共报告了 1,829 起网路事件。

- 此外,宏观经济趋势对云端处理市场也有重大影响。不断上升的通膨压力可能会增加在云端环境中营运的公司的专业服务成本。例如,根据经合组织的数据,经济合作暨发展组织(OECD)的年月通膨率从2021年2月到2022年10月稳步上升,与去年同月相比通膨率达到10.7%。做过。

云端运算市场趋势

业务与云端的整合正在推动各行业的数位化

- 在这个新的数位时代,企业的目标是透过整合新技术来变得敏捷。这主要是透过迁移到云端环境来实现的。拥抱云端意味着获得内建连接和智能,实现智慧操作的互通性,并为云端连接的数位服务奠定坚实的基础。

- 云端运算为数位转型提供了一个额外的维度,从简单地采用新技术到在远端虚拟环境中完全重新设计流程、工具和体验。云端处理增强安全性、改善使用者体验并保护文件免遭劣化。因此,企业正在将云端处理纳入其生态系统,从而刺激云端处理市场的成长。

- 与依赖人工互动的过时的本地伺服器模型相比,云端处理为自动化提供了巨大的机会。透过平台即服务模型、基础架构即程式码技术、自动备份、工作流程版本控製配置和使用者存取的安全管理都透过云端得到了简化。

- 对于希望快速成功开发供应链管理 (SCM) 的公司来说,云端处理已经成为游戏规则的改变者。例如,作为 2022 年 6 月开始的多年合作伙伴关係的一部分,Google Cloud 和总部位于康乃狄克州的 XPO Logistics 将合作加强整个供应链中的货物流动。 XPO 利用 Google Cloud 的资料分析、机器学习和人工智慧 (AI) 功能来创建更快、更有效的供应链,并提高视觉性。

- 自从这项技术推出以来,许多银行和金融科技公司已逐渐转向云端。在金融领域,资料产生和消费正在迅速扩大。此解决方案提高了开放性,同时让消费者能够更好地控制审核程序和资料。提供更具可扩展性的资料分类方法。此外,各种与医疗保健相关的功能,如远端医疗、用药医嘱遵从性、防止药品盗窃和假冒、资源效率低下、个人资料隐私、病历统一等都可以透过云端处理。医疗整合的成果。

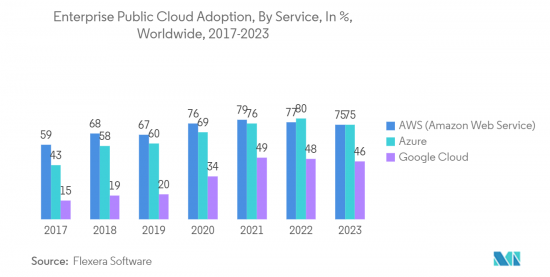

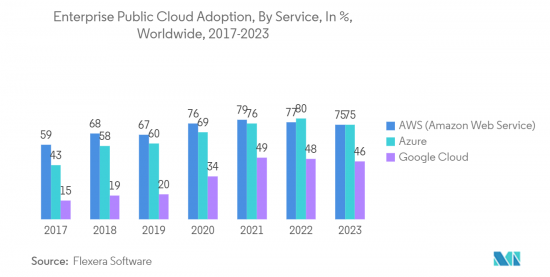

- 包括亚马逊、谷歌和甲骨文在内的多家公司提供强大的云端基础设施和服务,以满足不断变化和日益复杂的消费者需求。例如,根据 Flexera Software 的《2023 年云端状况报告》,75% 的企业受访者表示他们正在采用 Microsoft Azure 来使用公共云端。 AWS、Microsoft Azure 和 Google Cloud(也称为超大规模供应商)是全球领先的云端处理平台供应商。

预计北美将占据较大市场占有率

- 过去几年,北美一直主导着云端处理市场。美国公司正在优先考虑数位转型。他们通常被视为先进技术的早期采用者,例如物联网、积层製造、巨量资料分析、连网型、人工智慧、机器学习、虚拟实境以及4G、5G和LTE等最新通讯技术。 是。

- 近年来,该地区的资料外洩事件不断增加。例如,根据身分盗窃资源中心的数据,2022 年美国发生了 1,802 起资料外洩事件。同时,同年约有4.22亿人受到资料外洩、曝光、外洩等资料外洩事件的影响。此类案例可能会限制该地区云端处理的采用。

- 在美国,公司正在联合起来发展业务并在全球市场上保持强大的影响力。随着企业加强对IT基础设施和云端服务的投资,以及美国跨境隐私保护条例 (CBPR) 的推进,预计美国的机会将会扩大。

- 为了更好地服务公民,政府机构正在重新思考其经济模式。根据美国联邦政府的云端处理策略,政府实施了云端优先政策来加速云端的采用。云端服务和边缘运算的使用不断增加,正在取代美国各种规模的政府机构中已经挤满了不同平台和供应商的资料中心的基础设施。

- 该地区也见证了多项满足技术先进消费者需求的技术创新。例如,2023 年 6 月,惠普企业公司宣布将部署云端处理服务,旨在为类似 ChatGPT 的人工智慧系统提供动力。据 HPE 高效能运算和人工智慧部门称,该公司将利用其在超级电脑方面的经验来提供专注于所谓的大规模语言模型的服务,即 ChatGPT 等服务背后的技术。

云端处理产业概况

云端处理市场目前处于高度分散的阶段,参与企业众多。云端处理市场的主要企业正在不断尝试带来进步。几家知名公司正在透过成立合资企业来扩大其在新兴市场的足迹,以巩固其市场地位。该市场的主要企业包括 Amazon Web Services, Inc、Google LLC, Ltd、微软公司、阿里云、Salesforce, Inc. 等。

- 2022 年 10 月 - Oracle 宣布将在南非约翰尼斯堡的 Microsoft Azure 网站建置新的 Oracle Interconnect,提供 Oracle 云端约翰尼斯堡区域和 Microsoft Azure 南非区域之间的直接连线。非洲用户现在可以使用最新的 Oracle Interconnect 存取适用于 Microsoft Azure 的 Oracle 资料库服务。

- 2022 年 10 月 - Google Cloud 宣布了多项变革,包括开放基础架构云端、资料云和 Google Workspace 的新方法和改进。它使组织内的个人(包括资料决策者、开发人员、建构者、IT 团队、网路安全专业人员和所有员工)能够实现可行、有意义和长期的变革。它旨在为您提供支援。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 市场驱动因素

- 向全球数位转型的强大转变

- 疫情后与远距工作相关的政策将对云端市场产生正面影响

- 市场挑战

- 监管合规性和资料外洩风险

- 市场机会

- 产业生态系统分析

- 评估 COVID-19 和宏观经济趋势对云端运算领域的形势

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间的敌对关係

- 行业法规和标准

第五章市场区隔

- 依计算类型

- IaaS

- SaaS

- PaaS

- 按最终用户产业

- IT&电信

- BFSI

- 零售/消费品

- 製造业

- 医疗保健

- 媒体与娱乐

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 西班牙

- 北欧的

- 比荷卢经济联盟

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 中东/非洲

- 拉丁美洲

- 北美洲

第六章 竞争形势

- 公司简介

- Amazon.com, Inc.(AWS)

- Google LLC

- Microsoft Corporation

- Alibaba Cloud

- Salesforce, Inc

- Adobe Group

- Oracle Corporation

- IBM Corporation

- DXC Group

- SAS

- SAP SE

第七章 投资场景

第八章市场展望

The Cloud Computing Market size is estimated at USD 0.68 trillion in 2024, and is expected to reach USD 1.44 trillion by 2029, growing at a CAGR of 16.40% during the forecast period (2024-2029).

Enterprise routers are essential products that are utilized on a daily basis by any business or enterprise. The global demand for cloud computing is growing due to emerging technologies like big data, AI, and machine learning (ML). Also, increased focus on customer-centric applications to boost consumer satisfaction is one element impacting the rise of emerging technologies.

Key Highlights

- Cloud-based infrastructure provides flexible, on-demand access to the resources underlying these new digital business solutions. The technology is beneficial for enterprise resource planning (ERP), online transaction processing (OLTP), and supply chain management (SCM) across sectors. In November 2022, Amazon Web Services Inc. launched a supply chain management application that would eliminate the requirement for businesses to utilize multiple systems and vendors to access critical network data. AWS Supply Chain is a machine learning-powered application that automatically combines and analyzes data across numerous supply chain systems, creating a "unified data lake."

- Companies are transforming towards implementing hybrid cloud in their business environment. Agility is the hybrid cloud's main advantage. Companies are integrating public, private, and on-premises resources to acquire agility and competitive advantage. To that extent, in May 2023, IBM unveiled IBM Hybrid Cloud Mesh, a SaaS offering that is developed to facilitate enterprises to obtain management to their hybrid multi-cloud infrastructure. Driven by "Application-Centric Connectivity," IBM Hybrid Cloud Mesh is arranged to automate the process, management, and observability of application connectivity in public and private clouds to facilitate modern enterprises to operate their infrastructure across hybrid multi-cloud and heterogeneous environments.

- The market is also witnessing several investments that significantly drive the adoption of cloud computing. For instance, in May 2023, Amazon's cloud computing unit, Amazon Web Services, revealed its intention to invest USD 12.7 billion in cloud infrastructure in India by 2030. The aim is to meet the country's increasing demand for cloud services. According to AWS, the investment is anticipated to support an average of 131,700 full-time equivalent jobs yearly in Indian businesses. AWS assesses that its overall contribution to India's gross domestic product from 2016 to 2022 surpassed approximately USD 4.6 billion.

- Organizations increasingly need solutions that enable employees to operate remotely safely and productively. To enable remote work for normal employees, contact center agents, and creative professionals, providers offer specialized solutions based on their clouds in a secure, timely, and affordable manner. However, cloud computing is a technology that provides platforms, software, and infrastructure on demand, making it prone to various kinds of data breaches. If customers are certain that security measures are in place, they will raise security concerns about outsourcing their data to public cloud services. Although cloud service providers work hard to protect their client's data, there have been several data breach events to cause problems for even the most well-known businesses. For instance, according to Verizon, in 2022, there were 1,829 reported cyber incidents in the financial industry worldwide.

- Further, macroeconomic trends have a significant impact on the cloud computing market. The rising inflationary pressure is likely to increase the costs of professional services for companies operating on cloud environment. For instance, according to OECD, the annual monthly inflation rate in the Organization for Economic Co-Operation and Development (OECD) increased steadily from February 2021 to October 2022, when the inflation rate reached 10.7% compared to the same month the previous year.

Cloud Computing Market Trends

Business Integration with Cloud Boosting Digitalization Across Industries

- In this new digital era, companies are aiming to become agile with the integration of new technologies. This is mainly accomplished by moving to a cloud environment. Being in the cloud entails obtaining embedded connections and intelligence, enabling the interoperability of smart operations, and developing a solid foundation for digital services linked to the cloud.

- Digital transformation is given an extra dimension by cloud computing, which transforms it from simply adopting new technology to a complete rebuilding of processes, tools, and experiences in a remote, virtual environment. Cloud computing boosts security, enhances user experience, and protects documents from deterioration. Because of this, businesses are now incorporating cloud computing into their ecosystem, fueling the growth of the cloud computing market.

- In contrast to the outdated on-premises server model that relies on human operations, cloud computing offers enormous opportunities for automation. The Platform-as-a-Service model, Infrastructure-as-Code techniques, automatic backups, version control provisioning for workflows, and security control administration through user access are all made simpler by the cloud.

- Cloud computing has emerged as a game-changer for businesses looking to develop Supply Chain Management (SCM) swiftly and successfully. For instance, as part of a multi-year partnership started in June 2022, Google Cloud and Connecticut-based XPO Logistics will work together to enhance the movement of commodities throughout supply chains. XPO will utilize Google Cloud's data analytics, machine learning, and artificial intelligence (AI) capabilities to build quicker, more effective supply chains with improved visibility.

- Since the introduction of the technology, many banking and fintech organizations have gradually migrated to the cloud. Data generation and consumption are expanding quickly in the financial sector. The solution increases openness while granting consumers more control over auditing procedures and data. It offers a more scalable method of categorizing data. Also, a variety of healthcare-related functions, including telehealth and virtual care, medication adherence, drug anti-theft and counterfeiting measures, resource inefficiency, personal data privacy, and the uniformity of medical records, have a great deal to gain from the integration of cloud computing and healthcare.

- Several companies like Amazon, google, and Oracle are offer robust cloud infrastructure and services to cater to the evolving and complex requirements of consumers. For intstacne, according to Flexera Software, state of cloud report 2023, 75% of enterprise respondents indicated that they were adopting Microsoft Azure for public cloud usage. AWS, Microsoft Azure, and Google Cloud, also known as hyperscalers, are among the leading cloud computing platform providers worldwide.

North America is Expected to Hold a Major Market Share

- Over the past few years, North America controlled the Cloud Computing Market. Companies in the U.S. prioritize digital transformation. They are often seen as early adopters of advanced technologies like the Internet of Things, additive manufacturing, big data analytics, connected industries, artificial intelligence, machine learning, virtual reality, and the newest telecommunications technologies like 4G, 5G, and LTE.

- The region is facing increasing data breaches in the recent years. For instance, according to Identity Theft Resource Center, in 2022, the number of data compromises in the United States totaled 1802 cases. Meanwhile, approximately 422 million individuals were affected in the same year by data compromises, including data breaches, exposure, and leakage. Such instances are likely to restrain the adoption of cloud computing in the region.

- The United States businesses are working together to grow their operations and maintain a strong global presence a strong presence in the global marketplace. Opportunities for the United States are predicted to increase due to organizations investing more in IT infrastructure and cloud services and the country's promotion of Cross Border Privacy Rules (CBPR).

- To provide better citizen services, government institutions are rethinking their economic models. According to the United States federal cloud computing strategy, the government implemented the CloudFirst policy to accelerate cloud adoption. Increased use of cloud services and edge computing is replacing the addition of infrastructure to data centers that are already overflowing with various platforms and vendors in U.S. government agencies of all sizes.

- The region is also witnessing several innovations that cater to the requirements of the technologically advanced consumers. For instance, in June 2023, Hewlett Packard Enterprise Co. announced that it is rolling out a cloud computing service designed to power artificial intelligence systems similar to ChatGPT. HPE's high-performance computing and artificial intelligence unit said the company would use its experience in supercomputers to offer a service specifically for what are called large language models, the technology behind services like ChatGPT.

Cloud Computing Industry Overview

The Cloud Computing Market is at a highly fragmented stage as the market currently consists of many players. Several key players in the Cloud Computing market constantly try to bring advancements. A few prominent companies are entering into collaborations and expanding their footprint in developing regions to consolidate their positions in the market. The major player in this market includes Amazon Web Services, Inc, Google LLC, Ltd, Microsoft Corporation, Alibaba Cloud, Salesforce, Inc, and others.

- October 2022 - Oracle announced the creation of a new Oracle Interconnect for the Microsoft Azure site in Johannesburg, South Africa, to provide direct connectivity between the Oracle Cloud Johannesburg area and the Microsoft Azure South Africa region. African users can now access the Oracle Database Service for Microsoft Azure on the back of the most recent Oracle Interconnect.

- October 2022 - Google Cloud unveiled a variety of advancements, including fresh approaches and improvements for its open infrastructure cloud, data cloud, and Google Workspace. This aims to assist individuals within organizations - including data decision-makers, developers, builders, IT teams, cybersecurity experts, and all employees - in achieving practical, significant, and long-lasting transformation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Study Scope

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Robust Shift Towards Digital Transformation Across the World

- 4.2.2 Post- Pandemic Remote Work-Related Policies Positively Impacting the Cloud Market

- 4.3 Market Challenges

- 4.3.1 Regulatory Compliance and Data Breaching Risk

- 4.4 Market Opportunities

- 4.5 Industry Ecosystem Analysis

- 4.6 Assessment of the Impact of COVID-19 and Macro Economic Trends on the Cloud Computing Landscape

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers/Consumers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Industry Regulations & Standards

5 MARKET SEGMENTATION

- 5.1 By Computing Type

- 5.1.1 IaaS

- 5.1.2 SaaS

- 5.1.3 PaaS

- 5.2 By End-user Verticals

- 5.2.1 IT & Telecom

- 5.2.2 BFSI

- 5.2.3 Retail & Consumer Goods

- 5.2.4 Manufacturing

- 5.2.5 Healthcare

- 5.2.6 Media & Entertainment

- 5.3 By Geography

- 5.3.1 North America

- 5.3.1.1 US

- 5.3.1.2 Canada

- 5.3.2 Europe

- 5.3.2.1 UK

- 5.3.2.2 Germany

- 5.3.2.3 France

- 5.3.2.4 Spain

- 5.3.2.5 Nordics

- 5.3.2.6 Benelux

- 5.3.2.7 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Japan

- 5.3.3.4 South Korea

- 5.3.3.5 Rest of APAC

- 5.3.4 Middle East & Africa

- 5.3.5 Latin America

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Amazon.com, Inc. (AWS)

- 6.1.2 Google LLC

- 6.1.3 Microsoft Corporation

- 6.1.4 Alibaba Cloud

- 6.1.5 Salesforce, Inc

- 6.1.6 Adobe Group

- 6.1.7 Oracle Corporation

- 6.1.8 IBM Corporation

- 6.1.9 DXC Group

- 6.1.10 SAS

- 6.1.11 SAP SE