|

市场调查报告书

商品编码

1408493

连网型贩卖机:市场占有率分析、产业趋势与统计、2024年至2029年成长预测Connected Vending Machine - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

主要亮点

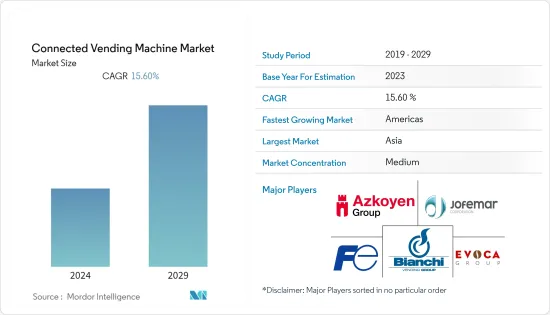

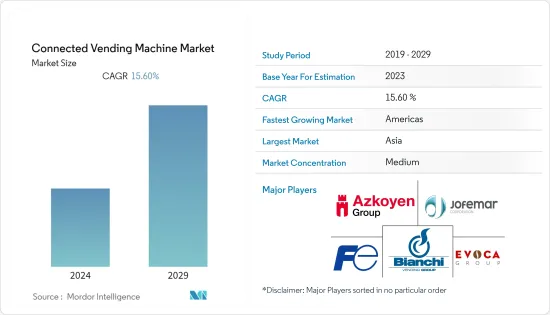

- 目前连网型自动贩卖机市场规模为134亿美元。预计未来五年将达到 326 亿美元,预测期内复合年增长率为 15.6%。

- 随着连网型贩卖机的普及,市场将继续成长,因为连网型贩卖机可以与客户互动并收集和分析资料,为消费者和企业主提供各种好处。

- 随着连网型自动贩卖机技术的进步,市场不断扩大。支援人工智慧 (AI) 的连网型贩卖机正在推动市场发展。人工智慧技术为消费者提供面向未来的体验。这些机器提供了便利性并增强了客户参与,因为人工智慧支援的功能对客户友好,并且不需要复杂的步骤或流程。人工智慧演算法还会即时显示广告和促销活动,以吸引註意力并推动销售。

- 连网型贩卖机还可以实现无现金付款,并且不需要实体货币。我们也接受各种付款方式,例如信用卡、签帐金融卡、UPI付款、行动钱包或生物识别。这也降低了与现金交易相关的盗窃和破坏的风险。

- 看看对非接触式付款系统不断增长的需求。许多连网型自动贩卖机製造商正在推出新产品,并已收到多份安装订单。例如,来自泰国的饮料自动贩卖机淘宾,透过触控萤幕接受订单,支援行动付款选项,计画在2023年扩大业务,在全国火车站和公寓完成6,000台机器,每个地方总共有2,000台机器。一天。我们的目标是销售10,000 瓶饮料。

- 推动市场的另一个因素是库存管理的便利性。连网型自动贩卖机利用感测器资料和内部智慧来做出最佳的库存管理决策。这使得生产商和经销商能够监控运往自动贩卖机和配送中心的出货。它还追踪区域和季节性销售趋势并远端处理系统问题。该软体将销售资料与服务和库存警报整合在一起,使公司能够首先引导服务负责人找到最盈利的设备。

- 由于供应链中断和非必需消费品需求减少,市场在 COVID-19第一季受到负面影响。然而,一旦情况正常化,随着一些消费品製造商重新启动其製造部门以及人们开始接受非接触式交易方式,对连网型自动贩卖机的需求就会增加。

连网型贩卖机市场的趋势

零售业可望以更快的速度成长

- 近年来,由于技术进步和自动化程度的提高,零售业发生了重大变化。零售自动化彻底改变了从供应链管理和库存追踪到个人化行销和客户服务的流程。零售业的主要技术创新之一是智慧自动贩卖机的引进。这些技术先进的自动贩卖机为零售商和消费者提供了多种好处,推动了它们的普及和普及。

- 许多自动贩卖机公司开始透过推出更具创新性的连网型自动贩卖机来重塑其产品。例如,2023年4月,印度食品科技Start-UpsDaalchini Technologies在学校、大学、医院和火车站等不同地点推出了支援物联网的零售店,为人们提供新鲜健康的用餐。我们已成功为企业安装了自动贩卖机。

- 此外,智慧型自动贩卖机还整合了资料分析功能,使零售商能够收集有关客户行为、产品偏好和购买模式的宝贵见解。利用这些资料,零售商可以提供符合客户需求的产品、优化库存管理并设计有针对性的行销宣传活动。这种资料驱动的主导使零售商能够做出明智的决策,从而提高客户满意度并增加销售。

- 对于零售商来说,部署连网型贩卖机也是一种经济高效的解决方案。虽然初始投资可能高于传统自动贩卖机,但长期收益超过初期成本,包括降低人事费用以及透过提高客户参与增加销售额。此外,这些自动贩卖机易于扩展,可以安装在不同的位置,使零售商能够测试新市场并有效地扩大业务。

- 扩大商机 2023 年 2 月,韩国食品公司 Pulmuone 与美国食品科技公司 Yokai Express 合作推出了一款可以准备即食食品的连网型贩卖机。我们也计划透过这些介面提供使用者介面。客户可以浏览产品目录并查看详细资讯。这种程度的互动性增强了整体客户体验,从而提高了满意度和忠诚度。

亚太地区录得高成长

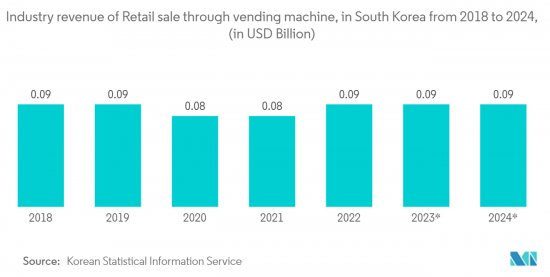

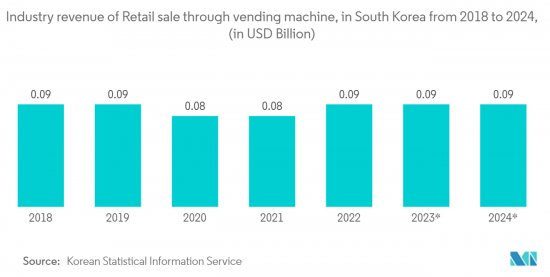

- 由于多种因素,包括都市化、消费者对便利性的期望不断提高、技术进步以及无现金交易的日益普及等,亚太地区的成长已经开始。亚太地区是世界上一些人口最稠密、技术最先进的国家的所在地,包括中国、日本、印度、澳洲和韩国。随着都市化不断加快,人们的生活方式变得更加忙碌,对快速、方便地获取行动产品的需求不断增长。连网型贩卖机透过在不同地点提供不同的产品来提供解决方案。

- 由于亚太地区对连网型自动贩卖机的需求不断增长,许多公司已开始在亚太地区的主要国家推出此类产品。例如,Advanced Food Technology 于 2022 年 12 月在亚洲推出了 Bites &Bytes 智慧型自动贩卖机(SVM)。提供各种菜单,包括亚洲菜、日本菜、韩国菜、台湾菜、欧陆菜和中东菜。

- 同样,2023 年 6 月,樟宜综合医院 (CGH) 推出了新加坡第一台连网型药品自动贩卖机。自动贩卖机还内建远端咨询功能,让患者与 CGH 药剂师联繫。这台自动贩卖机出售各种成药。

- 此外,印度政府也与私人公司合作,推动连网型自动贩卖机的采用。政府正在利用私人公司的专业知识和资源来促进自动贩卖机的普及和整合。例如,2023 年 7 月,全国农业合作社行销联盟 (NAFED) 与 Wendor 合作。根据此次合作,Wender 将向 Shashtri Bhawan、NITI AYOG、ICAR、MOFPI、Udyog Bhawan、APEDA 等主要政府大楼供应各种以小米为基础的产品。我们安装了智慧自动贩卖机。

连网型自动贩卖机产业概述

连网型贩卖机市场以 Azkoyen Group、Fuji Electric、Crane Co、FAS International SpA、Bianchi Vending Group SpA、Rhea Vendors Group、Jofemar、Westomatic Vending Services Ltd.、Evoca Group 和 Royal Vendors 等领先企业为中心。显示出中等中等为中心。显示出中等中等为中心。程度的整合。

这些主要产业参与者正在积极实施合作、创新、併购等策略方法,以加强产品系列建立永续的竞争力。

2023 年 3 月,人工智慧科技公司 DailyBlend 宣布获得来自旧金山知名投资者 Hustle Fund 和纽约 2048 Ventures 的 200 万美元资金,实现了一个重要的里程碑。透过本次注资,该公司推出人工智慧生鲜食品自动贩卖机,为数百万通勤者提供高品质的生鲜食品。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 买方议价能力

- 供应商的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

- 产业价值链分析

- COVID-19 市场影响评估

- 关键指标

- 使用者普及

- 每个用户的平均销售额

第五章市场动态

- 市场驱动因素

- 零售业自动化的进步

- 非接触式和卫生解决方案的增加

- 市场抑制因素

- 初始设定和安装成本较高

- 产品类型和容量限制

第六章市场区隔

- 按机器类型

- 壁挂式

- 桌面式

- 独立的

- 依产品类型

- 饮料

- 小吃

- 食品

- 糖果零食

- 其他产品类型

- 按用途

- 飞机场

- 火车站

- 办公室

- 教育机构

- 其他的

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 中东/非洲

- 世界其他地区

第七章 竞争形势

- 公司简介

- Azkoyen Group

- Fuji Electric

- Crane Payment Innovations

- FAS International SpA

- Bianchi Vending Group SpA

- Rhea Vendors Group

- N&W Global Vending SpA

- Westomatic Vending Services Ltd.

- Evoca Group

- Royal Vendors

第八章投资分析

第九章 市场机会及未来趋势

Key Highlights

- The connected vending machine market is valued at USD 13.4 billion in the current year. It is expected to register a CAGR of 15.6% during the forecast period, reaching USD 32.6 billion by the next five years.

- The market is continuously growing owing to the increasing adoption of connected vending machines, as these machines can interact with customers, collect and analyze data, and offer various benefits to both consumers and business owners.

- With the ongoing advancement in connected vending machine technology. Artificial intelligence (AI)-enabled connected vending machine is driving the market. AI technology provides consumers with a future-ready experience. These machines offer convenience and enhanced customer engagement, as AI-enabled features are customer-friendly and do not have any complicated steps or processes. Also, AI algorithms display ads and promotions in real time to capture attention and drive sales.

- Also, connected vending machines enable cashless payment options, eliminating the need for physical currency. It also accepts various payment methods like credit cards, debit cards, UPI payments, mobile wallets, or even biometric authentication. This also reduces the risk of theft and vandalism associated with cash transactions.

- Looking at the increasing demand for contactless payment systems. Many connected vending machine manufacturers are introducing new products, and they are also getting multiple orders for the installation. For instance, in 2023, Tao Bin, a company that offers a beverage vending machine from Thailand that takes orders via touch panel and accepts mobile payment options, is expanding its business and aims to complete 6000 units in railway stations and apartment buildings across the country, selling 20,000 drinks per day.

- Another factor that is driving the market is the ease of inventory management. Connected vending machine leverages sensor data and internal intelligence to make the best decisions regarding inventory management. It enables producers and distributors to monitor shipments to vending machines and distribution centers. It also tracks sales trends by geography and season and remotely handles system problems. The software integrates sales data with service and stock alerts so that businesses may direct their service personnel to the most profitable equipment first.

- During the first quarter of COVID-19, the market was negatively affected due to the supply chain disruption and reduced nonessential consumer product demand. However, when the situation normalized, several consumer goods companies reopened their manufacturing units, and people started accepting contactless methods of deals, which increased the demand for connected vending machines.

Connected Vending Machine Market Trends

Retail Sector is expected to grow at a higher pace

- The retail industry has undergone significant transformations in recent years, largely driven by technological advancements and increasing automation. Automation in retail has revolutionized various processes, from supply chain management and inventory tracking to personalized marketing and customer service. One major innovation in the retail sector is the adoption of smart vending machines. These technologically advanced machines offer a range of benefits for both retailers and consumers, driving their popularity and widespread implementation.

- Many companies offering vending machines have started reshaping their product by launching more innovative connected vending machines. For instance, in April 2023, Daalchini Technologies, a food tech startup firm in India, successfully placed IoT-enabled vending machines for retail business at various sites that include schools, colleges, hospitals, and railway stations to provide people with access to fresh, healthy meals.

- Moreover, Smart vending machines are integrated with data analytics capabilities, allowing retailers to collect valuable insights on customer behavior, product preferences, and buying patterns. By leveraging this data, retailers can personalize product offerings to better align with customer demands, optimize inventory management, and design targeted marketing campaigns. This data-driven approach enables retailers to make informed decisions, resulting in improved customer satisfaction and higher sales.

- Implementing connected vending machines has also been a cost-effective solution for retailers. While initial investments may be higher compared to traditional vending machines, the long-term benefits, such as reduced labor costs and increased sales through improved customer engagement, outweigh the upfront expenses. Additionally, these machines can be easily scaled and deployed in various locations, allowing retailers to test new markets and expand their presence efficiently.

- Looking at the growing opportunities. In February 2023, Pulmuone, a South Korean food company, planned to collaborate with US food-tech company Yokai Express in order to launch a connected vending machine that can cook instant meals. Also, the company will be providing a user interface through these interfaces. Customers can browse through product catalogs to view detailed information about the items. This level of interactivity elevates the overall customer experience, leading to increased satisfaction and loyalty.

Asia-Pacific Region to Register High Growth

- Asia-Pacific was already on the rise due to various factors such as urbanization, increased consumer convenience expectations, technological advancements, and the growing popularity of cashless transactions. It is home to some of the world's most densely populated and technologically advanced countries, such as China, Japan, India, Australia, South Korea, and others. With urbanization continuing to accelerate, people's lifestyles have become more fast-paced, leading to an increased demand for quick and convenient access to products on the go. Connected vending machines provide a solution by offering a wide range of products in various locations.

- With the growing demand for connected vending machines in the region, many companies have started launching such Products in the major countries in Asia-Pacific. For instance, in December 2022, Advanced Food Technology launched the Bites & Bytes Smart Vending Machine (SVM) in the Asia region. It offered a variety of menus that include Asian, Japanese, Korean, Taiwanese, Continental, and Middle Eastern.

- Similarly, in June 2023, Changi General Hospital (CGH) launched its first connected pharmaceutical vending machine in Singapore. The vending machine is also in-built with a teleconsultation feature where patients can connect with a CGH pharmacist. The machine offers a wide range of over-the-counter medicines.

- Moreover, the government of India is also promoting the adoption of connected vending machines by collaborating with private companies. The government is leveraging private sector expertise and resources to drive adoption and ensure the successful integration of these machines. For instance, in July 2023, the National Agricultural Cooperative for Marketing Federation (NAFED) collaborated with Wendor. Under this collaboration, Wendor has installed smart vending machines stocked with a variety of millet-based products in key government buildings like Shashtri Bhawan, NITI AYOG, ICAR, MOFPI, Udyog Bhawan, APEDA, and others.

Connected Vending Machine Industry Overview

The connected vending machine market exhibits a moderate level of consolidation, featuring prominent players such as Azkoyen Group, Fuji Electric Co., Ltd., Crane Co., FAS International S.p.A., Bianchi Vending Group S.p.A, Rhea Vendors Group, Jofemar, Westomatic Vending Services Ltd., Evoca Group, and Royal Vendors. These key industry participants are actively implementing strategic approaches, including partnerships, innovations, mergers, and acquisitions, to strengthen their product portfolios and establish a sustainable competitive edge.

In March 2023, Daily Blends, an AI technology company, announced a significant milestone by securing USD 2 million in funding from prominent investors, namely San Francisco-based Hustle Fund and New York-based 2048 Ventures. This infusion of capital will empower the company to launch an AI-powered fresh food vending machine tailored to the Greater Toronto Hamilton area, catering to millions of commuters with high-quality, fresh food options.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Buyers

- 4.2.2 Bargaining Power of Suppliers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of the Impact of COVID-19 on the Market

- 4.5 Key Metrices

- 4.5.1 User Penetration Rate

- 4.5.2 Average Revenue Per User

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Automation in Retail Industry

- 5.1.2 Increasing Contactless and Hygenic Solutions

- 5.2 Market Restraints

- 5.2.1 High Initial Setup and Installation Cost

- 5.2.2 Limited Product variety and Capacity

6 MARKET SEGMENTATION

- 6.1 By Machine Type

- 6.1.1 Wall-mounted

- 6.1.2 Tabletop

- 6.1.3 Standalone

- 6.2 By Product Type

- 6.2.1 Beverages

- 6.2.2 Snacks

- 6.2.3 Food

- 6.2.4 Confections

- 6.2.5 Other Product Types

- 6.3 By Application

- 6.3.1 Airport

- 6.3.2 Railway Station

- 6.3.3 Offices

- 6.3.4 Educational institutes

- 6.3.5 Other Applications

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia Pacific

- 6.4.4 Middle East and Africa

- 6.4.5 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Azkoyen Group

- 7.1.2 Fuji Electric

- 7.1.3 Crane Payment Innovations

- 7.1.4 FAS International S.p.A.

- 7.1.5 Bianchi Vending Group S.p.A

- 7.1.6 Rhea Vendors Group

- 7.1.7 N&W Global Vending S.p.A.

- 7.1.8 Westomatic Vending Services Ltd.

- 7.1.9 Evoca Group

- 7.1.10 Royal Vendors

- 7.2 *List Not Exhaustive