|

市场调查报告书

商品编码

1408177

教育保障:市场占有率分析、产业趋势与统计、2024年至2029年成长预测Education Security - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

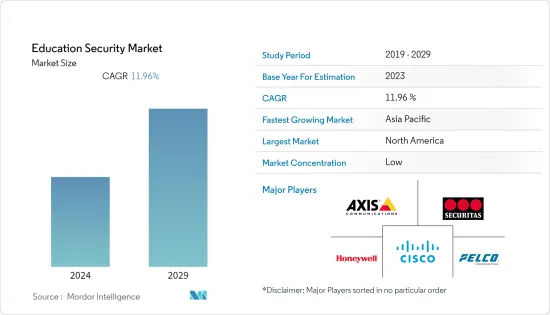

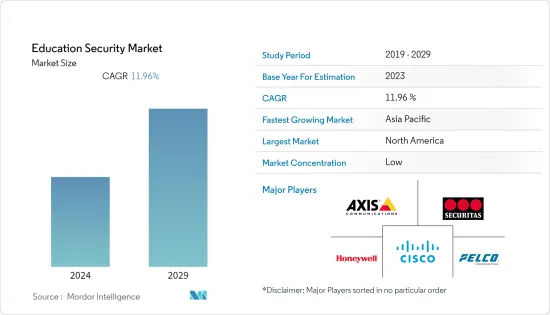

上年度教育安全市场收益为6.435亿美元,预计在预测期内将达到12.3亿美元,复合年增长率为11.96%。

主要亮点

- 教育安全市场追踪世界各地教育设施保全服务的收益。主要驱动因素包括对即时监控的需求增加、对具有成本效益的安全解决方案的需求不断增长以及大规模基础设施开发。

- 安全系统旨在保护学生和教师免受疾病、火灾、骚扰、盗窃、攻击以及内部和外部攻击。教育设施技术创新的发展需要更多的安全支出。视讯监控系统以实惠的价格提供即时资讯。如果发生严重的安全事件,这些解决方案会向最近的警察部门发出警报,以保护学生和教职员工并解决日常纪律问题。

- 每个国家的教育机构结构有显着差异,这影响了暴力预防和介入的方法和支持。开发中国家、贫穷低度开发国家在学生和教师的学习标准、教育品质、对教师的支持以及基础设施方面存在显着差异。此外,教育安全市场的扩大是由各种安全系统和服务所驱动的。

- 此外,由于人们越来越意识到学校、学院和大学需要采取强有力的安全措施,教育产业近年来经历了重大变革。随着安全成为重中之重,教育机构越来越多地寻求先进的安全解决方案来保护学生、教职员工和财产。此外,政府援助的扩大促进了教育保障的成长和基础设施的扩大,据信将增强安全体系,并在预测期内对市场成长做出重大贡献。

- 严重限制教育安全市场成长的因素包括采购成本和与公共监控相关的隐私问题。预计市场只有透过采取平衡的方法才能克服这些挑战。

- 疫情对市场产生了负面影响,全球多家教育机构已关闭。然而,在恢復期,教育安全扮演了新的角色,并且在后COVID-19环境下,对教育安全自动化解决方案的需求不断增长。为了从 COVID-19 的影响中恢復过来,全球范围内的教育设施建设正在增加,据分析,这对预测期内的市场成长率产生积极影响。

教育安全市场趋势

高等教育设施推动成长

- 高等教育机构对 ID 存取管理和访客管理系统的需求不断增加,为市场成长创造了机会。

- Identisys、霍尼韦尔和 Pelco Products Inc. 等供应商提供针对大学和学院的独特需求而设计的客製化解决方案,促进教育安全解决方案的市场采用。例如,教育安全解决方案提供者 Identisys 为大学校园提供客製化安全系统、简化的识别流程、进阶存取控制、整合访客管理和行动资讯。

- 此外,市场供应商正在推出先进技术,例如行动资讯解决方案,允许学生和工作人员使用智慧型手机作为虚拟ID卡和存取金钥,从而消除对实体卡的需求,并提供多因素透过身分验证和轻鬆增强安全性的能力。提供数位存取控制系统正在推动高等教育机构教育安全解决方案市场的成长。

- 例如,Amity 大学实施了智慧卡、生物识别读卡机、IP 摄影机和火灾警报系统的安全解决方案,这表明校园对教育安全解决方案的需求。此外,学生携带晶片智慧卡进入校园,可以在咖啡简餐店、书店等地方用作电子钱包,缓解校园、学生和工作人员的安全需求,刺激市场增长。它在。

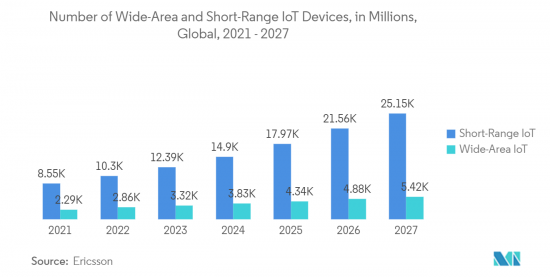

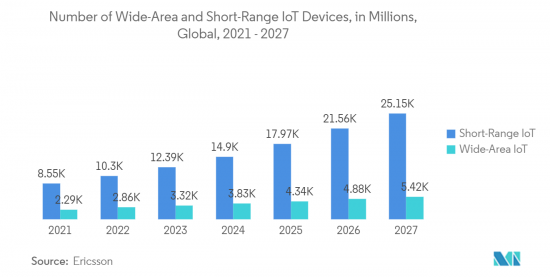

- 由于需要整合安全解决方案和开放原始码平台来同时管理和更好地管理大学校园内安装的所有物联网,系统整合和管理服务正在推动高等教育领域的教育安全市场。Masu。该服务为客户提供单一仪表板解决方案来控制、监控和管理其安全需求,并提供客户管理和供应商管理的版本。

- 高等教育领域的教育安全解决方案市场取得了显着的技术进步,整合了人工智慧(AI)支援的安全风险管理和检测解决方案,支援了市场的成长。

北美占据主要市场占有率

- 过去几年学校枪击事件的增加、新的小学和高等教育设施的建设、教育预算的增加以及该地区运营商推出的创新解决方案推动了北美教育安全市场的发展。主要因素是由于以下因素导致的安全需求增加此外,思科系统公司、霍尼韦尔安全集团等大公司也正在向该地区扩张,进一步扩大该地区的教育安全市场。

- 美国和加拿大的校园和学校安全市场成长最快。主要原因是教育设施建设成本急剧上升以及监视录影机需求增加导致教育安全支出增加。该国各学校和高等教育机构正在投入大量资金升级其安全措施。这正在推动该地区教育安全市场的成长。

- 例如,2023年2月,芝加哥公立学校启动了监视录影机投资计划,以改善学校安全。该计划包括为现有学校添加摄影机并更新目前使用过时设备的系统,确保该地区所有 330 所学校的教职员工和学生都是安全的。它确保我们拥有必要的技术来为您提供支援。芝加哥公立学校表示,这笔 7,630 万美元的投资将在未来三年内为 330 所学校安装或更新监视录影机。

- 此外,该地区的基础设施开发和建设活动正在取得进展,采用安全解决方案来保护新建教育设施的机会也越来越多。例如,2023年4月,奇科州立大学选择特纳建筑公司建造该校耗资9,800万美元的行为与社会科学学院。完工后,这座 94,000 平方英尺的建筑将成为奇科州立大学校园内第一座净零能耗建筑,也是加州州立大学系统中的第三座建筑。 2024年学校开学时,将设有九个系。共有22间教室、5间实验室和1间大型报告厅。还将设有教师办公室、会议空间以及开放封闭的学习空间。

- 此外,随着对物理安全系统的日益关注,教育机构越来越多地寻求为学校和大学开发校园安全解决方案,允许授权人员进入场所并允许未经授权的人员离开场所,这已成为有必要引入的。该国教育当局正大力投资扩大教育机构的视讯监控、门禁和门锁系统。

- 因此,分析认为,由于产品推出的增加、政府和教育主管部门增加学校安全津贴以及全部区域教育设施建设的增加,北美市场在教育安全市场中占据了重要份额。

教育保障产业概况

教育安全市场的主要企业包括思科系统公司、霍尼韦尔国际公司、Axis Communications AB 和 Genetec Inc.。这些市场领导透过实施旨在增强其能力的各种策略,成功地使自己脱颖而出。这些策略包括远端存取、无线功能、策略合作伙伴关係(提供其他服务、好处、产品捆绑和分销)以及提供更大的折扣。因此,这些供应商的产品在市场上具有显着差异化。

您的品牌形象的强度与您在市场中的影响力密切相关。成熟品牌是高效能的代名词,因此,老参与企业有望保持竞争优势。凭藉广泛的市场覆盖范围和提供先进产品的能力,我们预计该领域竞争对手之间的竞争将继续激烈。

2023 年 6 月,Bosch Sicherheitssysteme GmbH 推出了具有智慧型音讯分析功能的 FLEXIDOME 全景摄影机 5100i。该摄影机使安全人员能够透过声音“看到”,从而使他们能够快速、适当地对事件做出反应。这种创新的语音人工智慧接受来自各种环境和背景噪音来源的真实世界资料的训练,以最大限度地减少误报,例如推车或车门关闭的声音。它可以准确地侦测声音特征,例如枪声、烟雾警报器、和一氧化碳警报器。

2023 年 3 月,云端基础的存取控制解决方案供应商 Kisi Inc. 透过两个基于视讯的附加功能扩展了其存取控制解决方案套件。 Kisi 的完整套件现在包括视讯管理,并准备很快推出视讯对讲功能。这项扩展将公司的解决方案和服务范围提升为完全整合的一体化存取控制平台。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- COVID-19 大流行对市场的影响

第五章市场动态

- 市场驱动因素

- 即时监控需求不断成长

- 对经济高效的安全解决方案和关键基础设施的需求不断增长

- 市场抑制因素

- 安全解决方案的采购成本和与公共监控相关的隐私问题影响市场成长

第六章市场区隔

- 按服务

- 安全

- 就业前筛检

- 安全咨询

- 系统整合/管理

- 警报监控服务

- 其他私人保全服务

- 按设施分类

- 中小学教育设施

- 高等教育设施

- 其他教育设施

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东/非洲

第七章 竞争形势

- 公司简介

- Cisco Systems Inc.

- Honeywell International Inc

- Pelco Inc.(Motorola Solutions Inc.)

- Securitas Technology(Securitas AB)

- Axis Communications AB

- Genetec Inc.

- Verkada Inc.

- Hangzhou Hikvision Digital Technology Co. Ltd

- Silverseal Corporation

- Bosch Sicherheitssysteme GmbH(Robert Bosch GMBH)

- SEICO Inc.

- AV Costar

- Kisi Incorporated

- Siemens AG

第八章投资分析

第九章 市场未来展望

The education security market revenue was valued at USD 643.5 million in the previous year and is expected to register a CAGR of 11.96%, reaching USD 1.23 billion over the forecast period.

Key Highlights

- The education security market tracks revenue accrued from security services across education facilities globally. The primary drivers include increasing demand for real-time surveillance and growing demand for cost-effective security solutions and significant infrastructure developments.

- Security systems are designed to protect students and teachers from diseases, fires, harassment, theft, aggression, and attacks from internal and external forces. More security spending is needed to develop technology innovation in education facilities. Video surveillance systems are affordable and provide real-time information. In case of significant security incidents, these solutions alert the nearer law enforcement offices to protect students and staff and handle routine discipline issues.

- There are significant differences in the structure of educational establishments in different countries, which affect the approach and support for violence prevention and intervention. There are substantial differences in the level of student and teacher learning standards, quality of teaching, support to teachers, and infrastructure across countries with development, poverty, or underdeveloped status. Moreover, the increase in the market for education safety is driven by a variety of security systems and services.

- Moreover, The education sector has witnessed a significant transformation in recent years, driven by the increased awareness of the need for robust security measures in schools, colleges, and universities. With safety becoming a top priority, educational institutions increasingly turn to advanced security solutions to protect students, staff, and property. In addition, the growing government aid to boost education security growth and the increasing expansion of infrastructure are set to boost the security systems and significantly contribute to the market's growth during the forecast period.

- The procurement costs and privacy concerns related to public surveillance act as a significant restraint on the growth of the Education Security Market. The market is expected to overcome these challenges only through implementing a well-balanced approach.

- The pandemic had a negative impact on the market, with several education institutions shut down globally. However, in the recovery, education security served additional purposes, and in the post-COVID-19 environment, the demand for automated solutions in education security has risen. The growing construction of education facilities globally to recover from the covid-impact is analyzed to impact the market growth rate during the forecast period positively.

Education Security Market Trends

Higher Education Facilities to Witness the Growth

- The need for identity access management and visitor management systems, among others, is gaining traction in higher education campuses, creating market growth opportunities.

- Market vendors, such as Identisys, Honeywell, and Pelco Products Inc., provide customized solutions to universities and colleges designed for their unique needs, driving the market adoption of education security solutions. For instance, IdentiSys, an education security solution provider, offers customized security systems, streamlined identification processes, advanced access control, integrated visitor management, and mobile credentials for university campuses.

- Additionally, market vendors are introducing advanced technologies, such as mobile credential solutions to allow students and staff to use their smartphones for virtual ID cards and access keys, eliminating the need for physical cards and enhancing security through multi-factor authentication, driving the market growth of educational security solutions in higher educational institutions due to its ease in providing digital access control system.

- For instance, Amity University implemented security solutions through smart cards, biometric readers, IP cameras, and fire warning systems, which shows the need for education security solutions on campuses. Additionally, students carry a chip-enabled smart card to access the campus, which can be used as an e-wallet in the cafeteria, book shops, etc., easing the security needs of the campus, students, and staff and fueling the market growth.

- The system integration and management services are driving the market of educational security in the higher education departments due to the need for integrated security solutions and an open-source platform to simultaneously manage all the IoTs installed in the university premises for better management. This service offers a single dashboard solution to the user to control, monitor, and manage their security needs, which can be customer-managed and vendor-managed.

- The market for education security solutions in the higher education sector has been registering significant technological advancement and integrating artificial intelligence (AI)-enabled solutions to manage and detect security risks, supporting market growth.

North America to Hold Significant Market Share

- The education security market in the North American region is primarily driven by the increased demand for security owing to the increased shooting attacks in schools in the past few years, construction of new primary and higher education facilities, growth in the education budget coupled with innovative solutions launches by the market vendors operating in the region. Additionally, the region is home to some of the major players, such as Cisco Systems Inc., Honeywell Security Group, etc., which further expand the education security market in the region.

- The United States and Canada have experienced the highest growth in the region's campus and school security market, primarily because of rising education security spending caused by high construction costs for educational facilities and increased demand for surveillance cameras. Various schools and higher education institutions in the country are upgrading their security measures by investing substantial funding. This, in turn, drives the growth of the education security market in the region.

- For instance, in February 2023, Chicago Public Schools launched a security camera investment plan to improve school safety. The program includes adding cameras to existing schools and updating systems that currently have outdated equipment to ensure that all 330 District schools have the necessary technology to support the safety of staff and students. According to Chicago Public Schools, A USD 76.3 million investment will bring new and upgraded surveillance cameras to 330 schools over the next three years.

- Furthermore, the region's ongoing infrastructure development and construction activities are expected to create growth opportunities for adopting security solutions for the security of newly constructed educational facilities. For instance, in April 2023, Chico State University chose Turner Construction Co. to build the school's USD 98 million College of Behavioral and Social Sciences. When completed, the 94,000 sq ft building will be the first net-zero energy building on the Chico State University campus and the third in the California State University system. The building will have nine academic departments when it opens in 2024. It will offer 22 classrooms, five laboratories, and one large, tiered lecture hall. It will also feature faculty offices, conference space, and open and enclosed study spaces.

- Further, with a greater focus on physical security systems, it's becoming vital that educational facilities implement school and college campus security solutions that can allow authorized individuals onto their sites and keep unauthorized individuals out. Education authorities in the country are investing heavily to expand educational institutions' video surveillance systems, access control systems, and door-locking systems.

- Therefore, the North American market is analyzed to hold a significant share in the education security market owing to the growing product launches, increasing school security funding by the government and educational authorities, and growth in educational facilities construction across the region.

Education Security Industry Overview

The Education Security market features key players such as Cisco Systems Inc., Honeywell International Inc., Axis Communications AB, and Genetec Inc. These market leaders have successfully set themselves apart by implementing various strategies aimed at enhancing functionality. These strategies include remote access, wireless capabilities, strategic partnerships (offering additional services, benefits, product bundling, and distribution), and providing deeper discounts. As a result, these vendors have significantly differentiated their offerings in the market.

The strength of their brand identity is closely tied to their influence in the market. Established brands are synonymous with high performance, and as a result, long-standing players are anticipated to maintain a competitive advantage. Due to their extensive market reach and capacity to offer advanced products, the competitive rivalry in this sector is expected to remain intense.

In June 2023, Bosch Sicherheitssysteme GmbH (Bosch Security and Safety Systems) introduced the FLEXIDOME panoramic 5100i cameras, which incorporate Intelligent Audio Analytics. These cameras enable security personnel to "see" through sound, allowing for a swift and appropriate response to incidents. This innovative audio AI has been trained on real-world data from various environments and background noise sources, enabling it to accurately detect sound signatures such as gunshots, smoke alarms, and carbon monoxide alarms while minimizing false positives like cart noises or car doors slamming.

In March 2023, Kisi Inc., a provider of cloud-based access control solutions, expanded its suite of access control solutions with two video-based additions. The full Kisi suite now includes video management and is poised to introduce video intercom capabilities shortly. This expansion elevates their range of solutions and services to a fully integrated, all-in-one access control platform.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of the COVID-19 Pandemic on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand for Real-time Surveillance

- 5.1.2 Growing Demand for Cost-effective security solutions and significant Infrastructure Developments

- 5.2 Market Restraints

- 5.2.1 The Security Solutions Procurement Costs and Privacy Concerns Related to Public Surveillance Impact the Growth of the Market

6 MARKET SEGMENTATION

- 6.1 By Services

- 6.1.1 Guarding

- 6.1.2 Pre-Employment Screening

- 6.1.3 Security Consulting

- 6.1.4 Systems Integration & Management

- 6.1.5 Alarm Monitoring Services

- 6.1.6 Other Private Security Services

- 6.2 By Facilities

- 6.2.1 Primary & Secondary Facilities

- 6.2.2 Higher Education Facilities

- 6.2.3 Other Educational Facilities

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia-Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles*

- 7.1.1 Cisco Systems Inc.

- 7.1.2 Honeywell International Inc

- 7.1.3 Pelco Inc. (Motorola Solutions Inc.)

- 7.1.4 Securitas Technology (Securitas AB)

- 7.1.5 Axis Communications AB

- 7.1.6 Genetec Inc.

- 7.1.7 Verkada Inc.

- 7.1.8 Hangzhou Hikvision Digital Technology Co. Ltd

- 7.1.9 Silverseal Corporation

- 7.1.10 Bosch Sicherheitssysteme GmbH (Robert Bosch GMBH)

- 7.1.11 SEICO Inc.

- 7.1.12 AV Costar

- 7.1.13 Kisi Incorporated

- 7.1.14 Siemens AG