|

市场调查报告书

商品编码

1408236

5G基地台-市场占有率分析、产业趋势与统计、2024年至2029年成长预测5G Base Station - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

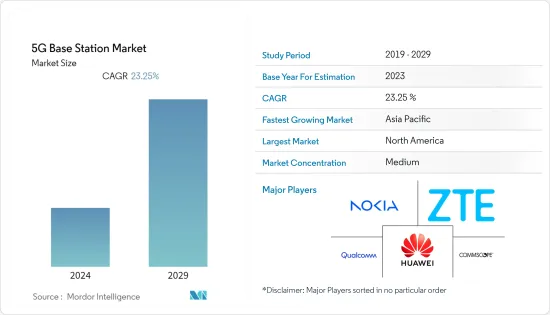

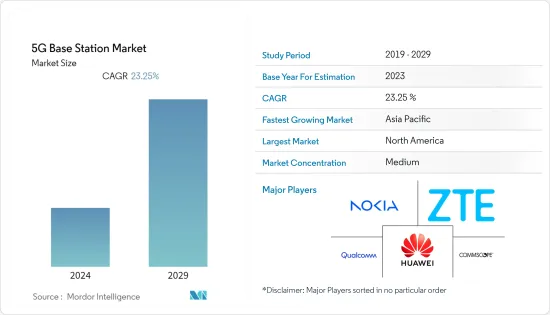

今年全球5G基地台市场规模为411.2亿美元。

预计到预测年末将达到 1,413.5 亿美元,预测期内复合年增长率为 28.01%。

主要亮点

- 由于对低延迟高速资料的需求不断增长,5G基地台市场预计将在研究期间显着发展。此外,5G物联网生态系统的成长和强大的通讯服务预计将为5G基地台市场的发展提供良好的前景。此外,推动市场扩张的关键原因之一是采用网路设备的趋势不断增加。

- 大多数 5G 网路可能由小型基地台组成。小型基地台对于 5G 网路的运作至关重要,因为它们可以增加 5G 所需的资料容量。提供者还可以透过消除昂贵的屋顶系统和安装成本来节省资金,并提高行动装置的性能和电池寿命。在当今的环境中,需要增加频宽和更多连接设备的应用需要小型基地台。例如,据思科系统公司称,到 2030 年,将有 5,000 亿台设备连接到网际网路。此外,5G通讯业者正专注于在较低频宽部署小型基地台,以便为客户提供增强的频宽服务。

- 此外,爱立信表示,2022年至2023年,全球5G用户数量预计将增加,从超过5.5亿增加到超过16.7亿。此外,根据GSMA的数据,到2025年,海湾合作委员会国家的5G采用率将略高于全球平均(15%)(客户5G采用率为16%)。此外,中东和北非地区5G用户数预计将达到1.2962亿。 5G 用户数量的大幅增加预计将推动市场发展。

- 根据中国工业和资讯化部预计,截至年终,中国5G基地台数量将达231万个。凭藉大规模的基础设施投资和雄心勃勃的部署计划,中国已经实现了显着的 5G普及。根据基本估算,到2024年基地台数量预计将达到600万个以上。此外,根据日本内务部,截至 2022 年,日本的 5G 合约数量预计将超过 4,500 万份。日本主要行动营运商 KDDI、软银、NTT Docomo 和 Rakuten Mobile 于几年前开始在国内推出 5G 网络,最初专注于都市区。日本政府的目标是到 2024 年 3 月覆盖 95% 的人口。

- 此外,一些主管部门也致力于解决频谱挑战并减少与 5G 基础设施部署相关的成本障碍。例如,2023 年 7 月,哥斯大黎加通讯管理局 Sutel 发布了无线电频率竞标要求草案,以实现全国 5G 部署。与先前的竞标相比,该计划优先考虑基础设施开发而不是收取频谱使用费。这显示将不再向Fonatel通讯发展基金提供进一步捐款。这些倡议符合高初始资本支出带来的挑战,并将有助于克服与部署 5G 网路相关的限制。

- 在新冠疫情期间,5G(至少在其初始版本)将充分利用通讯监管机构释放某些频宽频宽的倡议,全球行动网路营运商(MNO)预计都市区开始广泛部署农村地区均在网路内。随后,新冠肺炎 (COVID-19) 大流行在全球爆发,导致供应链严重中断,并减缓了 5G 的扩张速度。

5G基地台市场趋势

智慧城市可望推动市场发展

- 在全球范围内,随着都市化进程的加快,智慧城市正在不断发展。根据联合国的数据,到 2050 年,印度(4.04 亿人)、中国(2.92 亿人)和奈及利亚将分别拥有 2.12 亿居住者。新兴的拉丁美洲大陆是世界上都市化。

- 此外,许多智慧城市计划和措施正在全球实施,鼓励全球对都市化的投资。经济合作暨发展组织(OECD)预测,2010年至2030年间,全球智慧城市大都会基础建设计划投资将达到约1.8兆美元。智慧城市的这项措施预计将推动对 5G基地台的需求,以便为客户提供不间断的服务。

- 透过侦测紧急情况,5G智慧城市可以启动多个紧急应变步骤,例如快速派遣救护车、医疗队和消防队前往灾难现场。如果侦测到火灾,它还可以在适当的时间自动关闭防火百叶窗或交换器喷灌。建筑物中的感测器还可以侦测火灾并向建筑物管理系统发送警报,该系统可以指示致动器进行操作。由于5G的快速反应时间,消防喷灌将在侦测到火灾后1-2秒启动。

- 2022 年 6 月,在关键通讯世界大会上,摩托罗拉解决方案宣布了多种解决方案,以及其关键任务整合技术生态系统如何帮助克服公共行业最困难和不可预见的挑战。我向您展示了我正在做的事情。虽然快速发展的技术和用户需求继续推动现代化的需求,但公共和军事组织必须做好应对任何情况的准备。这包括重大紧急情况下的跨境通讯、利用人工智慧 (AI) 识别威胁以及部署用于远端操作的云端解决方案。

- 市场参与企业正在开发新的5G解决方案以占领智慧城市市场,对5G基地台的需求将成比例增加。例如,2022年12月,杜拜综合经济区管理局(DIEZ)与Derq建立策略伙伴关係,为DIEZ的自由区提供先进的能力和有竞争力的智慧城市解决方案。两家公司的代表和员工出席了纪念这项合作关係的签署仪式。透过新的合作伙伴关係,Khazna资料中心的 5G MEC 伺服器或平台将使 DIEZ 能够展示利用 5G通讯和边缘运算技术的智慧城市解决方案。

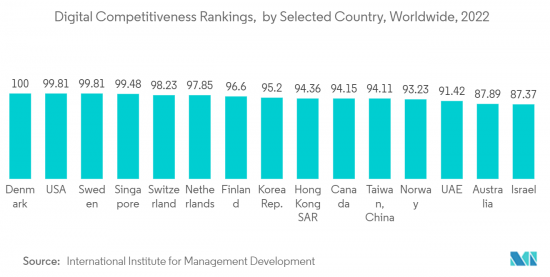

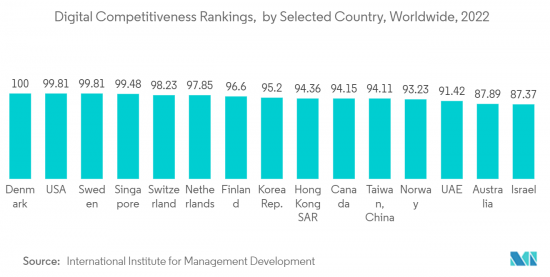

- 根据国际管理髮展研究所的数据,截至 2022 年,丹麦被评为全球最具数位竞争力的国家。数位竞争力排名旨在分析公司和政府组织采用和实施数位技术的能力。北欧多国排名靠前,其中瑞典、芬兰和挪威位居前15名。美国排名第二,被列为2021年最具竞争力的国家。数位化的大规模采用可能会为 5G 服务创造机会并增加 5G基地台的安装。

预计北美将占据很大的市场份额

- 美国由于5G部署投资率高,是5G基地台市场的主要创新者和投资者之一。该国的通讯业占全球 5G 技术消耗的很大一部分。美国在区域5G基地台台市场的投资、部署和应用方面也占据主导地位。 AT&T、Verizon和T-Mobile等美国通讯业者已与爱立信、三星、诺基亚、华为和中兴通讯等网路设备供应商签署了价值10亿美元的协议,在美国建设5G网路基础设施。

- 此外,2023 年 4 月,美国商务部长正式推出了一项 15 亿美元的公共无线供应链创新基金,该基金将用于建立开放和互通性的网路。透过展示无线网路新型开放架构技术的可行性,这一轮首轮融资将确保美国及其全球盟友和合作伙伴创造 5G 和下一代无线技术的未来。为了展示开放无线接取网路等新无线技术的可行性并消除其采用的障碍,NTIA 的第一个 NOFO 遵循这些流程的回馈,旨在改进和扩大测试。

- 此外,该国5G部署的蓬勃发展将增加对5G基地台的需求,以支援已部署的5G功能和服务。例如,爱立信预计,到2026年5G用户数将超过1.95亿,而在美国,到2029年5G将占美国行动市场总量的约71.5%。 CTIA表示,快速成长将为美国5G经济奠定基础。它将带来2,750亿美元的投资和300万个新就业岗位,带来5,000亿美元的经济成长。

- 加拿大已成为所研究市场的潜在市场。近年来,儘管境外外包持续不断且来自美国和东亚製造商的竞争加剧,5G 产业仍在不断扩张。 2022年,爱立信在加拿大最大规模的消费者调查结果已经发布。爱立信是加拿大领先的5G网路服务供应商。资料显示,加拿大有400万智慧型手机用户打算在12至15个月内升级到5G服务。从2020年开始,加拿大的智慧型手机用户已经可以连接5G网路。爱立信消费者实验室进行了「5G:下一波」研究。据介绍,近两年5G用户数成长了6倍。此外,已经拥有 5G 的加拿大人中有十分之八表示他们不想回到 4G。儘管 75% 的加拿大人可以使用 5G,但只有三分之一的 5G 用户认为自己与 5G 的联繫更紧密。

- 此外,政府协助该国发展无线连线预计将提振对 5G基地台的需求。例如,2023 年 5 月,加拿大政府宣布了一个新框架,以增强连接性和创新 5G 应用。创新、科学和工业部长宣布的一项新许可政策将使网路服务供应商、创新公司以及农村、偏远和原住民社区更容易获得 5G 本地频率。

5G基地台行业概况

全球5G基地台市场适度整合,市场参与企业包括华为科技公司、中兴通讯公司、诺基亚公司、康普控股公司和高通技术公司。公司持续投资于策略合作伙伴关係和产品开拓,以大幅提高市场占有率。以下是一些最近的市场开拓:

2023年6月,华为技术有限公司赢得了一份重要合同,将在2023年至2024年期间向通讯业者中国移动供应一半以上的5G基地台。合约分为两个计划,第一个项目涵盖2.6GHz至4.9GHz频段的63,800个基地台,第二个项目涵盖700MHz频段的23,141个基地台。据估计,华为已获得 45,426 个 5G基地台,价值估计为 41 亿元人民币(5.74 亿美元)。

2023 年 2 月,第 1 层 5G IP 专家 AccelerComm 和英国技术和产品开发公司 TTP 宣布推出高效能 5G LEO(低地球轨道)再生系统,用于部署在 LEO(低地球轨道)上地球轨道卫星)宣布正在开发基地台。该计划融合了两家公司的专业知识和智慧财产权以及合作伙伴的额外技术,创建了一个专门专用5G 的再生 gNodeB 解决方案,旨在提案复杂的非地面网路(NTN) 环境中的高效能5G 服务。 。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 买方议价能力

- 供应商的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- COVID-19 市场影响评估

第五章市场动态

- 市场驱动因素

- 提高智慧型手机普及

- 5G 相对于领先技术的主要优势

- 市场挑战

- 设计和营运挑战

- 市场机会

- 持续努力在新兴国家引入5G

第六章市场区隔

- 按类型

- 小型基地台

- 宏蜂巢

- 按最终用户

- 商业的

- 住宅

- 工业的

- 政府机关

- 智慧城市

- 其他最终用户

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东/非洲

第七章 竞争环境

- 公司简介

- Huawei Technologies Co., Ltd.

- ZTE Corporation

- Nokia Corporation

- CommScope Holding Company, Inc.

- Qualcomm Technologies, Inc

- Qorvo inc

- Alpha networks inc

- NEC Corporation

- Telefonaktiebolaget LM Ericsson

- Samsung Group

第八章投资分析

第九章 市场未来展望

The global 5G base station market was valued at USD 41.12 billion in the current year. It is expected to reach USD 141.35 billion by the end of the forecasted year, registering a CAGR of 28.01% during the forecast period.

Key Highlights

- Because of the rising need for high-speed data with lower latency, the 5G base station market is likely to evolve significantly throughout the studied period. Furthermore, the growth of the 5G Internet of Things ecosystem and robust communication services is anticipated to provide lucrative prospects for the 5G base station market to develop. Furthermore, one of the primary reasons propelling market expansion is the growing trend to employ networked devices.

- A majority of the 5G networks are feasible to be composed of small cells. Small cells are critical to the functionality of 5G networks because they provide the improved data capacity that 5G demands. They also enable providers to reduce costs by eliminating expensive rooftop systems and installation costs, and they are expected to allow improvements in the performance and battery life of mobile handsets. In today's environment, small cells are required for applications needing increased bandwidth and the increasing number of connected devices. For instance, according to Cisco Systems Inc., 500 billion devices will be connected to the internet by 2030. Moreover, 5G telecom operators are focused on deploying small cells under a low-frequency band to provide enhanced bandwidth services to the customer.

- Further, according to Ericsson, 5G subscriptions are expected to increase globally between 2022 and 2023, rising from over 0.55 billion to over 1.67 billion. Further, According to GSMA, The usage of 5G in GCC states will be slightly higher (16% customer 5G adoption) than the global average (15%) by 2025, mainly driven by governments and mobile operators with the support of mobile technology partners. Moreover, the number of 5G subscriptions is expected to reach 129.62 million in the Middle East and North African regions. Such a huge rise in 5g subscriptions would drive the market.

- According to the Ministry of Industry and Information Technology China, At the end of 2022, the number of 5G base stations in China amounted to 2.31 million. With extensive infrastructure investments and ambitious rollout plans, China has achieved significant 5G coverage. According to estimates, the number of base stations is expected to reach over six million by 2024. Further, according to the Ministry of Internal Affairs and Communications (Japan), More than 45 million 5G subscriptions were estimated in Japan as of 2022. The domestic rollout of 5G networks by Japan's major mobile carriers KDDI, SoftBank, NTT Docomo, and Rakuten Mobile started a few years back with an initial focus on urban areas. The Japanese government intends to reach a coverage of 95% of the population by March 2024.

- Moreover, several authorities are focusing on addressing the spectrum challenges and reducing the cost barriers associated with deploying 5G infrastructure. For instance, in July 2023, the draft requirements for the radio frequency auction that will enable the deployment of 5G throughout the nation were issued by Sutel, the Costa Rican telecom authority. The implementation of infrastructure is given priority above collecting fees for spectrum rights in the current plan, in contrast to earlier auctions. This indicates that no further contributions will be made to the Fonatel Telecommunications Development Fund. These initiatives align with the challenges posed by high initial capital expenditure and contribute to overcoming the restraints associated with deploying 5G networks.

- During the Covid pandemic, it was expected that 5G, at least in its earliest version, would see mobile network operators (MNOs) globally launch deployment widely within their networks in both urban and rural areas, taking considerable advantage of the move by telecom regulators to free up spectrum in few frequency bands. Then the COVID-19 pandemic hit worldwide, causing significant supply chain interruptions that slowed down the expanded rollout of 5G at the beginning of covid.

5G Base Station Market Trends

Smart Cities are Expected to Drive the Market

- Globally, smart cities are growing as urbanization picks up speed. According to the United Nations, India (404 million), China (292 million), and Nigeria will each have an extra 212 million urban dwellers by the year 2050. The highest pace of urbanization in the globe is observed in the emerging continent of Latin America.

- Further, Globally, many smart city projects and efforts are being implemented, encouraging global investments owing to urbanization. The Organization for Economic Co-operation and Development (OECD) predicts that between 2010 and 2030, worldwide investments in smart city endeavors will total around USD 1.8 trillion for all metropolitan city infrastructure projects. Such developments towards smart cities are expected to raise the demand for the 5G base stations to provide uninterrupted services to its customers.

- In a 5G-enabled Smart City, detecting an emergency can start several emergency response procedures, such as a quicker dispatch of first responders, medical teams, and firefighters to the disaster scene. The device may also automatically close fire shutters and switch on fire sprinklers when appropriate when a fire is detected. Building sensors can also detect fires, sending an alarm to the building's management system and instructing the actuators to act. Fire sprinklers are activated 1 to 2 seconds after a fire is detected because of 5G's faster response times.

- In June 2022, At Critical Communications World Conference, Motorola Solutions launched several solutions to demonstrate how its mission-critical, integrated ecosystem of technologies is assisting the public safety industry in overcoming some of its most difficult and unforeseen challenges. While rapidly evolving technologies and user needs to continue to drive the need for modernization, public safety and military organizations must be prepared to handle any situation. This includes cross-border communication in significant emergencies, identifying threats with artificial intelligence (AI), and deploying cloud solutions for remote operations.

- The players in the market are developing new 5G solutions to capture the smart cities market, which would proportionately increase the demand for the 5G base stations. For instance, in December 2022, a strategic alliance was established between, Dubai Integrated Economic Zones Authority (DIEZ) and Derq to provide advanced capabilities and competitive smart city solutions to DIEZ's Freezones. Top representatives and employees from both parties attended a signing ceremony to mark the partnership. With the new partnership, a 5G MEC server or platform from the Khazna Data Centre will enable DIEZ to demonstrate smart city solutions powered by 5G communication and edge computing technologies.

- According to International Institute for Management Development, as of 2022, Denmark ranked as the most digitally competitive country in the world. Digital competitiveness rankings aim to analyze a country's ability to adopt and implement digital technologies within enterprises and government organizations. Many Nordic countries ranked high, with Sweden, Finland, and Norway in the top fifteen. The United States was ranked second, listed as the most competitive country in 2021. Such huge adoption of digitalization would create an opportunity for the 5G services, which would increase the installation of 5G base stations.

North America is Expected to Hold Significant Share of the Market

- The United States is one of the major innovators and investors in the 5G Base station market, owing to a high investment rate for 5G deployment. The telecom industry in the country accounts for a significant portion of the global consumption of 5G technology. Also, the United States dominates the regional 5G base station market regarding investment, adoption, and applications. Telecom operators in the country, such as AT&T, Verizon, and T-Mobile, have made billion-dollar deals with network equipment vendors, such as Ericsson, Samsung, Nokia, Huawei, and ZTE, to build up their 5G network infrastructure in the United St.

- Moreover, in April 2023, The US Secretary of Commerce officially launched a USD 1.5 billion public wireless supply chain innovation fund, which will be used to build Open and Interoperability networks. By demonstrating the viability of new, open-architecture techniques for wireless networks, this initial budget round will ensure that the United States and its global allies and partners will produce the future of 5G and next-gen wireless technology. To demonstrate the feasibility of new wireless technologies, such as Open Radio Access Networks, with a view to removing barriers to their adoption, NTIA's first NOFO will seek to improve and extend tests in accordance with feedback received from these processes.

- Further, the booming 5G deployments in the country will increase the demand for 5g base stations to support the 5G features and services being rolled out. For instance, according to Ericsson, there will be more than 195 million 5G subscriptions by 2026, and by 2029, in the United States, 5G will account for about 71.5% of the entire US mobile market. According to CTIA, rapid growth creates a platform for the US's 5G economy. It will lead to USD 275 billion in investment and 3 million new jobs, creating USD 500 billion in economic growth.

- Canada is emerging as a potential market for the studied market. Over the past few years, the 5G industry has expanded, despite continued offshoring and greater competition from the US and East Asian manufacturers. In 2022, The Canadian findings from Ericsson's largest consumer survey have been made public. Ericsson is a key provider of 5G network services in Canada. According to the data, four million Canadian smartphone users intend to upgrade to 5G service in 12 to 15 months. Since 2020, Canadian smartphone users have had access to 5G networks. Ericsson's Consumer Lab performed the 5G: The Next Wave study. It demonstrates that the number of 5G users has multiplied by six over the previous two years. Additionally, eight out of ten Canadians already using 5G said they would not want to return to 4G. Only a third of 5G users believe they are linked to 5G more, despite 75% of Canadians having access to 5G.

- In addition, the government aid in developing wireless connectivity in the nation is analyzed to boost the 5G base station demand. For instance, in May 2023, the Government of Canada launched A new framework to enhance connectivity and innovative 5G applications. A new licensing policy has been announced by the Minister of Innovation, Science and Industry that will make access to the local spectrum in 5G easier for internet service operators, innovation companies, as well as rural, frontier, or indigenous communities.

5G Base Station Industry Overview

The global 5G base station market is moderately consolidated with the presence of several players like Huawei Technologies Co., Ltd., ZTE Corporation, Nokia Corporation, CommScope Holding Company, Inc., Qualcomm Technologies, Inc., etc. The companies continuously invest in strategic partnerships and product developments to gain substantial market share. Some of the recent developments in the market are:

In June 2023, Huawei Technologies secured a significant contract that will supply over half of the 5G base stations for telco China Mobile between 2023 and 2024. The contracts have been split into two projects, with the first covering 63,800 base stations using the 2.6G Hz to 4.9 GHz spectrum, while the second covers 23,141 in the 700 MHz band. Huawei is estimated to have secured 45,426 5G base stations worth an estimated 4.1 billion yuan (USD574 million).

In February 2023, AccelerComm, the Layer 1 5G IP specialists, and TTP, an technology and product development firm based in the United Kingdom, announced they are developing a high-performance 5G LEO (low-earth orbit satellites) Regenerative - base station for deployment on LEO (low-earth orbit satellites). The project incorporates expertise and IP from the two companies and additional technology from partners to propose a dedicated 5G regenerative gNodeB solution tailored to support high-performance 5G services in a Non-Terrestrial Network (NTN) complex environment.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Buyers

- 4.2.2 Bargaining Power of Suppliers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increase in Penetration Rate of Smartphones

- 5.1.2 Key benefits offered by 5G over its predecessors

- 5.2 Market Challenges

- 5.2.1 Design & Operational Challenges

- 5.3 Market Opportunities

- 5.3.1 Ongoing efforts towards introduction of 5G in emerging countries

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Small Cell

- 6.1.2 Macro Cell

- 6.2 By End-User

- 6.2.1 Commercial

- 6.2.2 Residential

- 6.2.3 Industrial

- 6.2.4 Government

- 6.2.5 Smart Cities

- 6.2.6 Other End-Users

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East and Africa

7 COMPETETIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Huawei Technologies Co., Ltd.

- 7.1.2 ZTE Corporation

- 7.1.3 Nokia Corporation

- 7.1.4 CommScope Holding Company, Inc.

- 7.1.5 Qualcomm Technologies, Inc

- 7.1.6 Qorvo inc

- 7.1.7 Alpha networks inc

- 7.1.8 NEC Corporation

- 7.1.9 Telefonaktiebolaget LM Ericsson

- 7.1.10 Samsung Group