|

市场调查报告书

商品编码

1429225

WiGig(无线千兆位元):市场占有率分析、产业趋势/统计、成长预测(2024-2029)WiGig - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

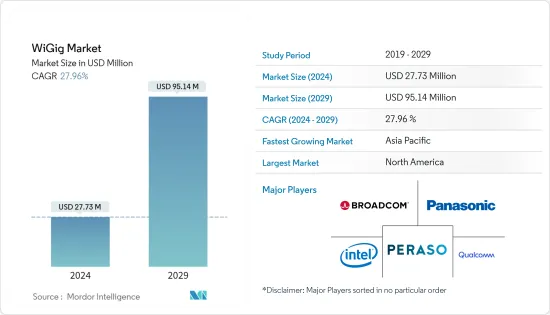

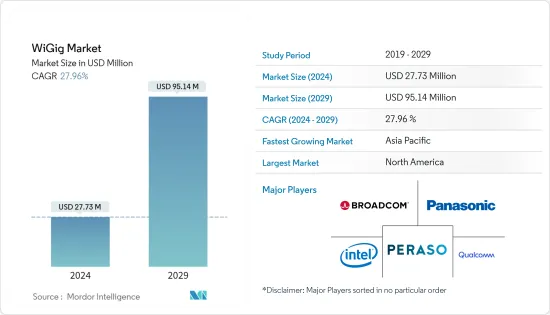

WiGig(无线千兆)市场规模预计到2024年为2773万美元,预计到2029年将达到9514万美元,在预测期内(2024-2029年)复合年增长率为27.96%。

推动WiGig市场成长的因素包括不断增长的频宽需求、智慧型手机饱和状态以及各种设备的使用,所有这些都有助于行业的整体发展。此外,新兴经济体 IT 支出的增加和预算分配的变化正在推动对支援当前主导基础设施的技术先进产品的需求。

主要亮点

- 公共 Wi-Fi 有助于实现各种智慧城市目标,包括弥合数位落差、实现基于物联网 (IoT) 的城市服务,以及为居民、学生、访客和游客提供便利设施。这加上各国政府机构对智慧城市改善的投资不断增加,是推动市场成长的主要原因之一。除此之外,许多公司都使用 WiGig 设备来允许员工透过各种设备完成工作,而无需电缆连接的负担。

- 为了在办公室中实现高效联网,还可以移动大型文件、无缝运行占用频宽的程序,以及以超低延迟将影像和音频投影到会议室和礼堂的宽屏幕上。 WiGig 产品也用于便利的公共资讯亭服务以及行动电话、笔记型电脑、投影机和平板电脑等装置之间的无线对接。它也经常用于下载高清 (HD) 电影、同时串流多个超高清影片、身临其境型游戏、扩增实境(AR)、虚拟实境 (VR) 体验等。这加上消费者在数位媒体上的支出增加,正在推动产业扩张。

- 各最终用途产业的组织越来越偏好BYOD 政策,这创造了对 WiGig 的强劲需求,这将在未来几年推动市场发展。向 BYOD 的转变使企业能够增加IT基础设施预算以提高网路速度。职场中行动电话、笔记型电脑、桌上型电脑和其他电子设备的使用增加,增加了对高频宽和互联网速度来支援许多应用程式和服务的依赖。此外,对高速网路连线的需求不断增长,以加快应用程式和业务相关活动的速度,也推动了市场的扩张。

- 技术限制是全球WiGig市场参与企业面临的主要问题。目前技术的运作频率高于 60Hz,但现代 Wi-Fi 产品仅使用 2.4 至 5GHz 之间的频率。因此,目前的基础设施需要升级,这需要客户大量的资金投入。

- 疫情期间,在家工作已成为一大趋势。向大规模远端工作转变的速度导致了行动电话、平板电脑和桌上型电脑等个人设备的使用。我们也看到员工使用个人 Wi-Fi 和网路连线来存取公司网路。此外,在后 COVID-19 的情况下,Wi-Fi 的使用增加,以维持业务和关键功能的运作。

WiGig市场趋势

游戏和多媒体推动市场

- 更复杂的线上多人游戏教导玩家策略性和分析性地评估风险和回报。这些游戏需要年轻玩家对游戏的变化做出快速反应。孩子们从这个游戏中受益匪浅,因为他们学到的技能可以应用于现实世界中需要解决问题、分析技能和策略思考的工作。游戏是孩子们了解不同思维方式和文化的好方法,因为他们可以沉浸在虚拟世界中,有时还可以与来自世界各地的人们交流。这些趋势预计将增加游戏领域对 WiGig 市场的需求。

- 近年来,随着端到端的本地游戏开发,网路生态系统开始改变方向。例如,Zynga 在从社交转向行动的过程中挣扎了几年,但到 2022 年 2 月,其第四季销售额年增 52%,达到 7.27 亿美元。该公司于 2019 年 6 月推出了免费游戏 Farmville-3,但 Zynga 创建的基于 Flash 的游戏主要设计用于在 Facebook 内玩。

- 据行动视讯产业委员会称,由于近几个月云端游戏服务的快速发展,行动电信业者预计到2022年云端游戏将占5G资料流量的25-50%。 Over-the-Top (OTT) 公司也有雄心勃勃的计划,要成为“游戏界的 Netflix”,託管数千个易于访问的游戏库,并最终提供 5G 网路频宽。未来如此高的频宽将需要使用WiGig。

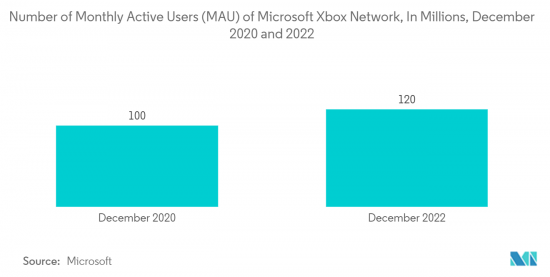

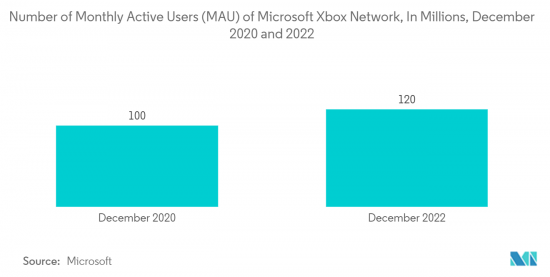

- 此外,微软表示,截至 2022 年 12 月,微软线上游戏服务的月有效用户数量已从 2016 年初的略低于 4,000 万增加到约 1.2 亿。该服务之前称为 Xbox Live,直到 2023 年 3 月才更名为 Xbox Network,以区别于 Xbox Live Gold 订阅服务。对此类线上主机的需求不断增长预计将推动研究市场的发展。

- 此外,Razer Edge 将于 2023 年 1 月透过 Verizon 在美国上市。 Razer Edge 搭载 Snapdragon G3x Gen 1 处理器,据信该处理器是基于 Snapdragon 888。 6.8 吋 AMOLED 显示屏,解析度为 2,400 x 1,080px (20:9),刷新率为 144Hz,使其比 Steam Deck 和 Nintendo Switch 等产品更具优势。相比之下,Switch 的 OLED 为 7 英寸,Steam Deck 的为 7 英寸 LCD,但两者的分辨率均为 720p,运作频率均为 60Hz。

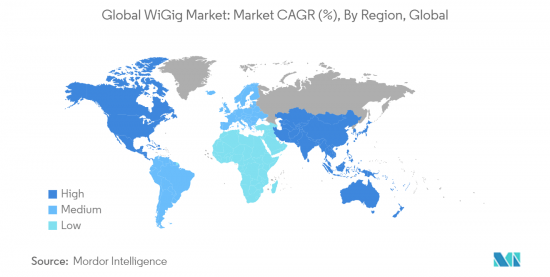

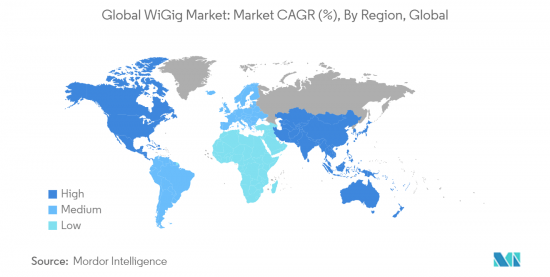

亚太地区预计将创下最高市场成长纪录

- IEEE 802.11aj是IEEE 802.11TM的修订标准,规定了60GHz和45GHz频段的物理(PHY)层和介质访问控制(MAC)层,以满足中国对高速无线局域网容量日益增长的需求。 。此次标准变更在 60GHz 频段定义了 4 个 1.08GHz 通道,以支援具有高资料传输和宽覆盖区域的低功耗设备,并在 45GHz 频段定义了新的 5GHz频宽,可支援高达 15Gb/s 的资料传输速度。实现了。这增强了 IEEE 802.11(Wi-Fi 网路设备的基础)的功能。

- 2022年9月,藤仓开发了无需许可证即可在日本独立检验技术标准合规性认证的60GHz频段毫米波无线通讯模组,并开始分发样品。新开发的60GHz频段毫米波无线通讯模组对结构进行了改进和最佳化,以获得技术标准合规认证。此模组被赋予认证机构的技术标准合格认证标誌。这使得开发配备该模组的通讯设备和工业设备变得更加容易。

- 2022年2月,日本电报电话公司(NTT)实现了全球首个60GHz无线区域网路(WiGig),利用终端主导的动态站点分集控制技术,实现了高速移动条件下不间断的大容量无线区域网路传输。实现了。 NTT 的「终端主导的动态站点分集控制技术」即使在 WiGig 等非行动无线通讯系统中也能实现与高速行动终端的连续高容量无线连接。可用于无人机、汽车的即时影像传输、大量资料传输等。

- 同样,印度电讯机构 ITU-APT 基金会 (IAFI) 最近推动取消 V 频段 (60GHz)频宽的许可,允许在不竞标的情况下授予许可,从而降低成本。透过保持较低的成本,我们正在为政府旨在弥合数位落差的「全民WiFi」倡议。此外,60GHz 频段 (57-64GHz) 的新技术可提供类似光纤的可靠性和数千兆Gigabit速度,同时实现比现有光纤低一个数量级的成本。与光纤和传统毫米波骨干网路相比,60 GHz 频段的一些新技术可以节省个位数到两位数的成本。

- 营运商和设备製造商越来越了解整相阵列天线和电子束控制技术的优势,并引发了监管委员会的讨论。莱迪思最近参与了华为进行的一项技术分析,该分析构成了多家公司向 CEPT 固定服务工作组 (ECC SE 19)提案的文件的基础,倡导监管改革作为这项工作的一部分。莱迪思提供了目前无线基础设施解决方案的系统参数,使华为能够在城市部署模拟中模拟传播特性和干扰机率。

- 60GHz 频段是在装置之间无线传输高品质、低延迟 4K 视讯的唯一途径。其他无线解决方案需要对 4K 视讯进行大量压缩,从而导致低品质、高延迟的视讯体验。无线 60 GHz 可实现装置之间的顺畅无线通讯,无需干扰电线。 60GHz 频段的频宽为 7GHz,可满足越来越多的连网装置所需的容量。个人使用的资料量和连结设备的数量持续增加。 60GHz 频段可以处理更多资料和连接,同时提供更好的使用者体验。

WiGig 产业概述

WiGig 市场分散,全球参与者竞相创新以消除市场挑战,这可能会阻碍当前的成长。主要参与者包括英特尔公司、松下公司和高通科技公司。

- 2023 年 10 月 Tarana Wireless, Inc. 宣布其先进的固定无线存取 (ngFWA) 平台 Gigabit 1 将能够在即将在美国推出的新的免许可 6GHz 频段中运作。在美国,许多公共和私人组织目前正在努力解决宽频问题。

- 2023 年 11 月 网路解决方案供应商 Cambium Networks 宣布 Nextlink Internet 已下了一份重要订单,以利用其先进的 ePMP 6GHz 固定无线宽频解决方案增强其覆盖范围。 Nextlink 计划主要使用 ePMP 在农村、低密度地区进行远端连线。 Cambium Networks 对解决方案的策略性投资将显着增强Gigabit固定无线的接入,使美国中心地带的许多农村和郊区居民受益。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

- 产业价值链分析

- 评估 COVID-19 对产业的影响

第五章市场动态

- 市场驱动因素

- 通讯业的技术不断进步

- 高画质影片的采用率增加

- 市场限制因素

- WiGig 产品的工作范围短

第 6 章 技术概览

第七章市场区隔

- 产品

- 显示装置

- 网路基础设施设备

- 目的

- 游戏和多媒体

- 联网

- 其他用途

- 地区

- 北美洲

- 欧洲

- 亚太地区

- 世界其他地区

第八章 竞争形势

- 公司简介

- Panasonic Corporation

- Qualcomm Technologies Inc.

- Intel Corporation

- Broadcom Inc.

- Peraso Technologies Inc.

- Blu Wireless Technology Limited

- Tensorcom Inc.

- Fujikura Ltd

- Sivers Ima Holding AB

- Cisco Systems Inc.

- Dell Technologies Inc.

- Lenovo Group Limited

- HP Development Company LP

第九章投资分析

第10章市场的未来

The WiGig Market size is estimated at USD 27.73 million in 2024, and is expected to reach USD 95.14 million by 2029, growing at a CAGR of 27.96% during the forecast period (2024-2029).

The factors driving the growth of the Wireless Gigabit Market include an increase in bandwidth demand, a saturation of smartphones, and the use of various devices, all of which contribute to the overall industry development. Furthermore, rising IT spending and shifting budget distributions in emerging economies drive demand for technically advanced items to support the current initiative infrastructure.

Key Highlights

- Public Wi-Fi contributes to various smart city goals, including bridging the digital divide, allowing Internet of Things (IoT)-based city services, and offering amenities for residents, students, visitors, and tourists. This, together with increased investments in smart city improvements by government agencies from various nations, is one of the primary reasons driving the market growth. Apart from that, WiGig devices are used in many enterprises to allow employees to finish work from various devices without the burden of a cable connection.

- They are also used for effective in-office networking, moving huge files, seamlessly running bandwidth-intensive programs, and projecting visuals and audio on a wide screen in a conference room or auditorium with very low latency. WiGig products are also used in handy public kiosk services and wireless docking between devices such as cellphones, laptops, projectors, and tablets. They are also frequently used for high-definition (HD) movie downloads, simultaneous streaming of multiple ultra-HD videos, and immersive gaming, augmented reality (AR), and virtual reality (VR) experiences. This, together with rising consumer expenditure on digital media, is fueling industry expansion.

- The growing preference for BYOD policies among organizations operating in various end-use industries is creating a considerable demand for WiGig, which will drive the market in the future. This shift toward BYOD allows enterprises to increase their IT infrastructure budgets to improve network speed. The rising usage of mobile phones, laptops, desktop computers, and other electronic devices at work is creating a major reliance on high bandwidth and internet speed to support the many apps and services. Furthermore, the growing necessity for a high-speed internet connection to speed up applications and work-related activities is fueling market expansion.

- Technological constraints are the main issue confronting industry participants in the worldwide WiGig market. The current technology operates at frequencies over 60Hz; however, the frequencies employed in contemporary Wi-Fi products are only between 2.4 and 5 GHz. As a result, there is a need to upgrade the current infrastructure, which will need a significant capital commitment from customers.

- Working from home has become a megatrend during the pandemic days. The speed of the shift to large-scale remote work has resulted in the use of personal devices, including mobile phones, laptops, tablets, desktops, etc. Employees are also observed using personal Wi-Fi and internet connections to access the corporate network. Moreover, in the post COVID-19 scenario, the market boosted Wi-Fi use to keep businesses and critical functions operational.

WiGig Market Trends

Gaming and Multimedia Expected to Drive the Market

- The more complex online multiplayer games educate players on strategically and analytically assessing risk and reward. These games require young players to react fast to game changes. Children gain from this game because the abilities learned can be applied to real-world careers that require problem-solving, analytical skills, and strategic thinking. Games may be a terrific method for children to learn about diverse ideas and cultures since they allow them to immerse themselves in virtual worlds and, at times, communicate with people from all over the world. Such trends would raise the demand for the wireless gigabit market in gaming.

- In recent years, the internet ecosystem has initiated course correction by end-to-end local game development. For instance, Zynga's shift from social to mobile meant several tough years, but in February 2022, it reported Q4 revenue of USD 727 million, up by 52% year-over-year. It launched its free game Farmville-3 in June 2019, but the Flash-based game created by Zynga was primarily designed to be played within Facebook.

- According to the Mobile Video Industry Council, mobile operators expected cloud gaming to represent 25-50% of 5G data traffic by 2022, owing to the quick progression of cloud gaming services in recent months. Over-the-top (OTT) players also have ambitious plans to become the 'Netflix for gaming,' hosting libraries of thousands of immediately accessible games that will ultimately consume three to four times the amount of bandwidth on 5G networks compared to standard definition video traffic. Such high bandwidth will require the use of WiGig in coming future.

- Additionally, According to Microsoft, Microsoft's online gaming service had around 120 million monthly active users as of December 2022, up from just under 40 million at the start of 2016. The service was previously known as Xbox Live until being rebranded as Xbox Network in March 2023 to distinguish it from the Xbox Live Gold subscription service offering. Such a rise in demand for online consoles is expected to drive the studied market.

- Furthermore, In January 2023, the Razer Edge will be available in the United States through Verizon. The Razer Edge is powered by a Snapdragon G3x Gen 1 processor, which appears to be based on the Snapdragon 888. The 6.8" AMOLED display with 2,400 x 1,080px resolution (20:9) and 144Hz refresh rate provides it an advantage (heh) over the likes of the Steam Deck and the Nintendo Switch. In comparison, the Switch OLED has a 7-inch display, and the Steam Deck has a 7-inch LCD, but both feature just 720p resolution and run at 60Hz.

Asia-Pacific is Expected to Register the Highest Market Growth

- IEEE 802.11aj, an amendment to IEEE 802.11TM that specifies the Physical (PHY) layer and the Medium Access Control (MAC) layer in the 60 GHz and 45 GHz bands to accommodate expanding high-speed wireless LAN capacity demands in China, was authorized by IEEE and the IEEE Standards Association (IEEE-SA). The standard modification defines four 1.08 GHz channels in the 60 GHz band to support low-power devices with high data rates and broader coverage areas, as well as 5 GHz of new bandwidth in the 45 GHz band with up to a 15 Gb/s data rate. This enhances the capabilities of IEEE 802.11, the foundation of Wi-Fi networking equipment.

- In September 2022, Fujikura Ltd. developed and began distributing samples of a 60 GHz millimeter-wave wireless communication module that may be independently verified for Technical Regulations Conformity Certification in Japan, which does not require a license. The newly developed 60 GHz band millimeter-wave wireless communication module's structure has been upgraded and optimized to qualify for Technical Regulations Conformity Certification. This module will be provided with a certifying body's Technical Rules Conformity Certification mark. Its pre-certification greatly simplifies the development of communication and industrial equipment with the module.

- In February 2022, Nippon Telegraph and Telephone Corporation, Japan implemented 60-GHz band wireless LAN (WiGig) for the first time globally, achieving uninterrupted large-capacity wireless transmission in high-speed mobility situations using terminal-driven dynamic site diversity control technology. NTT's terminal-driven dynamic site diversity control technology enables even non-mobile wireless communication systems like WiGig to achieve continuous high-capacity wireless connections to high-speed mobile terminals. It can be utilized for real-time video transmission from drones and autos and batch data transmission.

- Similarly, recently, the ITU-APT Foundation of India (IAFI), a telecom industry organization, has pushed to delicense spectrum in the V-band (60 GHz range), allowing it to be granted without auctions and so keeping costs low, thereby aiding in the government's 'WiFi-for-all' effort to bridge the digital divide. Additionally, new technologies in the 60 GHz band (57-64 GHz) can achieve cost points an order of magnitude lower than existing fiber while providing fiber-like reliability and multigigabit speeds. Certain new 60 GHz band technologies can offer cost savings of one or two orders of magnitude over fiber and conventional milli-metric band backbone networks.

- The rising understanding of the benefits of phased array antenna and electronic beam-steering technology among operators and equipment makers is now translating into a debate among regulatory committees. Lattice recently participated in a technical analysis conducted by Huawei that forms the basis of a multi-company proposal to the Fixed Service working group in CEPT (ECC SE 19) advocating regulatory reform as part of this effort. Lattice provided the system parameters for their current wireless infrastructure solution, allowing Huawei to simulate the propagation characteristics and interference probability in an urban deployment simulation.

- The only way to wirelessly stream high quality, low latency 4K video across devices is at 60 GHz. Other wireless solutions must drastically compress 4K video, resulting in a lower quality and higher latency video experience. There aren't any cords. 60 GHz enables for smooth wireless communications between devices, removing the need for obtrusive cords and wires. The 60 GHz spectrum has 7 GHz of bandwidth, which provides the required capacity for the expanding number of Internet-connected devices. The amount of data that individuals utilize and the number of linked gadgets will only grow. The 60 GHz band can handle more data and connections while providing a better user experience.

WiGig Industry Overview

The WiGig market is fragmented in nature, as the global players are competing to innovate the technology to remove the market challenges, which can hamper the current growth. The key players are Intel Corporation, Panasonic Corporation, and Qualcomm Technologies Inc., among others.

- October 2023: Tarana Wireless, Inc. announced that its advanced fixed wireless access (ngFWA) platform, Gigabit 1, has the capability to operate in the expansive new unlicensed 6 GHz spectrum that will soon be accessible in the United States. Numerous public and private organizations in the country are currently dedicating their efforts to addressing the ongoing broadband challenges.

- November 2023: Cambium Networks, a networking solutions provider, announced that Nextlink Internet has made a substantial order to enhance its coverage area with the advanced ePMP 6 GHz fixed wireless broadband solution. Nextlink intends to utilize ePMP primarily to connect remote areas in low-density rural regions. This strategic investment in Cambium Networks solutions will greatly enhance gigabit fixed wireless accessibility, benefiting numerous rural and suburban residents throughout the American heartland.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of Impact of Covid-19 on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Technological Advancements in the Communications Industry

- 5.1.2 Rising Adoption of High-resolution Videos

- 5.2 Market Restraints

- 5.2.1 Shorter Operating Range of WiGig Products

6 TECHNOLOGY SNAPSHOT

7 MARKET SEGMENTATION

- 7.1 Product

- 7.1.1 Display Devices

- 7.1.2 Network Infrastructure Devices

- 7.2 Application

- 7.2.1 Gaming and Multimedia

- 7.2.2 Networking

- 7.2.3 Other Applications

- 7.3 Geography

- 7.3.1 North America

- 7.3.2 Europe

- 7.3.3 Asia-Pacific

- 7.3.4 Rest of the World

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 Panasonic Corporation

- 8.1.2 Qualcomm Technologies Inc.

- 8.1.3 Intel Corporation

- 8.1.4 Broadcom Inc.

- 8.1.5 Peraso Technologies Inc.

- 8.1.6 Blu Wireless Technology Limited

- 8.1.7 Tensorcom Inc.

- 8.1.8 Fujikura Ltd

- 8.1.9 Sivers Ima Holding AB

- 8.1.10 Cisco Systems Inc.

- 8.1.11 Dell Technologies Inc.

- 8.1.12 Lenovo Group Limited

- 8.1.13 HP Development Company LP