|

市场调查报告书

商品编码

1408585

资料整合:市场占有率分析、产业趋势/统计、成长预测,2024-2029Data Integration - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

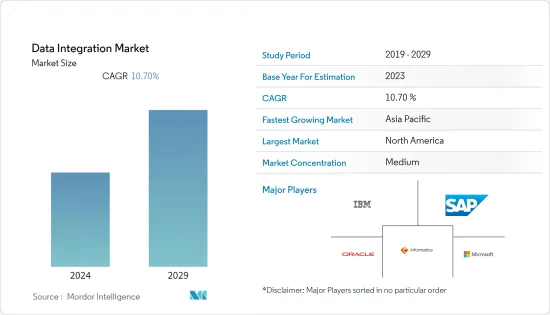

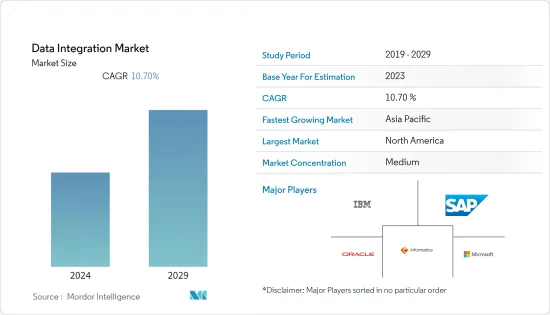

目前资料整合市场的市场规模为97亿美元。

预计未来五年将达到 178.5 亿美元,预测期内复合年增长率为 10.7%。

主要亮点

- 资料整合是将不同来源的资料组合起来以获得单一、连贯的视图的过程。资料整合包括转换、清理、提取、转换和路径规划等流程。借助资料集成,分析解决方案可以提供有价值且准确的商业智慧。

- 资料集成为商业智慧应用程式提供了组织资料的清晰视图,无论资料来源或格式如何,使它们能够根据自己的资料资产提供准确的见解。公司已经意识到,充分发挥其潜力的最实际方法是整合资料。透过将公司掌握的所有资讯集中到一个地方,他们可以发现并利用其中最相关、最准确的见解。公司可以将这些见解应用于其业务营运的策略目标,从而获得相对于竞争对手的优势。

- 预计云端领域将在未来几年显着成长。云端平台的主要目的是建立一个统一的资料存储,可供所有应用程式和使用者透明、有效率地存取。云端运算中的资料整合是指连接各个系统、IT环境、储存库和应用程式以交换即时资料的技术和工具。如果端点是 Google Cloud 或 Oracle Cloud 等云端供应商,它还包括连接来自多个系统的不同资料。

- 随着云端资料可用性的不断增加以及该领域新市场和参与者的出现,零售商正在评估其资料资产并寻找可以维持和推动业务的新收入来源,这是创建流量的好机会。这种资料整合可能会为您的企业带来当今所需的活力。

- 分析认为,扩大合作以最大限度地实现资料整合将显着提高市场成长率。例如,2022 年 8 月,IT 服务管理公司 Nagarro 与云端基础的软体供应商 Zendesk 合作。该计划将为 Nagarro 的 IT 客户提供统一的仪表板视图,并透过 Zendesk 开放且灵活的平台与客户资料进行简单整合。除了个人化客户互动和大规模自动化主动服务之外,它还提高了座席工作效率。

资料整合市场趋势

对云端运算技术的需求不断增长

- 由于 COVID-19 大流行,办公室、学校和企业关闭增加了全球对云端解决方案和服务的需求。公共和私营部门采用「在家工作」文化增加了对基于 SaaS 的员工沟通协作解决方案的需求。与 Amazon Web Services (AWS)、Microsoft Azure 和 Google Cloud 等主要云端供应商合作的云端解决方案供应商正在扩展其云端服务业务,因为许多客户需要敏捷性和快速扩充性。我们预计会有显着增长。

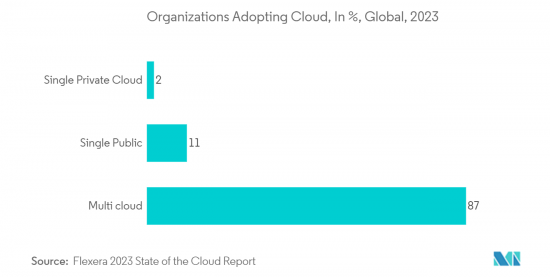

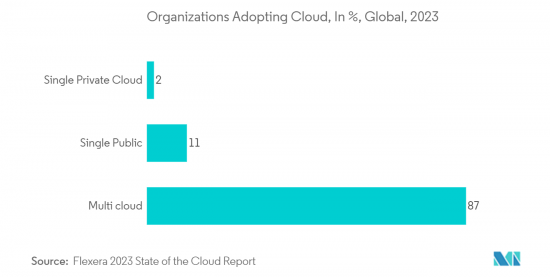

- 云端基础的业务流程的快速采用促使企业获得资料管理能力来管理大量资料。多重云端运算的进步正在推动资料中心世界的成长,并导致资料整合市场需求的增加。

- 新技术推动了资料成长,导致资料呈指数级增长。这些技术包括边缘运算、5G 网路、人工智慧和机器学习(AI 和 ML)、增强智慧和虚拟实境(AR/VR)、区块链和物联网(IoT)。资料量、种类和速度前所未有的成长正在推动资料整合的采用。

- 2022 年 11 月,资料整合平台和分析供应商 Qlik 推出了一项新的云端基础的资料整合平台服务,可以即时从不同来源收集资料。该平台由一组形成资料架构的互连服务组成,允许组织创建资料的单一视图。

分析显示北美占最大市场份额

- 北美是高级分析解决方案和实践的早期采用者和创新倡议的主办者,包括巨量资料、机器学习、资讯科学和高效能运算。此外,该地区拥有强大的供应商,有助于市场成长。

- 传统上,组织从技术和业务流程领域的转型工作中受益。最近技术、监管发展和消费行为的进步都标誌着这种资料主导转型的到来。 Pinterest、Twitter 和 Facebook 等社群网站持有全面的资讯。相较之下,eBay 和亚马逊等零售网站将用户体验和期望提升到了一个完全不同的水平。

- 美国是最重要的分析市场,许多公司都在大力投资,透过先进的特征工程开发更复杂的资料分析和资料整合平台。

- 此外,还分析了该地区合作的扩大,以提高预测期内的市场成长率。例如,2023 年 2 月,Siren 和 DarkOwl 建立了新的资料整合合作伙伴关係。透过整合来自开放原始码、供应商和机密资讯来源的信息,供应商可以为调查人员和资料科学家提供有关国家安全威胁、公共安全问题、诈骗、合规性以及对大型企业的威胁等风险的见解。为了进行可靠的 OSINT 研究,研究人员可以使用 Siren Graph Browser 来结合来自不同来源的研究结果。

资料整合行业概况

资料整合市场的参与者越来越多,凝聚力也越来越强。分析了包括联盟、产品创新和收购在内的多种策略,以推动预测期内的市场成长。

2023 年 7 月,Atturra 和 Denodo 之间的策略合作伙伴关係将资料虚拟功能引入了资料和整合服务。这种合作伙伴关係使企业能够透过逻辑资料架构和资料网格功能最大限度地发挥分散式资料集的价值。此外,它还增强了 Atturra 的资料储存和整合功能。 Denode的逻辑资料管理平台提供统一且易于使用的资料访问,使其在复杂多样的资料环境中尤其有价值。

2022 年 5 月,资料整合软体和服务供应商 Informatica 与Oracle企业连接和自动化平台合作。该合作伙伴关係旨在为企业分析、资料仓储和资料科学提供云端资料整合和管治解决方案。透过将本地工作负载转移到云端平台,两家公司的基本客群都可以从自动化资料产生中受益。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 买方议价能力

- 供应商的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

- 影响市场的宏观经济因素

第五章市场动态

- 市场驱动因素

- 对云端运算技术的需求不断增长

- 巨量资料技术的发展

- 市场抑制因素

- 缺乏专业知识

第六章市场区隔

- 按成分

- 工具

- 服务

- 按发展

- 云

- 本地

- 按公司规模

- 中小企业

- 大公司

- 按申请

- 销售

- 销售/供应链

- 行销

- 人力资源

- 其他的

- 最终用户产业

- 资讯科技/通讯

- BFSI

- 卫生保健

- 製造业

- 零售/电子商务

- 政府/国防

- 其他的

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东/非洲

第七章 竞争形势

- 公司简介

- IBM Corporation

- Microsoft Corporation

- Informatica Inc.

- SAP SE

- Oracle Corporation

- SAS Institute Inc.

- Denodo Technologies

- TIBCO Software Inc.

- QlikTech International AB

- Precisely

第八章投资分析

第九章 市场机会及未来趋势

The data integration market is valued at USD 9.7 billion in the current year. It is expected to register a CAGR of 10.7% during the forecast period to become USD 17.85 billion by the next five years.

Key Highlights

- Data integration is the process of combining data from different sources in order to obtain a single, coherent view. Transformation, cleansing, extract, transform, and load mapping are a few processes involved in data integration. With the help of data integration, analytical solutions are capable of providing valuable and accurate business intelligence.

- The integration of data gives the business intelligence application, irrespective of source or format, a clear view of an organization's data and allows it to provide accurate insight based on its own data assets. It was realized by businesses that the single most practical way of maximizing its potential is to integrate data. With all the information at their disposal in one place, enterprises will find and use the very relevant and accurate insights inside it. They benefit from an advantage over competitors as they can apply such insights for strategic purposes in their business operations.

- The cloud sector will grow significantly over the next few years. The main objective of cloud platforms is to create a unified data store that can be accessed by all applications and users transparently and efficiently. The integration of data in cloud computing refers to technology and tools that connect individual systems, IT environments, repositories, and applications for exchanging real-time data. It also includes connecting different data from multiple systems when the endpoint is a cloud provider, such as Google Cloud or Oracle Cloud, among others.

- With the rising availability of cloud data, as well as new markets and players in this field, it is an opportune time for retailers to assess their data assets and generate new income flows that can sustain and potentially drive development in their business. This data integration may provide the current businesses with the vitality needed.

- The growing collaborations to maximize the cloud data integration are analyzed to significantly drive the market growth rate. For instance, in August 2022, Nagarro, an IT services management firm, partnered with Zendesk, which provides cloud-based software. This initiative would provide for a unified view of the dashboard and simple integration with customer data by Nagarro's IT clients through Zendesk's open, flexible platform. It will also make agents more productive, in addition to the personalization of client interactions and automation of proactive services at scale.

Data Integration Market Trends

Increasing demand for cloud computing technologies

- The shutdown of offices, schools, and enterprises caused by the COVID-19 pandemic increased the demand for cloud solutions and services worldwide. The acceptance of the 'work-from' culture across public and private sectors has resulted in high demand for SaaS-based collaboration solutions, which employees use to communicate with each other. Cloud solution providers partnering with major cloud providers like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud expect significant growth in their cloud services businesses as agility and rapid scalability become necessary for many customers.

- The rapid adoption of cloud-based business processes has encouraged companies to acquire data management capabilities to manage the vast amount of data that is being generated. The advancement in multi-cloud computing is driving the growth of data centers globally, leading to an increased demand for the data integration market.

- The increase in data has been accelerated by emerging technologies contributing to exponential data growth. These technologies are Edge Computing, 5G networking, Artificial intelligence and machine learning (AI and ML), Augmented and virtual reality (AR/VR), Blockchain, and the Internet of Things (IoT). The unprecedented data volume, variety, and speed increase have increased data integration adoption.

- In November 2022, Qlik, a data integration platform and analytics provider, launched a cloud-based new data integration platform service that gathers data from disparate sources in real-time. The platform consists of a set of services that form the data fabric and are interconnected to make it possible for organizations to create one single view of their data.

North America is Analyzed to Hold Largest Share in the Market

- North America is an early adopter and host to innovative initiatives for advanced analytics solutions and practices, such as big data, machine learning, information science, and high-performance computing. Additionally, the region has a strong foothold of vendors, contributing to the market's growth.

- Traditionally, organizations have been gaining benefits from transformation initiatives across technology and business process domains. Recent technology improvements, regulatory developments, and consumer behavior are all converging to usher in this data-led transformation. Social networking sites like Pinterest, Twitter, and Facebook possess comprehensive information. In contrast, retail sites such as eBay and Amazon have taken user experience and expectations to an entirely different level.

- The United States is the most prominent market for analytics, buoyed by the presence of a large number of companies investing heavily to develop more sophisticated data analytics and data integration platforms through advanced feature engineering. For instance, in November 2022, VMware, Inc. announced the number of VMware Sovereign Cloud providers across the globe has more than doubled to 25 partners. VMware has also announced the VMware Aria Operations Compliance pack for sovereign clouds, VMware Tanzu on the sovereign cloud, and new open ecosystem solutions. With sovereign SaaS, VMware Sovereign Cloud Providers can build highly differentiated solutions to capture modern workloads, simplify operations with continuous compliance monitoring, and support data integration with lower risk.

- Further, the growing collaborations in the region are analyzed to bolster the market growth rate during the forecast period. For instance, in February 2023, Siren and DarkOwl entered into a new Data Integration Partnership. Siren provides investigators and data scientists with an insight into risks, such as national security threats, public safety issues, fraud, compliance, or the threat to large enterprise corporations by pooling together information from open source, vendor, and classified sources. For the purpose of conducting robust OSINT investigations, researchers are able to combine findings from a variety of disparate sources using Siren Graph Browser.

Data Integration Industry Overview

The data integration market could be more cohesive, featuring a substantial number of players. To foster market growth during the forecast period, several strategies, including collaborations, product innovations, and acquisitions, have been analyzed.

In July 2023, a strategic partnership between Atturra and Denodo brought data virtualization capabilities to Data and Integration Services. This collaboration empowers enterprises to maximize the value of their distributed data sets through logical data fabrics and data mesh capabilities. Moreover, it enhances Atturra's data storage and integration capabilities. Denodo's logical data management platform offers unified and user-friendly data access, which is particularly valuable in complex and diverse data environments.

In May 2022, Informatica, a provider of data integration software and services, allied with Oracle's enterprise connectivity and automation platform. This partnership aims to provide enterprise Analytics, Data Warehouses, and Data Science with cloud data integration and governance solutions. By transitioning on-premise workloads to the cloud platform, both companies' customer bases will benefit from automated data generation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Buyers

- 4.2.2 Bargaining Power of Suppliers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Macro Economic Factors Impacting the market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing demand for cloud computing technologies

- 5.1.2 Growth in Big data Technologies

- 5.2 Market Restraints

- 5.2.1 Lack of Expertise

6 MARKET SEGMENTATION

- 6.1 By Component

- 6.1.1 Tools

- 6.1.2 Services

- 6.2 By Deployment

- 6.2.1 Cloud

- 6.2.2 On-premise

- 6.3 By Enterprise Size

- 6.3.1 Small and Medium

- 6.3.2 Large Enterprises

- 6.4 By Application

- 6.4.1 Sales

- 6.4.2 Operations and Supply chain

- 6.4.3 Marketing

- 6.4.4 HR

- 6.4.5 Others

- 6.5 By End-user Vertical

- 6.5.1 IT & Telecom

- 6.5.2 BFSI

- 6.5.3 Healthcare

- 6.5.4 Manufacturing

- 6.5.5 Retail & E-commerce

- 6.5.6 Government & Defense

- 6.5.7 Others

- 6.6 By Geography

- 6.6.1 North America

- 6.6.2 Europe

- 6.6.3 Asia Pacific

- 6.6.4 Latin America

- 6.6.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 IBM Corporation

- 7.1.2 Microsoft Corporation

- 7.1.3 Informatica Inc.

- 7.1.4 SAP SE

- 7.1.5 Oracle Corporation

- 7.1.6 SAS Institute Inc.

- 7.1.7 Denodo Technologies

- 7.1.8 TIBCO Software Inc.

- 7.1.9 QlikTech International AB

- 7.1.10 Precisely