|

市场调查报告书

商品编码

1693924

综合设施管理:市场占有率分析、产业趋势与成长预测(2025-2030 年)Integrated Facility Management - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

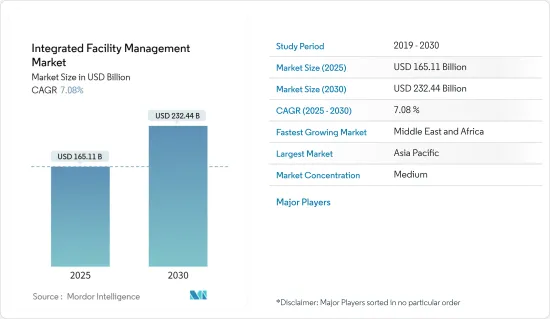

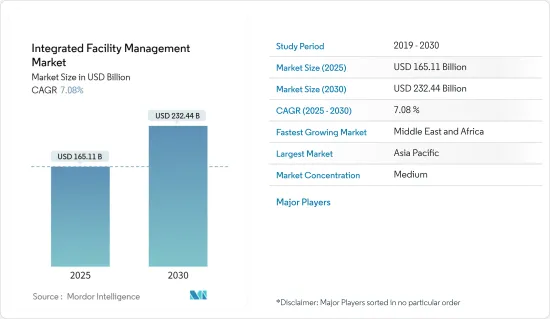

综合设施管理 (FM) 市场规模预计在 2025 年为 1,651.1 亿美元,预计到 2030 年将达到 2,324.4 亿美元,预测期内(2025-2030 年)的复合年增长率为 7.08%。

综合设施管理 (IFM) 主要是指将所有设施管理合约整合到单一服务中。 IFM 将复杂的设施管理与安全、清洁和废弃物管理等软设施管理相结合。将这些不同的服务整合在一起将改善客户服务,增强 FM 服务之间的协作,并整合成本以保持在预算之内。

关键亮点

- 对环保永续建筑实践的日益重视以及建设活动的復苏被分析为推动综合设施管理市场成长的因素。

- 过去几年,由于各种政府措施推动的建设活动扩大、都市化加快以及已开发经济体和新兴经济体商业建筑计划的增加,对综合设施管理服务的需求不断增加。

- 由于业务扩张导致入住需求增加、技术进步导致设施需求不断变化以及对成本效率的关注,各行业的商业活动正在回暖,综合设施管理 (IFM) 正在经历上升趋势。

- 日益增强的环境意识和相关商业实践已经推动综合设施管理 (IFM) 超越其作为计划业务驱动因素的传统维护角色。 IFM 不再局限于其作为成本中心的角色,而是成为了产业的策略驱动力。

- 对专业人才的需求是发展全球综合设施管理市场的一大挑战。 IFM 涵盖的服务范围很广,从复杂 FM 到软 FM,而寻找拥有多个类别专业知识的专家非常困难,这意味着人才缺口阻碍了 IFM服务供应商发挥其服务的潜力。

综合设施管理市场趋势

商业领域成为最大的终端使用者领域

- 商业房地产涵盖由商业服务机构建造或占用的办公大楼,例如企业 IT 和通讯办公室、製造企业和其他服务供应商。提供必要的设备、室内设计和商业建筑装饰和管理已变得越来越重要,并正在推动商业领域市场的发展。商业区需要物业会计、租赁、合约管理、采购管理等多项服务,需要聘请专业人员。由于这些因素,商业类别在市场上有进一步的成长机会,预计这一趋势将在整个预测期内持续下去。

- 随着美国各零售商开设分店并扩大业务范围,对软 FM 服务的需求也随之增加。例如,2023年4月,宜家商店所有者英格卡集团宣布计划在未来三年内投资20亿欧元(22亿美元)在美国扩张。根据该计划,该公司已完成在美国开设 8 家新的大型宜家商场和 9 家小型宜家商场以及对现有商场进行升级,美国是宜家继德国之后的第二大销售额市场。

- 此外,世邦魏理仕预计,印度等国家的零售业将在 2023 年显着增长,该国主要城市的零售面积将创历史新高,达到 710 万平方英尺(比 2022 年增长 47%)。零售空间的需求主要受到最近竣工的购物中心的建设所推动。随着国内外品牌的涌入,时尚服饰占据了商业区最大的租赁面积。随着商场零售空间的扩大,消费者流量增加,需要增加维护、清洁、安全和能源管理服务。

- 根据高力国际的一项调查,预计到2023年,办公大楼和工业/物流房地产将成为房地产投资者最需要的资产类别,全球近60%的投资者打算投资这些类型的房地产。 48% 的受访者表示多用户住宅位居第二,其次是饭店。

- 总体而言,商业活动的復苏预计将推动综合设施管理的需求,以管理不断增加的运转率,并采用先进的技术,使企业能够开展核心活动,同时确保业务顺利运作。

亚太地区占主要市场占有率

- 亚太地区商业发展日益壮大,医院、机场、製造工厂、资料中心和教育机构等基础建设计划的投资也日益增加。人们对综合 FM 外包和服务整合优势的认识不断提高有望推动市场发展。

- 在中国,许多设施管理者正在采用可持续的建筑管理实践来提高职场效率、改善基础设施并延长资产的使用寿命。综合设施管理影响组织的各个方面。预计设施经理和战略管理规划在该国的地位将变得越来越重要。

- 中国经济拥有巨大的市场潜力,尤其是上海、北京等商业中心。政府对房地产行业的投资增加预计将为市场带来成长机会。例如,中国的五年计画(2021-2025)针对关键领域制定了平衡国家经济的目标。

- 2023年12月,中国汽车製造商比亚迪表示将向韩国汽车製造商KG Mobility投资4.12亿美元,以确保电动车电池的稳定供应。该厂计划于2025年开始量产。韩国是汽车市场主要参与者的所在地,包括 LG Energy Solutions、三星 SDI、SK On 和比亚迪。他们对该工厂的投资对于该国电动车生态系统的发展至关重要。

- 按类型划分,MEP(机械、电气、管道)和 HVAC(维护服务、企业资产管理等)等硬体维修在亚太地区迅速普及。在设施管理的各个领域,对制定和实施计划维护计划以及确保减少设施热量损失的需求不断增长,从而提高建筑物的能源效率并延长设施的使用寿命,正在推动市场上硬体维修领域的增长。

- 在日本,FM 业者必须应对现场劳动力短缺和老化设施的维护,包括建筑物和空调、照明系统等设备。日本生活水准的提高推动了对具有先进安全功能且管理更有效率的建筑的需求。这一趋势在城市地区尤为明显,预计在预测期内将获得发展动力。

综合设施管理产业概况

综合设施管理市场高度细分,主要企业包括仲量联行 IP 公司、索迪斯公司、ISS 设施服务公司、世邦魏理仕集团公司和康帕斯集团有限公司。该市场的参与企业正在采取合作和收购等策略来加强其产品供应并获得可持续的竞争优势。

- 2023年12月-仲量联行宣布将继续为德州达拉斯、埃尔帕索和圣安东尼德克萨斯州的35家小型医院和急诊部提供综合设施管理、奥克拉荷马市管理和能源可持续性服务,总面积达100万平方英尺;内华达州拉斯维加斯;俄克拉荷马城和匹兹堡;以及威斯康辛州密尔瓦基。

- 2023 年 7 月-EMCOR Group, Inc. 收购位于威斯康辛州的能源效率改善服务供应商 ECM Holding Group, Inc.。该集团相信,ECM的加入将进一步加强其在专业能源效率服务领域的地位,并拓宽其捆绑节能和永续性解决方案的全国组合范围。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概览

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 产业价值链分析

- 评估影响市场的宏观经济因素

第五章市场动态

- 市场驱动因素

- 商业活动復苏可望推动经济成长

- 强调绿色和永续的建筑实践

- 市场限制

- 缺乏专业人员

第六章市场区隔

- 按类型

- 硬体维修

- 软调频

- 按最终用户

- 公共/基础设施

- 商业的

- 工业的

- 设施

- 其他的

- 按地区

- 北美洲

- 欧洲

- 亚洲

- 拉丁美洲

- 澳洲和纽西兰

第七章竞争格局

- 公司简介

- Jones Lang LaSalle IP Inc.

- Sodexo Inc.

- ISS Facility Service

- CBRE Group Inc

- Compass Group PLC

- Cushman & Wakefield

- AHI Facility Services Inc

- EMCOR Facility Services

- Facilicom

- CBM Qatar LLC.

第八章投资分析

第九章 市场机会与未来趋势

The Integrated Facility Management Market size is estimated at USD 165.11 billion in 2025, and is expected to reach USD 232.44 billion by 2030, at a CAGR of 7.08% during the forecast period (2025-2030).

An integrated facilities management (IFM) primarily brings all the facility management contracts under a single service. IFM combines complex facilities management and soft FM, such as security, cleaning, and waste management. Bringing all these different services together under a single umbrella can result in better customer service, better coordination between FM services, and consolidated costs to bring everything in under budget.

Key Highlights

- Growing emphasis on green and sustainable building practices coupled with rebounding construction activity are analyzed as drivers for the growth of the integrated facility management market.

- The growing construction activities due to various government initiatives, rising urbanization, and growing commercial construction projects in developed and developing economies have necessitated the need for integrated facility management services in the past few years.

- Integrated facility management (IFM) is experiencing an upswing due to rebounding commercial activity across various sectors due to the increased need for occupancy due to business expansion; evolving facility needs with technology advancements, and a focus on cost-efficiency.

- Augmented environmental awareness and concerned business practices have pushed integrated facility management (IFM) to exceed its conventional maintenance role as planned business drivers. IFM has appeared as a strategic driver within industries, no longer limited to being a cost center.

- The need for specialized talents poses significant challenges to advancing the integrated facility management market worldwide. The talent gap hinders IFM service providers from delivering the potential of their services as IFM involves a broad range of services from complex FM to soft FM, and finding professionals with expertise in these multiple categories is challenging.

Integrated Facility Management Market Trends

Commercial Segment to be the Largest End-user Segment

- Commercial entities cover office buildings constructed or occupied by business services, such as corporate IT and communication offices, manufacturers, and other service providers. Due to the provision of necessary fitments, interiors, and commercial buildings, decoration and management have gained significant importance, driving the commercial sector market. Commercial spaces require property accounting, renting, contract management, procurement management, and several other services, so hiring professionals becomes necessary. Due to such factors, the commercial category has further growth opportunities in the market, and the trend is likely to continue throughout the forecast period.

- Various retail businesses are expanding their presence by opening new stores in the United States, creating demand for soft FM services. For instance, in April 2023, IKEA store owner Ingka Group announced a plan to spend EUR 2 billion (USD 2.2 billion) expanding in the United States over the next three years. With this plan, the company finalized the opening of eight new big IKEA stores and nine smaller stores and upgraded existing stores in the United States, which is IKEA's second-biggest market by sales after Germany.

- Furthermore, the retail sector in countries like India has shown significant growth during 2023, with the highest record of 7.1 million square feet across key cities in the country, which is 47% more than in 2022, according to CBRE. Recently completed mall constructions primarily led to the demand for retail spaces. Fashion and apparel accounted for the largest leasing of commercial spaces with the expansion of domestic and international brands. Retail space growth in malls is witnessing higher consumer traffic, necessitating robust maintenance, cleaning, security, and energy management services.

- According to a survey by Colliers International, among real estate investors, offices and industrial and logistic properties are expected to be the most demanding asset classes in 2023, with nearly 60% of global investors intending to invest in these types of properties. Multifamily real estate came second with 48% of respondents, followed by hotels.

- Overall, rebounding commercial activities are expected to drive the need for integrated facility management to manage increased occupancy and adopt evolving technologies that allow businesses to address core activities while ensuring smooth business operations.

Asia Pacific to Hold Major Market Share

- The Asia-Pacific region is witnessing an increased development of commercial facilities, with significant investments in infrastructure projects such as hospitals, airports, manufacturing facilities, data centers, and educational institutions, which are expected to drive the Integrated FM market growth. Increasing awareness of Integrated FM outsourcing and service integration benefits is expected to fuel the market's development.

- In China, many facilities managers are incorporating sustainable building management techniques to encourage workplace efficiency and improve the infrastructure to increase asset longevity. Integrated Facility Management impacts every aspect of the organization; a facilities manager's position and the plans for strategic business management will become increasingly strategic in the country.

- China's economy offers an enormous market potential, especially in commercial hubs such as Shanghai and Beijing. Increasing government investments in the country's real estate sector would provide growth opportunities to the market. For instance, China's Five-Year Plan (2021- 2025) targets key areas to balance the country's economy.

- In December 2023, China's automotive company, BYD, announced it would invest USD 412 million to supply South Korea's automaker KG Mobility Co. Ltd with a stable supply of EV batteries. The factory is expected to start mass production in 2025. The country is home to big automotive market players, including LG Energy Solutions, Samsung SDI, SK On, and BYD. Their investment in the factory is crucial to advancing the EV ecosystem in the country.

- By type, hard FM such as MEP (Mechanical, Electrical, Plumbing) and HVAC (Maintenance Services, Enterprise Asset Management, and others) is gaining rapid popularity in Asia-Pacific. Growing demands for creating and operating a planned maintenance schedule across all areas of facility management and enhancing the energy efficiency of buildings by ensuring a reduction in heat loss from premises and lengthening a premise's operational lifespans are propelling the growth of the Hard FM segment in the market.

- In Japan, FM businesses must deal with frontline labor shortages and the upkeep of aging facilities, including buildings and equipment like air-conditioning and lighting systems. Improvements in living standards in the country have escalated demand for buildings equipped with sophisticated security features that can be managed more efficiently. This trend has been particularly evident in urban centers and is expected to gain even more momentum in the forecast period.

Integrated Facility Management Industry Overview

The integrated facility management market is highly fragmented, with significant players like Jones Lang LaSalle IP Inc., Sodexo Inc., ISS Facility Service, CBRE Group Inc., and Compass Group PLC. Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

- December 2023 - JLL declared that it would continue to provide Integrated Facilities Management, Lease Administration, Property Management, and Energy and Sustainability Services for 35 small-format hospitals and emergency departments totaling 1 million square feet in Dallas, El Paso, and San Antonio, Texas; Las Vegas, Nev.; Oklahoma City, Okla.; Pittsburgh, Pa.; and Milwaukee, Wis.; in addition to starting to provide Project and Development Services (PDS) for select markets.

- July 2023 - ECM Holding Group, Inc., a Wisconsin-based provider of energy efficiency retrofit services, was acquired by EMCOR Group, Inc. The group believes that adding ECM will further strengthen its position in energy efficiency specialty services and broaden the scope of its nationwide portfolio of bundled energy conservation and sustainability solutions.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of Macroeconomic Factors on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rebounding Commercial Activity Expected to Drive Growth

- 5.1.2 Emphasis on Green and Sustainable Building Practices

- 5.2 Market Restrains

- 5.2.1 Lack of Specialized Talents

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Hard FM

- 6.1.2 Soft FM

- 6.2 By End -User

- 6.2.1 Public/Infrastructure

- 6.2.2 Commercial

- 6.2.3 Industrial

- 6.2.4 Institutional

- 6.2.5 Other End-Users

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia

- 6.3.4 Latin America

- 6.3.5 Australia and new Zealand

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Jones Lang LaSalle IP Inc.

- 7.1.2 Sodexo Inc.

- 7.1.3 ISS Facility Service

- 7.1.4 CBRE Group Inc

- 7.1.5 Compass Group PLC

- 7.1.6 Cushman & Wakefield

- 7.1.7 AHI Facility Services Inc

- 7.1.8 EMCOR Facility Services

- 7.1.9 Facilicom

- 7.1.10 CBM Qatar LLC.