|

市场调查报告书

商品编码

1408328

医用复合材料市场占有率分析、产业趋势与统计、2024年至2029年成长预测Medical Composites - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

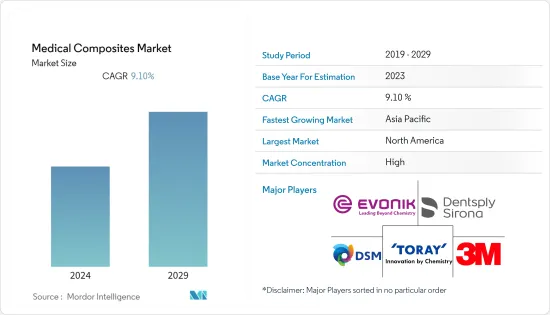

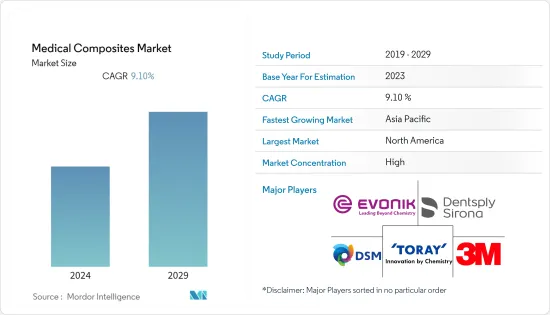

医疗复合材料市场预计在预测期内复合年增长率为 9.1%

主要亮点

- COVID-19 对过去研究的市场的成长速度产生了重大影响。疫情爆发初期,许多牙科诊所和诊所面临暂时关闭或非紧急治疗限制,以最大程度地降低病毒传播风险,牙科就诊和包括牙科修復在内的选择性手术也受到限制,但已大幅减少。因此,牙科修復手术的减少被认为影响了医用复合材料市场的成长。

- 例如,MDPI Journal 2021 年 3 月发表的一篇论文发现,在大流行的早期阶段,商业修復和填充根管等保守牙科手术的数量显着减少。因此,包括复合抗蚀剂在内的牙科材料市场受到早期牙科手术整体下降以及随之而来的修復材料需求下降的强烈影响。然而,随着 COVID-19 病例的减少,牙科修復手术的数量增加,因此预计市场在预测期内将出现显着增长。

- 推动医用复合材料市场成长的关键因素包括医用复合材料在诊断设备、身体植入和手术器械中的快速使用,对轻质耐用材料的需求不断增加,增材製造技术的进步等。

- 医用复合材料越来越多地应用于诊断影像设备,如 CT 扫描仪、 核磁共振造影系统和 X 光系统。因此,对先进诊断设备的需求不断增长预计将在预测期内推动医用复合材料的成长。此外,市场参与企业推出先进诊断设备的努力预计也将有助于市场成长。

- 例如,2023年5月,佳能医疗推出了Celex,这是一种内建碳纤维的多用途X射线系统,可最大限度地减少X射线吸收。因此,随着配备碳纤维的X射线等先进诊断设备的不断推出,未来一段时期医用复合材料市场的需求预计将加速。

- 此外,各种医用复合材料在牙科器械製造中的快速采用也推动了预测期内的市场成长。例如,根据 Elsevier Journal 2023 年 1 月发表的报导,基于半渗透聚合物网络的纤维增强复合聚合物基质系统对于黏合和修復多面间接牙科结构至关重要。因此,用于製造基于黏合的牙科修復产品的医用复合材料的需求预计将推动未来一段时间的整体市场成长。

- 因此,由于X光和牙科修復产品等诊断设备中医用复合材料的使用量迅速增加,以及主要企业推出的产品增多等因素,预计市场在预测期内将出现显着增长。然而,医用复合材料的高製造成本预计将阻碍预测期内的市场成长。

医用复合材料市场趋势

预计身体植入部分在预测期内将显着成长

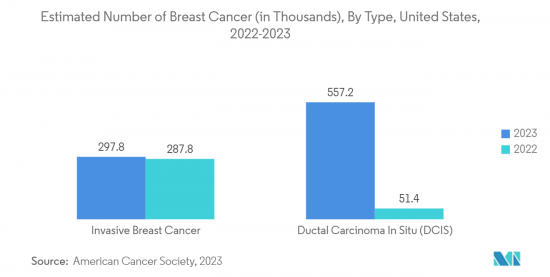

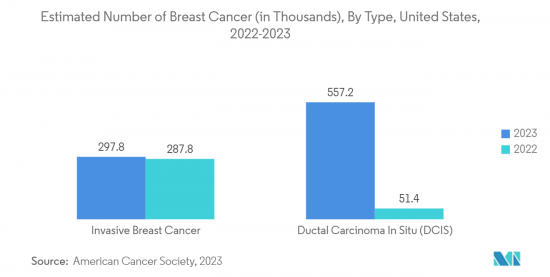

- 医用复合材料用于取代身体部位或改善身体部位的正常功能和外观,例如整形外科植入、心血管植入、牙科植入、颅骨植入和乳房植入。用于製造各种预期的身体植入为了乳癌盛行率的上升预计将推动医用复合材料市场的成长。例如,根据美国癌症协会2023年1月发布的资料,到2023年终,美国将有约297,790名女性新诊断出罹患侵袭性乳癌。

- 乳癌通常需要手术干预,包括植入重组和支撑。碳纤维和玻璃纤维增强聚合物等医用复合材料提供了适合此类应用的轻质、坚固、生物相容性材料。这些复合材料可提高机械性能、耐用性和患者舒适度。随着全球乳癌发生率的不断上升,乳房重建和其他相关手术对医用复合材料的需求可能会激增,从而刺激医用复合材料市场的成长。此外,交通事故的高发生率也有望推动医用复合材料市场的成长。

- 例如,根据道路运输和公路部(MoRTH)2022年12月发布的报告,2021年印度报告了约412,432起道路事故,造成384,448人受伤。交通事故常导致骨折、脊髓损伤和四肢损伤。因此,全球不同国家不断增加的道路事故数量可能会增加整形外科植入、铸件和义肢对医用复合材料的需求,从而促进医用复合材料市场的成长,并且具有很强的可塑性。

- 此外,领先公司正在积极扩大新的製造设施以开发整形外科医疗设备,这也支持了该行业的成长。例如,2023 年 2 月,Victrex plc 旗下公司 Invibio Biomaterial Solutions 在英国开设了一家新的整形外科医疗设备产品开发工厂。此次扩张将使该公司能够支援医疗设备原始设备OEM,并共同开发和推出创新的聚醚醚酮(PEEK)聚合物植入设备,从而促进整体细分市场的成长。

- 因此,由于脑肿瘤和脊髓癌患病率上升、道路事故数量急剧增加以及开发身体植入的主要企业的地域扩张,预计身体植入物行业将在预测期内出现显着增长。

预计北美在预测期内将占据很大份额

- 由于各种慢性病患病率的上升、大量门诊手术中心(ACS)的存在以及该地区主要企业的存在,预计北美医用复合材料市场在预测期内将出现显着增长。该地区多处骨折的增加,加上多起受伤事件,可能会推动该地区未来一段时间的市场成长。例如,根据美国疾病管制与预防中心 (CDC) 2023 年 5 月发表的报导,美国每年约有 30 万名老年人因髋部骨折而住院。

- 据同一资讯来源称,每年约有 300 万名老年人因跌倒受伤而在急诊室接受治疗。此外,该地区很大一部分人口患有心臟病,这可能会推动对心臟植入的需求并促进医用复合材料的成长。例如,根据加拿大政府 2022 年 7 月发表的报导,每年 20 岁以上的加拿大成年人(260 万)中约有二分之一被诊断出患有心臟病。

- 此外,美国开展脊椎手术的各种门诊手术中心(ASC)的存在也支持了该地区的市场成长。例如,根据 2023 年 2 月更新的 Becker's Healthcare资料,美国有超过 183 个 ASC 进行微创脊椎手术 (MISS)。

- 因此,由于各种损伤、心臟疾病和许多 ASC 的盛行率不断上升,预计北美医用复合材料市场在预测期内将出现显着增长。

医用复合材料产业概况

医用复合材料市场适度整合。市场参与企业透过新产品发布、收购和合作来维持其市场地位。研究市场的主要企业包括 3M、东丽工业公司、CeramTec GmbH、登士柏西诺德和帝斯曼。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 市场驱动因素

- 慢性病增加

- 对轻质和生物相容性材料的需求不断增加

- 医疗科技的进步与创新

- 市场抑制因素

- 製造成本高且材料可得性有限

- 波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章市场区隔(以金额为准的市场规模 - 美元)

- 依材料类型

- 碳

- 陶瓷製品

- 其他材料类型

- 依产品类型

- 手术器械

- 诊断设备

- 生物植入

- 组织工程

- 其他产品类型

- 地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 欧洲其他地区

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 其他亚太地区

- 中东/非洲

- 海湾合作委员会国家

- 南非

- 其他中东/非洲

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 北美洲

第六章 竞争形势

- 公司简介

- 3M

- Toray Industries, Inc.

- CeramTec GmbH

- Dentsply Sirona

- DSM

- SGL Carbon

- Evonik Industries AG

- Victrex plc.(Invibio Ltd.)

- Solvay

- Kulzer GmbH

- Composiflex

第七章 市场机会及未来趋势

简介目录

Product Code: 50000951

The medical composites market is expected to register a CAGR of 9.1% over the forecast period.

Key Highlights

- COVID-19 significantly impacted the growth pace of the studied market in the past. During the early pandemic period, many dental clinics and practices faced temporary closures or restrictions on non-emergency treatments to minimize the risk of virus transmission, which led to a significant reduction in dental visits and elective procedures, including dental restorations. As a result, the decreased volume of dental restoration procedures likely impacted the growth of the medical composites market.

- For instance, according to the article published by the MDPI Journal in March 2021, during the initial phase of the pandemic, the number of conservative dental procedures such as commercial restorations or filled canals significantly decreased. Hence, the market for dental materials, including composites, was highly influenced by the overall decline in dental procedures and the subsequent decrease in the need for restorative materials during the initial phases. However, with the decline in COVID-19 cases, the number of dental restoration procedures increased, due to which the market is expected to project substantial growth over the forecast period.

- The major factors driving the growth of the medical composites market include the surging usage of medical composites in diagnostic equipment, body implants, and surgical instruments, increasing demand for lightweight and durable materials, and technological advancements in additive manufacturing.

- Medical composites are increasingly used in imaging and diagnostic equipment, such as CT scanners, MRI machines, and X-ray systems, as they offer excellent radiolucency, enabling more precise imaging and diagnosis. Hence, the rising demand for advanced diagnostic equipment is projected to drive the growth of medical composites during the forecast period. Also, the initiatives taken by the market players to launch advanced diagnostic equipment are expected to contribute to the growth of the market.

- For instance, in May 2023, Canon Medical launched a Celex, a multipurpose X-ray system with in-built carbon fiber to minimize X-ray absorption. Therefore, with the increase in the launch of advanced diagnostic equipment like X-rays having carbon fiber, the demand for the medical composites market is projected to accelerate during the upcoming period.

- Furthermore, the surging adoption of various medical composites during the manufacturing of dental equipment is also set to drive market growth during the forecast period. For instance, according to an article published by the Elsevier Journal in January 2023, the polymer matrix systems of semi-interpenetrating polymer network-based fiber-reinforced composites are essential for bonding multiphasic indirect dental constructs and repair. Therefore, the necessity of medical composites to manufacture adhesion-based dental restoration products is projected to drive overall market growth during the upcoming period.

- Therefore, the market is expected to register significant growth during the forecast period owing to factors such as surging usage of medical composites in diagnostic equipment like X-ray and dental restoration products and the increasing number of product launches by prominent players. However, the high production costs of medical composite materials are expected to hinder market growth during the forecast period.

Medical Composites Market Trends

The Body Implants Segment is Expected to Show Significant Growth Over the Forecast Period

- Medical composite materials are used to manufacture various body implants, like orthopedic, cardiovascular, dental, cranial, and breast implants, intended to replace body parts or for proper functioning or appearance of the body parts. The rising prevalence of breast cancer is expected to drive the growth of the medical composites market. For instance, according to the data published by the American Cancer Society in January 2023, approximately 297,790 new cases of invasive breast cancer will be diagnosed in women in the United States by the end of 2023.

- Breast cancer often requires surgical interventions, including implants for reconstruction or support. Medical composites, such as carbon fiber or glass fiber-reinforced polymers, offer lightweight, strong, and biocompatible materials suitable for these applications. These composites provide improved mechanical properties, durability, and patient comfort. With the increasing incidence of breast cancer globally, the demand for medical composites in breast reconstruction and other related procedures is likely to surge, fueling the growth of the medical composites market. In addition, the high prevalence of road accidents is expected to drive the growth of the medical composites market.

- For instance, per the report published by the Ministry of Road Transport and Highways of India (MoRTH) in December 2022, approximately 412,432 road accidents were reported in India in 2021, with injuries to 384,448 persons. Road accidents often result in fractures, spinal cord injuries, and limb damage. Hence, with the increasing number of road accidents in different countries across the world, the demand for medical composites in orthopedic implants, casts, and prosthetics is likely to rise, contributing to the growth of the medical composites market.

- Moreover, the prominent players are actively expanding new manufacturing facilities for developing orthopedic medical devices, also driving the segment growth. For instance, in February 2023, Invibio Biomaterial Solutions, part of Victrex plc, opened a new orthopedic medical device product development facility in the United Kingdom. The expansion will enable the company to support medical device OEMs to co-develop and launch innovative Polyether Ether Ketone (PEEK) polymer implantable devices, augmenting the overall segment growth.

- Therefore, the body implants segment is expected to register significant growth during the forecast period owing to the rising prevalence of brain and spinal cord cancer, surging number of road accidents, and geographical expansion of prominent players to develop body implants.

North America is Expected to Hold the Significant Share of the Market Over the Forecast Period

- Medical Composites market in North America is expected to register significant growth during the forecast period owing to the rising prevalence of various chronic diseases, the presence of numerous ambulatory surgical centers (ACS), and prominent players in the region. The increasing number of multiple fractures in the region, coupled with several injuries, is likely to drive regional market growth during the upcoming period. For Instance, as per the article published by the CDC in May 2023, around 300,000 older people are hospitalized annually for hip fractures in the United States.

- According to the same source, approximately 3 million older people are treated in emergency departments for fall injuries yearly. In addition, many of the population in the region are suffering from heart disease, which is set to drive the demand for cardiac implants, thereby augmenting the growth of medical composites. For Instance, as per the article published by the Government of Canada in July 2022, about 1 in 12 (or 2.6 million) Canadian adults aged 20 and over are diagnosed with heart disease yearly.

- Moreover, the presence of various ambulatory surgical centers (ASCs) nationwide in the United States to perform spinal surgeries is also driving the market growth in the region. For Instance, Becker's Healthcare data updated in February 2023 shows that more than 183 ASCs in the United States perform minimally invasive spine surgery (MISS).

- Thus, the North American medical composites market is expected to witness significant growth during the forecast period due to the rising prevalence of various injuries, cardiac diseases, and many ASCs.

Medical Composites Industry Overview

The medical composites market is moderately consolidated in nature. The prominent players are participating in new product launches, acquisitions, and collaborations to uphold their position in the market. Some of the key players in the studied market include 3M, Toray Industries, Inc., CeramTec GmbH, Dentsply Sirona, and DSM, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Prevalence of Chronic Diseases

- 4.2.2 Increasing Demand for Lightweight and Biocompatible Materials

- 4.2.3 Advancements in Medical Technology and Innovations

- 4.3 Market Restraints

- 4.3.1 High Manufacturing Costs and Limited Materials Availability

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value-USD)

- 5.1 By Material Type

- 5.1.1 Carbon

- 5.1.2 Ceramic

- 5.1.3 Other Material Types

- 5.2 By Product Type

- 5.2.1 Surgical Instruments

- 5.2.2 Diagnostic Equipment

- 5.2.3 Body Implants

- 5.2.4 Tissue Engineering

- 5.2.5 Other Product Types

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.2.5 Spain

- 5.3.2.6 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 Australia

- 5.3.3.5 South Korea

- 5.3.3.6 Rest of Asia-Pacific

- 5.3.4 Middle-East & Africa

- 5.3.4.1 GCC

- 5.3.4.2 South Africa

- 5.3.4.3 Rest of Middle-East & Africa

- 5.3.5 South America

- 5.3.5.1 Brazil

- 5.3.5.2 Argentina

- 5.3.5.3 Rest of South America

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 3M

- 6.1.2 Toray Industries, Inc.

- 6.1.3 CeramTec GmbH

- 6.1.4 Dentsply Sirona

- 6.1.5 DSM

- 6.1.6 SGL Carbon

- 6.1.7 Evonik Industries AG

- 6.1.8 Victrex plc. (Invibio Ltd.)

- 6.1.9 Solvay

- 6.1.10 Kulzer GmbH

- 6.1.11 Composiflex

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219