|

市场调查报告书

商品编码

1408451

工业边缘运算 -市场占有率分析、产业趋势/统计、2024-2029 年成长预测Industrial Edge Computing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

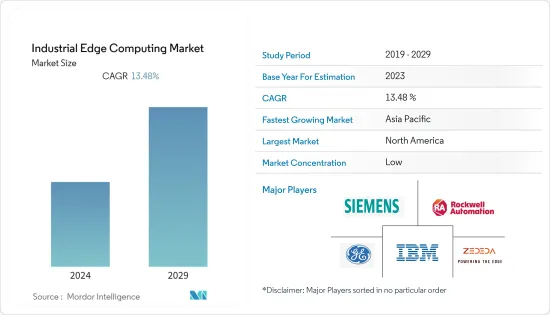

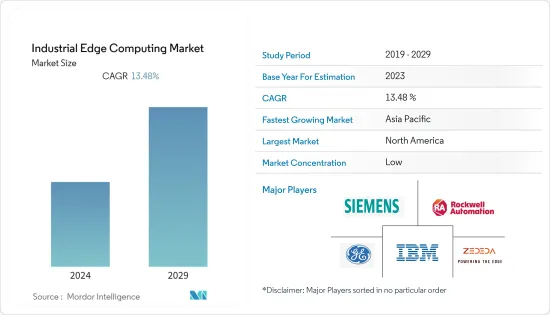

本财年工业边缘运算市场规模预估为438.4亿美元,预估未来五年将达到825亿美元,预测期内复合年增长率为13.48%。

主要亮点

- 企业对边缘运算的需求不断增长,因为他们了解边缘运算在改变製造业方面的巨大潜力。边缘运算使公司能够利用 IT 和 OT 融合、即时资料处理和高级分析的力量来提高製造效率、降低成本并改善业务成果。

- 工厂自动化、物联网的使用以及汽车和物流等各种最终用户行业中连网型设备的应用等不断上升的趋势正在创造市场需求。

- Industrial Edge 可让您透过向云端发送更少的资料来节省网路频宽。本地处理资料还可以最大限度地减少云端处理和储存成本。当运算和储存分散时,资料外洩或网路攻击导致整个网路瘫痪的风险就会降低。 Industrial Edge 还结合了 IT 和营运技术 (OT),以实现复杂的资料分析和重大营运改进。 OT 和业务系统之间的即时、事件驱动的互动有助于最大限度地发挥工业自动化的价值。

- 工业边缘运算还具有节省成本的优势。将资料传输资料集中式资料集的成本很高,因此您可以透过将此类资料储存在边缘并在使用后进行处理来降低成本。边缘运算还可以更轻鬆地追踪製造车间中各个设备和设备的实施情况。这些资料可协助製造商优化设备效能,同时降低成本和危险情况。

- 很少有组织有能力在远端位置安装冗余的高阶伺服器、储存和网路设备。相反,您可以在没有冗余元件(例如电源或硬碟)的商用伺服器上安装所需的应用程式。更糟的是,边缘定位可能没有伺服器机房或其他用于 IT 设备的环境控制空间。缺乏足够的电力、冗余、冷却和通风可能是该行业面临的挑战。

- 汽车产业正试图从 COVID-19 时代的收入损失中恢復过来。製造业之间日益激烈的竞争正在推动后竞争时代对工业边缘运算的需求,因为他们越来越多地选择市场上可用的新技术。边缘运算解决方案提供者也与製造商合作,产生新的想法和独特的解决方案。这些因素使工业边缘运算解决方案提供者和製造商能够实现快速、实际的现金流效益。

工业边缘运算市场趋势

石油和天然气产业预计将高速成长

- 当前全球油气市场的不确定性加剧了油气产业的竞争。这迫使公司降低营运成本和资本支出。此外,边缘运算和物联网 (IoT) 等技术的兴起正在为产业带来数位转型。

- 物联网的变革潜力尚未被开发,因为该行业在数位化和自动化方面需要赶上製造业等其他产业。公司必须利用这项变化来提高生产力、降低成本并在当今的市场中保持竞争力。

- 由于石油和天然气价格持续波动,企业开始转向像边缘基础设施编配的领导者ZEDEDA这样的公司,利用资料的力量和提高机械化程度来优化流程并在竞争中试图获得优势。透过减少设备故障、安全问题和保持法规遵从性,从石油钻井平台、油井、炼油厂等边缘的条件提供有用、可操作的见解,可以节省数百万美元。然而,这些环境可能非常偏远且现场工作人员有限,因此应对这些挑战需要一种能够简化边缘基础设施处理和保护所需工具的设计。

- 边缘运算透过降低网路频宽和资料中心成本来节省成本。透过边缘运算最大限度地减少计划外停机也可以带来显着的好处。麻省理工学院斯隆管理学院的一项研究发现,液化天然气 (LNG) 设施每天的停机成本为 2500 万美元,而典型的中型液化天然气设施每年大约会停机五次。我确实是这样。边缘运算透过减轻IT基础设施的处理负担来防止代价高昂的停机。

- 石油和天然气海上结构每天都会产生大量资料。根据思科的报告,石油钻井平台每天产生 2 Terabyte的资料。然而,由于海上石油和天然气行业的远端性质,如果没有边缘运算解决方案的支持,就无法探索或利用这些资料进行决策。

- 施耐德电机最近的一篇部落格强调了减少延迟的重要性,这是离岸组织采用边缘平台的一个引人注目的因素。零接触边缘运算有助于即时资料组织并增强通讯、储存和分析功能。这有助于做出更资讯、更及时的关键业务决策。

亚太地区预计将占据较大份额

- 亚洲的主要新兴市场包括印度、中国、菲律宾、印尼和越南。此外,马来西亚、新加坡、泰国等国家也引起了广泛关注。这些国家正在经历显着的消费者成长、快速的技术采用和数位转型。例如,到 2025 年,菲律宾的网路经济预计每年增长 30%。预计到 2026 年,印度将拥有 10 亿智慧型手机用户,Google预测越南将成为未来十年成长最快的网路经济体之一。

- 然而,随着亚洲新兴市场越来越多的人同时连接和存取数位服务,本地网路的压力越来越大。公共网路拥塞已成为新兴亚洲企业最关心的问题,导致延迟和抖动等问题,可能对使用者体验产生负面影响。随着消费者越来越需要随时随地可靠、快速的数位服务,无法满足这些期望的企业可能会影响收益。

- 此外,政府为增强数位化提供的资金增加以及企业对资料处理和储存的需求不断增加也促进了市场的成长。智慧城市中新的物联网应用的兴起将产生大量资料。对靠近资料来源的经济高效的资料分析和处理的需求不断增长,导致了云端运算的采用,推动了该领域的成长。

- 亚洲多重云端平台的发展正在刺激电脑工程领域高技能劳动力的成长。专注于数位工具和技术的企业,以及新加坡和印度等国家之间在数位健康、智慧城市和基于 IT 的基础设施等领域的基于技术的合作,正在展示边缘运算如何在亚洲企业中占据一席之地。我们如何收集的范例。透过利用边缘运算平台,亚洲企业可以缓解因消费者激增而造成的基础设施瓶颈。值得注意的是,新加坡的多重云端平台已成为企业组织效益的基准。

- 例如,2022 年 9 月,Bharti Airtel 和 IBM 合作部署了 Airtel 的边缘运算平台。这项措施使汽车和製造业等各行业的大公司能够加速创新解决方案。印度最大的汽车製造商马鲁蒂SUZUKI计划使用 Edge 平台来提高工厂车间品质检查的效率和准确性。马鲁蒂铃木希望透过建立这个平台来改善品管并确保边缘资料安全。

- 作为一个组织,Nife 帮助企业建立未来的经营模式,提供强大的数位体验,增加额外的安全层。基于边缘运算平台的模型可以快速扩展并具有全局扩展因子,从而在扩展到新的离岸市场时节省成本。这些因素使本地边缘运算公司受益匪浅,使其能够在全球多重云端服务中有效竞争。

- 为了满足不断增长的需求,公司经常实施自动化策略以维持生产环境的高效率。因此,与三大油气领域相比,下游领域的自动化普及相对较高。

工业边缘运算产业概况

工业边缘运算市场的特征是分散化和竞争激烈。目前主导市场的一些主要企业包括西门子、ZEDEDA、通用电气公司和罗克韦尔自动化。通用电气 (GE) 等公司以其在航太和製造等各行业提供边缘运算解决方案的专业知识而闻名,并在市场中占据重要地位。这些供应商采取了关键的竞争策略,包括收购、与产业参与企业结盟以及推出新产品和服务。市场最近的显着发展包括:

2022年11月,罗克韦尔自动化宣布开发结合边缘应用生态系统的编配与智慧型边缘管理平台。该倡议基于开放的行业标准和零信任安全原则,旨在加速工业客户的数位转型之旅。随着工业设备製造商越来越多地接受数位转型,该公司希望透过分析、人工智慧 (AI) 和製造执行系统 (MES) 等创新来扩大其数位转型工作。这种方法提供了对接近工业资料来源的即时情报的存取。

2023年8月,ABB与专注于边缘到云端加速平台的Pratexo合作并进行了策略性投资。此次合作将使 ABB 客户能够部署基于边缘的网路和解决方案架构,以提供即时洞察。重点是要增强资料隐私和安全性,减少传输到云端的资料量,并在断网时也能进行操作。此次战略合作是推动工业领域边缘运算解决方案的重要一步。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 买方议价能力

- 供应商的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

- 产业价值链分析

- COVID-19 市场影响评估

第五章市场动态

- 市场驱动因素

- 工业领域对自动化的需求不断增加

- 组织从云端运算和储存系统转向边缘运算

- 市场抑制因素

- 向老化劳动力引入新技术会暴露技能差距

第六章市场区隔

- 按成分

- 硬体

- 软体

- 服务

- 按行业分类

- 製造业

- 油和气

- 矿业

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 中美洲和南美洲

- 中东/非洲

第七章 竞争形势

- 公司简介

- IBM Corporation

- Rockwell Automation

- Siemens

- General Electric Company

- Honeywell International

- Huawei Technologies

- Microsoft Corporation

- SAP SE

- Intel Corporation

第八章投资分析

第九章 市场机会及未来趋势

The industrial edge computing market size is estimated at USD 43.84 billion in the current year and is expected to reach USD 82.50 billion in the next five years, registering a CAGR of 13.48% during the forecast period.

Key Highlights

- The need for edge computing is growing among businesses because they understand the tremendous potential of edge computing in transforming the manufacturing industry. Edge computing enables organizations to leverage the power of IT and OT convergence, real-time data processing, and advanced analytics to drive efficiencies, reduce costs, and improve business outcomes in manufacturing.

- The increasing trend of factory automation, usage of IoTs, and the application of connected devices across various end-user industries such as automobile and logistics are creating a demand for the market.

- The industrial edge allows organizations to conserve network bandwidth by reducing the data sent to the cloud. Organizations can also minimize cloud computing and storage costs by processing data locally. When computing and storage are decentralized, there's less risk that data will be compromised or a cyberattack will take down the entire network.The industrial edge also combines IT with operational technology (OT), allowing complex data analysis and significant operation improvements. Real-time, event-driven interactions between OT and business systems help maximize industrial automation's value.

- Industrial edge computing also provides cost-reduction benefits. Transferring large data sets of temporary or unimportant data to a centralized cloud is cost-prohibitive, so keeping such data at the edge and discarding it after use lowers the cost. Edge computing also makes tracking individual devices or equipment implementation on a shop floor easy. This data will assist the manufacturer in optimizing equipment performance while decreasing costs and hazardous circumstances.

- Few organizations can afford to establish redundant high-end servers, storage, and networking equipment in remote locations. Instead, they may install required applications on commodity servers that don't have redundant components (such as power supplies and hard drives). Worse still, edge locations may not contain a server room or other environmentally controlled space for IT equipment. The lack of adequate power, redundancy, cooling, or ventilation can be a challenge for the industry.

- The automotive industry is set to recover from the loss of revenue from the COVID-19 years. Manufacturing companies are opting for new technologies available in the market, and the rising competition in these companies has fueled the demand for industrial edge computing in post-COVID times. Edge computing solution providers also produce new ideas and signature solutions in collaboration with manufacturers. These factors result in rapid and tangible cash flow benefits for industrial edge computing solution providers and manufacturers.

Industrial Edge Computing Market Trends

Oil and Gas sector is expected to grow at a higher pace

- The current uncertainty around the global market for oil and natural gas has boosted the highly competitive nature of the oil and gas industry. This has pressured companies to reduce their operating costs and capital expenditures. Also, the industry is transforming digitally due to the rise of technologies such as edge computing and the Internet of Things (IoT).

- The industry needs to catch up to other sectors, such as manufacturing when it comes to digitalization and automation, so the potential for IoT to be transformative remains to be explored. Companies must leverage this change to increase their productivity and cut costs, enabling them to stay competitive in today's market.

- As oil and gas prices remain volatile, companies are looking to companies like ZEDEDA, the leader in edge infrastructure orchestration, to leverage the power of data and increased mechanization to optimize processes and gain a competitive edge. Pulling convenient actionable insights from edge conditions like oil rigs, wells, and refineries can save millions by reducing equipment failure and safety issues and maintaining regulatory compliance. These conditions, however, can be very remote and may have limited on-site staff, so managing these challenges requires tools designed to simplify handling and securing edge infrastructure.

- Edge computing introduces cost savings by lowering the network bandwidth and reducing data center costs. Minimizing unplanned downtime through edge computing can also lead to significant payoffs. An MIT Sloan study found that a single day of downtime for a liquefied natural gas (LNG) facility can cost USD 25 million, with a typical midsize LNG facility going down about five times a year. Edge computing prevents costly shutdowns by reducing the processing burden on IT infrastructure.

- Offshore oil and gas structures produce an extraordinary amount of data daily. According to a Cisco report, an oil rig can create two terabytes of data daily. Still, due to the remote area of the offshore oil and gas industry, this data is only examined and leveraged for decision-making with support from edge computing resolutions.

- A recent blog from Schneider Electric underscores the significance of latency reduction as a compelling factor driving offshore organizations to adopt edge platforms. Zero-touch edge computing facilitates real-time data organization, enhancing communication, storage, and analysis capabilities. This, in turn, contributes to more informed and timely business-critical decision-making.

Asia- Pacific is anticipated to hold the significant share

- Asia's top emerging markets encompass India, China, the Philippines, Indonesia, and Vietnam. Additionally, countries like Malaysia, Singapore, and Thailand are attracting significant attention. These economies are undergoing substantial growth in their consumer classes, rapid technological adoption, and digital transformation. For instance, the Philippines is experiencing a 30% annual growth in its Internet economy through 2025. India is projected to have 1 billion smartphone users by 2026, and Google predicts that Vietnam will be one of the fastest-growing Internet economies in the next decade.

- However, as more individuals across Asia's emerging markets simultaneously connect and access digital services, there is a growing strain on local networks. Public internet congestion has become a top concern for companies in emerging Asia, resulting in issues such as latency and jitter, which can adversely affect user experiences. In an era where consumers increasingly expect reliable and fast digital services anytime, anywhere, businesses failing to meet these expectations risk impacting their bottom line.

- Furthermore, increased government funding to enhance digitization and the growing demand for businesses to process and store data contribute to market growth. The rise of emerging IoT applications in smart cities generates vast amounts of data. The increasing need for cost-effective data analysis and processing near the data source has led to the adoption of cloud computing, driving segment growth.

- The development of multi-cloud platforms in Asia has spurred the growth of a high-skilled workforce in computer engineering. Businesses focused on digital tools and techniques, as well as technology-based collaboration between countries like Singapore and India in areas such as digital health, smart cities, and IT-based infrastructure, are examples of how edge computing is gaining traction in Asian enterprises. By using edge computing platforms, Asian organizations can alleviate infrastructure bottlenecks caused by the surge in consumers. Notably, Singapore's multi-cloud platform serves as a benchmark for its benefits to business organizations.

- For instance, in September 2022, Bharti Airtel and IBM partnered to deploy Airtel's edge computing platform. This initiative enables large enterprises across various industries, including automotive and manufacturing, to accelerate innovative solutions. Maruti Suzuki, India's largest carmaker, plans to use the edge platform to enhance efficiency and accuracy in quality inspections on the factory floor. By establishing this platform, Maruti Suzuki expects to improve quality control and ensure data security at the edge.

- Nife, as an organization, assists enterprises in building future business models that offer robust digital experiences with an added layer of security. Models based on edge computing platforms are rapidly scalable and possess a global scaling factor, which can result in cost savings when expanding into new offshore markets. These factors are significantly benefiting local edge computing enterprises, allowing them to compete effectively in multi-cloud services on a global scale.

- In response to increasing demand, companies often implement automation strategies to maintain high efficiency in their production environments. Consequently, compared to all three oil and gas streams, automation penetration is relatively high in the downstream sector.

Industrial Edge Computing Industry Overview

Its fragmentation and competitive nature characterize the industrial edge computing market. Currently, key players dominating the market include Siemens, ZEDEDA, General Electric Company, and Rockwell Automation, among others. Companies like General Electric (GE), renowned for their expertise in delivering edge computing solutions across various industries, including aerospace and manufacturing, hold substantial market positions. These vendors employ key competitive strategies, such as acquisitions, partnerships with industry players, and the introduction of new products and services. Notable recent developments in the market include:

In November 2022, Rockwell Automation announced the development of an orchestration and intelligent edge management platform coupled with an edge application ecosystem. This initiative is based on open industry standards and zero trust security principles, aimed at accelerating the digital transformation journey for industrial customers. As industrial manufacturers increasingly embrace digital change, the company seeks to amplify digital transformation efforts through innovations in analytics, artificial intelligence (AI), Manufacturing Execution Systems (MES), and other technologies. This approach allows them to access real-time intelligence closer to the source of industrial data.

In August 2023, ABB made a strategic investment by partnering with Pratexo, a company specializing in edge-to-cloud acceleration platforms. This collaboration empowers ABB's customers to deploy edge-based networks and solution architectures that provide real-time insights. Importantly, it offers enhanced data privacy and security, reduces the volume of data transferred to the cloud, and enables operations even when disconnected from the internet. This strategic partnership represents a significant step in advancing edge computing solutions within the industrial sector.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Buyers

- 4.2.2 Bargaining Power of Suppliers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Demand For Automation in the Industrial Sector

- 5.1.2 Organizations shifting from cloud computing and storage systems to edge computing

- 5.2 Market Restraints

- 5.2.1 Introduction of a new technology to an ageing workforce exposes the skills gap

6 MARKET SEGMENTATION

- 6.1 By Component

- 6.1.1 Hardware

- 6.1.2 Software

- 6.1.3 Services

- 6.2 By End-user Vertical

- 6.2.1 Manufacturing

- 6.2.2 Oil and Gas

- 6.2.3 Mining

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia-Pacific

- 6.3.4 Latin Amerca

- 6.3.5 Middle East & Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 IBM Corporation

- 7.1.2 Rockwell Automation

- 7.1.3 Siemens

- 7.1.4 General Electric Company

- 7.1.5 Honeywell International

- 7.1.6 Huawei Technologies

- 7.1.7 Microsoft Corporation

- 7.1.8 SAP SE

- 7.1.9 Intel Corporation