|

市场调查报告书

商品编码

1408831

日本汽车贷款:市场占有率分析、产业趋势/统计、成长预测,2024-2029Japan Auto Loan - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

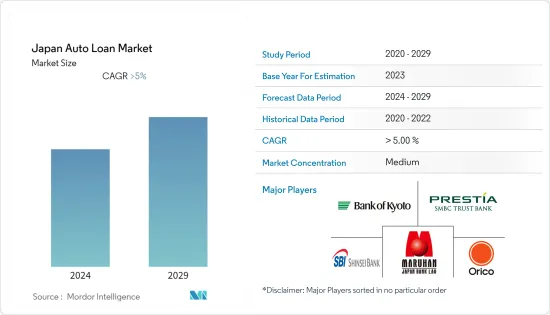

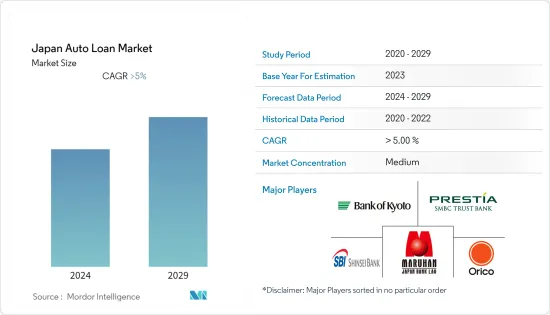

本财年日本汽车贷款市场贷款余额预计为86.7亿美元,预测期内复合年增长率将超过5%。

日本的贷款余额持续逐年增加,显示包括汽车贷款在内的贷款合约数量增加。在日本的小客车领域,中型汽车和小型货车的销售份额较高,贷款提供者专注于汽车贷款市场的特定部分。自新冠疫情以来,国内商用车销量持续下降,导致贷款提供者转向小客车以增加市场占有率。违约率上升、工资成长放缓导致的通货膨胀以及政府的支持措施都对该行业产生了负面影响。

由于国内贷款利率下降,贷款机构主要关注汽车价格的上涨,导致客户选择汽车贷款购买汽车,增加了汽车贷款机构的业务。汽车製造商创建自己的融资公司,让买家更容易购买汽车。丰田、SUZUKI、大发、本田和日产都有自己的金融公司,如丰田金融服务、日产金融服务以及其他作为日本主要经销商存在的金融公司。

长野县、群马县、茨城县和栃木县的汽车持有率超过65%。在日本,由于都市区大众交通工具的可用性,小客车的比例随着远离都市区都市区而增加,而这一人群正在成为汽车贷款的潜在购买者。自COVID-19以来,随着电动车市场的兴起,政府正在补贴电动车的购买成本,因为电动车的价格相对高于传统汽车,这使其成为汽车贷款提供者的新选择。创造新的商业机会。

日本汽车贷款市场趋势

小客车销量增加

自COVID-19以来,日本小客车销量有所增加,而商用车销量持续下降。 SUV、中型轿车、大型轿车和全尺寸货车正在推动小客车的成长,而其他细分市场则继续呈现小幅下滑。随着因COVID-19而陷入负成长的经济逐渐走强,新车销售量与前一年同期比较呈现超过20%的高成长率。从小客车销售来看,丰田、SUZUKI、大发、本田、日产、马自达是日本排名前列的汽车製造商。除此之外,该地区的三轮车销量也呈现正成长,加上推出的电动车燃油效率的提高,小客车销量在未来几年将呈现正成长,从而带动贷款业务。预计会去。

网路银行业务增加

随着银行、金融科技公司、非银行金融公司、OEM和其他贷款机构越来越多地涉足汽车贷款领域,市场竞争持续变得更加激烈。因此,贷款提供者正在转向数位技术来扩大其市场范围,并使客户更能负担得起汽车贷款。借款人发现,透过一个舒适的地点比较混合贷款和线上贷款提供者的不同汽车贷款报价更加舒适。 COVID-19 之后,日本数位银行的净利息收入持续增加,导致线上提供产品的汽车贷款提供者增加。随着越来越多的贷方接受数位化存在以提高销售的作用,银行、金融公司和OEM正在投资数位化其贷款流程服务,这也是汽车贷款的未来贷款过程模式。

日本汽车贷款产业概况

日本汽车贷款市场较为分散,参与企业数量不断增加。汽车价格急剧上升导致更多的人透过贷款为汽车融资。银行业的技术创新使金融机构能够提供数位贷款服务,扩大其覆盖范围和市场规模。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态与洞察

- 市场概况

- 市场驱动因素

- 小客车需求增加

- 透过数位银行业务快速处理贷款

- 市场抑制因素

- 利率增加

- 市场机会

- 由于金融公司灵活的利率设置,贷款销售增加

- 电动车新兴市场扩大汽车贷款市场

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

- 日本汽车贷款市场的技术创新

- COVID-19 对市场的影响

第五章市场区隔

- 按车型

- 小客车

- 商用车

- 车龄

- 新车

- 二手车

- 按最终用户

- 个人

- 公司

- 按贷款提供者

- 银行

- OEM

- 信用合作社

- 其他的

第六章 竞争形势

- 市场集中度概览

- 公司简介

- Maruhan Japan Bank

- SMBC Trust Bank

- Bank of Kyoto

- Orient Corporation

- Orient Corporation

- Mitsubishi UFJ Financial Group

- Volkswagen Financial Services Japan

- HDB Financial Service

- Toyota Financial Services

- Nissan Financial Services

第七章 市场未来趋势

第 8 章 免责声明/关于出版商

Japan's auto loan market has a loan outstanding of USD 8.67 billion in the current year and is poised to register a CAGR of more than 5% for the forecast period.

The value of outstanding loans in Japan has observed a continuous rise over the years, signifying an increase in the number of loan policies being taken, including auto loans as well. In the passenger vehicles segment of the country, medium cars and minivans have more share in market sales, leading to loan providers focusing on certain sections of the auto loan market. Sales of commercial vehicles in the country are observing a continuous decline post covid resulting in loan providers shifting toward passenger vehicles to increase their market share. Rise in the level of default rate, inflation with a decline in wage rate growth, and government support measures are among the factors negatively affecting the industry.

With an existing lower interest rate on loans in the country, loan providers are majorly focusing on the rising price of automobiles, which is resulting in customers opting for auto loans to finance their vehicles and increase the business of automobile loan providers. Automobile manufacturers are coming up with their own finance companies to make it simple for buyers to buy the car. Toyota, Suzuki, Daihatsu, Honda, and Nissan are existing as leading sellers in Japan having their own finance companies such as Toyota Financial Services, Nissan Financial Services, and others.

Nagano, Gunma, Ibaraki, and Tochigi are among the cities in Japan with a leading automobile share of more than 65% of their population. The share of passenger vehicles in the country increases with distance away from cities because of the availability of public transportation facilities in the cities and is leading to population segment away from cities emerging as potential buyers of auto loans in the market. Post-COVID-19, with the emerging market of electric vehicles, the government is providing subsidies on the cost of electric vehicles as their price is relatively higher than conventional vehicles and is leading to the creation of new business opportunities for auto loan providers.

Japan Auto Loan Market Trends

Increasing Sales Of Passenger Vehicles

Post-COVID-19, sales of passenger vehicles in Japan are observing an increase with a continuous decline in sales of commercial vehicles. SUVs, medium cars, large cars, and full-sized vans are among the segments driving the growth of passenger vehicles, with other segments still observing a small decline in sales. As the economy is gaining strength after observing a negative decline during COVID-19, sales of new vehicles are coming up with strong growth of more than 20% in comparison to last year. Among the passenger vehicle sales, Toyota, Suzuki, Daihatsu, Honda, Nissan, and Mazda are existing as automobile manufacturers leading in auto sales in the country. In addition to this, sales of three-wheelers in the region are also observing positive growth, and combined with the fuel efficiency of launched electric vehicles, sales of passenger vehicles are expected to observe positive growth over the coming years and drive its loan segment business as well.

Rising Online Banking

With an increase in business participation ranging from banks, fintech, NBFC, OEM, and other financial lenders in auto loans, there is continuously increasing competition in the market. As a result of this, loan providers are opting for digital technologies to make it affordable for users to borrow automobile loans and increase their market reach. Borrowers are finding it more comfortable to compare different auto loan offers of hybrid and online loan providers through their comfort place. Post-COVID-19, the net interest income of digital banks in Japan observed a continuous rise, leading to an increasing number of auto loan providers offering their products online. With an increasing number of lenders accepting the role of digital presence for improving their sales, banks, financial companies, and OEMs are investing in digitizing their loan process services, and this is an upcoming loan processing model for auto loans as well.

Japan Auto Loan Industry Overview

The Japanese auto loan market is fragmented, with a continuously increasing number of players in the market. The rising price of automobiles is leading to an increasing number of people financing their vehicles through loans. Technological innovations in the banking industry are resulting in lenders offering their digital loan services to increase their reach and market size. Some of the existing players in the Japanese auto loan market are Maruhan Japan Bank, SMBC Trust Bank, Bank of Kyoto, and SBI Shinsei Bank.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS AND INSIGHTS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increase In Demand For Passenger Vehicles

- 4.2.2 Quick Processing of Loan through Digital Banking

- 4.3 Market Restraints

- 4.3.1 Rise of Interest Rates

- 4.4 Market Opportunities

- 4.4.1 Flexible Interest Rate by Financing Companies Raising their Loan Sales

- 4.4.2 Emerging Market of Electric Vehicles Expanding the Auto Loan Market

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Technological Innovations in Japan Auto Loan Market

- 4.7 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Vehicle Type

- 5.1.1 Passenger Vehicle

- 5.1.2 Commercial Vehicle

- 5.2 By Vehicle Age

- 5.2.1 New Vehicle

- 5.2.2 Used Vehicle

- 5.3 By End User

- 5.3.1 Individual

- 5.3.2 Enterprise

- 5.4 By Loan Provider

- 5.4.1 Banks

- 5.4.2 OEM

- 5.4.3 Credit Unions

- 5.4.4 Other Loan Providers

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profile

- 6.2.1 Maruhan Japan Bank

- 6.2.2 SMBC Trust Bank

- 6.2.3 Bank of Kyoto

- 6.2.4 Orient Corporation

- 6.2.5 Orient Corporation

- 6.2.6 Mitsubishi UFJ Financial Group

- 6.2.7 Volkswagen Financial Services Japan

- 6.2.8 HDB Financial Service

- 6.2.9 Toyota Financial Services

- 6.2.10 Nissan Financial Services*