|

市场调查报告书

商品编码

1408237

语音合成:市场占有率分析、产业趋势与统计、2024年至2029年成长预测Text-to-Speech - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

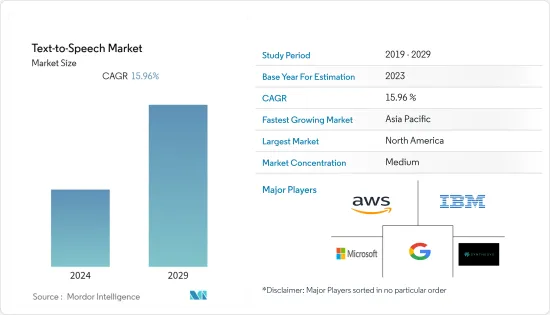

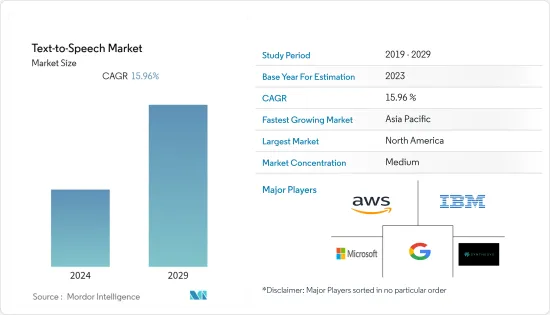

语音合成市场在基准年的估值为 29.5 亿美元,预计在未来五年内将以 15.96% 的复合年增长率增长至 66.5 亿美元。

主要亮点

- 语音合成解决方案透过将文字转换为语音格式,使有语言和阅读障碍(例如视觉障碍和阅读障碍)的人更容易进行交流,从而支持市场成长。

- 这些解决方案能够提供多语言音讯输出,以增强您的沟通能力并帮助您的公司在全球扩张。例如,企业可以实施将书面内容转换为多种口语的解决方案,从而更轻鬆地与世界各地的客户和员工进行沟通。此外,文字转语音解决方案使您的业务更容易被更多人接受,并提供地区口音和方言,提高客户参与度并加速文字转语音解决方案的市场采用。

- 语音合成解决方案还可用于教育技术,让教师在课堂、LMS、网路研讨会和数位学习中实施它们,以改善学生的整体学习体验,并帮助听觉学习者更好地记住资讯。我是。此外,像 Speechify 这样的新兴市场供应商已经开发了解决方案,提供可支援多种不同语言的文字转语音工具,并提供大量自订选项,可以为有困难的读者客製化声音。

- 语音合成解决方案在医疗保健领域的广泛应用可提高医学教育和研究的效率,这正在推动预测期内的市场采用。例如,2023 年2 月,全球领先的心肺復苏(CPR) 模型和其他救生技术、医疗培训和资源医疗提供者挪度医疗(Laerdal Medical) 宣布,其目标是到2030 年每年挽救100 万人的生命。投资人工智慧和机器学习,包括 Azure 文字转语音。 Laerdal 为医学生和提供者提供的 3D 虚拟训练模拟器将使用 Azure AI 文字转语音技术来提供模拟现实生活中患者与提供者互动的身临其境型体验。

- 然而,文字转语音 (TTS) 最常见的问题之一是语音听起来机械且不自然。这可能会给听众带来不吸引人的体验,因为该解决方案缺乏模仿自然人类语调和语气的能力。

- COVID-19 大流行加速了市场的采用,因为它可以帮助客户透过线上媒体更有效地学习。 TTS 解决方案供应商 Readspeaker 还发现,由于 COVID-19 大流行期间各种远距学习技术的出现,仅在学术环境中文字转语音的使用量就增加了 32%,并且在疫情后也有所增加。大流行时期也是如此。

语音合成市场趋势

对多语言音讯和影片内容的需求正在推动市场发展

- 语音合成解决方案可以将文字转换为跨语言的语音,使企业能够最大限度地减少语言障碍,提高可访问性,并透过有效的全球参与开拓新的商机。这为他们提供了与全球受众沟通的工具,并在预测期间推动市场发展时期。

- 国际商务中多语言语音合成的主要好处之一是改善与客户的沟通。企业可以利用基于AI技术的语音合成器,轻鬆将文字转换为多种语言的自然语音,为不同语言背景的客户提供更个人化的体验,我们正在推动大小企业的市场导入。

- 此外,透过将公司的客户服务入口网站或互动式语音应答(IVR) 与基于多语言特征的语音合成解决方案集成,它可以了解并有效回应客户需求,从而实现全球覆盖。它可以为他们所在的公司建立信任,提高客户满意度和客户维繫。

- 电子学习平台的多语言内容对于容纳世界各地的学生来说是必要的,这些解决方案可以将文本转换为语音,因此学生可以使用多种语言和方言的内容。电子学习平台在世界各地教育系统中的主流化正在推动市场成长。

- 例如,到 2022 年 9 月,使用电子学习平台 Moodle 的学生将能够透过整合 ReadSpeaker 的数位音讯和文字转语音工具来收听 50 多种语言的学习内容,ReadSpeaker 已成为经过认证的Moodle 的整合合作伙伴. .

北美地区占据主要市场占有率

- 透过将 TTS 解决方案整合到他们的电子学习平台中,该地区的教育工作者可以透过基于音讯的内容来提高学习课程的成效,帮助学习者参与学习并获得新技能。这是因为它可以有效支持

- 例如,2023 年 2 月,美国语言学习应用程式 Duolingo 与 Microsoft 合作开发文字转语音解决方案,创建独特的文字转语音声音,从而利用人工智慧 (AI) 来增强学习者体验。我们进行了改进,使每节课对学习者来说都更有吸引力。

- 文字转语音解决方案可用于快速且经济高效地创建音讯。 TTS 允许出版商将书面书籍转换为音讯格式,无需人工解说员,从而节省时间和成本,同时为消费者提供聆听体验。在北美音讯市场扩张的支撑下,这正在为北美市场创造机会。

- 例如,2022年9月,Spotify在其串流媒体服务上推出了音讯,为客户提供了音乐和播客之外的第三种音讯内容。最初,音讯是向美国用户提供的,可访问超过 300,000 种图书,音讯在美国市场的趋势是由于用于转换文本内容的应用程序的文本转语音软体和服务的日益普及进入演讲。我认为这会创造需求。

- 此外,美国公司正在使用 TTS 解决方案透过人工智慧解说员来增强行销力度,使他们能够快速轻鬆地创建引人入胜的影片、广告和其他行销内容。例如,行销公司 Oberelo 表示,到 2023 年,美国每个网路用户的人均数位广告支出预计将达到 869 美元,比 2022 年成长 9.5%。

语音合成产业概况

语音合成市场适度分散,因为 IBM 公司、亚马逊网路服务公司、谷歌有限责任公司和微软公司等许多全球公司贡献了整体市场份额。语音合成市场的供应商越来越注重透过创新、协作和研发投资来提供增强的解决方案,以在预测期内提高其在市场上的影响力。

2022 年10 月,IBM 公司宣布了三项新创新,旨在帮助IBM 生态系统中的合作伙伴、客户和开发人员更轻鬆、快速且经济高效地建立人工智慧驱动的解决方案并将其推向市场。我们计划扩展我们的嵌入式产品组合透过发布库来实现人工智慧软体。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 买方议价能力

- 供应商的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

- 产业价值链分析

- COVID-19 市场影响评估

第五章市场动态

- 市场驱动因素

- 对多语言音讯/影像内容的需求

- 电子学习在教育领域的主流化

- 市场抑制因素

- 适应人类语音细微差别的技术的局限性

- 缺乏支援语音合成API的软体

第六章市场区隔

- 按成分

- 软体

- 按服务

- 依实施型态

- 云端基础

- 本地

- 按语言

- 英语

- 西班牙语

- 印地语

- 中国人

- 其他语言

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东/非洲

第七章 竞争形势

- 公司简介

- Synthesys.io

- Amazon Web Services, Inc

- IBM Corporation

- Google LLC

- Microsoft Corporation

- ReadSpeaker BV

- Nine Thirty-Five LLC(Fliki)

- Murf AI

- Speechify Inc

- LOVO AI

第八章投资分析

第九章 市场机会及未来趋势

The text-to-speech market is valued at USD 2.95 billion in the base year and is expected to grow at a CAGR of 15.96% during the forecast period to become USD 6.65 billion by the next five years.

Key Highlights

- Text-to-speech solutions make communication more accessible to people with speech or reading disabilities, such as visual impairments, dyslexia, or other difficulties, by converting text into audio format, supporting the market growth.

- These solutions have the feature of providing multiple language audio output, helping businesses to expand globally by increasing their communication ability. For instance, companies can implement solutions to convert their written content into many spoken languages, making communicating with customers and employees worldwide easier. In addition, the text-to-speech solution can make businesses more accessible to a broader audience and even deliver regional accents and dialects for better customer engagement, driving the market adoption of speech-to-text solutions.

- Text-to-speech solutions can be used for educational technology, and teachers have been implementing them in their classes, LMS, webinars, and e-learning, to improve students' overall learning experience and help auditory learners retain information better. Additionally, market vendors, such as Speechify, have developed a solution to provide text-to-speech tools that work in numerous different languages, and there are plenty of customization options for struggling readers to adjust the sound, which is helping the market growth because implementing the solution the e-learning platform can generate audible content with ease.

- The broad application of text-to-speech solutions in healthcare to increase the efficiencies of medical education and research is fueling the adoption of the market during the forecast period. For instance, in February 2023, Laerdal Medical, a world-leading healthcare provider of cardiopulmonary resuscitation (CPR) manikins and other lifesaving technology, medical training, and resources, has planned to invest in artificial intelligence and machine learning, including Azure Text to Speech, to help save 1 million lives annually by 2030. Laerdal's 3D virtual training simulator for healthcare students and providers would use Azure AI text-to-speech to provide an immersive experience that simulates the real-life interactions between patients and providers.

- However, one of the most common issues with text-to-speech (TTS) is that the voices sound robotic and unnatural, which may not be an engaging experience for listeners due to the solutions' lack of the ability to mimic the natural inflection and tonality of human speech, which can be a market challenge because by delivering a same pitch for all texts, it can create a gap in the communications.

- The Covid-19 pandemic fueled market adoption due to its application in enabling customers to learn more efficiently through online mediums, which was raised during the Covid-19 pandemic. In addition, Readspeaker, a provider of TTS solutions, stated that there was a 32 percent increase in text-to-speech usage in academic environments alone during the Covid-19 pandemic due to the emergence of various distance learning techniques during the period, which grew in the post-pandemic period as well.

Text-to-Speech Market Trends

The Need for Multilingual Audio and Video Content is Driving the Market

- Text-to-speech solutions can convert text into speech across languages, giving businesses a tool to communicate with global audiences by minimizing language barriers, enhancing accessibility, and opening up new business opportunities from effective global engagement, driving the market during the forecast period.

- One of the primary benefits of multilanguage text-to-speech for international businesses is improved customer communication. Companies can easily convert text into natural-sounding speech using AI technology-based voice synthesizers across many languages to provide more personalized experiences to customers from different linguistic backgrounds, driving market adoption in small and large enterprises.

- Additionally, companies' customer service portals and interactive voice response (IVR) can be integrated with multilingual feature-based text-to-speech solutions to understand and address customers' needs effectively, creating trust in the companies operating on a global scale and improving customer satisfaction and retention.

- The need for multilanguage content for e-learning platform to cater to students worldwide fuel the adoption of the market because these solutions can convert text to audio, allowing students to engage with content in many languages and dialects, driving the market growth supported by the mainstreaming of E-learning platform in the educational system worldwide.

- For instance, in September 2022, students using the E-learning platform Moodle can listen to learning content in more than 50 languages due to the integration of digital voice and text-to-speech tools from ReadSpeaker, which became a certified integration partner with Moodle to provide TTS solutions to the e-learning platform for its 200 million learners worldwide.

The North America Region is Registering a Significant Market Share

- The growth of E-learning platforms in the North American region, including the USA and Canada, supported by their high percentage of tech-savvy populations, is creating an opportunity for the market because integrating TTS solutions in E-learning platforms, educators in the region can make learning sessions more productive through audio-based content, helping the learners to improve engagement and learning of new skills effectively.

- For instance, in February 2023, Duolingo, an American language-learning app, used artificial intelligence (AI) to enhance the learner experience by partnering with Microsoft for its Text-to-speech solutions in creating unique text-to-speech voices, making every lesson more engaging for the learner, which shows the market potential of the TTS solutions in the North American Market.

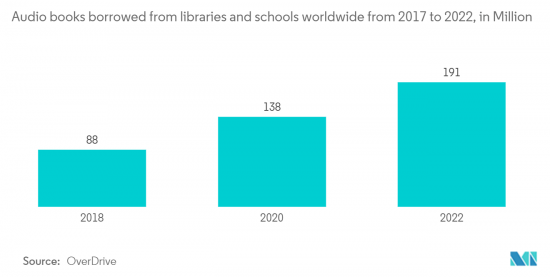

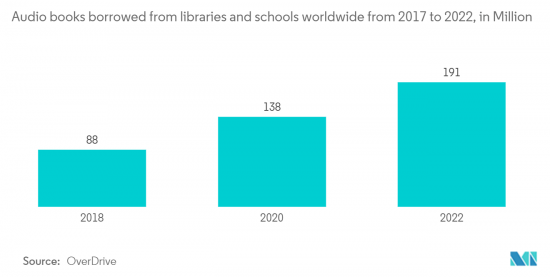

- Text-to-speech solutions can be used to create audiobooks quickly and cost-effectively. With TTS, publishers can convert written books into audio format without the need for a human narrator, which can save both time and money while still providing a listening experience for consumers, creating an opportunity for the market in North America supported by the market expansion of audiobooks in the USA.

- For instance, in September 2022, Spotify launched audiobooks on its streaming service, offering a third type of audio content for its customers beyond music and podcasts. Initially, audiobooks would be made available to U.S. users who can access over 300,000 titles, and this trend of audiobooks in the American market would create a demand for text-to-speech software and services due to their application in converting text-based content to audio.

- Additionally, American businesses are using TTS solutions to enhance marketing efforts through AI narrators and can create engaging videos, commercials, and other marketing content quickly and easily, which is gaining traction due to the increasing advertising spending per person in the USA. For instance, Oberelo, a marketing company, has stated that US digital ad spending per person is expected to reach USD 869 per internet user in 2023, a 9.5% increase from 2022.

Text-to-Speech Industry Overview

Text-to-Speech Market is moderately fragmented due to the presence of many global companies, such as IBM Corporation, Amazon Web Services Inc, Google LLC, and Microsoft Corporation, which have contributed to the overall market share. Text-to-Speech Market vendors increasingly focus on delivering enhanced solutions through innovations, collaborations, and investment in R&D to increase their market presence during the forecast period.

In October 2022, IBM Corporation planned to expand its embeddable AI software portfolio by releasing three new libraries designed to help IBM Ecosystem partners, clients, and developers more easily, quickly, and cost-effectively build their AI-powered solutions and bring them to market, which includes the building of natural language processing, speech to text, and text to speech capabilities into applications across any hybrid, multi-cloud environment.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Buyers

- 4.2.2 Bargaining Power of Suppliers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 The Need for Multilingual Audio and Video Content

- 5.1.2 The Mainstreaming of E-Learning Method in the Education Sector

- 5.2 Market Restraints

- 5.2.1 Technology Limitations in Matching the Nuances of Human Speech

- 5.2.2 Lack of Software Supporting Text-to-Speech API

6 MARKET SEGMENTATION

- 6.1 By Component

- 6.1.1 Software

- 6.1.2 Services

- 6.2 By Deployment Mode

- 6.2.1 Cloud-Based

- 6.2.2 On-Premise

- 6.3 By Language

- 6.3.1 English

- 6.3.2 Spanish

- 6.3.3 Hindi

- 6.3.4 Chinese

- 6.3.5 Other Languages

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia-pacific

- 6.4.4 Latin America

- 6.4.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Synthesys.io

- 7.1.2 Amazon Web Services, Inc

- 7.1.3 IBM Corporation

- 7.1.4 Google LLC

- 7.1.5 Microsoft Corporation

- 7.1.6 ReadSpeaker B.V

- 7.1.7 Nine Thirty-Five LLC (Fliki)

- 7.1.8 Murf AI

- 7.1.9 Speechify Inc

- 7.1.10 LOVO AI