|

市场调查报告书

商品编码

1408269

亚磷酰胺 - 2024 年至 2029 年市场占有率分析、产业趋势与统计、成长预测Phosphoramidite - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

亚磷酰胺市场预计在预测期内复合年增长率为 7.4%

主要亮点

- 当COVID-19大流行开始时,SARS-CoV-2病毒的感染率不断上升,导致世界各地大多数公司和研究活动停止,导致市场上出现了对亚磷酰胺等基因合成剂的研究。减少了。然而,基因合成仪在基于 mRNA 的 COVID-19 疫苗的研发中发挥了关键作用,最终增加了市场对亚磷酰胺的需求。例如,2022 年 1 月,食品药物管理局第二次核准了 Moderna 的基于 mRNA 的 COVID-19 疫苗 Spikevax。因此,这些发展增加了大流行期间对亚磷酰胺的需求。

- 亚磷酰胺市场的成长要素包括合成核苷酸在治疗学中的应用不断增加、合成生物学的增长以及用于治疗各种慢性疾病的药物。此外,由于合成生物学具有广泛的应用范围,因此世界各国政府都提供研究支援。例如,2022年9月,新南威尔斯州政府宣布将投资超过600万美元用于新的合成生物学和生物製造开发项目,增加澳大利亚威尔斯州各地的製造和生产设施及设备。 。

- 此外,产品上市和核准的增加预计将增加对亚磷酰胺合成的需求,推动市场成长。例如,2021年6月,DNAScript推出了Syntax平台和Syntax System,这是一款配备酵素DNA合成(EDS)技术的桌上型核酸印表机。语法系统的建构长度可达 60 个核苷酸,无需额外处理即可在基因组工作流程和分子生物学中使用。该系统允许以创纪录的速度按需列印 DNA 寡核苷酸,消除了外包亚磷酰胺合成服务可能出现的延迟和缺货情况。预计此类案例将在预测期内推动市场成长。

- 然而,长核苷酸序列开发方面的挑战预计将阻碍市场成长。

亚磷酰胺市场趋势

DNA 亚磷酰胺预计将在预测期内增长

- 亚磷酰胺是现代 DNA 合成中使用的标准化学修饰核苷。这些分子能够透过极其简单且高效的循环反应在 DNA 链顺序中付加新碱基。

- 次世代定序仪技术在生物标记发现、肿瘤学研究和个人化医疗等多种应用中的使用越来越多,是推动市场成长的关键因素。例如,次世代定序技术的迅速出现正在彻底改变基因组学和医学诊断领域,用基于综合征的面板测序、诊断EXOME测序 (DES) 和基因组序列取代传统的逐基因方法模型。 (DGS)并改为精确模型。根据美国疾病管制与预防中心 (CDC) 的数据,随着各国率先对大量人口进行定序,到 2021 年,全球将有超过 6,000 万人进行基因组定序。事实确实如此。

- 此外,各种公司正在开发利用亚磷酰胺进行寡核苷酸合成的不同方法,预计将增加製药和生物技术行业的采用和市场开拓。例如,2022 年 6 月,Amerigo Scientific 推出了一款用于研究应用的超大干阱(最多可容纳 4 公升乙腈溶液)。这些新型 DNA 防潮器可用于在寡核苷酸合成过程中保持无湿环境。这些捕集器可有效干燥乙腈中的亚磷酰胺溶液、乙腈中的四唑溶液(活化剂溶液)或干燥乙腈(用于製备亚磷酰胺溶液或活化剂溶液)。

预计北美将在预测期内主导市场

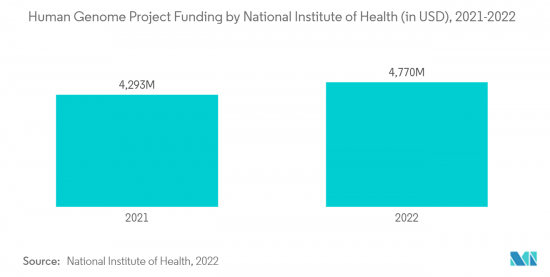

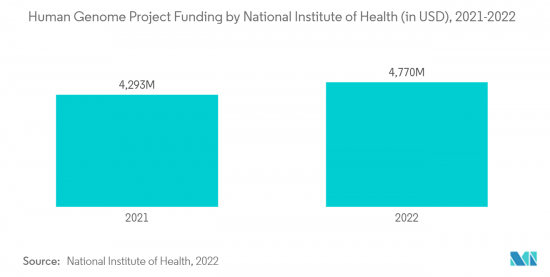

- 政府投资的增加、NGS 研发的进步以及目标疾病盛行率的增加预计将推动北美市场的成长。研究机构、公司和大学增加对次世代定序仪的资助正在促进该地区的市场成长。例如,卫生与公共服务部将于2022 年8 月宣布,将为利用人类转化/临床方法(例如基因组学、代谢组学、蛋白质组学)和动物模型的创新研究和结构性出生缺陷研究提供资金。

- 此外,公司更加重视研发活动,并采取各种业务策略,如产品发布、联盟、联合研究和收购,这些也促进了市场的成长。例如,2022 年 5 月,TriLink BioTechnologies 宣布与国防部达成合作协议,其中包括为 TriLink 在加州圣地牙哥扩大核酸生产提供资金。

- 因此,由于上述新兴市场的开拓,预计市场在预测期内将大幅成长。

亚磷酰胺产业概况

亚磷酰胺市场竞争非常激烈,有几个主要参与者进入该市场。从市场占有率来看,目前Thermo Fisher Scientific、Biosynth Carbosynth、TriLink BioTechnologies、Bioneer Corporation、Hongene Biotech Corporation等主要公司占据产业主导地位。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 市场驱动因素

- 合成核苷酸在治疗上的应用增加

- 合成生物学的增长

- 市场抑制因素

- 开发长核苷酸序列的挑战

- 波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章市场区隔(市场规模-美元)

- 按类型

- DNA亚磷酰胺

- RNA亚磷酰胺

- 其他亚磷酰胺

- 按最终用户

- 製药和生物技术公司

- 学术/研究机构

- 其他最终用户

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 欧洲其他地区

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 其他亚太地区

- 其他的

- 北美洲

第六章 竞争形势

- 公司简介

- Thermo Fisher Scientific Inc.

- Biosynth Ltd

- TriLink BioTechnologies

- Bioneer Corporation

- Hongene Biotech Corporation

- Tokyo Chemical Industry Pvt. Ltd.

- Danaher Corporation

- Creative Biolabs, Inc.

- PolyOrg, Inc.

- Lumiprobe Corporation

- QIAGEN NV

- BOC Sciences

第七章 市场机会及未来趋势

简介目录

Product Code: 50000918

The phosphoramidite market is expected to register a CAGR of 7.4% over the forecast period.

Key Highlights

- At the start of the COVID-19 pandemic, most businesses and research activities around the world ceased due to the increasing rate of infection from the SARS-CoV-2 virus, which reduced the use and demand of gene synthesizers like phosphoramidite in laboratories in the market. However, gene synthesizers played a crucial role in the research and development of the mRNA-based COVID-19 vaccine, which eventually increased the demand for phosphoramidite in the market. For example, in January 2022, the Food and Drug Administration provided a second approval to the mRNA-based COVID-19 vaccine from Moderna called Spikevax. Therefore, such developments increased the demand for phosphoramidite during the pandemic.

- The factors responsible for the growth of the phosphoramidite market include increasing synthetic nucleotide applications in therapeutics, growth in synthetic biology, and therapeutics for different chronic diseases. Also, governments of various nations have been providing research support for synthetic biology because of its extensive applications. For instance, in September 2022, the Government of New South Wales announced an investment of over USD 6 million into a new synthetic biology and biomanufacturing development program, which would improve access to manufacturing and production facilities and equipment across the State of Wales, Australia.

- Furthermore, increasing product launches and approvals are expected to increase the demand for phosphoramidite synthesis, propelling the market growth. For instance, in June 2021, DNA Script launched the Syntax platform with its Syntax System, an Enzymatic DNA Synthesis (EDS) technology-powered benchtop nucleic acid printer. The Syntax System comprises up to 60 nucleotides in length and delivers ready-for-use in d genomics workflows and molecular biology without additional handling. The system enables DNA oligos to be printed on-demand at record speed and without the delays or backorders that can occur with outsourced phosphoramidite synthesis services. Such instances are expected to propel the market's growth over the forecast period.

- However, challenges in developing long nucleotide sequences are expected to hinder the market's growth.

Phosphoramidite Market Trends

DNA Phosphoramidites is Expected to Witness Growth Over the Forecast Period

- Phosphoramidites are standard chemical and amodified nucleosides used in modern DNA synthesis. These molecules allow the sequential addition of new bases to the DNA chain in an exquisitely simple and exceptionally efficient cyclic reaction.

- The increasing use of next-generation sequencing technology in several applications, such as biomarker discovery, oncology studies, and personalized medicine, is the key factor driving the market growth. For instance, the fast emergence of next-generation sequencing technology has revolutionized the field of genomics and medical diagnosis and has changed the traditional model of a gene-by-gene approach to syndrome-based panel sequencing, diagnostic exome sequencing (DES), and diagnostic genome sequencing (DGS), and precision model. According to the Centers for Disease Control and Prevention (CDC), in 2021, it is projected that more than 60 million people will have their genomes sequenced by 2025 worldwide as countries have taken the initiative to sequence large populations.

- Moreover, various companies are developing different ways to utilize phosphoramidite for oligonucleotide synthesis, which are expected to increase their adoption in the pharmaceutical and biotechnology industry, bolstering market growth. For instance, in June 2022, Amerigo Scientific launched extra large Drying Traps (up to 4 liters of acetonitrile solution) for research applications. These new DNA moisture traps can be used for maintaining moisture-free environments in oligonucleotide synthesis. These traps efficiently dry phosphoramidite solutions in acetonitrile, tetrazole solutions in acetonitrile (activator solutions), or dry acetonitrile (for preparing phosphoramidite solutions or activator solutions).

North America is Expected to Dominate the Market Over the Forecast Period

- The increasing number of investments by the government, advancements in research and development about NGS, and the growing prevalence of target diseases are expected to drive market growth in North America. The rising funding by research institutes, companies, and universities for next-generation sequencing is contributing to the growth of the market in the region. For instance, in August 2022, the Department of Health and Human Services announced funding for innovative research and study of structural birth defects with the use of human translational/clinical approaches (genomics, metabolomics, proteomics, etc.) and animal models.

- Moreover, the rising focus of companies on research and development activities, as well as the rising adoption of various business strategies such as product launches, partnerships, collaborations, and acquisitions, are also contributing to the market's growth. For instance, In May 2022, TriLink BioTechnologies announced a cooperative agreement with the Department of Defense and included funding for TriLink's expansion in San Diego, California, for nucleic acid production.

- Thus, the market is expected to witness significant growth over the forecast period due to the above-mentioned developments.

Phosphoramidite Industry Overview

The phosphoramide market is moderately competitive and consists of several major players. In terms of market share, a few of the major players Thermo Fisher Scientific, Biosynth Carbosynth, TriLink BioTechnologies, Bioneer Corporation, Hongene Biotech Corporation and others, are currently dominating the industry.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Synthetic Nucleotide Applications in Therapeutics

- 4.2.2 Growth in Synthetic Biology

- 4.3 Market Restraints

- 4.3.1 Challenges in Developing Long Nucleotide Sequences

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - USD)

- 5.1 By Type

- 5.1.1 DNA Phosphoramidites

- 5.1.2 RNA Phosphoramidites

- 5.1.3 Other Phosphoramidites

- 5.2 By End-User

- 5.2.1 Pharmaceutical and Biotechnology Companies

- 5.2.2 Academic and Research Institutes

- 5.2.3 Other End-Users

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.2.5 Spain

- 5.3.2.6 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 Australia

- 5.3.3.5 South Korea

- 5.3.3.6 Rest of Asia-Pacific

- 5.3.4 Rest of the World

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Thermo Fisher Scientific Inc.

- 6.1.2 Biosynth Ltd

- 6.1.3 TriLink BioTechnologies

- 6.1.4 Bioneer Corporation

- 6.1.5 Hongene Biotech Corporation

- 6.1.6 Tokyo Chemical Industry Pvt. Ltd.

- 6.1.7 Danaher Corporation

- 6.1.8 Creative Biolabs, Inc.

- 6.1.9 PolyOrg, Inc.

- 6.1.10 Lumiprobe Corporation

- 6.1.11 QIAGEN N.V.

- 6.1.12 BOC Sciences

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219