|

市场调查报告书

商品编码

1408578

电子轮班业务管理解决方案:市场占有率分析、产业趋势与统计、2024年至2029年的成长预测Electronic Shift Operations Management Solutions - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

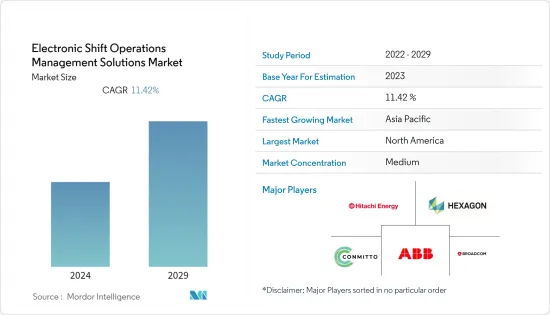

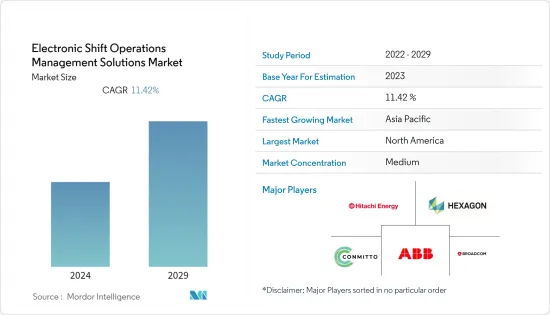

电子轮班业务管理解决方案市场上年度估值为75.7亿美元,预计未来五年复合年增长率为11.42%,达130.1亿美元。

主要亮点

- 电子轮班业务管理解决方案 (eSOMS) 是一款整合软体,透过自动化和整合发电和製造等关键工厂流程来实现关键功能。电子业务管理解决方案采用高效的模组化设计,可实现最大的弹性,同时自动化和整合产业中的所有关键流程。

- 按行业来看,对改善客户体验、业务敏捷性和员工敬业度的变革性技术的需求不断增长,推动了对电子轮班业务管理解决方案的需求。数位转型的兴起正在推动公司如何利用客户洞察、技术力和研发来推动收益成长的方式发生根本性变化。

- 全球工业场地的扩张增加了对高效资料收集工具的需求,以管理关键的人工程序,例如轮班交接和记录每日或轮班事件。传统的资料登录方法未与工业软体集成,因此 eSOMS 透过将日常维护任务和资料组织到单一电子套件中来简化操作。

- 低效率的轮班交接流程会导致致命事故,您始终需要准确的资料。为了解决此类挑战,电子轮班业务管理解决方案的采用市场正在不断增加。该解决方案为企业提供扩充性高效的营运管理解决方案。

- 高阶 eSOMS 解决方案可以提供一致、安全和资讯的轮班交接,增强沟通,并最大限度地降低危险事件的风险。 eSOMS 包括连续的工作订单流程,并确保有效率地完成任务。

- 由于 COVID-19 的爆发,组织越来越多地采用电子轮班营运管理解决方案,以确保以最少的投资安全、高效、可靠地运行和维护关键任务设备。我做到了。军事、核能和化学品生产等关键产业的活动需要一致、有组织和综合的方法,这增加了大流行后 eSOMS 的部署。例如,ABB推出了Ability Asset Suite eSOMS来简化资料中心营运。

电子轮班业务管理解决方案市场趋势

化学工业显着成长

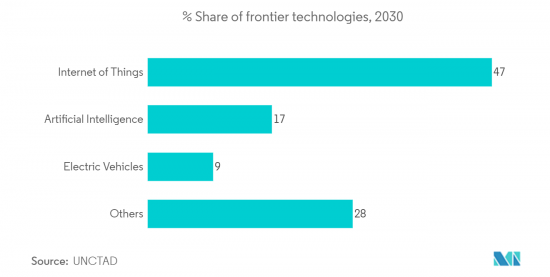

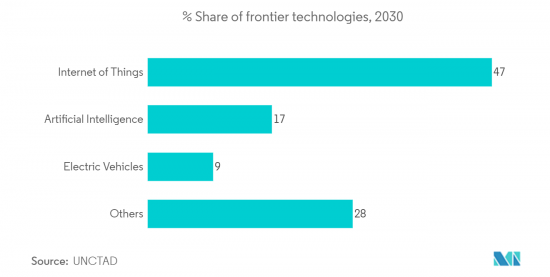

- 在全球范围内,第四次工业革命结合了生产流程和工业运营中的创新技术,正在迅速增长,并推动了对电子轮班营运管理解决方案 (eSOMS) 的需求。物联网、人工智慧、机器人、电动车和积层製造等先进技术的兴起正在推动全球 eSOMS 市场需求的成长。化工材料及零件在各行业的生产过程中都至关重要。因此,化工设备的运作效率非常重要。

- 化学设施采用多种管理系统,包括工厂控制系统、记录和管理运作状态的资讯管理系统以及管理产品品质的系统。 eSOMS 透过数位化所有重要的工厂资讯、操作员工作指示、工作日誌、工作流程资讯等来实现整合管理。

- 化学工业的电子轮班营运管理系统透过标准化的工作程序和简化的流程,有助于确保安全、可靠、高效的工厂运作和法规合规性。例如,横河电机的营运管理系统是一个集中平台,可将工厂营运资讯标准化和数位化,并提出智慧型提案。基于工作流程的执行可让您透过核准生命週期和电子邮件警报有效地自动化任务、权限和变更。

- Innovapptive 的行动操作员查房解决方案以行动和穿戴式技术取代了纸本流程。该解决方案可确保在仪器的工厂资产上收集的资料、关键环境和安全检查按计划进行,并且操作员可以轻鬆获取资讯。

- ABB 提供化学製造营运管理软体,其中包括所有 ABB 能力製造营运管理 (MOM) 应用程式的资料以及 MOM资讯服务託管的外部资料来源。

- 据印度品牌股权基金会称,印度政府推出了生产连结奖励(PLI)计划,以鼓励国内农药生产。特种化学品的需求占印度化学品和石化市场总量的22%,去年大幅成长。

- 印度政府在 2023-24 年联邦预算中向化学和石化部拨款 2,093 万美元。此类措施可能会加速对电子轮班管理解决方案的需求,这些解决方案可以透过连续、即时的资料有效管理业务经理的工作,以优化工作流程。

亚太地区预计将出现显着成长

- 在亚太地区,各行业对可配置性和扩充性的需求不断增长。电子业务管理解决方案可以轻鬆管理员工和人员的出勤情况。随着产业扩充性的提高,eSOMS 有助于防止人员不足、人员过多和时间浪费等问题。

- 亚太地区对工业自动化和智慧工厂的投资强劲,这可能会在预测期内推动对 eSOMS 的需求。新加坡在先进製造技术方面处于领先地位。据威斯康辛州经济发展公司称,新加坡最近宣布了其 10 年蓝图“製造业 2030”,旨在将其製造业增长 50%。

- 去年,现代汽车集团与 JTC 签署了协议。该政府机构监督新加坡的工业发展,并将在新加坡下一代工业的运输和物流方面进行合作。马来西亚也计划在这十年将工业生产力提高30%,泰国政府推出了泰国4.0,这是一项旨在向创新主导经济转型的20年国家发展计画。

- 亚太地区的供应商正在采用新方法,透过先进的工业软体解决方案实现整个工业设施的自动化。 ABB 和日立能源是亚太地区领先的 eSOMS 供应商。与生态系统参与者合作,新工具的开发速度比以往任何时候都快。

- 亚太地区供应商提供的 eSOMS 软体可以自动适应您公司的结构。智慧型工厂的出现促使製造商对智慧工厂的投资增加了 30%。中国和日本等国家是智慧型工厂的早期采用者,其次是韩国。

- 在印度和中国等国家,许多中小型组织正在兴起,eSOMS 解决方案正在迅速被采用,以最大限度地提高效率、提高生产力,并在降低成本的同时增加利润。市场需求由 eSOMS 可靠地提供满足消费者需求的高品质服务的能力所驱动。

电子轮班业务管理解决方案产业概述

由于大量公司的存在,电子轮班业务管理解决方案市场的特征是分散。该市场的主要企业,包括 ABB、日立能源有限公司、Hexagon AB、Conmitto, Inc 和 Broadcom,不断推出创新产品并建立合作伙伴关係和协作,以提高竞争力。

2023 年 7 月,富士通作为製造云端合作伙伴与微软合作,将数位工厂解决方案引进微软市场。富士通的平台旨在优化企业营运并提高製造客户的可用性、性能和品质。该解决方案将所有流程整合到端到端业务价值链中,并解决了製造车间熟练技工短缺和劳动力可用性等挑战。製造商依靠富士通的製造管理解决方案来增强製造流程并提高生产力。

2023年3月,ENEOS Materials公司和横河电机公司向ENEOS Materials公司的化工厂引入了基于强化学习的AI演算法「FKDPP(因子核动态策略编程)」。此自主控制系统在管理工厂蒸馏塔的同时确保了高性能,也是案例正式采用强化学习人工智慧来直接控制工厂。两家公司正在策略合作,探索创新方法,利用人工智慧实现工厂管理和基于状态的工厂维护的数位转型。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 买方议价能力

- 供应商的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

- 产业价值链分析

- 宏观经济因素及其对市场影响的评估

第五章市场动态

- 市场驱动因素

- 任务关键型工业应用对自动化和整合的需求不断增长

- 能源和公共产业领域的需求不断增长

- 市场抑制因素

- 初始实施成本高

- 缺乏熟练的工程师

第六章市场区隔

- 按申请

- 有限运作条件 (LCO) 跟踪

- 管理

- 追踪与管理

- 人员、资格和日程安排

- 其他应用

- 按最终用户

- 化学

- 油和气

- 军队

- 车

- 能源和公共产业

- 其他最终用户

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东/非洲

第七章 竞争形势

- 公司简介

- Conmitto, Inc.

- Globorise Technologies LLC

- ABB

- Hitachi Energy Ltd

- Trinoor.com

- Hexagon AB

第八章投资分析

第九章 市场机会及未来趋势

The electronic shift operations management Solutions Market was valued at USD 7.57 billion in the previous year and is expected to grow at a CAGR of 11.42%, reaching USD 13.01 billion by the next five years.

Key Highlights

- An electronic shift operations management solution (eSOMS) is an integrated software that achieves critical functions by automating and integrating the factory's essential processes, such as power generation and manufacturing. Electronic shift operations management solution comes with highly efficient modular designs that allow for maximum flexibility while automating and integrating all major processes in industries.

- Growing demand for transformation technologies to improve customer experiences, business agility, and employee engagement in industry verticals is driving the demand for Electronic Shift Operations Management Solutions. The rise of digital transformation has steered a radical shift in how businesses harness customer insights, technology capabilities, and research and development to drive revenue growth.

- The expansion of industrial sites worldwide is increasing the demand for efficient data collection tools for managing crucial human procedures like shift handover and capturing the events of the day or shift. As the conventional data logging methods are not integrated with industrial software, eSOMS simplifies operations by organizing routine maintenance operations and data in a single electronic suite.

- Inefficient shift handover processes have caused fatal incidents, requiring constant and precise data. To fix these challenges, there is a rising adoption of electronic shift operations management Solutions to offer an efficient operations management solution with enterprise scalability.

- High-end eSOMS solutions can achieve consistent, safe, and fully informed shift handovers, enhance communication, and minimize the risk of dangerous incidents. The software solution is designed to record, track, and manage events within various departments in industrial setups. eSOMS contains a continuous stream of work instructions and ensures the productive completion of tasks.

- With the outbreak of COVID-19, electronic shift operation management solutions had been increasingly deployed by organizations to ensure a safe, efficient, and reliable operation and maintenance of mission-critical facilities with minimum investment. The need for a consistent, organized, and integrated approach to activities in critical industries, including military, nuclear power, chemical production, and others, had increased the deployment of eSOMS post-pandemic. For instance, ABB had deployed its Ability Asset Suite eSOMS to simplify operations in data centers.

Electronic Shift Operations Management Solutions Market Trends

Chemicals industry to witness significant growth

- The world is witnessing rapid growth in the fourth Industrial revolution that combines innovative technologies in production processes and industrial operations, driving the demand for electronic shift operations management Solutions (eSOMS). The rise of frontier technologies such as the Internet of Things, artificial intelligence, robotics, electric vehicles, and additive manufacturing adds to the growing demand of the global eSOMS market. Chemical materials and components are crucial throughout the entire production process across a wide range of industries. Therefore, operational efficiency in chemical facilities is important.

- Chemical facilities utilize multiple management systems, such as plant control systems, information management systems for recording and managing operational conditions, and systems for managing product quality. This has increased the demand for eSOMS owing to its advantages over traditional methods wherein plant operators use handwritten notes to share information and to give instructions on operations. eSOMS enables integrated management by digitizing all critical plat information, operator task instructions, task logs, and workflow information.

- Electronic shift Operations Management System in the chemicals sector helps to ensure safe, reliable, and efficient plant operations and regulatory compliance through standardized work practices and streamlined processes. For instance, Yokogawa Electric Corporation's Operations Management system is a centralized platform that standardizes and digitizes plant operations information to provide intelligent recommendations. Its workflow-based execution helps to automate tasks, permits, and changes effectively through approval lifecycle and email alerts.

- Innovapptive's Mobile Operator Rounds solutions replace paper-based processes with mobile and wearable technology. The solution checks that data collected on non-instrumented plant assets, critical environmental and safety inspections are performed on schedule and operators have the information at their fingertips.

- ABB offers chemical manufacturing operations management software that includes data across all ABB ability manufacturing operations management (MOM) Applications and external data sources hosted by MOM data services.

- According to the India Brand Equity Foundation, the government of India has introduced a production-linked incentive (PLI) scheme to facilitate the domestic manufacturing of agrochemicals. The demand for specialty chemicals, which constitute 22% of India's total chemicals and petrochemicals market, increased significantly in the previous year.

- The Indian government allocated USD 20.93 million under the Union Budget 2023-24 to the Department of Chemicals and Petrochemicals. Such initiatives will accelerate the demand for electronic shift operation management systems to effectively manage an operations manager's efforts with continuous, real-time data to optimize workflows.

Asia-Pacific is Expected to Grow at a Significant Rate

- Asia-Pacific is registering an increasing demand for configurability and scalability across industry verticals. Electronic shift operation management facilitates the supervision of employee and personnel attendance. With the growing scalability in industry verticals, eSOMS helps prevent issues like understaffing, overstaffing, and time wastage.

- The Asia-Pacific region is observing a significant investment in industrial automation and smart factories, which is likely to boost the demand for eSOMS during the forecast period. Singapore is the leader in advanced manufacturing technologies. According to the Wisconsin Economic Development Corporation, Singapore recently announced Manufacturing 2030, a 10-year roadmap aiming to grow the manufacturing sector by 50%.

- Last year, Hyundai Motor Group signed an agreement with JTC. This government agency oversees industrial progress in Singapore to collaborate on transportation and logistics for Singapore's next-generation industrial parks. Malaysia also plans to increase industrial productivity by 30% by this decade, and Thailand's government launched Thailand 4.0, a 20-year national development plan to transition into an innovation-driven economy.

- Vendors in the Asia Pacific region are embracing new ways of achieving automation across industrial setups with advanced industrial software solutions. ABB and Hitachi Energy Ltd are some of the major providers of eSOMS in the Asia Pacific. New tools are being developed much faster than ever in collaboration with ecosystem players.

- Vendors across the Asia Pacific are providing eSOMS software that schedules shifts to rotate automatically according to the company's structure. With the advent of intelligent factories, manufacturers are devoting significant investments, as much as 30%, to smart factories. Countries such as China and Japan are among the early adopters of intelligent factories, followed by South Korea.

- With the rise of numerous small and medium organizations in countries such as India and China, eSOMS solutions are rapidly being adopted to maximize efficiency, increase productivity, and increase profits while reducing costs. The ability of eSOMS to ensure the delivery of high-quality services that suit consumers' necessities is driving the market demand.

Electronic Shift Operations Management Solutions Industry Overview

The electronic shift operations management solutions market is characterized by fragmentation due to the presence of numerous companies. Key players in this market, including ABB, Hitachi Energy Ltd, Hexagon AB, Conmitto, Inc., and Broadcom, among others, are continually introducing innovative products and forging partnerships and collaborations to gain a competitive edge.

In July 2023, Fujitsu established a partnership with Microsoft as a Cloud for Manufacturing partner and introduced its Digital Factory solution on Microsoft's commercial marketplace. Fujitsu's platform is designed to optimize enterprise operations and enhance availability, performance, and quality for customers in the manufacturing sector. This solution aligns all processes with end-to-end business value chains, addressing challenges such as a shortage of skilled craftsmen and enabling labor at manufacturing sites. Manufacturers are leveraging Fujitsu's manufacturing management solutions as a foundation to enhance manufacturing processes and boost productivity.

In March 2023, ENEOS Materials Corporation and Yokogawa Electric Corporation collaborated to implement a reinforcement learning-based AI algorithm known as Factorial Kernel Dynamic Policy Programming (FKDPP) for use at an ENEOS Materials chemical plant. This autonomous control system ensures a high level of performance while managing a distillation column at the plant, marking the first formal adoption of reinforcement learning AI for direct plant control. These two companies are strategically working together to explore innovative approaches for carrying out digital transformation through AI for plant management and condition-based plant maintenance.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Buyers

- 4.2.2 Bargaining Power of Suppliers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of Macro-economic factor and its Impact on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing demand for automation and integration across mission-critical industrial applications

- 5.1.2 Rising demand across the energy and utilities sector

- 5.2 Market Restraints

- 5.2.1 High cost of initial installation

- 5.2.2 Lack of skilled technical expertise

6 MARKET SEGMENTATION

- 6.1 By Application

- 6.1.1 Limited Condition of Operation (LCO) Tracking

- 6.1.2 Administration

- 6.1.3 Tracking and Control

- 6.1.4 Personnel, Qualification & Scheduling

- 6.1.5 Other Applications

- 6.2 By End-User

- 6.2.1 Chemicals

- 6.2.2 Oil and gas

- 6.2.3 Military

- 6.2.4 Automotive

- 6.2.5 Energy and Utilities

- 6.2.6 Other End-Users

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East & Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Conmitto, Inc.

- 7.1.2 Globorise Technologies LLC

- 7.1.3 ABB

- 7.1.4 Hitachi Energy Ltd

- 7.1.5 Trinoor.com

- 7.1.6 Hexagon AB