|

市场调查报告书

商品编码

1408393

直线马达:市场占有率分析、产业趋势与统计、2024-2029 年成长预测Linear Motor - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

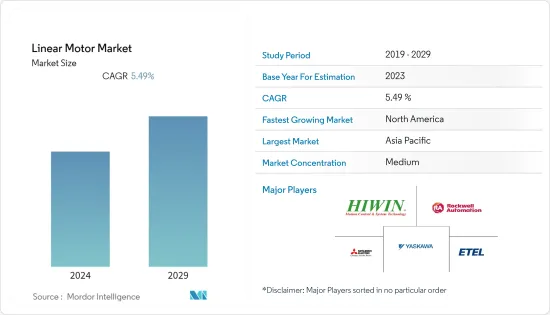

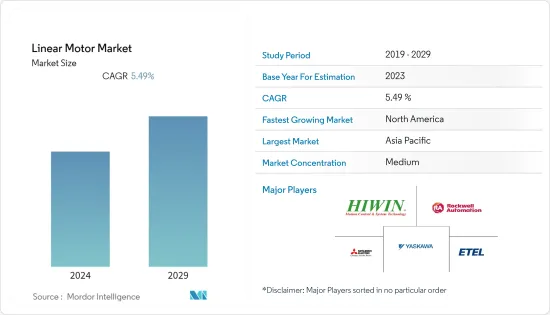

直线马达市场上年度市场规模为18.8亿美元,预计未来五年将达24.6亿美元,复合年增长率为5.49%。

直线电机是一种旋转电机,无需接触任何部件即可产生直线运动。这消除了间隙、缠绕和维护问题。因此,工具机、半导体设备、电子製造和许多其他工业运动控制应用对直线马达的需求不断增加。用于各种工业应用的自订直线马达的可用性也在增加。

主要亮点

- 预计在预测期内,直线马达市场将出现强劲成长。圆柱形直线马达是具有平滑轴向运动的高刚性机器。直线马达目前广泛用于自动化车辆性能,加速了汽车产业的市场成长。随着汽车行业的快速发展,对为驾驶员提供便利和安全的直线马达的需求正在迅速增加。汽车製造业的成长将增加对直线马达在生产线输送、搬运、定位、分类和送料方面的需求。

- 亚太地区预计将在全球直线马达市场中显着成长。 Technotion 是一家领先的直接驱动组件製造商,最近在中国苏州开设了新的销售办事处,这是其持续国际扩张的重要一步。对于该公司在直线运动行业的高性能产品和丰富的行业知识而言,中国是一个潜在的成长市场。为了满足亚太地区的市场需求,新兴市场的技术开拓正在推动直线马达的发展。

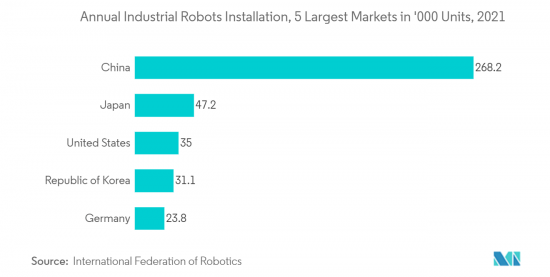

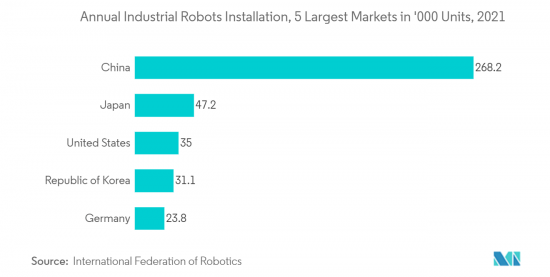

- 高性能工业自动化所占比例的不断增加正在推动直线马达在全球范围内的采用。亚洲被认为是全球最大的工业机器人部署市场。中国、日本和韩国是亚太地区年度工业自动化装置的重要市场。这些资料预示着该地区直线马达的未来成长。

- 今年,西门子宣布了一项20亿美元的投资策略,在新加坡建造一座新的高科技工厂,以服务东南亚快速成长的智慧型硬体技术市场。该公司还宣布对该工厂投资 2.15 亿美元,以整合高度自动化的製造流程。

- COVID-19 大流行促使各行业采用工业自动化来更好地管理业务。利用有限且昂贵的劳动力资源来管理高速营运的需求正在推动对自动化设备的需求。为了因应这一趋势,即使在COVID-19之后,製造业的自动化预计仍将持续,以降低全球供应链风险。这可能会在后疫情时代促进全球直线马达市场的采用。

直线马达市场趋势

研究直线马达的最佳控制特性以推动市场成长

- 高性能直线运动系统可以精确满足性能要求并适应特定行业的应用。因此,直线运动系统製造商正在专注于独特的设计,以实现最佳化的控制和更好的运作品质。这也使得目标商标产品(OEM) 能够优化“齿槽效应”,即铁芯直线马达中经常出现的力脉动。

- 对直线马达动态特性的日益增长的要求促使製造商与自动化专家合作以实现他们的目标。人们对轻型线性伺服驱动器的需求不断增长,这些驱动器比传统机械驱动系统更节能且具有更好的控制技术。

- 先进的运动控制器和伺服驱动器为线性马达运动提供增强的控制特性。因此,透过创新,OEM正在为直线马达引入新的模组化设计。直线马达采用一流的控制技术,为各种应用提供快速、准确且可靠的运动控制能力。与传统马达相比,直线马达在刚度和频率响应方面的优越性预计将推动全球直线马达市场的成长。

- 在电子和半导体行业,晶圆处理、检查、测试、组装和包装等应用对直线马达的需求量很大。线性驱动器能够有效控制电子和半导体行业中的高精度、高功率和低维护等挑战,使当局能够确保长期和永续的竞争优势。

- 随着全球电子工业的发展,对微晶片的需求不断增加。随着世界各地建立越来越多的半导体製造地,对製造微晶片的机器人和自动化的需求不断增加。高度控制的线性马达可以支援广泛的半导体应用,从晶圆级到检查、拾放和计量要求。

亚太地区可望主导全球直线马达市场

- 亚太地区拥有全球最大的工业自动化市场。根据国际机器人联合会的数据,中国是亚太地区工业机器人系统的最大采用者,其次是日本。高精度、高速度和高反应性将推动机器人、CNC工具机和自动化系统对直线马达的需求。

- 亚太地区的工业正在采用 U 形直线马达进行拾取程序,以避免生产过程中的材料损坏。线性伺服驱动器具有用于精确拾放运动的客製化开发平台。客製化开发平台提高运作速度和效率,同时提供精确控制。

- 亚太地区直线马达市场为许多国家提供了巨大的成长机会。马来西亚、新加坡、台湾和泰国是电子公司最青睐的目的地。近年来,由于人事费用低且靠近重要终端市场,印度和越南已成为重要地点。

- 第四次工业革命为工厂引进了先进的硬体和软体,提高了效率。随着工业4.0的快速发展,东南亚国家正在将数位技术融入製造业,以提高生产力。据威斯康辛州经济发展公司称,新加坡最近宣布了一项十年蓝图,计划在本年终末将其製造业成长 50%。同样,马来西亚计划同期将工业生产力提高30%。

- 亚太地区先进製造和工业4.0的成长趋势为直线马达市场的公司提供了实现营运精度和效率的机会,从而推动了区域市场的成长。

直线马达行业概况

由于多家公司的存在,直线马达市场呈现分散化状态。主要企业包括 ETEL SA、三菱电机公司、Tecnotion、罗克韦尔自动化、Aerotech, Inc.、Fanuc Corporation、Hiwin Corporation、Sinotech, Inc.、Faulhaber Group 和 Yaskawa Electric Corporation。该市场的主要企业正在推出创新的新产品并建立伙伴关係和协作,以获得竞争优势。

2022 年 10 月,机器自动化製造商和电脑数值控制专家 NUM 集团推出了专为工具机连续工作循环应用而设计的新系列无刷线性伺服马达。该公司的LMX系列直线马达可以减少恶劣运转条件的影响。坚固的不銹钢和整合式冷却迴路可最大限度地提高初级线圈流量、最大限度地减少齿槽力并减少热损失。

2022年4月,电机与发电机製造商三洋电机开发出高能效高速加减速线性伺服电机,以扩大其伺服系统阵容。此线性马达可将设备加速至高速,从而缩短週期时间并提高生产率。此新产品适用于印刷基板表面黏着技术的传送带和进给轴等高速驱动装置。减少马达的功率损耗可以提高设备的能源效率,确保始终如一的高精度。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 买方议价能力

- 供应商的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

- 产业价值链分析

- 宏观经济因素及其对市场影响的评估

第五章市场动态

- 市场驱动因素

- 工业自动化的兴起推动了对直线马达的需求

- 半导体产业对高性能直线马达的需求不断扩大

- 市场抑制因素

- 初始投资高

- 高负载应用程式中功耗增加

第六章市场区隔

- 按设计

- 圆柱形

- 平板型

- U型

- 按用途

- 建筑/施工

- 电力/电子

- 食品和饮料

- 纤维

- 农业

- 车

- 其他的

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东/非洲

第七章 竞争形势

- 公司简介

- ETEL SA

- Mitsubishi Electric Corporation

- Tecnotion

- Rockwell Automation

- Aerotech, Inc.

- FANUC CORPORATION

- Hiwin Corporation

- Sinotech, Inc.

- FAULHABER GROUP

- YASKAWA ELECTRIC CORPORATION

第八章投资分析

第九章 市场机会及未来趋势

The linear motor market was valued at USD 1.88 billion in the previous year and is expected to register a CAGR of 5.49%, reaching 2.46 billion by the next five years. A linear motor is a rotary electric motor that can produce linear motion without contacting parts. This helps in eliminating backlash, windup, and maintenance issues. Thus, there is a growing demand for linear motors in machine tools, semiconductor equipment, electronic manufacturing, and many other industrial motion control applications. There is also a rising availability of custom linear motors for various industry applications.

Key Highlights

- The cylindrical motor segment is anticipated to witness robust growth in the linear motor market during the forecast period. A cylindrical linear motor is a highly rigid machine with smooth axis movement. The broader use of linear motors in cars to automate their performance is accelerating the market growth in the automotive sector. As the automotive industry is rapidly evolving, there is a surge in demand for linear motors to provide convenience and safety to drivers. Growth in automotive manufacturing will likely boost the demand for linear motors in production line transport, handling, positioning, sorting, and material provisioning.

- Asia Pacific is anticipated to grow significantly in the global linear motor market. Tecnotion, a leading direct drive components manufacturer, recently opened its new sales office in Suzhou, China, as an essential step towards continuous international expansion. China stands as a potential growth market for the company's high-performance products and vast industry knowledge in the linear motion industry. Growing technological advancements are aiding linear motors' development to meet the market demands in the Asia Pacific region.

- The growing rate of high-performance industrial automation is fuelling the adoption of linear motors globally. Asia is regarded as the world's largest market for the deployment of industrial robots. China, Japan, and the Republic of Korea are significant markets for annual industrial automation installations in Asia Pacific. Such data indicates the region's growth of linear motors in the coming years.

- In the current year, Siemens presented its investment strategy of USD 2 billion for a new high-tech factory in Singapore to serve Southeast Asia's booming intelligent hardware technologies market. The company also announced an investment of USD 215 million in the factory to incorporate highly automated manufacturing processes.

- The COVID-19 pandemic encouraged industries to adopt industrial automation to manage operations better. With the need to manage high-velocity operations with limited and expensive labor resources, the demand for automated equipment has risen. Following this trend, manufacturers are expected to increase automated manufacturing post-COVID-19 to mitigate global supply chain risks. This is likely to boost the adoption of the linear motor market across the globe in the post-pandemic era.

Linear Motor Market Trends

Optimum Control Characteristics of Linear Motors to Propel the Growth of the Market Studied

- A high-performance linear motion system enables performance requirements to be met precisely and adapts to industry-specific applications. As a result, linear motion system manufacturers focus on unique designs to achieve optimized control and better-traversing quality. This also enables original equipment manufacturers (OEMs) to optimize 'cogging,' a force ripple occurring frequently in iron-core linear motors.

- Growing demands for dynamic characteristics of linear motors are encouraging manufacturers to collaborate and cooperate with automation specialists to achieve their objectives. There is a rising demand for lightweight linear servo drives, which can be more energy efficient than conventional mechanical drive systems and with solid control technology.

- Sophisticated motion controllers and servo drives provide enhanced control characteristics to the motion of the linear motor. OEMs are, therefore, introducing new modular designs in linear motors through innovation. Linear motors with best-in-class control technology offer faster, precise, and reliable motion control capabilities for various applications. The advantage of linear motors in terms of stiffness and frequency response compared to traditional motors is anticipated to propel the global linear motor market growth.

- There is a growing demand for linear motors in the electronics and semiconductor industries for applications such as wafer handling, inspection, testing, assembly, and packaging, among others. The ability of the linear drives to effectively control the challenges, such as high precision, high dynamics, and low maintenance, in the electronics and semiconductor industries, enables authorities to secure long-term, sustainable competitive advantages.

- As the global electronics industry evolves, the need for microchips is proliferating. The growing establishment of semiconductor manufacturing hubs worldwide has increased the demand for robotics and automation to produce microchips. High-control linear motors can assist through a wide range of semiconductor applications from the wafer level, through inspection to pick and place and measurement requirements.

Asia Pacific Expected to Dominate the Global Linear Motor Market

- The Asia Pacific region accounts for the world's largest industrial automation market. The International Federation of Robotics states that China is the largest adopter of industrial robotic systems in Asia Pacific, followed by Japan. High accuracy, speed, and responsiveness are likely to boost the demand for linear motors in robotics, CNC machines, and automation systems.

- Industries in Asia Pacific have adopted the U-shaped linear motor for the pick and place procedure to avoid damaging materials during production. Linear servo drives feature a customized development platform for precise pick and place motion. The personalized development platform enhances operational speed and efficiency while achieving precise control.

- The Asia Pacific linear motor market presents significant growth opportunities for many countries. Malaysia, Singapore, Taiwan, and Thailand are some of the most preferred sites for relocating electronics companies. India and Vietnam have become important hubs in recent years, mainly due to their low labor costs and proximity to crucial final markets.

- The Fourth Industrial Revolution involved equipping factories with advanced hardware and software that promoted greater efficiency. With rapid advancements in Industry 4.0, Southeast Asian countries are incorporating digital technology in manufacturing to improve productivity. According to the Wisconsin Economic Development Corporation, Singapore recently announced a ten-year roadmap to grow its manufacturing sector by 50 percent by the end of this decade. Similarly, Malaysia plans to increase its industrial productivity by 30 percent within the same time.

- Growing trends of advanced manufacturing and Industry, 4.0 in Asia Pacific will provide opportunities for businesses in the linear motor market to achieve operational accuracy and efficiency, thereby promoting regional market growth.

Linear Motor Industry Overview

The Linear Motor Market is fragmented because of the presence of several companies. Some key players are ETEL SA, Mitsubishi Electric Corporation, Tecnotion, Rockwell Automation, Aerotech, Inc., Fanuc Corporation, Hiwin Corporation, Sinotech, Inc., Faulhaber Group, Yaskawa Electric Corporation., etc. Key players in this market are introducing new innovative products and forming partnerships and collaborations to gain competitive advantages.

In October 2022, NUM Group, a machine automation manufacturer and Computerized Numerical Control specialist launched its new series of brushless linear servo motors designed for continuous duty cycle applications in machine tools. The company's LMX series linear motors can help mitigate the effect of arduous operating conditions. Robust stainless steel and integrated cooling circuits maximize the flow rate in the primary coil section, which minimizes cogging forces and reduces thermal losses.

In April 2022, Motors and generators company Sanyo Denki Co., Ltd. developed an energy-efficient linear servo motor with fast acceleration and deceleration to expand its servo system lineup. The linear motor accelerates equipment faster, shortens the cycle time, and increases productivity. The new product is for high-speed drive equipment applications such as conveyor machines and feed axes of PCB surface mounters. Reduced power loss offered by the motor makes equipment more energy efficient, consistently providing high precision.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Buyers

- 4.2.2 Bargaining Power of Suppliers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of Macro-economic factor and its Impact on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Industrial Automation is fuelling the demand for linear motors

- 5.1.2 Growing demand for high performance linear motor in the semiconductor industry

- 5.2 Market Restraints

- 5.2.1 High Initial Investment

- 5.2.2 Increased power consumption for high load applications

6 MARKET SEGMENTATION

- 6.1 By Design

- 6.1.1 Cylindrical

- 6.1.2 Flat Plate

- 6.1.3 U-Channel

- 6.2 By Application

- 6.2.1 Building and Construction

- 6.2.2 Electrical and Electronics

- 6.2.3 Food and Beverage

- 6.2.4 Textile

- 6.2.5 Agriculture

- 6.2.6 Automotive

- 6.2.7 Others

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East & Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 ETEL SA

- 7.1.2 Mitsubishi Electric Corporation

- 7.1.3 Tecnotion

- 7.1.4 Rockwell Automation

- 7.1.5 Aerotech, Inc.

- 7.1.6 FANUC CORPORATION

- 7.1.7 Hiwin Corporation

- 7.1.8 Sinotech, Inc.

- 7.1.9 FAULHABER GROUP

- 7.1.10 YASKAWA ELECTRIC CORPORATION.