|

市场调查报告书

商品编码

1408174

食品卡车:市场占有率分析、行业趋势和统计、2024-2029 年成长预测Food Truck - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

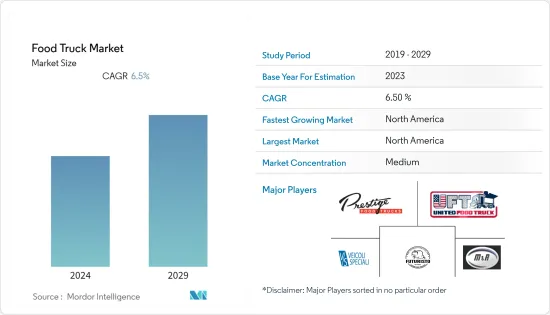

目前餐车市场规模为41.5亿美元。

未来五年,预计将成长至 68.7 亿美元,预测期内收益复合年增率为 6.5%。

从中期来看,全球快餐店 (QSR) 的增加可能会增加预测期内餐车的需求。在预测期内,经营餐厅的地租成本上涨可能会增加餐车的受欢迎程度。

由于食品车在商务用餐厅中越来越受欢迎,该市场可能会大幅成长。商业餐厅正在黄金地段推出餐车来探索餐厅设施。预计这将在预测期内推动市场。然而,随着全球监管的规范化,一些国家的食品服务业出现了显着增长,并且在预测期内市场可能会显着增长。例如

主要亮点

- 2022 年 10 月:Loblaw 和 Gatik 在加拿大推出无人驾驶食品配送卡车。该公司在加拿大拥有 2,400 多家商店。目前,多辆无人驾驶卡车将在多伦多地区提供服务。

此外,消费者对快餐和食品和饮料的趋势不断上升预计将推动对餐车的需求。快速的都市化和世界各地集体工作的女性数量的增加可能会在预测期内为食品卡车业务创造机会。

餐车市场趋势

快餐消费的增加预计将推动市场

随着人们生活方式的改变,对速食产品的需求不断增加。这种趋势在学生中尤其普遍。

易于准备并在点心棒、酒店、餐厅、大学和学校外带等处作为用餐或外带的加工食品。快餐的营养价值通常低于其他类型的食品。任何需要较短准备时间的用餐都可以被视为快餐,但该术语最常见的是指在餐馆、酒店或商店出售的餐食,包含已烹调食材,冷冻或预热,并且可以外带/外带。指打包后提供给顾客的食品。

传统上,快餐店因其能够透过得来速窗口提供食物而脱颖而出。不提供庇护所或座位的摊位或摊位是快餐店(也称为快速服务餐厅)经销店的一个例子。在连锁餐厅的特许经营业务中,食品从一个中心位置出货到每家餐厅。

- 麦当劳将在2022年成为全球最有价值的速食品牌,预计品牌价值约1,965亿美元。同年星巴克的品牌价值约617亿美元。

此外,刨冰和咖啡是一个新兴概念,只需一点空间即可蓬勃发展。轻型卡车是经营此类业务的完美选择。由于咖啡车在美国越来越受欢迎,预计该市场在预测期内将出现显着增长。例如,Rise 咖啡车于 2022 年 7 月在密苏里州圣路易斯首次亮相。街对面有一辆咖啡车,供应糕点和咖啡。

北美和欧洲确认显着成长

以 2021 年收益计算,欧洲在餐车市场占据主导地位,预计在预测期内也将实现成长。 2021年欧洲将举办多场美食节活动,可能会增加对餐车的需求。例如

- 2022年3月,欧洲街头美食节在奥地利举行。此次活动已确定在餐车周围举办多个食品展览。这可能会在预测期内提振市场。

欧洲对货车的需求庞大,占全球货车销售量的90%以上。儘管 COVID-19 大流行阻碍了欧洲市场,但电动充电货车和混合电动货车的销量在 2021 年有所增长。此类电动货车的兴起已在食品卡车行业中流行,并且该市场在预测期内可能会显着增长。

食品卡车在北美很受欢迎,因为资本成本较低,而且北美各地都有很好的地点可以开展食品卡车业务。在美国,餐车业务的成本约为 50,000 至 60,000 美元。该国的食品卡车业务每年收入为 25 万美元至 50 万美元。随着业务收益利润的增加,人们被吸引在美国开展食品卡车业务,这可能会增加预测期内对食品卡车的需求。

目前美国有超过 35,500 辆食品卡车在运营,在预测期内食品卡车的数量可能会增加。加州的餐车数量最多,共有 753 家企业在营业。其次是德克萨斯州(拥有 549 家运营商)和佛罗里达州(拥有 502 家运营商)。这些州旅游业的成长可能会显示本财年食品卡车业务的强劲成长,并且在预测期内也可能显示强劲成长。

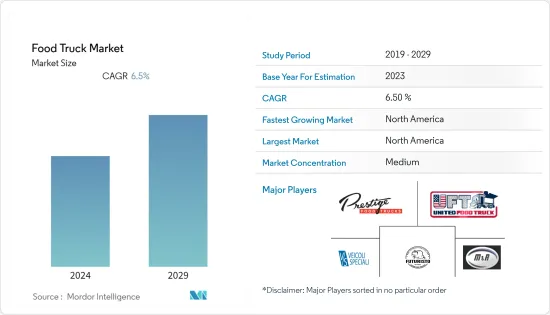

餐车产业概况

食品卡车市场由 Prestige Food Trucks、United Food Trucks United LLC 和 M&R SPECIALTY Trailers and Trucks 等几家主要企业主导。一些国家已经宣布了在全国范围内开展食品卡车运营的政策。例如

- 2022 年 8 月:德里政府宣布世界上第一个类似美国和英国的食品卡车政策。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场驱动因素

- 快餐消费的增加预计将推动市场

- 市场抑制因素

- 线上食品配送的增加可能会阻碍市场成长

- 波特五力分析

- 供应商的议价能力

- 买家/消费者的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章市场区隔(市场规模-美元)

- 类型

- 货车

- 预告片

- 卡车

- 其他的

- 尺寸

- 14 英尺或以下

- 14英尺或以上

- 按用途

- 速食

- 纯素食者和肉类工厂

- 麵包店

- 其他的

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 其他北美地区

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 欧洲其他地区

- 亚太地区

- 印度

- 中国

- 日本

- 韩国

- 其他亚太地区

- 其他的

- 巴西

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 南非

- 北美洲

第六章 竞争形势

- 供应商市场占有率

- 公司简介

- Prestige Food Trucks

- United Food Trucks United, LLC

- VS VEICOLI SPECIALI

- Futuristo Trailers

- M&R SPECIALTY TRAILERS AND TRUCKS

- MSM Catering Manufacturing Inc.

- The Fud Trailer Company

- Food Truck Company BV

- Foodtrucker Engineering LLP

第七章 市场机会及未来趋势

The food truck market is valued at USD 4.15 billion in the current year. It is anticipated to grow to USD 6.87 billion by the next five years, registering a CAGR of 6.5% in terms of revenue during the forecast period.

Over the medium term, an increase in the number of quick service restaurants (QSR) across the globe will likely increase the demand for food trucks during the forecast period. The rise in the cost of land rent to run a restaurant is likely to increase in popularity of food trucks during the forecast period.

The growing popularity of food trucks among commercial restaurants is likely to witness significant growth in the market. Commercial restaurants are launching food trucks across prime locations to explore the restaurant facilities. It is expected to propel the market during the forecast period. However, several countries witnessed significant growth in food services as the restrictions are normalized across the globe and are likely to witness substantial growth for the market during the forecast period. For instance,

Key Highlights

- October 2022: Loblaw and Gatik launched driverless food delivery trucks in Canada. The company includes more than 2,400 stores across Canada. For now, a number of driverless trucks will service the Toronto area.

Further, the rising consumer trend toward fast food and beverages is anticipated to enhance the demand for food trucks. Rapid urbanization and an increasing number of women working for populations across the globe will likely create an opportunity for the food truck business during the forecast period.

Food Truck Market Trends

Increasing Consumption of Fast Food is Expected to Drive the Market

The demand for fast food products is increasing as people's lifestyle is changing. The trend is particularly prevalent among the student fraternity.

Processed food that is easily prepared and served in snack bars, hotels, restaurants, and college or school canteens as a quick meal or to be taken away. Fast food is typically less nutritionally valuable than other types of food. While any meal with a short preparation time can be considered fast food, the term most commonly refers to food sold in a restaurant, hotel, or store that contains precooked ingredients, frozen or pre-heated, and served to the customer in a packaged form from take-out/take-away.

Fast food restaurants were traditionally differentiated by their ability to serve food through a drive-through window. Stands or kiosks that do not provide shelter or seating are examples of outlets of fast food restaurants (also known as quick service restaurants). Food is shipped to each restaurant from central locations in franchise operations that are part of restaurant chains.

- McDonald's was the most valuable fast food brand in the world in 2022, with an estimated brand value of approximately USD 196.5 billion. Starbucks' brand value was approximately USD 61.7 billion that same year.

Further, shaved ice and coffee are rising concepts that only require a little space to thrive. Small-size trucks are the best option for running these businesses. The growing popularity of coffee trucks across the United States is expected to drive significant market growth during the forecast period. For example, the rise coffee truck debuted in St. Louis, Missouri, in July 2022. Across the street, the coffee truck will be serving pastries and coffee.

North America and Europe witnessing Major Growth

Europe is dominating the food truck market in terms of revenue in 2021 and is projected to grow during the forecast period. Europe witnessed several food festival events in 2021, likely increasing the demand for food trucks. For instance,

- In March 2022, the Europe Street Food Festival was held in Austria. The event witnessed several food exhibitions over the food trucks. It is likely to boost the market during the forecast period.

Europe witnessed significant demand for vans, which accounted for more than 90% of global van sales. Although the COVID-19 pandemic dragged down the European market, sales of electrically chargeable and hybrid electric vans increased in 2021. Such increases in electric vans are becoming popular for the food truck business, which is likely to witness significant growth in the market during the forecast period.

Food trucks are popular in North America owing to their low cost of capital and availability of prime locations to start food truck businesses across the country. The food truck business costs around USD 50,000 to USD 60,000 in the United States. The country witnessed revenue from the food truck business of around USD 2,50,000 to USD 5,00,000 per year. With the increase in revenue profit in business, people are attracted to start food truck businesses in the United States, which is likely to increase the demand for food trucks during the forecast period.

The United States currently operates more than 35,500 food trucks, which will likely increase the number of food trucks during the forecast period. California includes the highest number of food trucks, with 753 businesses operating in the state. Followed by Texas, with 549 businesses, then Florida, which includes 502 food truck businesses. The rise in tourism across these states is likely to witness significant growth for the food truck business in the current year and is witnessing significant growth during the forecast period.

Food Truck Industry Overview

The Food Truck Market is dominated by several key players such as Prestige Food Trucks, United Food Trucks United LLC, M&R SPECIALTY Trailers and Trucks, and many others. Several countries announced policies to start a food truck business across the country. For instance,

- August 2022: The Delhi government announced a first-of-its-kind food truck policy similar to that of the United States and the United Kingdom.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Increasing Consumption of Fast Food is Expected to Drive the Market

- 4.2 Market Restraints

- 4.2.1 Increase in the Online Food Deliveries May Hamper the Growth of the Market

- 4.3 Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - USD)

- 5.1 Type

- 5.1.1 Vans

- 5.1.2 Trailers

- 5.1.3 Trucks

- 5.1.4 Others

- 5.2 Size

- 5.2.1 Up to 14 Feet

- 5.2.2 Above 14 Feet

- 5.3 By Application Type

- 5.3.1 Fast Food

- 5.3.2 Vegan and Meat Plants

- 5.3.3 Bakery

- 5.3.4 Others

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States Of America

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.1.4 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 India

- 5.4.3.2 China

- 5.4.3.3 Japan

- 5.4.3.4 South Korea

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 Rest of the World

- 5.4.4.1 Brazil

- 5.4.4.2 Saudi Arabia

- 5.4.4.3 United Arab Emirates

- 5.4.4.4 South Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles*

- 6.2.1 Prestige Food Trucks

- 6.2.2 United Food Trucks United, LLC

- 6.2.3 VS VEICOLI SPECIALI

- 6.2.4 Futuristo Trailers

- 6.2.5 M&R SPECIALTY TRAILERS AND TRUCKS

- 6.2.6 MSM Catering Manufacturing Inc.

- 6.2.7 The Fud Trailer Company

- 6.2.8 Food Truck Company BV

- 6.2.9 Foodtrucker Engineering LLP