|

市场调查报告书

商品编码

1408261

药筒:市场占有率分析、产业趋势与统计、2024-2029 年成长预测Pharmaceutical Cartridges - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

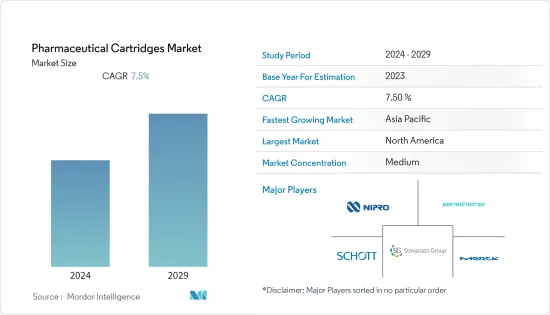

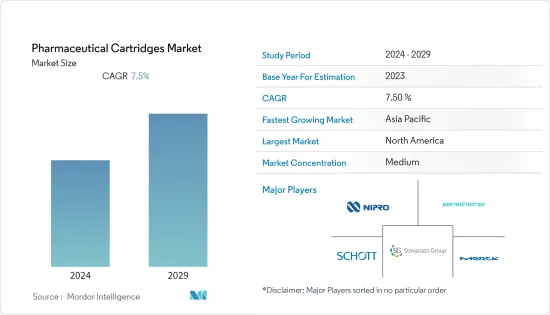

预计在预测期内,药筒市场将以 7.5% 的复合年增长率大幅成长。

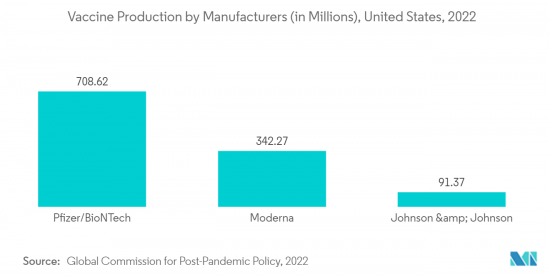

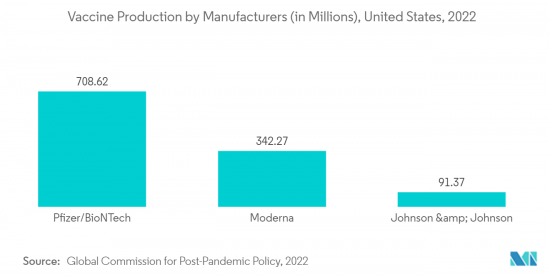

由于药筒生产和分销的中断,COVID-19 大流行在最初阶段扰乱了药筒市场。然而,疫情也创造了对药筒的巨大需求,并导致对各种药品、疫苗和其他基本药物的需求激增。例如,截至 2022 年 4 月,全球总合给药了114 亿剂 COVID-19 疫苗。美国、中国、印度、德国和英国等具备疫苗生产能力的国家每100人给药超过100剂疫苗。此外,2021年将供应约160亿剂(相当于1,410亿美元)疫苗,约2019年供应量的3.5倍。由此可见,疫苗的庞大需求对药筒市场产生了正面影响。

推动药筒市场成长的关键因素是製药业研发(R&D)支出的增加、药物输送设备的技术发展以及慢性病盛行率的增加。例如,据 SHL Medical 称,到 2022 年,将开发一种称为针隔离技术 (NIT) 的创新方法来解决药筒注射器的问题。使用NIT,针头隐藏在註射器内,因此无需手动插入针头。使用 NIT,使用者只需在註射前取下盖子并插入针头,即可打开流体途径并自动灌註註射器。此类产品的进步将有助于药筒市场的成长。

然而,新药的开发创造了对药筒产品的需求。例如,根据国际药品製造商联合会的报告,2022年将有64种新活性物质(NAS)在全球上市,目前有超过6,147种产品正处于从第一阶段到核准备案的积极开发中。目前,所有治疗领域正在开发的药物超过 9,000 种,疫苗有 260 种。此类新药的开发可能会在预测期内创造对药筒的需求。

然而,与材料相关的挑战,例如运输过程中的损坏和破损,可能会阻碍药筒市场的成长。

药用墨盒市场趋势

预计玻璃材质在预测期内将占据主要市场占有率

预计在预测期内,玻璃材料领域的药筒市场将显着成长。这主要是由于对其卓越品质和比塑料更强的耐化学性的需求增加。这些墨盒具有最低的膨胀係数,并且具有很强的抗热衝击和抗应力能力。它能抵抗多种物质的损害,并且由于熔点高而洗脱率低。玻璃药筒与各种常用的给药笔和自动注射器相容,例如牙医的局部麻醉和糖尿病患者的胰岛素。

此外,玻璃药筒不可吸收且不可洗脱,这对于保持生物製药和敏感药品的纯度和效力以及提供长期的产品保护非常重要。医疗专业人员可以透过玻璃材质轻鬆检查给药、检查内容物以及检查是否有杂质。玻璃还具有化学惰性,不会与大多数药物物质发生反应。这使其成为保存和储存各种药品的安全可靠的材料,且不会影响功效和安全性。

此外,COVID-19 大流行增加了对注射药物的需求,增加了生物製药公司缩短上市时间的压力。因此,2021 年 6 月,SGD Pharma 宣布 20ml EasyLyo 模压玻璃 1 型管瓶现已以即用型形式提供给消费者。 SGD Pharma 是第一家提供工业规模注射用 RTU管瓶的玻璃模具製造商。此外,我们与 Stevanato Group 合作,首次推出了 EZ-fill Nest &Tub 的 20ml EasyLyo 玻璃模製 I 型管瓶。

预计北美将在预测期内主导市场

预计在预测期内,北美将主导药筒市场。市场的关键因素是高度发展的医疗基础设施和确保对製药业进行严格监管的权威。

对药品和精确给药系统的需求不断增长是该地区市场成长的主要驱动力。慢性病的流行、人口老化以及製药业新技术的采用和进步推动了对药品的高需求。例如,美国癌症协会报告称,癌症是美国第二大死因。此外,到 2023 年,每天可能会诊断出 195 万新癌症病例,相当于 5,370 例。因此,癌症很可能会增加对药品的需求,并进一步推动药筒市场的成长。

此外,主要企业增加加拿大和美国製药业的研发支出也促进了该地区的市场成长。例如,在美国,拜耳公司计划在2023年3月投资10亿美元用于药品研发。此外,2022年约有25家製药公司在研发方面投入大量资金。顶级投资者包括罗氏公司、默克公司、辉瑞公司、诺华公司和阿斯特捷利康公司。其中,罗氏2022年投资1,470万美元,较2021年大幅成长27.1%。辉瑞是全球製药业的领导者,2022 年研发支出为 114 亿美元。因此,研发支出的增加正在推动药品成长,这也将增强该地区的药筒需求。

因此,由于上述因素,该地区的药筒市场预计在预测期内将会成长。

医药墨盒产业概况

药筒市场的竞争是温和的。市场上的主要企业包括 Schott AG、Nipro Corporation、Stevanato Group、West Pharmaceutical Services, Inc、Gerresheimer AG 和 Merck KGaA。公司正在采取各种策略来加强其市场地位,包括产品发布、将产品和服务扩展到新的地区、併购以及建立新的合作伙伴关係和联盟。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 市场驱动因素

- 对易于使用和方便的药品包装解决方案的需求不断增长

- 医药业研发费用增加

- 市场抑制因素

- 药筒的製造复杂性和严格的法规遵从性

- 波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章市场区隔(以金额为准的市场规模 - 百万美元)

- 按材质

- 玻璃

- 类型1

- 2型

- 类型3

- 类型4

- 塑胶

- 聚对苯二甲酸Terephthalate(PET)

- 高密度聚苯乙烯(HDPE)

- 其他塑料

- 橡皮

- 玻璃

- 按容量

- 3ml以下

- 3~5ml

- 5~10ml

- 10ml以上

- 按治疗区域

- 眼科

- 呼吸系统

- 神经

- 肿瘤学

- 免疫学

- 循环系统

- 糖尿病学

- 牙科

- 其他治疗领域

- 按最终用户

- 製药公司

- 生技公司

- 其他最终用户

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 欧洲其他地区

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 其他亚太地区

- 中东/非洲

- 海湾合作委员会国家

- 南非

- 其他中东/非洲

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 北美洲

第六章 竞争形势

- 公司简介

- Merck KGaA

- Nipro Corporation

- Schott AG

- Stevanato Group

- West Pharmaceutical Services, Inc.

- Gerresheimer AG

- Datwyler Holding Inc.

- AptarGroup, Inc.

- Transcoject GmbH

- Shandong Province Medicinal Glass Co., Ltd.

- Kalbag Filters Pvt.

- Kel India Filters

第七章 市场机会及未来趋势

The Pharmaceutical Cartridges Market is expected to grow at a significant CAGR of 7.5% during the forecast period.

The COVID-19 pandemic has disrupted the pharmaceutical cartridges market in the initial phase due to the disruptions in the production and distribution of pharmaceutical cartridges. However, the pandemic has also led to a surge in demand for a wide range of drugs, vaccines, and other essential pharmaceuticals which created a huge demand for pharmaceutical cartridges. For instance, a total of 11.4 billion doses of COVID-19 vaccines have been administered globally as of April 2022. Countries with vaccine manufacturing capabilities such as the United States, China, India, Germany, and the United Kingdom have administered more than 100 vaccine doses per 100 people. Also, around 16 billion vaccine doses worth USD 141 billion were supplied in 2021 which is nearly 3.5 times of 2019. Thus, the huge demand for vaccines positively impacted the pharmaceutical cartridges market.

The key factors driving the growth of the pharmaceutical cartridges market are the increase in research & development (R&D) spending in the pharmaceutical industry, technological advancements in drug delivery devices, and the growing prevalence of chronic diseases. For instance, in 2022, according to SHL Medical an innovative method known as Needle Isolation Technology (NIT) is developed to address the problems with cartridge-based injection devices. Based on a pre-installed needle hidden inside the device, the technology eliminates the need for users to manually attach the needle. With NIT, users merely remove the cap to insert the needle prior to injection, allowing the fluid route to be opened and the injector to automatically prime. Such advancements in products will contribute to the growth of the pharmaceutical cartridge market.

However, the development of new drugs creates demand for pharmaceutical cartridges products. For instance, according to a report by the International Federation of Pharmaceutical Manufacturers and Associations, globally, 64 novel active substances (NAS) have been launched in 2022, while more than 6,147 products are currently in active development from Phase 1 to regulatory submission. There are currently more than 9,000 drugs in development across all therapeutic areas, along with 260 vaccines. Such developments of novel drugs are likely to create demand for pharmaceutical cartridges over the forecast period.

However, the challenges associated with material such as damage or breakage during transportation may hinder the growth of the pharmaceutical cartridges market.

Pharmaceutical Cartridges Market Trends

Glass Material is Expected to have Significant Market Share during the Forecast Period

The glass material segment is expected to witness significant growth in the pharmaceutical cartridges market over the forecast period. This is largely due to increased demand for their superior quality and stronger chemical resistance than plastics. These cartridges have the lowest coefficient of expansion and a high level of thermal shock and stress tolerance. It is resistant to damage from many substances and has less leaching due to characteristics such as a high melting point. Glass cartridges are compatible with a wide range of pens and auto-injectors that are often utilized for administering drugs, including local dental anesthesia and insulin for people with diabetes.

Also, there are several advantages of glass material over plastic that includes the non-absorbent and non-leaching nature of glass cartridges which is crucial for preserving the purity and effectiveness of biological & sensitive drugs and providing product protection over a period. It is easy for healthcare professionals to check the dosage, inspect the content and check for any impurities through glass material. Also, glass is chemically inert, and it does not react with most pharmaceutical substances. This makes it secure and dependable material for preserving and storing a wide range of drugs without compromising efficacy and safety.

Furthermore, the COVID-19 pandemic has increased the demand for parenteral drugs, which has increased the pressure on biopharmaceutical companies to reduce their time to market. Thus, in June 2021, SGD Pharma announced that 20ml EasyLyo molded glass Type 1 vials were available to consumers in a ready-to-use manner. SGD Pharma was the first manufacturer of molded glass to deliver RTU vials for injectable drugs on an industrial scale. Also, due to the company's collaboration with the Stevanato Group, it has also been the first to market 20ml EasyLyo molded glass Type I vials in EZ-fill Nest & Tub.

North America is Expected to Dominate the Market Over the Forecast Period

North America is expected to dominate the pharmaceutical cartridges market over the forecast period. The key factors contributing to the market are highly developed healthcare infrastructure, and well-established authorities ensuring stringent regulatory monitoring of the pharmaceutical industry.

The increasing demand for drugs & precise drug delivery systems is a major factor contributing to the market growth in the region. The high demand for drugs has been influenced by the prevalence of chronic diseases, the rising aging population, and the adoption of new technologies and advancements in the pharmaceutical industry. For instance, according to the American Cancer Society report, cancer is the second most prevalent cause of mortality in the United States. Also, 1.95 million new cases of cancer, which is equal to 5,370 cases every day are likely to be diagnosed in the country in 2023. Hence, cancer is increasing the demand for pharmaceutical drugs which is further likely to drive the growth of the pharmaceutical cartridges market.

Furthermore, the rising R&D expenditure in the pharmaceutical industry in Canada and the United States by the top key players are also driving market growth in the region. For instance, in March 2023, in the United States, Bayer AG planned to invest USD 1.0 billion in the research & development of drugs. Also, there were around 25 pharmaceutical companies that invested heavily in R&D in 2022. The top investors include Roche, Merck & Co., Pfizer, Novartis, and AstraZeneca. Among these players, Roche invested USD 14.7 million in 2022, a significant increase of 27.1% from 2021. Pfizer, a global leader in pharmaceuticals, spent USD 11.4 billion on R&D in 2022. Thus, the increasing R&D expenses are driving the growth of pharmaceutical drugs which would also strengthen the demand for cartridges in the region.

Therefore, due to the factors mentioned above, the pharmaceutical cartridges market is expected to grow in the region over the forecast period.

Pharmaceutical Cartridges Industry Overview

The pharmaceutical cartridges market is moderately competitive. Some of the key players operating in the market include Schott AG, Nipro Corporation, Stevanato Group, West Pharmaceutical Services, Inc, Gerresheimer AG, and Merck KGaA. Companies are adopting various strategies such as product launches, expansion of the products and services into new regions, mergers & acquisitions, and entering new partnerships and collaborations to strengthen their position in the market.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Demand for Easy to Use and Convenient Pharmaceutical Packaging Solutions

- 4.2.2 Increase in R&D Spending in the Pharmaceutical Industry

- 4.3 Market Restraints

- 4.3.1 Manufacturing Complexity and Stringent Regulatory Compliance Related to Pharmaceutical Cartridges

- 4.4 Porter's Five Force Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - USD million)

- 5.1 By Material

- 5.1.1 Glass

- 5.1.1.1 Type 1

- 5.1.1.2 Type 2

- 5.1.1.3 Type 3

- 5.1.1.4 Type 4

- 5.1.2 Plastic

- 5.1.2.1 Polyethylene Terephthalate (PET)

- 5.1.2.2 High-Density Polyethylene (HDPE)

- 5.1.2.3 Other Plastic Material

- 5.1.3 Rubber

- 5.1.1 Glass

- 5.2 By Capacity

- 5.2.1 Less than 3ml

- 5.2.2 3ml-5ml

- 5.2.3 5ml-10ml

- 5.2.4 More than 10 ml

- 5.3 By Therapeutic Area

- 5.3.1 Ophthalmology

- 5.3.2 Respiratory

- 5.3.3 Neurology

- 5.3.4 Oncology

- 5.3.5 Immunology

- 5.3.6 Cardiology

- 5.3.7 Diabetes

- 5.3.8 Dental

- 5.3.9 Other Therapeutic Area

- 5.4 By End User

- 5.4.1 Pharmaceutical Companies

- 5.4.2 Biotechnology Companies

- 5.4.3 Other End Users

- 5.5 Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East and Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East and Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Merck KGaA

- 6.1.2 Nipro Corporation

- 6.1.3 Schott AG

- 6.1.4 Stevanato Group

- 6.1.5 West Pharmaceutical Services, Inc.

- 6.1.6 Gerresheimer AG

- 6.1.7 Datwyler Holding Inc.

- 6.1.8 AptarGroup, Inc.

- 6.1.9 Transcoject GmbH

- 6.1.10 Shandong Province Medicinal Glass Co., Ltd.

- 6.1.11 Kalbag Filters Pvt.

- 6.1.12 Kel India Filters

![药筒市场- 按组件(柱塞、小瓶[玻璃、塑胶]、密封件)、类型(双室、大容量)、容量、使用设备(笔式註射器、自动注射器、穿戴式註射器)、应用、最终用户- 全球2024 - 2032 年预测](/sample/img/cover/42/default_cover_gmi.png)