|

市场调查报告书

商品编码

1693705

步进马达-市场占有率分析、产业趋势与统计、成长预测(2025-2030)Stepper Motor - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

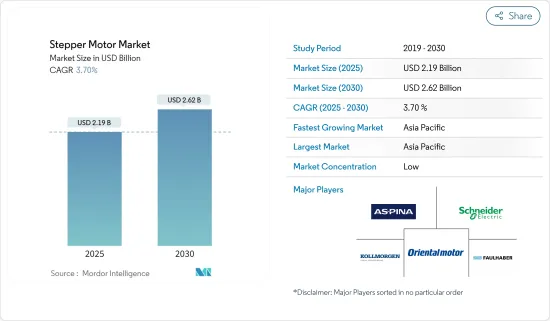

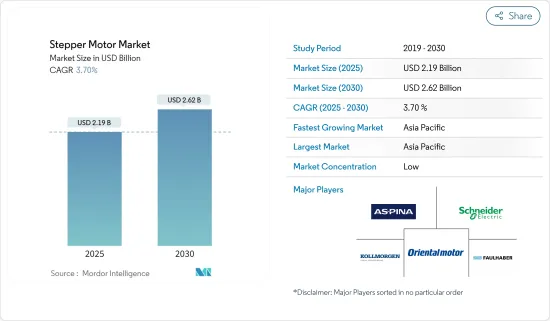

步进马达市场规模预计在 2025 年为 21.9 亿美元,预计到 2030 年将达到 26.2 亿美元,预测期内(2025-2030 年)的复合年增长率为 3.7%。

关键亮点

- 步进马达是一种将电讯号转换为机械讯号的电子机械系统。这些马达旨在实现精确的运动并到达精确的位置。步进马达的这种运动是透过使用线圈提供并由磁铁感应的磁场来实现的。此磁场迫使旋转部件做出反应并调整到其最低能量状态(平衡),从而使它们移动。因此,步进马达通常由一个由週期性通电线圈製成的固定部分(即定子)和一个由铁磁性材料或磁铁製成的移动部分(即转子)组成。

- 步进马达的低成本、运作精确的特性大大扩展了它的应用范围。如今,步进马达已用于许多常见的工业和商用应用。这些马达的典型家庭应用包括空调百叶窗、驱动电动窗帘、开/关管道阀门以及数位相机和行动电话中的变焦和自动对焦机制。此外,在商业领域,这些马达常见于 ATM、旋转监视摄影机等。

- 这一市场成长的主要驱动力是产业努力加速数位转型,其中包括向「工业 4.0」概念的转变。考虑到其优势,世界各国政府也在采取倡议推动先进製造和工业解决方案的采用。

- 多年来,医疗设备市场经历了显着增长,这得益于技术发展、各国政府对提供优质医疗基础设施的需求不断增加以及消费者对个人医疗设备意识的不断提高。

- 此外,步进马达是各个终端用户产业中使用最广泛的马达之一,因为它们具有出色的速度控制、运动重复性和精确定位。此外,由于没有接触刷,可以最大限度地减少机械故障,最大限度地延长马达的使用寿命,从而使这些马达极其可靠。

步进马达市场趋势

混合动力马达将实现显着成长

- 混合式步进马达是永磁马达和变磁阻马达的组合。混合式步进马达的转子是轴向磁化的,类似于步进马达中的永久磁铁。儘管如此,定子是电磁充电的,就像可变磁阻步进马达一样。

- 它采用永磁式和变磁阻式相结合的原理,具有输出扭矩大、脉衝率高、加速和响应快、噪音低、性能优良等特点。此外,其坚固而简单的结构使其高度可靠且几乎不需要维护。

- 混合式步进马达的一个主要特性是其能够在两相或三相配置下运作。两相步进马达透过交替激励两个相互吸引和排斥的定子绕组来旋转转子。相较之下,三相步进马达使用三个定子绕组,这些绕组按顺序通电,使转子每转多步。

- 由于机器人和自动化产业的快速发展,工业机器人选项变得极为受欢迎,其在製造业的广泛部署证明了这一点。混合式步进马达的发展取决于工业机器人适合作为独立车辆并在现场提供个人协助的优势。

- 此外,儘管全球经济面临挑战,但 IFR 世界机器人 2023 报告显示工业机器人安装产业前景光明。到2024年,亚洲/澳洲预计将成为安装工业机器人数量最多的地区,达到37万台。

亚太地区预计将实现强劲成长

- 预计亚太地区将主导全球市场,这主要归功于日本、中国、印度和韩国等国家的存在。这些国家以其电子材料行业而闻名,这对该地区的市场兴趣做出了重大贡献。此外,该地区对医疗和机器人领域的持续投资预计将进一步扩大市场前景。

- 此外,印度最近在各个领域采用机器人技术的情况显着增加。国家机器人战略等政府倡议旨在将印度定位为机器人领域的全球领导者,并实现其变革潜力。它还将机器人技术列为以「印度製造2.0」为基础并加强印度融入全球价值链的27个子产业之一。这一显着的成长预示着印度机器人产业的前景非常光明。此外,先进技术和製造能力的不断进步预计将推动该地区机器人产业的成长,从而产生市场需求的激增。

- 除了机器人产业之外,由于该地区医疗产业的新兴发展,步进马达市场预计也将大幅成长。由于人口快速成长和医疗成本上升,印度和中国等国家对医疗设备的需求正在大幅增加。

- 例如,根据印度政府估计,印度医疗设备和设备市场规模到2023年将达到110亿美元,到2025年将达到500亿美元。由于投资不断增加,该行业一直保持持续成长。

- 政府实施了与生产挂钩的奖励计划来鼓励本地製造业。这些计划将为医疗设备提供4亿美元的财政奖励。因此,许多公司正在大力投资提高医疗设备生产能力。

步进马达市场概况

步进马达市场主要分为 Kollmorgen(Regal Rexnord Corporation)、Faulhaber、Oriental Motor、ASPINA Group(Shinano Kenshi)和 Schneider Electric SE 等主要企业。市场参与企业正在利用伙伴关係、创新、投资和收购来加强其产品供应并获得可持续的竞争优势。

- 2023 年 12 月:科尔摩根推出 P80360 步进马达,这是一种先进的解决方案,采用闭合迴路操作,可实现实时位置校正。这种先进的驱动器不仅提供广泛的编程功能和扩展的位置控制,而且闭合迴路反馈系统还可确保提高可靠性和效率。 P80360 步进驱动器的最大峰值相电流能力为 3A,单相输入电压范围为 100 至 240VAC,与所有步进马达相容。

- 2023 年 10 月:FAULHABER 推出 AM3248 步进马达,展示其令人难以置信的速度和扭矩。这款新马达的转速高达惊人的 10,000 rpm,性能比同类马达高出 5 倍。儘管其直径仅 32 毫米,但体积非常紧凑,性能出色,非常适合各种应用,包括航太、实验室自动化、大型光学系统、半导体工业、机器人和 3D 列印。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概览

- 技术开发

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 工业供应链分析

- COVID-19 的副作用和其他宏观经济因素将如何影响市场

第五章市场动态

- 市场驱动因素

- 机器人和自动化解决方案的采用率不断提高

- 步进马达在医疗产业的应用日益广泛

- 市场限制

- 性能限制和与伺服马达的衝突

第六章市场区隔

- 依马达类型

- 杂交种

- 永久磁铁

- 可变磁阻

- 按应用

- 医疗设备

- 机器人

- 工业设备

- 计算

- 其他的

- 按地区

- 北美洲

- 欧洲

- 亚洲

- 澳洲和纽西兰

- 拉丁美洲

- 中东和非洲

第七章竞争格局

- 公司简介

- Kollmorgen(Regal Rexnord Corporation)

- Faulhaber

- Oriental Motor Co. Ltd

- ASPINA Group(Shinano Kenshi Co. Ltd)

- Schneider Electric SE

- Nanotec Electronic GMBH & Co. KG

- JVL AS

- I.CH Motion

- Changzhou Fulling Motor Co. Ltd

- Shanghai MOONS Electric Co. Ltd

- Minebea Mitsumi Inc.

- Nippon Pulse America Inc.

第八章投资分析

第九章:市场的未来

The Stepper Motor Market size is estimated at USD 2.19 billion in 2025, and is expected to reach USD 2.62 billion by 2030, at a CAGR of 3.7% during the forecast period (2025-2030).

Key Highlights

- A stepper motor is an electromechanical system that transduces an electrical signal into a mechanical one. These motors are designed to accomplish a discrete movement and reach a precise position. This movement in stepper motors is achieved by using a magnetic field provided by coils and sensed by magnets, which force the rotating part to respond and align itself in the lowest energy state (equilibrium), giving motion. Hence, stepper motors generally comprise a fixed part (i.e., stator) made of cyclically energized coils and a moving part (i.e., rotor) made of ferromagnetic material or magnets.

- The low cost and precise movement features of stepper motors significantly expand their application area. Currently, stepper motors are available in many familiar industrial and commercial applications. Some typical domestic applications of these motors include applications in air conditioning louvres, driving electrically operated drapes, turning pipe valves on or off, and the zoom and autofocus mechanisms in digital or phone cameras. Furthermore, in the commercial sector, these motors can commonly be found in ATMs, rotating security cameras, etc.

- A significant driving aspect behind the growth of the market studied is the efforts by industrial organizations to accelerate their digital transformation, which includes the shift toward the "Industry 4.0" concept, which governs a higher adoption of automation, robotics, and advanced solutions, such as AI and IIoT, in industrial setups. Considering the benefits, governments across various countries are also taking initiatives to promote the adoption of advanced manufacturing and industrial solutions.

- Over the years, the medical equipment market has witnessed significant growth, driven by technological development, the growing desire of government entities across various countries to offer high-quality healthcare infrastructure, and the growing awareness among consumers regarding personal healthcare devices.

- Furthermore, stepper motors are among the most widely used motors across various end-user industries, as they offer excellent speed control, repeatability of movement, and precise positioning. Additionally, the absence of any contact brush makes these motors highly reliable, as it minimizes mechanical failure and maximizes the motor's operating lifespan.

Stepper Motor Market Trends

Hybrid Type of Motors to Witness Significant Growth

- A hybrid stepper motor is a variety of permanent magnet-type and variable reluctance motors. The rotor in hybrid stepper motors is magnetized axially, much like the permanent magnets in stepper motors. Still, the stator is electromagnetically charged like a variable reluctance stepper motor.

- It has a higher output torque, a higher pulse rate, quicker acceleration and response, less noise, and better performance delivery because it operates on the combined principles of permanent-magnet and variable-reluctance variants. Additionally, they are incredibly dependable and require little maintenance, owing to their sturdy and straightforward construction.

- A vital feature of a hybrid stepper motor is its ability to operate in either a two-phase or three-phase configuration. Two-phase stepper motors use two stator windings that are alternately energized to rotate the rotor by attracting and repelling each other. In contrast, three-phase stepper motors use three stator windings that are energized sequentially, causing the rotor to rotate multiple steps per revolution.

- Industrial robotics options are becoming very popular due to the rapid advancement of the robotics and automation industry, as evidenced by their extensive deployment in the manufacturing sector. The development of hybrid stepper motors depends on the advantages of industrial robots, such as their suitability as independent vehicles and the provision of private assistance on the floor.

- Moreover, despite the global economic challenges, the IFR World Robotics 2023 report revealed a positive future for the industrial robot installation industry. In 2024, industrial robot installations in Asia/Australia are expected to reach 370,000 units, accounting for the highest number of installations.

Asia-Pacific is Expected to Witness Significant Growth

- Asia-Pacific anticipates dominance in the global market, primarily due to the presence of countries like Japan, China, India, and South Korea. These countries are renowned for their electronic materials industry, significantly contributing to the market's interest in this region. Moreover, the region's continuous investments in the medical and robotic sectors are projected to further augment the market's prospects.

- Furthermore, there has been a substantial increase in the implementation of robotics in different sectors within India in recent times. Government initiatives such as the National Strategy for Robotics aim to position India as a global leader in robotics to actualize its transformative potential. It also builds upon Make in India 2.0, which has identified robotics as one of the 27 sub-sectors to enhance the country's integration in the global value chain. This substantial growth signifies a highly promising future for the robotics industry in India. Additionally, the continuous advancements in advanced technology and manufacturing capabilities are anticipated to propel the growth of the robotic industry in the region, consequently generating a surge in market demand.

- Despite the robotic industry, the market for stepper motors is also expected to increase significantly, owing to rising developments in the region's medical industry. The demand for medical equipment is experiencing a significant surge due to the rapidly growing population and the escalating healthcare expenditures in countries such as India, China, and other nations.

- For instance, as per the Government of India, the valuation of the Indian medical devices and equipment market stood at USD 11 billion in 2023 and is estimated to reach USD 50 billion by 2025. This industry has been witnessing consistent growth owing to heightened investments.

- The government has implemented the Production Linked Incentive Schemes to encourage local manufacturing. These schemes provide financial incentives amounting to USD 400 million for medical devices. As a result, numerous companies are making significant investments to augment the production capacities of healthcare equipment.

Stepper Motor Market Overview

The stepper motor market is fragmented, with major players such as Kollmorgen (Regal Rexnord Corporation), Faulhaber, Oriental Motor Co. Ltd, ASPINA Group (Shinano Kenshi Co. Ltd), and Schneider Electric SE. Market participants use partnerships, innovations, investments, and acquisitions to enhanced their product offerings and gain a sustainable competitive advantage.

- December 2023: Kollmorgen launched the P80360 stepper motor, an advanced solution that incorporates closed-loop operation to enable real-time position correction. This advanced drive not only offers versatile programming capabilities and extended positional control but also guarantees enhanced reliability and efficiency through its closed-loop feedback system. With a phase current capacity of up to 3A peak and an input voltage range of 100-240 VAC single-phase, the P80360 stepper drive is compatible with all stepper motors.

- October 2023: FAULHABER unveiled the AM3248 stepper motor, showcasing its remarkable speed and torque. This new motor outperforms similar models by five times with an impressive capability of reaching up to 10,000 rpm. Despite its compact 32 mm diameter, it delivers exceptional performance, making it an proper choice for various applications, including aerospace, laboratory automation, large optical systems, the semiconductor industry, robotics, and 3D printing.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Technological Developments

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Industry Supply Chain Analysis

- 4.5 Impact of COVID-19 Aftereffects and Other Macroeconomic Factors on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Adoption of Robotics and Automation Solutions

- 5.1.2 Increasing Usage of Stepper Motors in the Healthcare Industry

- 5.2 Market Restraint

- 5.2.1 Performance Limitations and Competition from Servo Motors

6 MARKET SEGMENTATION

- 6.1 By Type of Mortor

- 6.1.1 Hybrid

- 6.1.2 Permanent Magnet

- 6.1.3 Variable Reluctance

- 6.2 By Application

- 6.2.1 Medical Equipment

- 6.2.2 Robotics

- 6.2.3 Industrial Equipment

- 6.2.4 Computing

- 6.2.5 Other Applications

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia

- 6.3.4 Australia and New Zealand

- 6.3.5 Latin America

- 6.3.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Kollmorgen (Regal Rexnord Corporation)

- 7.1.2 Faulhaber

- 7.1.3 Oriental Motor Co. Ltd

- 7.1.4 ASPINA Group (Shinano Kenshi Co. Ltd)

- 7.1.5 Schneider Electric SE

- 7.1.6 Nanotec Electronic GMBH & Co. KG

- 7.1.7 JVL AS

- 7.1.8 I.CH Motion

- 7.1.9 Changzhou Fulling Motor Co. Ltd

- 7.1.10 Shanghai MOONS Electric Co. Ltd

- 7.1.11 Minebea Mitsumi Inc.

- 7.1.12 Nippon Pulse America Inc.