|

市场调查报告书

商品编码

1408170

半导体雷射-市场占有率分析、产业趋势与统计、2024年至2029年成长预测Semiconductor Laser - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

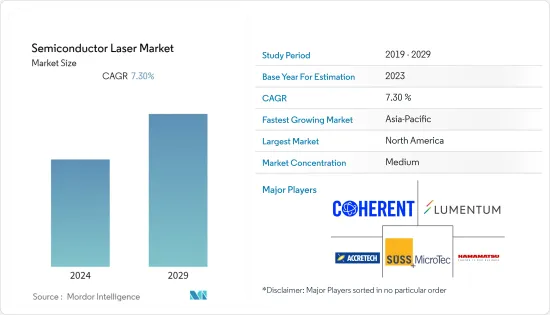

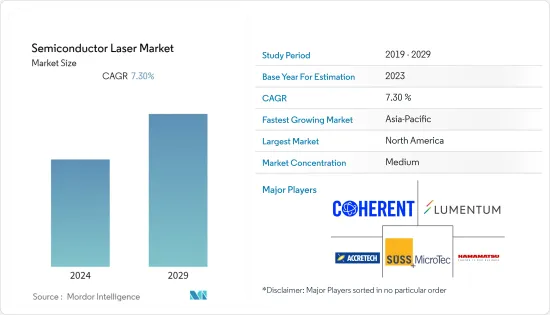

半导体产业的雷射器市场预计到 2024 年将达到 80.2 亿美元,2029 年将达到 114 亿美元,预测期内复合年增长率为 7.3%。

主要亮点

- 雷射在半导体行业中获得了巨大的关注,因为它们提供灵活且不断发展的加工来满足行业的苛刻需求,为半导体製造商提供了一种准确的方法,可以从不同的材料上高精度地切割出复杂的几何型态。我明白了。为半导体应用客自订开发的雷射系统可以准确、快速地切割各种材料。

- 由于积极的研发活动,半导体市场正在见证多项技术创新。例如,2022 年 11 月,法国 LP3 研究所的研究人员开发了一种直接雷射写入技术,可以在半导体晶片的 3D 空间进行局部材料处理。研究人员认为,光刻技术作为一项关键製造技术,在充分应对半导体製造业面临的挑战方面具有很大的限制。因此,非常需要在晶圆表面下方创建结构并利用材料内部的整个空间。在《国际极限製造杂誌》上,研究人员使用新设计的直接雷射写入技术展示了这种功能。

- 此外,2022 年 6 月,加州大学柏克莱分校(电机工程与电脑科学系 (EECS))的工程师将致力于实现光学领域一个难以捉摸的目标:能够增加辐射的尺寸和功率,同时保持能力为了增加尺寸和功率,我们设计了一种新型半导体雷射器,完善了维持单一模式光的能力。这意味着尺寸不必以牺牲相干性为代价,这是一项重要的成就,可以让雷射变得更强大,并在许多应用中覆盖更远的距离。

- 所研究的市场注意到,由于各国政府的许多倡议,需求增加。例如,美国政府的目标是在半导体供应链生态系统中实现独立。美国政府正开始采取倡议来实现这些目标。例如,美国政府最近在参议院提出了《投资国内半导体製造法案》。该法案扩大了针对半导体行业的联邦补贴计划“CHIPS for America”,涵盖製造、测试、组装、研发半导体以及半导体製造和半导体中使用的材料的公司。涉及製造设备的公司。透过向生产必需材料和设备的公司提供奖励,该法案可以为全国製造商创造更多机会,并加强支持国内半导体製造的供应链。

- 此外,2022年9月,拜登政府宣布将投资500亿美元发展国内半导体产业,对抗对中国的依赖。美国零生产并消费量了全球25%最先进的晶片,这些晶片对国家安全至关重要。拜登总统于 2022 年 8 月签署了 2800 亿美元的 CHIPS 法案,以促进国内高科技製造业,作为美国加强与中国竞争的努力的一部分。该地区半导体行业如此强劲的投资可能会为研究市场的成长创造有利可图的机会。

- 然而,雷射的初始校准是一项非常复杂的任务,需要高水准的专业知识才能实现应用所需的精确调谐。此外,在雷射调谐过程中必须考虑大量参数,即使是最轻微的偏移也可能导致错误并在各种应用中产生灾难性影响。雷射的製造过程非常复杂,这大大增加了製造成本。波长切换过程中雷射器性能的另一个重点是装置的波长稳定性。一旦雷射调谐到所需的波长,在通道最终稳定之前就会出现稳定漂移。这些因素可能会阻碍所研究市场的成长。

- 此外,半导体製造是一个成本高且耗时的过程,要求所有涉及的设备/过程都具有极高的精度。因此,经济欠发达地区的工业扩张受到限制。雷射是半导体产业的重要组成部分之一,也面临类似的挑战,导致所研究市场的成长放缓。

半导体雷射器市场趋势

检验和测量领域预计将占据主要市场占有率

- 智慧型手机、家用电器和汽车等应用正在增加对高性能、低成本半导体晶片的需求。无线技术(5G)和人工智慧等技术变革正在推动这些产业的发展。此外,物联网(IoT)设备的成长趋势预计将鼓励半导体产业投资该设备以实现智慧产品。

- 此外,数位化的进步以及远端工作和操作的趋势正在推动对能够实现各种新功能的先进半导体装置的需求。随着对半导体元件的需求不断增长,先进的封装技术提供了当今数位化世界所需的外形尺寸和处理能力。根据半导体产业协会(SIA)的数据,2022年8月全球半导体产业销售额为474亿美元,较2021年8月的473亿美元微增0.1%。对半导体不断增长的需求预计将为测试和测量设备的成长提供有利的机会。

- 此外,半导体产业产能的开拓也支撑着新兴市场的成长。例如,根据SEMI设备市场数据订阅(EMDS)显示,半导体产业牢牢踩在加速器上,扩大产能的努力也在增加前后端半导体设备产业以满足成长动力,帮助扩大产能。

- 2023年第一季半导体製造设备销售额年增9%至268亿美元。先进逻辑和代工产能扩张、DRAM 投资的復苏以及稳健的NAND快闪记忆体投资推动了设备市场的成长。这些趋势也为雷射市场创造了良好的前景,因为计量和检测是半导体晶片製造中涉及的关键过程。

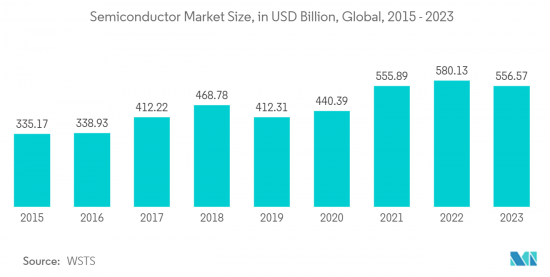

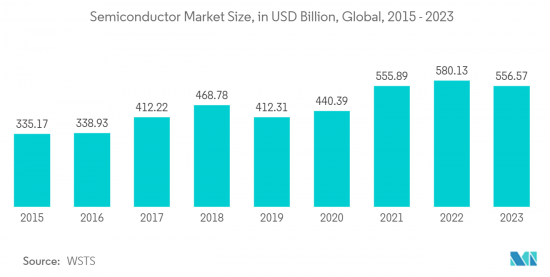

- 此外,根据WSTS预测,2022年全球半导体销售额将达5,801.3亿美元。半导体在电子领域极为重要,该行业竞争非常激烈。预计2022与前一年同期比较增速将达4.4%,未来可望进一步成长。预计此类趋势将支援预测期内计量和检测设备以及相关雷射系统的成长。

预计亚太地区市场将出现高成长

- 亚太地区是半导体产业的主要製造和消费地区之一。根据国际半导体设备与材料协会(SEMI)统计,2022年中国半导体设备支出超过282.7亿美元。同期在韩国和台湾的支出分别为 215.1 亿美元和 268.2 亿美元。由于雷射器广泛应用于半导体装置,这种趋势有利于市场成长。

- 该地区也拥有许多促进半导体产业发展的政府倡议。例如,中国政府的国家积体电路产业发展指导方针和中国製造2025倡议旨在加强国内半导体产业的成长并减少对其他国家的依赖。

- 在其他国家也可以看到类似的趋势。例如,印度电子和资讯技术部(MeitY)最近核准了一项用于发展半导体和显示器製造生态系统的综合 PLI 计划。未来六年将发放价值 7,600 亿印度卢比(98.1 亿美元)的奖励措施。该地区的此类倡议预计将促进半导体行业生态系统的发展,并为雷射市场创造机会。

- 半导体仍然是整合到汽车、智慧型手机、机器人和许多其他智慧型设备等现代设备中的智慧型产品的支柱。由于对更小、更坚固的晶片的持续需求,目前的半导体製造技术面临越来越大的压力。在亚太地区,消费性电子产品和汽车的采用不断增加,使得所研究市场的成长前景良好。

- 日本作为半导体设备和材料的领导供应商之一,在研究市场中占据着独特的地位。根据SEMI统计,日本占全球半导体製造设备和材料销售额的30%以上。因此,日本半导体产业使用的雷射预计将拥有显着的成长机会。

- 近年来,亚太地区对半导体的需求显着成长。随着多个国家的知名半导体客户加强供应链,对半导体产业价值链的投资进一步加速。例如,2022年7月,主要用于半导体光刻的光源製造商Gigaphoton Inc.宣布将在日本建造新大楼,并将产能提高2.5倍。该公司将投资约 50 亿日圆(3,620 万美元)建设新工厂,预计将于 2023 年 6 月完工。此类投资预计将支持半导体产业雷射市场的扩张。

半导体雷射器产业概况

半导体产业的雷射市场是一个适度竞争的市场,主要企业包括 Lumentum Operations、Trumpf、SUSS MicroTec 和 Coherent。市场参与企业努力创新先进的产品和工艺,以满足客户不断变化的需求。

- 2023 年 3 月 - Tower Semiconductor 与 Quintessent, Inc. 合作,宣布推出全球首个 GaAs 量子点 (QD) 雷射和铸造硅光子平台 (PH18DB) 的异质整合。 PH18DB 平檯面向资料中心和通讯网路中的光收发器模组,以及人工智慧 (AI)、机器学习、LiDAR 和其他感测器的新兴应用。这个调变平台结合了基于检测器的波导管点硅晶片和我们提供的半导体光放大器 (SOA)。该平台使高密度光子积体电路 (PIC) 能够以小尺寸支援高通道数。

- 2023 年 1 月 - 相干公司 (Coherent Corp.) 宣布推出新一代泵浦雷射二极体,可在单晶片中提供业界最高的 50W 输出功率。光纤雷射在切割、焊接、打标和增材製造等材料加工应用中的采用正在加速,推动了对降低每瓦电力成本的关键组件的需求。这款新型雷射二极体的功率达到 50W,比前代产品高出 40%,因此可以用更少的泵浦雷射二极体设计高功率工业光纤雷射。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 宏观趋势对市场的影响

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买方议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间的敌对关係

- 技术简介

第五章市场动态

- 市场驱动因素

- 扩大半导体製造工厂投资

- 市场抑制因素

- 雷射设计复杂性和成本

第六章市场区隔

- 依雷射类型

- 奈秒

- 皮秒

- CO2

- 其他(飞秒、准分子)

- 依加工步骤

- 去除过程

- 黏合工艺

- 检查/测量

- 改性过程

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 其他的

第七章 竞争形势

- Laser Equipment Suppliers Analysis

- Accretech

- Disco Corporation

- Coherent, Inc.

- IPG Photonics Corporation

- Veeco Instruments Inc.

- EVG Group

- SUSS MicroTec

- Orbotech/SPTS

- HGTech

- QMC

- Screen Semiconductor Solutions Co., Ltd.

- Nikon

- Laser Source Suppliers Analysis

- Micromac

- Lumentum Operations LLC

- Trumpf

- HANS Laser

- Amplitude Laser

- IPG

- Hamamatsu

- Ushio

- Jenoptik

- EO Technics

- HGTech

- Edgewave

- MKS

第八章 雷射设备厂商厂商排名分析

第九章 市场未来展望

简介目录

Product Code: 93343

The Laser Market for the Semiconductor Industry market is anticipated to be valued at USD 8.02 billion in 2024 and is expected to become 11.4 billion by 2029, growing at a CAGR of 7.3% during the forecast period.

Key Highlights

- Lasers are attaining significant traction in the semiconductor industry as they present flexible, developed machining to fulfill the stringent needs of the industry, delivering semiconductor manufacturers with an exact method of cutting complex shapes from different materials with high precision. A laser system custom-developed for semiconductor applications can cut a range of materials accurately and fast.

- The semiconductor market is witnessing several innovations owing to robust R&D activities. For instance, in November 2022, researchers from the LP3 Laboratory in France developed a direct laser writing technique to achieve local material processing within the 3D space of semiconductor chips. They claim that the dominating manufacturing technology, lithography, has significant limitations in thoroughly addressing the challenges posed by the semiconductor manufacturing sector. For this reason, fabricating structures under the wafer surfaces would be highly desirable to use the whole space inside the materials. In the International Journal of Extreme Manufacturing, the researchers demonstrated such capability via the newly designed direct laser writing technique, which facilitates fabricating implanted structures inside different semiconductor materials.

- Further, in June 2022, engineers at the University of California, Berkeley (Department of Electrical Engineering and Computer Sciences (EECS)) designed a new type of semiconductor laser that completes an elusive goal in the field of optics: the ability to sustain a single mode of emitted light while retaining the ability to scale up in size and power. It is a significant achievement as it means size does not have to come at the cost of coherence, allowing lasers to become more powerful and cover longer distances for many applications.

- The studied market is noticing an increase in demand due to numerous initiatives by governments of various nations. For instance, the United States government aims to become independent in the semiconductor supply chain ecosystem. To realize such goals, the United States government has started taking initiatives. Such as the US government recently introduced Investing in Domestic Semiconductor Manufacturing Act in the Senate. This proposed legislation would expand eligibility for CHIPS for America, a government subsidy program for the semiconductor industry, to fund financial assistance beyond entities involved in semiconductor fabrication, testing, assembly, or R&D to organizations involved with materials used to manufacture semiconductors and semiconductor manufacturing equipment. By incentivizing the companies that produce essential materials and equipment, this legislation can create more opportunities for manufacturers nationwide and strengthen the supply chain supporting domestic semiconductor manufacturing.

- Additionally, in September 2022, the Biden administration announced that it would invest USD 50 billion in building up the domestic semiconductor industry to counter dependency on China, as the US produces zero and consumes 25% of the world's leading-edge chips vital for its national security. President Joe Biden signed a USD 280 billion CHIPS bill in August 2022 to boost domestic high-tech manufacturing, part of his administration's push to increase US competitiveness over China. Such robust investments in the semiconductor sector in the region would create lucrative opportunities for the growth of the studied market.

- However, on the Flipside, the initial calibration of lasers is a very complex task and requires a high level of expertise to achieve the high-precision tuning needed for the application. Also, the vast number of parameters has to be considered while tuning the laser, and a small offset may lead to errors or be catastrophic in various applications. The manufacturing process of the lasers is very complex, due to which the manufacturing cost has also increased significantly. Another important aspect of the laser's performance when switching between wavelengths is the stability of the wavelength of the device. As the laser tunes into its desired wavelength, settling drift appears before the channel finally stabilizes. Such factors might hinder the growth of the studied market.

- Furthermore, semiconductor manufacturing is a costly and time-consuming process and requires cutthroat precision in all the equipment/processes involved. As a result, industry expansion is limited in economically less developed regions. Lasers, being one of the integral components of the semiconductor industry, also face similar challenges that slow down the studied market's growth.

Semiconductor Laser Market Trends

The Inspection & Metrology Segment is Expected to Hold a Major Market Share

- Smartphones & other applications across consumer electronics, automotive applications, etc., drive the need for high-performance, low-cost semiconductor chips. Technology transitions have encouraged these industries, including wireless technologies (5G), Artificial Intelligence, etc. Also, the trend of growing Internet of Things (IoT) devices is expected to push the semiconductor industry to invest in this equipment to achieve smart products.

- Moreover, the increasing digitization and trends of remote work and operations have sparked the requirement for advanced semiconductor devices that allow various new capabilities. As the need for semiconductor devices intensifies consistently, advanced packaging techniques deliver the form factor and processing power needed for today's digitized world. According to the Semiconductor Industry Association(SIA), during August 2022, global semiconductor industry sales were USD 47.4 billion, a slight increase of 0.1% over the August 2021 total of USD 47.3 billion. Such an expansion in the semiconductor requirement is anticipated to offer lucrative opportunities for the growth of inspection and metrology equipment.

- Furthermore, capacity developments in the semiconductor industry are also aiding the growth of the studied market. For instance, according to SEMI Equipment Market Data Subscription (EMDS), the semiconductor industry's foot is firmly on the accelerator as the capacity expansion efforts are also aiding the expansion of the front-end and back-end semiconductor equipment industries to meet growth drivers.

- Billings for semiconductor equipment in the first quarter of 2023 increased 9% year-over-year to USD 26.8 billion. Advanced logic and foundry capacity expansions, DRAM investment recovery, and robust NAND Flash spending drove equipment market growth. As metrology and inspection are crucial processes involved in the manufacturing of semiconductor chips, such trends also create a favorable outlook for the laser market.

- Further, according to WSTS, in 2022, semiconductor sales reached USD 580.13 billion worldwide. Semiconductors are crucial in electronic devices, and the industry is highly competitive. The YoY growth rate in 2022 reached 4.4 percent and is anticipated to grow more in the coming future. Such trends are anticipated to support the growth of metrology and inspection equipment and associated laser systems during the forecast period.

The Asia Pacific Region is Expected to Witness a High Market Growth

- The Asia-Pacific is one of the main regions for the semiconductor industry's manufacturing and consumption. According to Semiconductor Equipment and Materials International (SEMI), China's semiconductor equipment spending surpassed USD 28.27 billion in 2022. Moreover, in South Korea, spending amounted to USD 21.51 billion, while in Taiwan, it stood at USD 26.82 billion during the same period. As lasers are widely used in semiconductor equipment, such trends favor the studied market's growth.

- The region also boasts many initiatives by governments to boost the semiconductor industry. For instance, the Chinese government's National Integrated Circuit Industry Development Guidelines and the Made in China 2025 initiative aim to bolster the growth of the local semiconductor industry in the country, reducing the level of dependence on other countries.

- A similar trend is being observed across other countries. For instance, India's Ministry of Electronics and Information Technology (MeitY) recently approved a comprehensive PLI scheme for developing semiconductor & display manufacturing ecosystems. Incentives worth INR 76,000 crore (USD 9.81 billion) are to be distributed over the next six years. Such initiatives in the region are expected to drive the growth of the ecosystem of the semiconductor industry, creating opportunities in the laser market as well.

- Semiconductors remain the backbone material of electronics integrated with modern devices such as cars, smartphones, robots, and many other intelligent devices; driven by the continuous need for miniaturized and robust chips, current semiconductor manufacturing technologies face increasing pressure. The growing adoption of consumer electronics and automobiles in the Asia Pacific region also creates a favorable outlook for the growth of the studied market.

- Japan holds a unique place in the studied market as the country is among the leading suppliers of semiconductor equipment and materials. According to SEMI, Japan accounts for more than 30% of the global semiconductor manufacturing equipment and material sales. Hence, the country is anticipated to hold notable growth opportunities for lasers used in the semiconductor industry.

- The semiconductor need has grown significantly in the Asia Pacific region in recent years. As prominent semiconductor customers in several countries strengthen their supply chains, investments in the semiconductor industry value chain are further accelerated. For instance, in July 2022, GigaphotonInc., a manufacturer of light sources used primarily in semiconductor lithography, announced that it would increase its production capacity by 2.5 times by constructing a new building in Japan. The company invested around JPY 5 billion (USD 36.2 million) in the construction of the new facility, which is expected to be completed by June 2023. Such investments would boost the semiconductor industry's expansion of the laser market.

Semiconductor Laser Industry Overview

The Laser Market for Semiconductor Industry is a moderately competitive market with significant players like Lumentum Operations, Trumpf, SUSS MicroTec, Coherent, etc. The market players are striving to innovate advanced products and processes to cater to the evolving demands of their customers.

- March 2023 - Tower Semiconductor, in collaboration with Quintessent, Inc, announced the world's first heterogeneous integration of GaAs quantum dot (QD) lasers and a foundry silicon photonics platform (PH18DB). This PH18DB platform targets optical transceiver modules in data centers & telecom networks and new emerging applications in artificial intelligence (AI), machine learning, LiDAR, and other sensors. The new platform offers GaAs-based quantum dot lasers & semiconductor optical amplifiers (SOA) created on Tower's high-volume base PH18M silicon photonics foundry technology containing low-loss waveguides, photodetectors, & modulators heterogeneously integrated on a single silicon chip. This platform allows dense photonic integrated circuits (PICs) to assist higher-channel count in small form factors.

- January 2023 - Coherent Corp. announced the introduction of its next-generation pump laser diodes that execute an industry-record high output power of 50 W from a single chip. The deployment of fiber lasers for materials processing applications like cutting, welding, marking, and additive manufacturing is accelerating, driving the need for key components that lower the output power cost per watt. The new laser diodes reach 50 W of output power, 40% more than the existing product, allowing high-power industrial fiber laser designs with fewer pump laser diodes.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Impact of Macro Trends on the Market

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Technology Snapshot

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Investment in Semiconductor Fabrication Plants

- 5.2 Market Restraints

- 5.2.1 Desing Complexity and Cost of Lasers

6 MARKET SEGMENTATION

- 6.1 By Laser Type

- 6.1.1 Nanosecond

- 6.1.2 Picosecond

- 6.1.3 CO2

- 6.1.4 Others (Femtosecond and Excimer)

- 6.2 By Process Step

- 6.2.1 Removal Process

- 6.2.2 Bonding Process

- 6.2.3 Inspection & Metrology

- 6.2.4 Reforming Process

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia Pacific

- 6.3.4 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Laser Equipment Suppliers Analysis

- 7.1.1 Accretech

- 7.1.2 Disco Corporation

- 7.1.3 Coherent, Inc.

- 7.1.4 IPG Photonics Corporation

- 7.1.5 Veeco Instruments Inc.

- 7.1.6 EVG Group

- 7.1.7 SUSS MicroTec

- 7.1.8 Orbotech/SPTS

- 7.1.9 HGTech

- 7.1.10 QMC

- 7.1.11 Screen Semiconductor Solutions Co., Ltd.

- 7.1.12 Nikon

- 7.2 Laser Source Suppliers Analysis

- 7.2.1 Micromac

- 7.2.2 Lumentum Operations LLC

- 7.2.3 Trumpf

- 7.2.4 HANS Laser

- 7.2.5 Amplitude Laser

- 7.2.6 IPG

- 7.2.7 Hamamatsu

- 7.2.8 Ushio

- 7.2.9 Jenoptik

- 7.2.10 EO Technics

- 7.2.11 HGTech

- 7.2.12 Edgewave

- 7.2.13 MKS

8 VENDOR RANKING ANALYSIS OF LASER EQUIPMENT SUPPLIERS

9 FUTURE OUTLOOK OF THE MARKET

02-2729-4219

+886-2-2729-4219