|

市场调查报告书

商品编码

1408869

黄金:市场占有率分析、行业趋势和统计数据、2024年至2029年的成长预测Gold - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

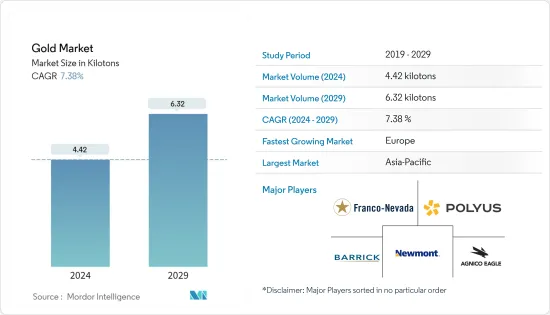

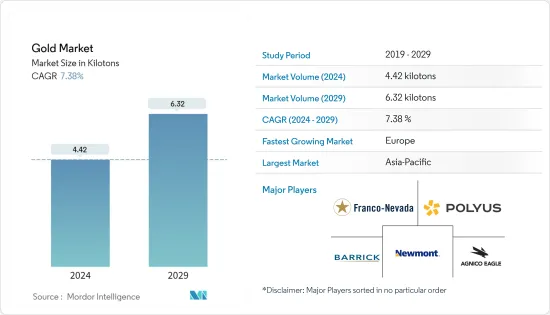

2024 年黄金市场规模预计为 4.42 吨,预计 2029 年将达到 6.32 吨,在预测期内(2024-2029 年)复合年增长率为 7.38%。

2020 年,COVID-19 大流行对多个产业产生了负面影响。大多数地区的封锁扰乱了采矿和加工活动,对货物运输的限制扰乱了供应链。然而,到了2021年,情况开始好转,市场恢復了成长轨迹。

推动市场的主要因素是珠宝饰品、技术和长期储蓄等形式的黄金需求。在开发中国家尤其如此,黄金经常被用作奢侈品和维持财富的手段。

然而,矿石变质、技术挑战和罢工等因素预计将阻碍全球黄金市场的扩张。

然而,预计中国和印度的婚礼市场将在未来几年为黄金市场提供一些成长机会。

亚太地区在全球市场中占据主导地位,其中消费量最高的国家来自中国和印度等国家,并且预计这种情况将持续下去。

黄金市场趋势

珠宝饰品领域主导需求

- 黄金有多种用途,包括珠宝饰品、电子产品、硬币、奖牌、美术、牙科、医学和货币系统。金的导电性、耐腐蚀、生物相容性和延展性等特性使其适合这些应用。某些医学问题,如癌症和关节炎,也可以使用放射性同位素和金盐来治疗。

- 透过钻探、爆破或刮削周围的岩石,从矿脉矿床中提取黄金。矿脉通常发现于地下深处。矿工透过沿着矿脉在地下挖掘隧道来挖掘矿物。然后,技术人员使用镐和小型炸药从周围的岩石中提取金矿石。

- 通常,在堆浸之前,金矿石被碾碎并结块。需要进一步加工从高等级矿石和粗粒且耐氰化浸出的矿石中提取金含量。在氰化物浸出前采用破碎、浓缩、焙烧、加压氧化等加工方法。

- 在预测期内,珠宝饰品业可能占据黄金市场的最大份额。黄金不会失去光泽、生锈或腐蚀。由于其优异的性能和光泽,它是珠宝饰品製造中最重要的金属。黄金太软,不适合日常使用,因此它与金属组合形成合金,使其更耐用,因此可以用于珠宝。

- 许多其他类型的黄金也用于珠宝的生产。黄金有多种颜色、克拉数和镀层,每种都有其独特的品质。市场上大约有15种黄金,包括黄金、白金和玫瑰金。

- 此外,根据世界黄金协会的数据,2022 年第三季珠宝用黄金需求预计为 581.7 吨。这是本季最受欢迎的目标,领先于投资、科技和央行。

- 总体而言,在预测期内,珠宝饰品需求可能会继续在推动全球黄金市场需求方面发挥重要作用。

亚太地区主导市场

- 亚太地区是最大的黄金生产国之一,以中国和澳洲为首。中国拥有最大的市场占有率,也是预测期内最大的黄金用户。

- 根据美国地质调查局的数据,2022年中国金矿的黄金产量位居亚太地区之首。澳洲、乌兹别克和印尼是该地区其他最大生产国,2022 年开采量分别为 320 吨、100 吨和 70 吨。

- 根据世界黄金协会的数据,随着山东省的采矿业在 2021 年大部分时间的安全停工后恢復正常,中国的矿场产量在 2022 年增加了 13%,达到 374 吨。

- 从地区来看,在中国产量復苏的推动下,2022年亚太地区矿山产量增幅最大,较2021年增加11吨。

- 2022年黄金回收市场将由印度主导,回收供应量快速增加。在以印度为最大市场的南亚地区,回收供应量较去年同期成长近40%,较上季成长约60%。

- 此外,与2022年(55天)相比,2023年吉祥结婚日的数量将增加(67天),这将刺激黄金首饰的需求。

- 在金融界,黄金是最受欢迎的贵金属。根据世界黄金协会的数据,从1971年1月到2022年12月,黄金的平均年回报率为7.78%,落后于商品的平均年回报率8.3%。 2002 年至 2022 年期间,黄金投资收益波动较大,但在大多数研究年份中都产生了正收益。 2022年,黄金投资报酬率约为0.44%。由于许多人希望投资黄金以对冲股市,因此对黄金的需求可能会增加。

- 因此,上述所有因素预计将在预测期内推动亚太地区黄金市场的需求。

黄金产业概况

黄金市场部分分散,市场上只有少数大型参与者和许多小型参与者。研究市场的主要企业(排名不分先后)包括纽蒙特公司、巴里克黄金公司、FRANCO-NEVADA CORPORATION、PJSC Polyus、Agnico Eagle Mines Limited 等。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 珠宝饰品的黄金需求和长期储蓄

- 高阶电子应用的消耗增加

- 其他司机

- 抑制因素

- 矿石品位下降和其他技术挑战

- 其他阻碍因素

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场区隔(市场规模)

- 按类型

- 合金金

- 分层金

- 按用途

- 珠宝饰品

- 电子产品

- 奖项和地位的象征

- 其他应用(牙科、航太等)

- 地区

- 生产分析

- 美国

- 澳洲

- 巴西

- 布吉纳法索

- 加拿大

- 中国

- 哥伦比亚

- 迦纳

- 印尼

- 哈萨克

- 马里

- 墨西哥

- 巴布亚纽几内亚

- 秘鲁

- 俄罗斯

- 南非

- 苏丹

- 坦尚尼亚

- 乌兹别克

- 其他国家

- 消费分析

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东/非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲

- 生产分析

第六章 竞争形势

- 併购、合资、联盟、协议

- 市场占有率(%)**/排名分析

- 主要企业策略

- 公司简介

- Agnico Eagle Mines Limited

- Barrick Gold Corporation

- FRANCO-NEVADA CORPORATION

- FURUKAWA CO.,LTD

- Gabriel Resources Ltd.

- Harmony Gold Mining Company Limited

- Jinshan Gold

- Johnson Matthey

- Kinross Gold Corporation

- New Gold Inc.

- Newmont Corporation

- PJSC Polyus

- Tertiary Minerals

- Vedanta Resources Limited

- Zijin Mining Group

第七章 市场机会及未来趋势

- 增加黄金投资增加外汇存底

- 其他机会

The Gold Market size is estimated at 4.42 kilotons in 2024, and is expected to reach 6.32 kilotons by 2029, growing at a CAGR of 7.38% during the forecast period (2024-2029).

The COVID-19 pandemic affected several industries negatively in 2020. The lockdown in most regions caused disruptions in mining and processing activities, and restrictions in freight transportation disturbed the supply chain. However, the conditions started recovering in 2021, restoring the market's growth trajectory.

The major factor driving the market is the demand for gold in the form of jewelry, technology, and long-term savings. This is especially true in developing nations, where gold is frequently utilized as a luxury item and a way of preserving wealth.

However, factors like declining ore grades, technical challenges, and strikes are expected to hinder global gold market expansion.

Nevertheless, the wedding market sector in China and India is projected to give several growth opportunities for the gold market segment in the future.

The Asia-Pacific region dominated the market globally, with the largest consumption coming from countries such as China and India, and this is expected to remain the same in the future.

Gold Market Trends

Jewelry Segment to Dominate the Demand

- Gold is used in a variety of applications, including jewelry, electronics, coins, medals, art, dentistry, medicine, and monetary systems. Gold is suitable for these applications due to properties such as conductivity, corrosion resistance, biocompatibility, and malleability. Certain medical problems, such as cancer and arthritis, can also be treated with gold by adopting radioactive isotopes or gold salts.

- Gold is extracted from lode deposits by drilling, blasting, or shoveling the surrounding rock. Lode deposits are typically found deep underground. Miners mine underground by digging tunnels through the earth following the vein. Technicians then use picks and tiny explosives to extract the gold ore from the surrounding rock.

- Typically, before heap leaching, the gold ore is crushed and agglomerated. Further processing is required to extract the gold contents from high-grade ores and ores resistant to cyanide leaching at coarse particle sizes. Before cyanidation, processing methods such as grinding, concentration, roasting, and pressure oxidation may be used.

- During the forecast period, the jewelry sector is likely to have the largest share of the gold market. Gold does not tarnish, rust, or corrode. It is the most significant metal in jewelry manufacturing due to its excellent features and shine. Since gold is too soft for everyday usage, it is alloyed with a metal combination to make it tougher so that it may be used for jewelry.

- Numerous other varieties of gold are used to produce the jewelry. Gold is available in a variety of hues, karats, and coatings, each with its own set of qualities. On the market, there are around 15 distinct varieties of gold available, including yellow gold, white gold, rose gold, and others.

- Moreover, according to the WGC, in the third quarter of 2022, the demand for gold for jewelry applications was estimated to be 581.7 metric tons. This was the most popular purpose in that quarter, ahead of investment, technology, and central banks.

- Overall, the gold jewelry demand is likely to continue playing an instrumental role in driving the global demand for the gold market over the forecast period.

Asia-Pacific Region to Dominate the Market

- Asia-Pacific is one of the largest producers of gold, driven by China and Australia. China has the biggest market share and will also be the top gold user over the forecast period.

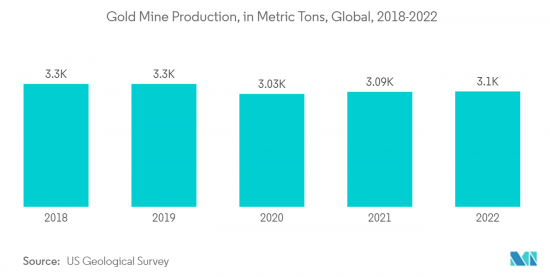

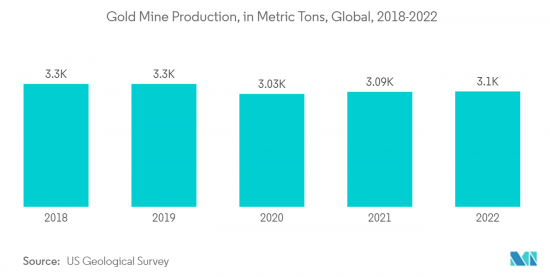

- According to the U.S. Geological Survey, in 2022, gold mines in China produced the most gold in the Asia-Pacific region. Australia, Uzbekistan, and Indonesia were the other top producers in the region, with 320 metric tons, 100 metric tons, and 70 metric tons mined in 2022, respectively.

- According to the World Gold Council, mine production in China increased by 13% in 2022 to 374 tons as mining in Shandong province returned to normal, following the widespread safety stoppages for most of 2021.

- Region-wise, mine production in Asia-Pacific saw the largest increase in 2022, up by 11 tons compared to 2021, driven by the recovery in China's output.

- India led the gold recycling market in 2022, with sharp increases in recycling supply. The South Asian region, with India being the biggest market, saw recycling supply up nearly 40% year-on-year and about 60% quarter-on-quarter.

- A higher number of auspicious wedding days in the country in 2023 (67 days) as compared to 2022 (55 days) will also add to the demand for gold jewelry.

- In the financial world, gold is the most popular precious metal. According to the WGC, from January 1971 and December 2022, gold had an average annual return of 7.78%, trailing only commodities, which had an average annual return of 8.3%. The rate of return on gold investments varied greatly from 2002 to 2022 but provided positive returns in the majority of the years studied. In 2022, the return on gold as an investment was around 0.44%. Many people are looking to invest in gold as a hedge against equity markets, which will increase its demand.

- Therefore, all such factors mentioned above are projected to contribute to driving demand for the gold market in the Asia-Pacific region over the forecast period.

Gold Industry Overview

The gold market is partially fragmented, with the presence of a few large-sized players and a large number of small players operating in the market. The major players in the studied market (not in any particular order) include Newmont Corporation, Barrick Gold Corporation, FRANCO-NEVADA CORPORATION, PJSC Polyus, and Agnico Eagle Mines Limited, amongst others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Demand for Gold in the form of Jewelry and Long-term Savings

- 4.1.2 Increasing Consumption in High-End Electronics Applications

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Declining Ore Grades and Other Technical Challenges

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 By Type

- 5.1.1 Alloyed Gold

- 5.1.2 Layered Gold

- 5.2 Application

- 5.2.1 Jewellery

- 5.2.2 Electronics

- 5.2.3 Awards and Status Symbols

- 5.2.4 Other Applications (Dentistry, Aerospace, etc.)

- 5.3 Geography

- 5.3.1 Production Analysis

- 5.3.1.1 United States

- 5.3.1.2 Australia

- 5.3.1.3 Brazil

- 5.3.1.4 Burkina Faso

- 5.3.1.5 Canada

- 5.3.1.6 China

- 5.3.1.7 Colombia

- 5.3.1.8 Ghana

- 5.3.1.9 Indonesia

- 5.3.1.10 Kazakhstan

- 5.3.1.11 Mali

- 5.3.1.12 Mexico

- 5.3.1.13 Papua New Guinea

- 5.3.1.14 Peru

- 5.3.1.15 Russia

- 5.3.1.16 South Africa

- 5.3.1.17 Sudan

- 5.3.1.18 Tanzania

- 5.3.1.19 Uzbekistan

- 5.3.1.20 Other countries

- 5.3.2 Consumption Analysis

- 5.3.2.1 Asia-Pacific

- 5.3.2.1.1 China

- 5.3.2.1.2 India

- 5.3.2.1.3 Japan

- 5.3.2.1.4 South Korea

- 5.3.2.1.5 Rest of Asia-Pacific

- 5.3.2.2 North America

- 5.3.2.2.1 United States

- 5.3.2.2.2 Canada

- 5.3.2.2.3 Mexico

- 5.3.2.3 Europe

- 5.3.2.3.1 Germany

- 5.3.2.3.2 United Kingdom

- 5.3.2.3.3 Italy

- 5.3.2.3.4 France

- 5.3.2.3.5 Rest of Europe

- 5.3.2.4 South America

- 5.3.2.4.1 Brazil

- 5.3.2.4.2 Argentina

- 5.3.2.4.3 Rest of South America

- 5.3.2.5 Middle East and Africa

- 5.3.2.5.1 Saudi Arabia

- 5.3.2.5.2 South Africa

- 5.3.2.5.3 Rest of Middle East and Africa

- 5.3.1 Production Analysis

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%) **/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Agnico Eagle Mines Limited

- 6.4.2 Barrick Gold Corporation

- 6.4.3 FRANCO-NEVADA CORPORATION

- 6.4.4 FURUKAWA CO.,LTD

- 6.4.5 Gabriel Resources Ltd.

- 6.4.6 Harmony Gold Mining Company Limited

- 6.4.7 Jinshan Gold

- 6.4.8 Johnson Matthey

- 6.4.9 Kinross Gold Corporation

- 6.4.10 New Gold Inc.

- 6.4.11 Newmont Corporation

- 6.4.12 PJSC Polyus

- 6.4.13 Tertiary Minerals

- 6.4.14 Vedanta Resources Limited

- 6.4.15 Zijin Mining Group

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Rising Investment in Gold to Increase the Forex Reserves

- 7.2 Other Opportunities