|

市场调查报告书

商品编码

1429210

全球化学种子处理:市场占有率分析、产业趋势、统计和成长预测(2024-2029)Global Chemical Seed Treatment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

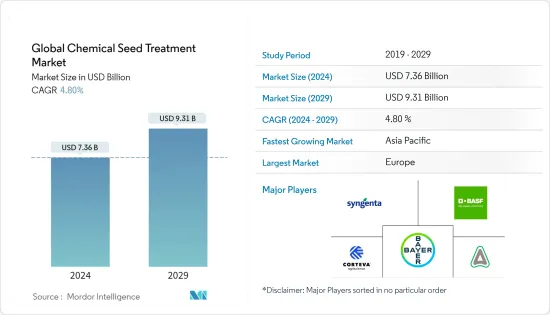

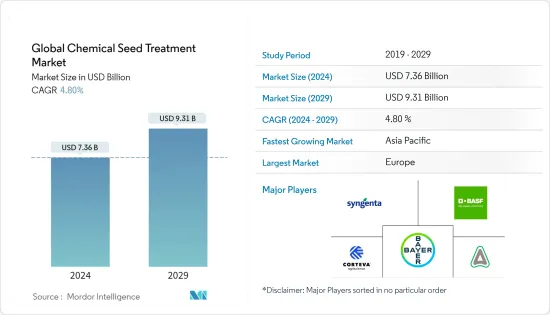

预计2024年全球化学种子处理市场规模为73.6亿美元,2029年达93.1亿美元,在预测期间(2024-2029年)复合年增长率为4.80%。

COVID-19大流行对种子处理化学品市场的影响可以忽略不计,主要是由于运输障碍。由于新冠疫情的爆发,所有类型的农业活动均被政府豁免,不受封锁和中断的影响,因此没有这种影响。事实上,由于农民的抢购行为,农药公司的利润与去年相比达到了两位数。农民对种子处理的认识不断提高,并得到了政府的支持。开发中国家政府在国家和村庄层级管理多个种子库,以储存经过适当种子处理的种子并防止种子腐败。围绕种子处理使用的政府法规和宣传活动激励措施正在推动市场发展。全球种子处理市场由农药、杀菌剂和其他化学品组成,其中化学品是最主要的应用领域。

化学种子处理市场的趋势

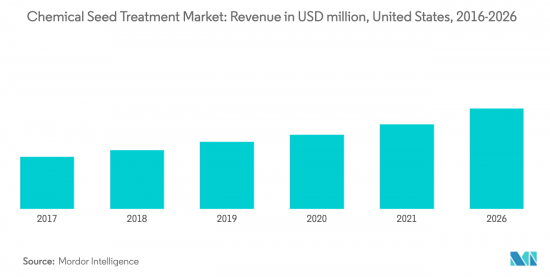

优质种子成本增加推动市场发展

与混合和基因改造种子相关的高成本是推动全球种子处理市场成长的主要因素。由于与农药熏蒸和叶面喷布相关的监管问题日益增多,农民越来越多地将种子处理视为保护其对优质种子投资的一种手段。由于对具有理想农艺性状的优质种子的需求增加,预计种子成本将会上升。公司和农民都愿意花钱购买种子处理解决方案来保存高品质的种子。根据 2019 年美国农业部的估计,自 1995 年以来,玉米种子的成本下降了约 300%,但产量仅增加了 35%。种植者试图透过选择不需要多次化学剂量的种子来降低营运成本。透过使用种子处理产品确保这些人造种子的初步保护。

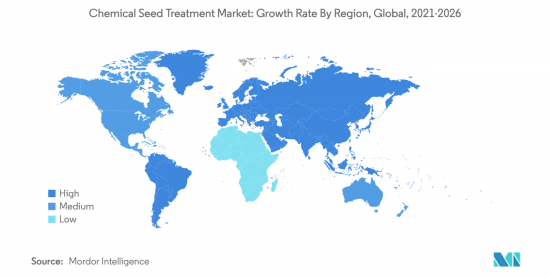

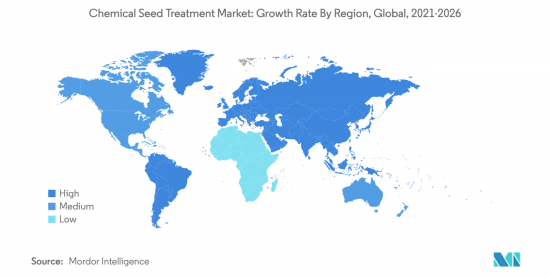

亚太地区的使用量增加

从地区来看,亚太地区是种子处理化学品的最大消费国,市场占有率约 60.0%。亚洲生产的主要作物有稻米、甜菜、水果和蔬菜、谷物和谷类。韩国、中国、日本和最近的越南等亚洲国家正在将更多的种子保护/增强产品应用于短期和多年生作物。各种大型种子处理公司,如先正达、BASF、拜耳等都在这些地区开展业务,并定期进行田间试验,以提高人们对其产品的认识,并展示使用其种子处理产品的好处,我们还举办培训课程。农业实践的增加和对优质农产品的需求预计将推动该地区种子处理市场的成长。

化学种子处理产业概况

化学种子处理市场得到巩固。市场上的主要企业占据了大部分市场,并拥有多样化且不断增长的产品系列。从市场占有率优势来看,先正达国际股份公司的市占率为24.0%,其次是拜耳作物科学股份公司、科迪华农业科学公司、BASF股份公司和先正达。这些市场领导者致力于透过扩张、投资、併购、联盟、合资和协议来扩大其影响力。这些公司在北美、亚太地区和欧洲拥有强大的影响力。我们在全部区域也拥有製造设施和强大的分销网络。该市场的主要企业致力于透过业务扩张、产品创新、併购、联盟、合资企业和协议来扩大自己的影响力。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 市场驱动因素

- 市场限制因素

- 波特五力分析

- 供应商的议价能力

- 买家/消费者的议价能力

- 替代品的威胁

- 新进入者的威胁

- 竞争公司之间的敌对关係

第五章市场区隔

- 目的

- 杀虫剂

- 杀菌剂

- 其他化学品

- 作物

- 玉米

- 大豆

- 小麦

- 米

- 油菜籽

- 棉布

- 地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 其他北美地区

- 欧洲

- 西班牙

- 英国

- 法国

- 德国

- 俄罗斯

- 义大利

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 印度

- 泰国

- 越南

- 澳洲

- 其他亚太地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东/非洲

- 南非

- 其他中东和非洲

- 北美洲

第六章 竞争形势

- 最采用的策略

- 市场占有率分析

- 公司简介

- Syngenta International AG

- Bayer CropScience AG

- BASF SE

- DowDuPont Inc.

- ADAMA Agricultural Solutions Ltd

- Advanced Biological Systems

- BioWorks Inc.

- Germains Seed Technology

- Incotec Group BV

- Nufarm Limited

- Plant Health Care

- Precision Laboratories

- Valent Biosciences Corporation

- Verdesian Life Sciences

第七章 市场机会及未来趋势

第 8 章 COVID-19 市场影响评估

The Global Chemical Seed Treatment Market size is estimated at USD 7.36 billion in 2024, and is expected to reach USD 9.31 billion by 2029, growing at a CAGR of 4.80% during the forecast period (2024-2029).

The impact of the COVID-19 pandemic on the seed treatment market has been minimal, mainly due to transportation barriers. The impact of lockdowns or disruptions has been exempted by the government for all types of agricultural activities, hence there has been no such effect of corona outbreak. Indeed, the agrochemical companies have made double-digit profits as compared to last year, due to panic buying behavior from farmers. Growing awareness among farmers over the use of seed treatment has resulted in support from the government. Multiple seed banks are being managed by the governments of developing countries, at the national, as well as village levels, in order to store seeds that are properly treated by seed treatment chemicals, hence preventing the rotting of seeds. Encouraging government regulations and campaigns over the use of seed treatment is driving the market. The global market for seed treatment comprises chemical agents, including insecticides, fungicides, and other chemicals, of which chemical agents form the most dominant application segment.

Chemical Seed Treatment Market Trends

Increase in Cost of High-Quality Seeds driving the Market

High costs associated with hybrids and genetically modified seeds is a major factor driving the growth of the seed treatment market, globally. Seed treatment is gradually being considered by farmers as a mode to protect investments made on good quality seeds, due to an increase in regulatory issues relating to fumigation, as well as the foliar application of pesticides. Cost of seeds is expected to increase, owing to a increase in the demand for high-quality seeds, with desirable agronomic traits. Both companies and farmers are ready to spend on seed treatment solutions, in order to save high-quality seeds. According to USDA estimates of 2019, corn seeds cost about 300% since 1995, while the yield grew by only 35%. Framers are trying to cut down operating costs by selecting seeds that do not require multiple doses of chemicals. The initial protection of these engineered seeds is ensured by using seed treatments products.

Increasing Usage in the Asia Pacific region

Geographically, Asia Pacific is the top consumer of seed treatment with a market share of around 60.0%. Major crops produced in Asia include rice, sugar beet, fruits & vegetables, cereals, and grains. Asian countries, such as Korea, China, Japan, and recently Vietnam, are applying more of seed protection/enhancement products for both short-term and perennial crops. Various leading seed treatment companies like Syngenta, BASF, and Bayer are operating in these regions and they regularly organize field trials and training sessions to increase the awareness regarding their products, as well as to present the benefits of using seed treatment products. The increasing agricultural practices and requirement of high-quality agricultural produce are factors that are projected to drive the seed treatment market growth in this region.

Chemical Seed Treatment Industry Overview

The market for chemical seed treatment is consolidated. Top players in the market occupy a major portion of the market, having a diverse and increasing product portfolio. In terms of market share dominance, Syngenta International AG with 24.0% share is followed by Bayer CropScience AG, Corteva Agriscience, BASF SE, and Syngenta. These major players in this market are focusing on increasing their presence through expansions & investments, mergers & acquisitions, partnerships, joint ventures, and agreements. These companies have a strong presence in North America, Asia Pacific, and Europe. They also have manufacturing facilities, along with strong distribution networks across these regions. The major players in this market are focusing on increasing their presence through expansions & product innovations, mergers & acquisitions, partnerships, joint ventures, and agreements.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Porter's Five Force Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Threat of Substitute Products

- 4.4.4 Threat of New Entrants

- 4.4.5 Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Application

- 5.1.1 Insecticide

- 5.1.2 Fungicide

- 5.1.3 Other Chemicals

- 5.2 Crop

- 5.2.1 Corn/Maize

- 5.2.2 Soybean

- 5.2.3 Wheat

- 5.2.4 Rice

- 5.2.5 Canola

- 5.2.6 Cotton

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.1.4 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Spain

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Germany

- 5.3.2.5 Russia

- 5.3.2.6 Italy

- 5.3.2.7 Rest of Europe

- 5.3.3 Asia Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 Thailand

- 5.3.3.5 Vietnam

- 5.3.3.6 Australia

- 5.3.3.7 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East & Africa

- 5.3.5.1 South Africa

- 5.3.5.2 Rest of Middle East & Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 Syngenta International AG

- 6.3.2 Bayer CropScience AG

- 6.3.3 BASF SE

- 6.3.4 DowDuPont Inc.

- 6.3.5 ADAMA Agricultural Solutions Ltd

- 6.3.6 Advanced Biological Systems

- 6.3.7 BioWorks Inc.

- 6.3.8 Germains Seed Technology

- 6.3.9 Incotec Group BV

- 6.3.10 Nufarm Limited

- 6.3.11 Plant Health Care

- 6.3.12 Precision Laboratories

- 6.3.13 Valent Biosciences Corporation

- 6.3.14 Verdesian Life Sciences