|

市场调查报告书

商品编码

1429213

涡轮膨胀机:市场占有率分析、产业趋势、成长预测(2024-2029)Turbo Expander - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

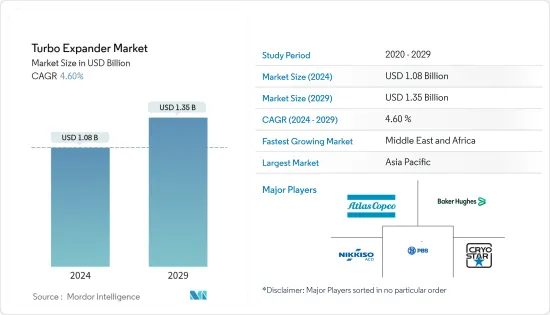

涡轮膨胀机市场规模预计到 2024 年为 10.8 亿美元,预计到 2029 年将达到 13.5 亿美元,在预测期内(2024-2029 年)复合年增长率为 4.60%。

主要亮点

- 从中期来看,增加对天然气作为发电和各行业燃料的投资预计将增加对涡轮膨胀机市场的需求。

- 另一方面,太阳能和风力发电等再生能源来源份额的增加预计将阻碍市场成长。

- 然而,增加技术投资以有效生产能源和减少二氧化碳排放预计将为涡轮膨胀机市场提供重大机会。

涡轮膨胀机市场趋势

发电板块占有较大份额

- 涡轮膨胀机与蒸气涡轮或燃气涡轮机类似,是一种带有膨胀涡轮的旋转机器,可将气体中包含的能量转化为机械功。蒸气涡轮或燃气涡轮机的目的是透过驱动发电机或作为其他旋转机械(例如压缩机或高功率泵)的原动机,将机械功转化为有用的电力。

- 2022年,天然气将在发电中发挥主要作用,约占发电总量的23%。这主要是由于美国和中国天然气发电的强劲成长。未来二十年,全球燃气发电厂装置容量预计将增加,到 2040 年,电网新增容量预计将超过 1,500 吉瓦。

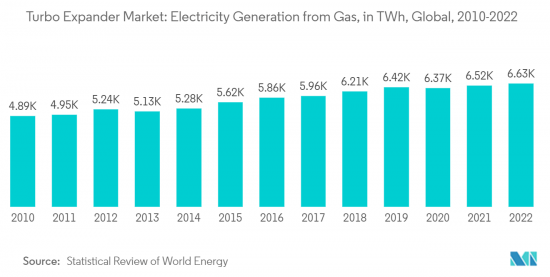

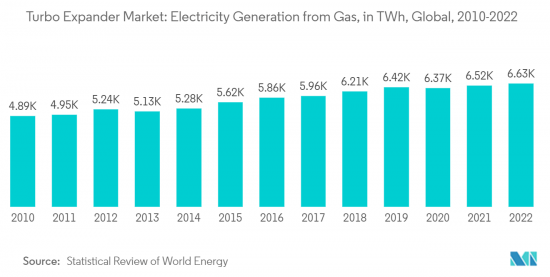

- 2022年天然气发电量为6,631.4太瓦时,较2021年成长1%。由于转向清洁能源来源的需求不断增加以及全球燃煤电厂的提前关闭,预计在预测期内也会出现类似的趋势。

- 此外,自 2011 年以来,日本已将核能发电能力大部分替换为液化天然气 (LNG) 发电厂。

- 2022年12月,马里兰州一家电力开发公司透露,计划在西维吉尼亚建设的180万千瓦天然气联合循环发电设施将采用碳捕获技术。竞争对手 Power Ventures (CPV) 宣布在西维吉尼亚州多德里奇县开设新的 CPV Shea 能源中心。

- 因此,在预测期内,越来越多地转向天然气发电预计将推动发电行业涡轮膨胀机市场的发展。

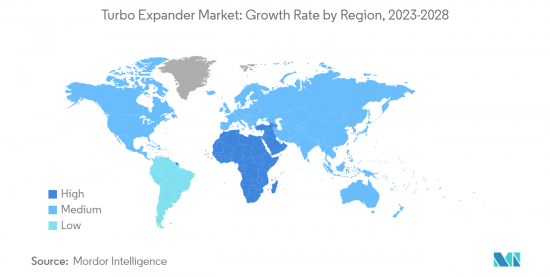

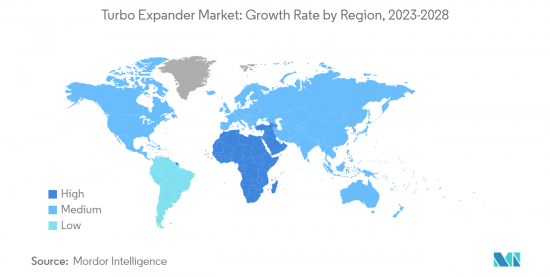

亚太地区主导市场

- 2022年,涡轮膨胀机市场主要由亚太地区主导,预计未来这种情况也将持续下去。涡轮膨胀机需求增加的主要原因之一是越来越多地使用天然气发电。由于大多数国家旨在透过转向天然气等更清洁的替代燃料来减少碳排放,预计这种资源的消费量将会增加。因此,涡轮膨胀机的需求预计将快速成长。

- 中国制定了气改电策略,到2030年将天然气占发电总量的比重从2021年的4.2%提高到15%。

- 此外,预计未来亚太地区将启动许多炼油厂和液化天然气计划。由于涡轮膨胀机大量用于炼油厂的能源回收和液化天然气工厂的液化天然气膨胀,预计此类设备的需求将激增。

- 例如,2022年1月,马来西亚国家石油公司和马来西亚沙巴州宣布有意建立一个年处理量200万吨(mmty)的液化天然气(LNG)接收站。该设施将建在西皮丹石油和天然气工业,是马来西亚国家石油公司与沙巴州合作的一部分,旨在扩大对该州工业和商业实体的清洁能源供应。

- 此外,印度等许多新兴经济体正在经历快速的经济成长,并有潜力变得更加工业化。因此,涡轮膨胀机的市场预计将因其在冷冻和能源提取等各种工业应用中的使用而得到推动。

- 因此,鑑于上述几点,亚太地区预计将在预测期内主导涡轮膨胀机市场。

涡轮膨胀机产业概况

涡轮膨胀机市场正在变得半固体。市场上的主要企业(排名不分先后)包括阿特拉斯·科普柯 AB、贝克休斯公司、Cryostar SAS、Nikkiso ADC 和 PBS Group。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 研究场所

第二章调查方法

第三章执行摘要

第四章市场概况

- 介绍

- 2028年之前的市场规模与需求预测(单位:美元)

- 最新趋势和发展

- 政府法规政策

- 市场动态

- 促进因素

- 增加对发电用天然气和各种工业燃料的投资

- 抑制因素

- 扩大再生能源来源的份额

- 促进因素

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章市场区隔

- 装载装置

- 压缩机

- 发电机

- 液压煞车

- 最终用户产业

- 油和气

- 发电

- 能源回收

- 其他最终用户产业

- 地区

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 德国

- 法国

- 英国

- 义大利

- 其他欧洲国家

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 其他亚太地区

- 南美洲

- 巴西

- 阿根廷

- 智利

- 南美洲其他地区

- 中东/非洲

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 南非

- 卡达

- 其他中东和非洲

- 北美洲

第六章 竞争形势

- 併购、合资、联盟、协议

- 主要企业策略

- 公司简介

- Atlas Copco AB

- Baker Hughes Company

- Cryostar SAS

- Nikkiso ACD

- PBS Group

- LA Turbine

- Elliott Group

- Blair Engineering

- Air Products and Chemicals Inc.

第七章 市场机会及未来趋势

- 增加高效率能源生产和减少碳排放的技术投资

简介目录

Product Code: 48372

The Turbo Expander Market size is estimated at USD 1.08 billion in 2024, and is expected to reach USD 1.35 billion by 2029, growing at a CAGR of 4.60% during the forecast period (2024-2029).

Key Highlights

- Over the medium term, the increasing investment in the adaption of natural gas for power generation and fuel for various industries is expected to increase the demand for a turbo expander market.

- On the other hand, an increasing share of renewable energy sources such as solar and wind energy is expected to hinder the market growth.

- Nevertheless, the increasing technological investments in the market to produce energy efficiently and control carbon emissions are expected to create huge opportunities for the turbo expanders market.

Turboexpander Market Trends

Power Generation Segment to Have a Significant Share

- A turboexpander is a rotating machine with an expansion turbine that converts the energy contained in a gas into mechanical work, much like a steam or gas turbine. A steam or gas turbine's goal is to convert the mechanical work into helpful power by either driving an electric generator or being the prime mover for another rotating machine, such as a compressor or a high-power pump.

- Natural gas played a significant role in electricity generation in 2022, accounting for almost 23% of the total. It was mainly due to robust growth in electricity generation from natural gas in the United States and China. The global installed capacity of gas-fired power plants is expected to increase over the next twenty years, with more than 1,500 GW of new capacity projected to be added to the power network by 2040.

- In 2022, electricity generation through natural gas was recorded at 6631.4 TWh, an increase of 1% compared to 2021. A similar trend is expected during the forecasted period due to the increasing demand for adapting cleaner energy sources and the early retirement of coal power plants worldwide.

- Additionally, since 2011, Japan largely replaced its nuclear power generation capacity with plants powered by liquefied natural gas (LNG).

- In December 2022, A power production development firm in Maryland revealed that a planned 1.8 GW combined-cycle natural gas-fired power facility in West Virginia would contain carbon capture technology. Competitive Power Ventures (CPV) announced the new CPV Shay Energy Center location in Doddridge County, West Virginia.

- Therefore, the increasing shift towards natural gas-based power generation is expected to drive the turbo expander market in the power generation sector during the forecast period.

Asia-Pacific to Dominate the Market

- In 2022, the turbo expander market was mainly dominated by Asia-Pacific, which is predicted to continue in the upcoming years. One of the major reasons for the rising demand for turbo expanders is the growing utilization of natural gas to generate power. With most nations aiming to reduce their carbon emissions by transitioning to cleaner fuel alternatives like natural gas, there is an anticipated increase in the consumption of this resource. It is expected to lead to a surge in demand for turbo expanders.

- China formulated a gas-to-power strategy to raise the percentage of natural gas in its overall power generation blend to 15% by 2030, up from 4.2% in 2021.

- In addition, numerous refineries and LNG projects are anticipated to emerge in the Asia-Pacific region in the projected timeframe. As a significant quantity of turbo expanders are utilized for recuperating energy in refineries and in the expansion of LNG within LNG plants, it is expected that there will be a surge in demand for such equipment.

- For instance, in January 2022, Petronas and the Malaysian State of Sabah disclosed their intentions to establish a liquefied natural gas (LNG) terminal with a capacity of two million metric tons/year (mmty). The upcoming facility in the Sipitang Oil and Gas Industrial Park is a component of Petronas' cooperation with the state in expanding Sabah's distribution of cleaner energy to industrial and commercial entities.

- Furthermore, many developing economies, such as India, are growing quickly, potentially leading to increased industrialization. As a result, the market for turbo expanders is expected to be stimulated due to their utilization in various industrial applications such as refrigeration and energy extraction.

- Therefore, due to the abovementioned points, the Asia-Pacific region is expected to dominate the turbo expander market during the forecasted period.

Turboexpander Industry Overview

The turbo expander market is semi-consolidated. Some of the major players in the market (in no particular order) include Atlas Copco AB, Baker Hughes Company, Cryostar SAS, Nikkiso ADC, and PBS Group., among others

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Increasing Investment in the Adaption of Natural Gas for Power Generation and Fuel for Various Industries

- 4.5.2 Restraints

- 4.5.2.1 Increasing Share of Renewable Energy Sources

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Loading Devices

- 5.1.1 Compressor

- 5.1.2 Generator

- 5.1.3 Hydraulic Brake

- 5.2 End-user Industry

- 5.2.1 Oil and Gas

- 5.2.2 Power Generation

- 5.2.3 Energy Recovery

- 5.2.4 Other End-user Industries

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 France

- 5.3.2.3 United Kingdom

- 5.3.2.4 Italy

- 5.3.2.5 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Japan

- 5.3.3.4 Australia

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Chile

- 5.3.4.4 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 United Arab Emirates

- 5.3.5.3 South Africa

- 5.3.5.4 Qatar

- 5.3.5.5 Rest of Middle-East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Atlas Copco AB

- 6.3.2 Baker Hughes Company

- 6.3.3 Cryostar SAS

- 6.3.4 Nikkiso ACD

- 6.3.5 PBS Group

- 6.3.6 LA Turbine

- 6.3.7 Elliott Group

- 6.3.8 Blair Engineering

- 6.3.9 Air Products and Chemicals Inc.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Technological Investments in the Market to Produce Energy Efficiently and Control Carbon Emissions

02-2729-4219

+886-2-2729-4219