|

市场调查报告书

商品编码

1429226

Wax -市场占有率分析、产业趋势/统计、成长预测(2024-2029)Wax - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

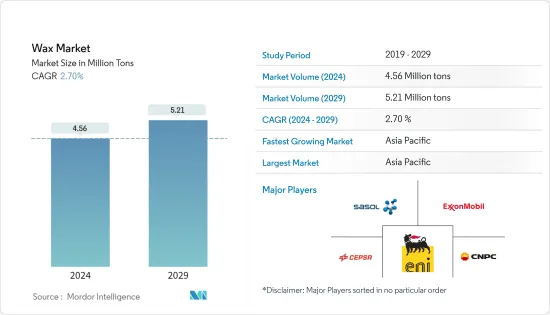

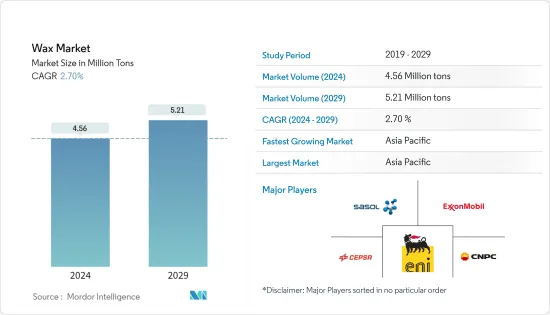

预计2024年蜡市场规模为456万吨,预计2029年将达到521万吨,在预测期内(2024-2029年)复合年增长率为2.70%。

主要亮点

- 由于 COVID-19、停工规定和工人短缺,导致各种化学品和其他行业的产量减少,包括化妆品、包装、橡胶、蜡烛和黏剂。工业原料供应减少,供需平衡被破坏。由于这些因素,石油市场受到了COVID-19的影响,蜡产量减少。

- 中期来看,蜡烛产业和包装产业需求的增加是推动市场的主要因素。亚太地区个人护理产业的成长也是推动市场的因素。

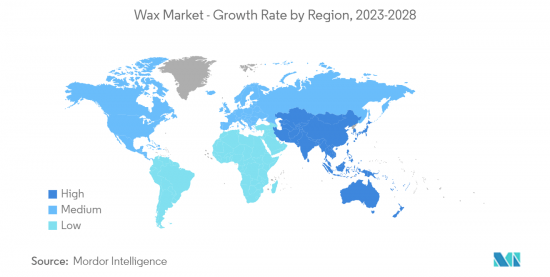

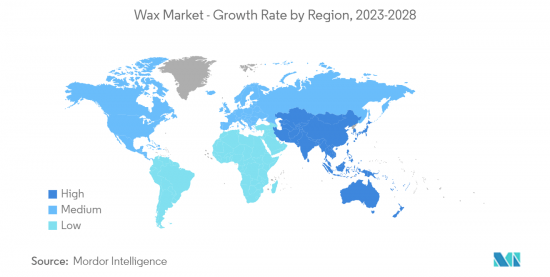

- 另一方面,人们对石化产品使用意识的提高预计将阻碍市场成长。预计亚太地区将主导市场,并可能在预测期内保持最高的复合年增长率。

蜡市场趋势

化妆品产业需求增加

- 化妆品和个人护理是蜡的主要用途。蜡用作增稠剂。为护肤品和化妆品提供稳定性、润肤性和保护性,增加黏度和浓稠度。就2022年的全球市场占有率而言,个人护理产业表现良好。

- 亚太地区是最大的蜡消费国和生产国。近年来产量达到高水平,使该地区成为向美国等已开发国家出口化妆品和个人保健产品的重要枢纽。

- 据欧洲个人护理协会称,5亿欧洲消费者每天使用化妆品和个人保健产品来保护自己的健康、提高幸福感并增强自尊。它们的范围从止汗剂、香水、化妆品和洗髮精到肥皂、防晒油、牙膏和化妆品。

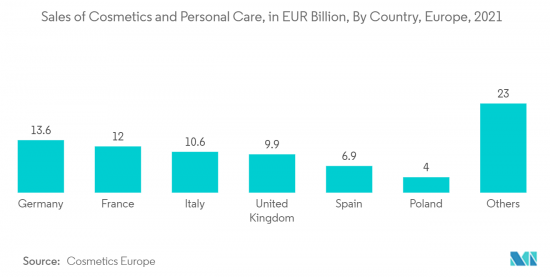

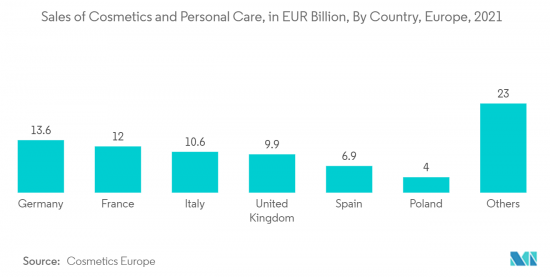

- 据欧洲化妆品协会称,2021 年欧洲化妆品和个人护理市场的零售额将达到 800 亿欧元(934 亿美元)。欧洲最大的化妆品和个人保健产品各国市场是德国、法国、义大利、英国、英国和波兰。 2021年,东南亚地区(一个充满活力、多元化的市场,新兴中产阶级)的个人购买力将增加,到2021年,化妆品价值链直接就业人数将超过255,111人,间接就业人数将达到171万人。预计将带动当地化妆品消费。

- 上述因素预计将推动受访市场的成长。

亚太地区主导市场

- 由于石油蜡生产精製集中在中国和印度等国家,亚太地区在全球市场占有率占据主导地位。

- 由于化妆品、黏剂和包装产品的生产和消费增加,预计亚太地区在预测期内也将出现最高的成长。近年来,亚太地区的需求达到了更高水平,使其成为化妆品和个人保健产品出口的主要枢纽。

- 印度也是世界主要肥皂生产国之一。每人香皂和沐浴皂的消费量约为800公克。印度约65%的人口居住在农村地区,可支配收入的增加和农村市场的成长正在推动消费者转向高级产品。

- 韩国等二级市场对个人保健产品的需求预计将激增。

- 此外,由于经济扩张和高购买力中阶的崛起,中国包装产业近年来持续快速成长。食品包装是包装产业的主要企业,约占中国市场总量的60%。 Interpak预计,在中国食品包装类别中,预计2023年包装总量将达到4,470亿件,显示包装产业对蜡的需求增加。

- 据印度包装工业协会(PIAI)称,预计印度包装行业在预测期内将以22%的成长率成长。此外,印度包装市场预计2020年至2025年复合年增长率为26.7%,到2025年将达到2,048.1亿美元。因此,该地区的蜡市场预计将会成长。

- 无论是在生产还是消费方面,中国也将成为该地区最大的黏剂市场。家具、建筑等行业的黏剂消耗量不断增加,这进一步推动了该地区蜡市场的成长。

- 由于上述因素,预计亚太地区将在预测期内主导市场。

蜡业概况

蜡市场部分分散。主导市场的主要公司有中国石油天然气集团公司、埃克森美孚公司、Cepsa、Sasol、Eni SpA等。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 蜡烛和包装行业的需求增加

- 亚太地区个人护理产业的成长

- 抑制因素

- 人们对石化产品使用的认识不断增强

- 其他限制因素

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场区隔(市场规模,基于数量)

- 类型

- 石油/矿物蜡

- 合成蜡

- 天然蜡

- 目的

- 化妆品

- 包装

- 蜡烛製造

- 黏剂

- 橡皮

- 其他用途

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 东南亚国协

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 欧洲其他地区

- 南美洲

- 阿根廷

- 巴西

- 南美洲其他地区

- 中东/非洲

- 沙乌地阿拉伯

- 南非

- 其他中东/非洲

- 亚太地区

第六章 竞争形势

- 併购、合资、联盟、协议

- 市场占有率(%)**/排名分析

- 主要企业策略

- 公司简介

- BP PLC

- Calumet Specialty Products Partners LP

- Cepsa

- China National Petroleum Corporation

- China Petroleum & Chemical Corporation

- Eni SpA

- Exxon Mobil Corporation

- H&R Group

- Ilumina Wax doo

- Kemipex

- Nippon Siero Co. Ltd

- Petrobras

- Petro Canada Lubricants Inc.

- Sasol

- The International Group Inc.

- CALWAX

第七章 市场机会及未来趋势

- 在橡胶生产中增加矿物蜡的使用

简介目录

Product Code: 47748

The Wax Market size is estimated at 4.56 Million tons in 2024, and is expected to reach 5.21 Million tons by 2029, growing at a CAGR of 2.70% during the forecast period (2024-2029).

Key Highlights

- Due to COVID-19, the lockdown regulations and a deficient number of workers led to a decline in the production of various chemicals and other industries such as cosmetics, packaging, rubber, candle, and adhesives. The supply of raw materials to the industries decreased and caused a disturbance in the supply and demand balance. Owing to all these factors, the oil market was negatively impacted by COVID-19, and the production of wax decreased.

- Over the medium term, the major factor driving the market studied is the increasing demand from the candle and packaging industries. The growing personal care industry in the Asia-Pacific region is the other factor driving the market studied.

- On the flip side, increasing awareness against the usage of petrochemicals is expected to hinder the growth of the market. The Asia-Pacific region is expected to dominate the market, and it is also likely to witness the highest CAGR during the forecast period.

Wax Market Trends

Increasing Demand from the Cosmetics Industry

- Cosmetics and personal care are one of the major applications of wax. It is used to thicken formulations. It provides stability to skincare products and cosmetics with emollient and protective qualities and boosts their viscosity and consistency. The personal care industry accounted for a healthy global market share in 2022.

- The Asia-Pacific region has become the largest consumer, as well as producer of wax. The production reached high levels in the past few years, and the region has become a significant hub for exporting cosmetics and personal care products to developed countries, such as the United States.

- According to Cosmetic Europe, the personal care association, Europe's 500 million consumers use cosmetic and personal care products every day to protect their health, enhance their well-being and boost their self-esteem. Ranging from antiperspirants, fragrances, make-up, and shampoos, to soaps, sunscreens and toothpaste, and cosmetics.

- According to Cosmetics Europe, the European cosmetics and personal care market amounted to EUR 80 billion (USD 93.4 billion) in retail sales in 2021. The largest national markets for cosmetics and personal care products within Europe are Germany, France, Italy, the United Kingdom, Spain, and Poland. In 2021, over 255,111 people were employed directly, and a further 1.71 million indirectly in the cosmetics value chainConsiderable purchasing power of individuals in the Southeast Asian region (a dynamic and diverse market for the emerging middle class) is likely to drive the consumption of cosmetics in the region.

- The above-mentioned factors are likely to boost the growth of the market studied.

Asia-Pacific Region to Dominate the Market

- The Asia-Pacific region dominated the global market share due to the concentration of dominant petroleum wax-producing refineries in countries like China and India.

- Asia-Pacific is also projected to register the highest growth during the forecast period, driven by increasing production and consumption of cosmetics, adhesives, and packaging products in the region. Asia-Pacific demand has reached higher levels in the past few years and has become a major hub for exporting cosmetics and personal care products.

- Moreover, India is one of the largest producers of soaps in the world. The per capita consumption of toilet/bathing soaps in the country is around 800 grams. Around 65% of the Indian population resides in rural areas, and the increasing disposable incomes and growth in rural markets make consumers shift to premium products.

- The tier-2 markets, such as South Korea, are expected to witness a rapid rise in the demand for personal care products.

- Furthermore, the Chinese packaging industry has grown at a rapid and consistent rate in recent years, owing to expanding economy and rising middle class with greater purchasing power. Food packaging is a major player in the packaging industry, accounting for roughly 60% of the total market share in China. According to Interpak, in China, in the foodstuff packaging category, total packaging is expected to reach 447 billion units in 2023, thereby indicating an increased demand for wax from the packaging industry.

- According to the Packaging Industry Association of India (PIAI), the Indian packaging industry is expected to grow at a rate of 22% during the forecast period. Moreover, the Indian packaging market is expected to reach USD 204.81 billion by 2025, registering a CAGR of 26.7% between 2020 and 2025. Therefore, the wax market is expected to grow in the region.

- Besides, China stands to be the largest market for adhesives in the region regarding both production and consumption. The consumption of adhesives has been increasing in the industries such as furniture, construction, etc., which is further driving the growth of the wax market in the region.

- Owing to all the aforementioned factors, the Asia-Pacific region is expected to dominate the market studied during the forecast period.

Wax Industry Overview

The wax market is partially fragmented. Major players dominating the market include China National Petroleum Corporation, Exxon Mobil Corporation, Cepsa, Sasol, and Eni SpA.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand from the Candle and Packaging Industries

- 4.1.2 Growing Personal Care Industry in the Asia-Pacific Region

- 4.2 Restraints

- 4.2.1 Increasing Awareness against Usage of Petrochemicals

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Type

- 5.1.1 Petroleum and Mineral Wax

- 5.1.2 Synthetic Wax

- 5.1.3 Natural Wax

- 5.2 Application

- 5.2.1 Cosmetics

- 5.2.2 Packaging

- 5.2.3 Candle Making

- 5.2.4 Adhesives

- 5.2.5 Rubber

- 5.2.6 Other Applications

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 ASEAN Countries

- 5.3.1.6 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Spain

- 5.3.3.6 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Argentina

- 5.3.4.2 Brazil

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/ Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 BP PLC

- 6.4.2 Calumet Specialty Products Partners LP

- 6.4.3 Cepsa

- 6.4.4 China National Petroleum Corporation

- 6.4.5 China Petroleum & Chemical Corporation

- 6.4.6 Eni SpA

- 6.4.7 Exxon Mobil Corporation

- 6.4.8 H&R Group

- 6.4.9 Ilumina Wax d.o.o.

- 6.4.10 Kemipex

- 6.4.11 Nippon Siero Co. Ltd

- 6.4.12 Petrobras

- 6.4.13 Petro Canada Lubricants Inc.

- 6.4.14 Sasol

- 6.4.15 The International Group Inc.

- 6.4.16 CALWAX

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Use of Mineral Wax in Rubber Production

02-2729-4219

+886-2-2729-4219