|

市场调查报告书

商品编码

1408235

伺服器作业系统:市场占有率分析、产业趋势与统计、2024-2029 年成长预测Server Operating System - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

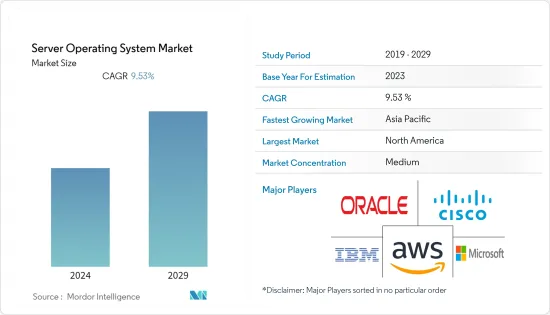

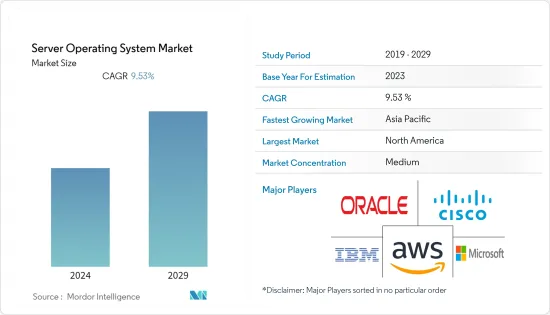

今年全球伺服器营运市场规模为190.7亿美元。

预测期内复合年增长率为9.53%,预计到预测年末将达到306.9亿美元。

主要亮点

- 该市场的成长归因于公司在建立强大的资料中心基础设施方面的支出。此外,混合云端环境的日益采用和 5G 网路技术的引入正在推动市场成长。此外,技术进步和基础设施安全要求的提高预计将在预测期内为市场提供有利的扩张机会。

- 许多知名参与企业越来越多地采用云端平台和基础设施,以及增加对资料中心基础设施的投资,正在推动市场成长。目前先进的基础设施发展预计将增加全球云端伺服器用户的数量。主要的云端运算服务公司正在投入金额在全球扩展其云端基础设施。例如,考虑到云端服务需求的不断增长,2023年2月,甲骨文公司宣布了一项新的公共云端计划,将在沙乌地阿拉伯投资15亿美元。

- 这些伺服器可用于智慧城市中的各种应用,包括为ITS(智慧型运输系统)和V2X(车对万物)通讯提供高效能、低延迟的服务,例如5G和AI应用。它还可用于託管公共运输的云端基础的IP 语音 (VoIP)通讯系统,以及储存和管理来自物联网感测器和设备的资料。此外,高可用性伺服器还可以在智慧城市服务的安全和身份验证过程中发挥作用。例如,许多智慧城市计划和措施正在世界各地实施,促进了全球都市化投资。经合组织估计,2010 年至 2030 年间,智慧城市措施的国际投资将达到约 1.8 兆美元,涵盖城市基础建设计划。这将为公司提供开发新版本作业系统以获得市场占有率的机会。

- 为了增加市场占有率,市场参与企业正在采取新的策略。例如,2023 年 7 月,CIQ 为在企业 Linux 发行版 Rocky Linux 上运行工作负载的企业建立软体基础设施,今天宣布启动 CIQ 合作伙伴计画。该公司旨在为世界各地寻求稳定性、无缝相容性和成本效益以满足IT基础设施和高效能运算需求的组织提供整套解决方案和服务。此次推出强化了 CIQ 合作伙伴优先的通路策略。 CIQ 合作伙伴计画非常适合向企业和政府机构出售基础设施的经销商和整合商,这些企业和政府机构大规模部署和管理资料密集型工作负载,例如产品开发、科学研究、建模、机器学习和人工智慧.

- 然而,对少数应用程式的客製化伺服器作业系统的兴趣日益增长,以及与合理伺服器选择相关的许多困难预计将对市场开拓产生负面影响。此外,高昂的设定和支援成本将成为预测期内推广该产品的挑战。无论如何,对 BYOD(自带设备政策)和整合准入框架的需求不断增长预计将有助于在预测期内保持对伺服器的兴趣。

- COVID-19 大流行极大地推动了世界各地的数位转型和互联网服务,很大一部分企业和企业开始在家工作和协作。在 COVID-19 大流行期间,由于需要远端技术来维持业务运营,因此对资料中心的需求增加。疫情过后,出现了新的企业环境,促进了云端服务和数数位化,企业对其数位基础设施进行了现代化改造,以支援更好的工作方式。

伺服器作业系统市场趋势

云端业务预计将占据主要市场份额

- 越来越多的公司正在使用云端运算技术来提供高效的应用程式和资料管理,而无需建置和维护自己的IT基础设施。根据 Flexera 2023 年云端状况报告,75% 的企业受访者表示他们正在采用 Microsoft Azure 来使用公共云端。

- 亚马逊网路服务(AWS)、微软Azure和Google云端是全球领先的云端运算平台供应商。云端技术的快速采用以及对一站式存取多重云端服务的需求不断增长,为云端服务中介机构创造了机会。云端的大规模采用将增加对伺服器的需求,并相应地推动对研究市场的需求。

- 此外,Fortinet 的业务永续营运云端报告显示,大多数组织正在追求混合(39%,高于 2021 年的 36%)或多重云端策略(33%),并整合多种服务。 76% 使用多个云端提供者。企业继续快速地将工作负载转移到云端。 39% 的受访公司已将超过一半的工作负载转移到云端,58% 的公司计划在未来 12 至 18 个月内达到这一水准。云端用户确信云端兑现了适应性容量和可扩展性 (53%)、更高的敏捷性 (50%) 以及更高的可用性和业务永续营运(45%) 的承诺。

- 由于突然需要实现组织现代化并迁移到云,各种金融机构与云端服务供应商合作。汇丰银行计划与亚马逊网路服务(AWS)达成云端协议,德意志银行与Google云端签署十年战略合作伙伴关係,桑坦德银行宣布每天将超过200台伺服器迁移到云端,因此该公司已宣布该计划的完成日期截至 2023 年。

- 根据泰雷兹集团预测,截至2022年,约60%的企业资料将储存在云端。这一比例在 2015 年达到 30%,随着公司越来越多地将资源转移到云端环境以提高安全性、可靠性和企业敏捷性,这一比例还在持续增长。这些因素为经过市场研究的供应商在未来几年扩大其服务范围创造了巨大的成长机会。

- 企业越来越多地采用云端运算也扩大了市场研究的范围。例如,印度市场供应商 Druva Inc. 报告称,由于存在大量非结构化资料,许多公司主要针对企业资料。该公司还报告称,这些资料占企业储存系统储存资料的 80% 以上。

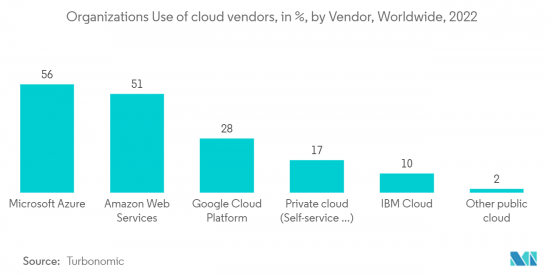

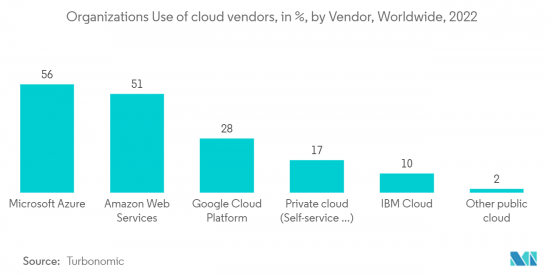

- Turbonomic 2022 年 7 月发布的资料显示,2021 年,56% 的受访者表示他们正在使用 Microsoft Azure 进行云端服务。亚马逊网路服务 (Amazon Web Services) 一直是排名第一的公司,直到 2020 年被微软取代。此外,不使用任何云端的受访者比例从 2021 年的 4% 增加到 2022 年的 8%。

- 根据疫情期间进行的 CloudPath 调查,89% 的银行计划采用混合云端储存和部署来运作。根据 Nutanix 第三届年度金融服务企业云端指数,混合云端采用率预计在未来五年内将成长 39%。云端部署的大规模采用可能会推动所研究市场的需求。

北美地区预计将实现显着成长

- 预计北美将占据市场的主要份额。由于对伺服器作业系统的需求不断增长以及网路应用的发展,美国人有望引领国际市场。利用人工智慧技术的伺服器作业系统管理许多应用程序,例如储存和伺服器管理。该地区的市场受到许多企业越来越多地采用云端运算解决方案的推动。因此,一些本地市场参与企业正在增加对云端运算服务的投资。一些参与企业也专注于提供伺服器作业系统服务。

- 该地区的参与企业正在开拓新的伺服器作业系统 (OS),以赢得市场占有率。例如,Red Hat Enterprise Linux (RHEL) 9 Beta 现已推出,并提供令人兴奋的新功能和许多修復。 RHEL 9 Beta 与上游核心版本 5.14 一起建立,并提供 RHEL 下一个主要更新的预览。此版本专为满足从本地、多重云端到边缘的混合、混合部署需求而设计。系统安全服务守护程序 (SSSD) 是一个内建的业务单一登入框架,现在拥有有关任务完成时间、错误、可能的身份验证流程等的更详细资讯。新的搜寻功能允许管理员分析效能和配置问题。

- 根据美国小型企业管理局倡议办公室的数据,2022年,美国小型企业数量达到3,320万家,几乎占全国所有企业的比例(99.9%)。 2022年美国小型企业数量的成长反映了持续成长,比上一年(2021年)成长2.2%,比2017年至2022年成长12.2%。各地区中小企业的大量增加可能会为市场参与企业创造机会,并开发新的解决方案以占领市场占有率。如此庞大的中小企业数量很可能会促进所研究市场的成长。

- 而且,随着云端运算的兴起,虚拟技术也正在成为市场驱动力。在云端环境中,虚拟用于建立和管理多个虚拟机器 (VM)。提供强大虚拟功能的作业系统,例如具有 KVM(基于核心的虚拟机器)的 Linux 或具有 Hyper-V 的 Microsoft Windows,已成为云端供应商和使用者的必需品。这些技术可实现高效的资源分配和虚拟机器管理,使某些伺服器作业系统对云端部署更具吸引力。

- 此外,随着 5G 部署在日本持续快速成长,对支援所部署的 5G 功能和服务的伺服器作业系统的需求可能会增加。例如,爱立信预计,到2026年5G用户数将超过1.95亿,而在美国,到2029年5G将占美国行动市场总量的约71.5%。 CTIA表示,快速成长将为美国5G经济奠定基础。

伺服器作业系统产业概述

全球伺服器作业系统市场由 Oracle、Cisco System、IBM、Amazon Web Services 和 Microsoft Corporation 等多家参与企业适度整合。公司持续投资于策略合作伙伴关係和产品开拓,以大幅提高市场占有率。以下是一些最近的市场开拓:

2023 年 6 月,专门从事特定应用运算解决方案的公司 HIPER Global 宣布与 Ubuntu Linux 发行版和开放原始码产品提供商 Canonical 建立新的合作伙伴关係。此次合作旨在为 HIPER Global 的全球客户提供附加价值服务,包括针对 Ubuntu Linux 的安全修復和长期支援订阅。此外,客户还可以使用整合到 HIPER Global 解决方案中的先进 Canonical 产品,包括私有云端基础架构、虚拟元件、中央管理系统和支援的 Kubernetes 版本。此外,此次合作也强化了 HIPER Global 为全球客户提供先进服务的承诺。

2023 年 1 月,全球开放原始码解决方案供应商红帽公司与 Oracle 签订了多州协议。此次合作旨在为客户提供 Oracle 云端基础架构的更多作业系统选择。此次合作始于将红帽企业 Linux 加入 QCI 支援的作业系统清单。此外,此次升级还将有助于依赖OCI和红帽企业Linux的企业进行数位转型以及将重要应用程式迁移到云端。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 买方议价能力

- 供应商的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

- 产业价值链分析

- COVID-19 市场影响评估

第五章市场动态

- 市场驱动因素

- 由于混合和云端平台的使用增加,对伺服器作业系统的需求不断增长

- 超大规模资料中心建设投资的增加将显着推动市场扩张

- 市场抑制因素

- 伺服器停机时间长和实施成本高可能会阻碍市场扩张

- 安全漏洞的增加可能会阻碍市场成长

第六章市场区隔

- 按成分

- 软体

- 服务

- 按类型

- Windows

- Linux

- UNIX

- 其他类型

- 透过虚拟

- 虚拟伺服器

- 实体伺服器

- 依实施型态

- 云

- 本地

- 按公司规模

- 大公司

- 中小企业 (SME)

- 按行业分类

- 资讯科技/通讯

- BFSI

- 製造业

- 零售/电子商务

- 政府机关

- 医疗保健

- 其他行业

- 地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东/非洲

第七章 竞争形势

- 公司简介

- Oracle System Corporation

- Cisco Systems, Inc.

- IBM Corporation

- Amazon Web Services(AWS)

- Microsoft Corporation

- NEC Corporation

- Google LLC

- Fujitsu Ltd.

- Delll Technologies Inc.

- Hewlett PAckward Enterprises

- Apple Inc.

第八章投资分析

第九章 市场机会及未来趋势

The global server operating market was valued at USD 19.07 billion in the current year. It is expected to reach USD 30.69 billion by the end of the forecasted year, registering a CAGR of 9.53% during the forecast period.

Key Highlights

- The market's growth is attributed to enterprise spending on creating a robust data center infrastructure. In addition, the increasing adoption of hybrid cloud environments and deployment of 5G networking technologies fuel the market's growth. Further, technological advancements and increasing security requirements in infrastructure are anticipated to provide lucrative expansion opportunities for the market during the forecast period.

- Increasing adoption of cloud platforms & infrastructure and rising data center infrastructure investments by most of the prominent players are assisting the market growth. The development of current advanced infrastructure is anticipated to boost the number of cloud server users worldwide. The key cloud computing service firms are investing a considerable portion of money in expanding cloud infrastructure around the globe. For instance, In February 2023, Oracle Corporation announced a new plan for public cloud in Saudi Arabia with an investment of USD 1.5 billion, considering the increasing demand for cloud services.

- Servers can be used in various applications in smart cities, including delivering high-performance, low-latency services such as 5G and AI applications for intelligent transportation systems (ITS) and vehicle-to-everything (V2X) communication. They can also be used to host cloud-based voice-over-IP (VoIP) communication systems for public transportation and storing and managing data from IoT sensors and devices. Additionally, high-availability servers can play a role in smart city services' security and authentication processes. For example, Globally, many smart city projects and efforts are being implemented, encouraging global investments owing to urbanization. The OECD estimates that between 2010 and 2030, international investments in smart city initiatives would total around USD 1.8 trillion for all urban city infrastructure projects. This would create an opportunity for the players to develop a new version of OS to capture the market share.

- To expand their market share, the market players are incorporating new strategies; for instance, In July 2023, CIQ, which builds software infrastructure for enterprises running workloads atop the Rocky Linux enterprise Linux distribution, announced today the launch of its CIQ Partner Program. The company said the launch reinforces CIQ's partner-first channel strategy as it aims to deliver its suite of solutions and services to organizations worldwide that desire stability, seamless compatibility, and cost-effectiveness for their IT infrastructure and high-performance computing needs. The CIQ Partner Program is ideal for resellers and integrators selling to enterprises and government organizations deploying and managing infrastructure at scale, data-intensive workloads for product development, scientific research, modeling, machine learning, and AI.

- However, the expanded interest in server operating systems with customized arrangements for a few applications & the many difficulties related to choosing a reasonable server is expected to affect the market development negatively. Besides, high establishment & support expenses represent a test to advertise product during the forecast period. In any case, the Bring Your Device Policy (BYOD) & the rising requirement for unified admittance frameworks are considered to assist with keeping the interest up for servers over the forecast period.

- The Covid-19 pandemic significantly boosted digital transformation and Internet services worldwide, with a significant part of businesses and enterprises that have started cooperating and working from home. The need for data centers has grown since remote technologies are demanded to keep companies operating during the Covid-19 pandemic. Following the pandemic, a new company environment has materialized, boosting cloud services and digitization as corporations modernize their digital infrastructure to support better working practices.

Server Operating System Market Trends

Cloud Segment is Expected to Hold a Significant Share of the Market

- A growing number of companies are increasingly using cloud computing technologies to provide efficient application and data management with no need for constructing or maintaining IT infrastructures on site. As per Flexera 2023 State of the Cloud Report, 75% of enterprise respondents indicated adopting Microsoft Azure for public cloud usage.

- Amazon Web Services (AWS), Microsoft Azure, and Google Cloud are the leading cloud computing platform providers globally. This rapid adoption of cloud technologies and the rising demand for one-stop access to multi-cloud services have created opportunities for cloud services brokerage. Such huge adoption of the cloud would increase the demand for servers, proportionately driving the demand for the studied market.

- Further, according to the Fortinet cloud report 2022, Most organizations pursue a hybrid (39%, up from 36% in 2021) or multi-cloud strategy (33%) to incorporate multiple services for scalability or business continuity reasons. 76% percent are utilizing two or more cloud providers. Firms continue to move workloads to the cloud at a rapid pace. 39% of surveyed members have more than half of their workloads in the cloud, while 58 percent plan to get to this level in the next 12-18 months. Cloud users guarantee that the cloud is delivering on the promise of adaptable capacity and scalability (53%), increased agility (50 percent), and improved availability and business continuity (45%).

- As organizations had to modernize and migrate to the cloud abruptly, various financial organizations partnered with cloud service providers. Such as HSBC's planned cloud contract with Amazon Web Services (AWS), Deutsche Bank striking a 10-year strategic partnership with Google Cloud, and Santander's made announcement that it is shifting its over 200 servers to the cloud per day, the company has declared the deadline to complete this project is the year 2023.

- According to Thales Group, as of 2022, around 60% of all corporate information is stored in the cloud. As companies progressively move their resources into cloud environments to enhance security, dependability, and enterprise agility, this proportion hit 30% in 2015 and has since continued to grow. These factors create a massive growth opportunity for the market-studied vendors to expand their offerings in the coming years.

- The growing adoption of cloud computing among enterprises also expands the market studied scope. For instance, India-based market vendor, Druva Inc., reported that many companies primarily target enterprise data due to a large amount of unstructured data. The company also reported that this data claim accounts for over 80% of the data stored in enterprise storage systems.

- According to Turbonomic, they released data in July 2022 stating that, in 2021, 56% of respondents stated that they are utilizing Microsoft Azure for their cloud services. Amazon Web Services was on top of the list until 2020 Microsoft took its place. Additionally, the percentage of respondents not utilizing any cloud increased to eight percent in 2022 from four percent in 2021.

- As per CloudPathSurvey conducted during a pandemic, 89% of banks plan to operate with hybrid cloud storage and deployment. As per Nutanix's third annual Enterprise Cloud Index report for financial services, hybrid cloud adoption is expected to grow 39% in the coming five years. Such huge adoption towards cloud deployment would drive the demand for the studied market.

North America Expected to Witness Significant Growth

- North America is expected to hold a significant share of the market. Americans are anticipated to lead the international market due to the increasing demand for server operating systems and the development of Internet applications. Using artificial intelligence technology, the server operating system manages many applications, such as storage and server management. The market in the region is being driven by the growing adoption of cloud computing solutions across numerous corporations. As a result, several provincial market participants are expanding their investments in cloud computing services. Several players are even focused on providing server operating system services.

- The players in the region are developing new operating systems (OS) for servers to capture the market share. For example, Red Hat Enterprise Linux (RHEL) 9 Beta is available and delivers exciting new features and many more modifications. RHEL 9 Beta is established on upstream kernel version 5.14 and delivers a preview of the following major update of RHEL. This release is designed to require hybrid multi-cloud deployments that range from on-premises and public cloud to edge. The System Security Services Daemon (SSSD), the built-in business single-sign-on framework, now adds more detail for possibilities such as time to complete tasks, errors, the authentication flow, and more. New search capabilities allow admins to analyze performance and configuration issues.

- According to the United States Small Business Administration Office of Advocacy, in 2022, the number of small businesses in the United States reached 33.2 million, accounting for nearly all (99.9 percent) firms in the country. The growth in the number of small businesses in the United States in 2022 reflects continuous growth, with a 2.2% increase from the previous year(2021) and a 12.2% increase from 2017 to 2022. Such a massive rise in the SMEs in the various region would create an opportunity for the market players to develop new solutions to capture the market share. Such a huge number of SMEs would allow the studied market to grow.

- Furthermore, virtualization technologies have also been instrumental in driving the market with the rise of cloud computing. Cloud environments use virtualization to create and manage multiple virtual machines (VMs). Operating systems that offer robust virtualization capabilities, for example, Linux with KVM (Kernael-based Virtual Machine) or Microsoft Windows with Hyper-V, become essential for cloud providers and users. Such technologies enable the efficient allocation of resources and managing VMs, further growing the appeal of specific server operating systems in cloud deployments.

- Further, the booming 5G deployments in the country will increase the demand for server operating systems to support the 5G features and services being rolled out. For instance, according to Ericsson, there will be more than 195 million 5G subscriptions by 2026, and by 2029, in the United States, 5G will account for about 71.5% of the entire U.S. mobile market. According to CTIA, rapid growth creates a platform for the US 5G economy.

Server Operating System Industry Overview

The Global Server Operating System market is moderately consolidated with the presence of several players like Oracle, Cisco System, IBM, Amazon Web Services, Microsoft Corporation, etc. The companies continuously invest in strategic partnerships and product developments to gain substantial market share. Some of the recent developments in the market are:

In June 2023, HIPER Global, a company specializing in application-specific computing solutions, announced a new partnership with Canonical, the provider of Ubuntu Linux distribution and open-source products. The collaboration aims to offer HIPER Global's worldwide customers value-added services, including a subscription to security fixes and long-term support for Ubuntu Linux. Additionally, customers will have access to advanced Canonical products integrated into HIPER Global solutions, such as private cloud infrastructures, virtualization components, centralized management systems, and supported versions of Kubernetes. Furthermore, the partnership strengthens HIPER Global's commitment to delivering advanced service to its customer worldwide.

In January 2023, Red Hat, Inc., the global provider of open-source solutions, and Oracle formed a multi-state agreement. The collaboration aims to provide clients with additional operating system options for Oracle Cloud Infrastructure. The partnership begins with adding Red Hat Enterprise Linux to QCI's supported operating systems list. Furthermore, this upgrade will assist enterprises that rely on OCI and Red Hat Enterprise Linux for digital transformation and cloud migration of essential applications.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Buyers

- 4.2.2 Bargaining Power of Suppliers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing hybrid and cloud platform usage will increase demand for server operating systems

- 5.1.2 Rising investments in the building of hyperscale data centers are significantly driving the market expansion

- 5.2 Market Restraints

- 5.2.1 High server downtime and implementation costs could impede market expansion

- 5.2.2 The growing number of security flaws could hamper the growth of the market

6 MARKET SEGMENTATION

- 6.1 By Component

- 6.1.1 Software

- 6.1.2 Service

- 6.2 By Type

- 6.2.1 Windows

- 6.2.2 Linux

- 6.2.3 UNIX

- 6.2.4 Other Types

- 6.3 By Virtualization

- 6.3.1 Virtual Server

- 6.3.2 Physical Server

- 6.4 By Deployment Mode

- 6.4.1 Cloud

- 6.4.2 On-premise

- 6.5 By Enterprise Size

- 6.5.1 Large Enterprises

- 6.5.2 Small and Medium-sized Enterprises (SMEs)

- 6.6 By Industry Vertical

- 6.6.1 IT and Telecom

- 6.6.2 BFSI

- 6.6.3 Manufacturing

- 6.6.4 Retail and E-Commerce

- 6.6.5 Government

- 6.6.6 Healthcare

- 6.6.7 Other Industry Verticals

- 6.7 Geography

- 6.7.1 North America

- 6.7.2 Europe

- 6.7.3 Asia-Pacific

- 6.7.4 Latin America

- 6.7.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Oracle System Corporation

- 7.1.2 Cisco Systems, Inc.

- 7.1.3 IBM Corporation

- 7.1.4 Amazon Web Services (AWS)

- 7.1.5 Microsoft Corporation

- 7.1.6 NEC Corporation

- 7.1.7 Google LLC

- 7.1.8 Fujitsu Ltd.

- 7.1.9 Delll Technologies Inc.

- 7.1.10 Hewlett PAckward Enterprises

- 7.1.11 Apple Inc.