|

市场调查报告书

商品编码

1429237

乙二醇醚:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Glycol Ethers - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

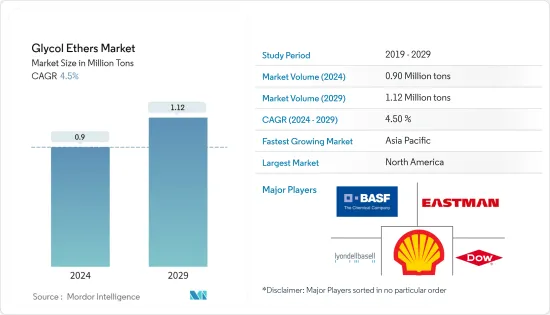

乙二醇醚市场规模预计到2024年为90万吨,预计到2029年将达到112万吨,在预测期内(2024-2029年)复合年增长率为4.5%。

COVID-19的爆发、世界各地的封锁、製造活动和供应链的中断以及生产停顿对2020年的市场产生了负面影响。然而,到了2021年,情况开始好转,市场恢復了成长轨迹。

主要亮点

- 推动市场成长的主要因素是化妆品和个人保健产品使用量的增加以及油漆和涂料行业需求的增加。

- 另一方面,REACH 和 EPA 关于乙二醇醚使用的法规以及用作清洗产品溶剂的新产品的出现正在限制市场成长。

- 意识的提高导致对低排放气体柴油燃料的 P 系列乙二醇的需求过剩,可能会在预测期内为同一市场提供机会。

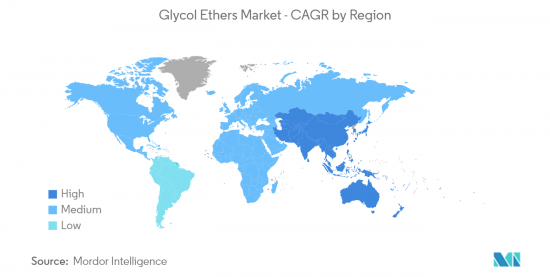

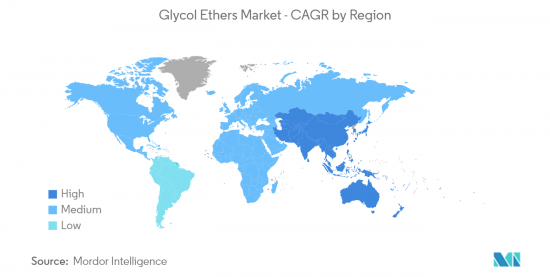

- 北美是全球乙二醇醚市场的关键地区,而亚太地区预计在预测期内将以最快的速度成长。

乙二醇醚市场趋势

油漆和涂料领域占据市场主导地位

- 乙二醇醚有助于在油漆固化时形成适当的薄膜,并充当树脂的活性溶剂。有助于优化涂料中溶剂的蒸发速率。它还有助于改善油漆径流特性并消除涂漆时的刷痕。

- 涂料工业是乙二醇醚的最大消费者。油漆和被覆剂广泛应用于建筑、汽车和包装等多种行业。

- 油漆和涂料市场的许多公司采取了多种商务策略来维持其在全球市场的地位。例如,2022 年 2 月,宣伟公司收购了 AquaSurTech,这是一家为建筑应用生产耐用涂料的公司。这加强了公司在建筑产品市场涂料行业的地位。

- 同样,2022 年 6 月,宣伟公司收购了德国领先的拖拉机涂料公司 Gross &Perthun GmbH。透过此次收购,宣伟公司巩固了其在高性能涂料行业的地位。

- 世界各地住宅和商业建筑的建设大幅增加,推动了对建筑油漆和被覆剂中使用的乙二醇醚的需求。

- 根据印度品牌资产基金会(IBEF)预测,到 2025 年,印度预计每年建造 1,150 万套住宅,成为第三大建筑市场,价值约 1 兆美元。此外,到2023年,美国和中国预计将占全球建筑业成长的60%。因此,对油漆和被覆剂的需求预计将增加,从而导致对乙二醇醚的需求增加。

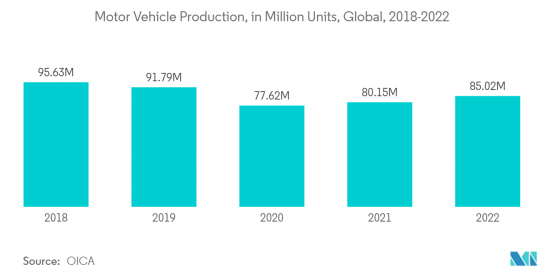

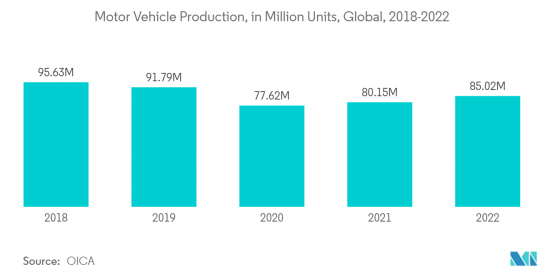

- 此外,全球汽车产量的成长预计将推动油漆和被覆剂的需求。例如,根据OICA的数据,2022年全球汽车产量为85,016,728辆,较2021年成长6%。

- 因此,上述趋势可能会增加油漆和涂料市场的需求和产量,这可能会进一步推动对乙二醇醚等原料的需求。

亚太地区是成长最快的市场

- 由于中国、印度和日本等主要国家的存在,亚太地区是全球乙二醇醚市场成长最快的地区。

- 汽车、建筑、电子和包装等最终用户行业对油漆、被覆剂和黏剂等产品的需求正在迅速增长。

- 中国汽车工业产量大幅成长。例如,根据国际汽车组织(OICA)的数据,2022年中国汽车总产量为27,020,615辆,较2021年成长3%。

- 此外,随着消费者越来越喜欢电动车,该国的转换趋势也处于高水准。此外,中国政府预计2025年电动车普及将达20%。这反映在该国的电动车销售趋势上,2022年电动车销量创下历史新高。根据中国小客车协会的数据,2022年电动车和插电式混合动力车销量为567万辆,几乎是2021年的两倍。

- 由于西方文化的影响以及年轻人对化妆品需求的增加,该地区对化妆品和个人保健产品的需求正在以惊人的速度增长。同时,市场相关人员不断加大投资和生产,拉动对含乙二醇醚原料的需求。

- 印度、韩国和东南亚国协的製药业正在进行大量外国投资,以开拓市场机会,这可能会增加预测期内该地区对乙二醇醚的需求。

- 中国的製药业是世界上最大的製药业之一。该国涉及学名药、治疗药物、原料药和草药的生产。

- 因此,这种有利的市场趋势预计将在预测期内推动该地区乙二醇醚市场的成长。

乙二醇醚产业概况

乙二醇醚市场较为分散,众多参与者各自持有的市场占有率不足以影响市场动态。该市场的一些知名参与者包括BASF股份公司、伊士曼化学公司、利安德巴塞尔工业控股公司、壳牌和陶氏化学公司。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 越来越多地在化妆品和个人保健产品中使用

- 加速在油漆和涂料行业的应用

- 其他司机

- 抑制因素

- REACH 和 EPA 关于乙二醇醚使用的规定

- 用作清洗产品溶剂的新产品的出现

- 其他阻碍因素

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场区隔(以金额为准的市场规模)

- 类型

- E系列

- 乙二醇甲醚

- 乙二醇乙醚

- 乙二醇丁醚

- P系列

- 丙二醇单甲醚 (PM)

- 二丙二醇单甲醚 (DPM)

- 三丙二醇单甲醚 (TPM)

- 其他丙二醇醚

- E系列

- 目的

- 溶剂

- 防冻剂

- 液压/煞车油

- 化学中间体

- 最终用户产业

- 画

- 印刷

- 药品

- 化妆品/个人护理

- 黏剂

- 其他最终用户产业

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东/非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲

- 亚太地区

第六章 竞争形势

- 併购、合资、联盟、协议

- 市场占有率**/排名分析

- 主要企业策略

- 公司简介

- BASF SE

- Dow

- Eastman Chemical Company

- FBC Chemical

- India Glycols Ltd

- Ineos Group Limited

- Kemipex

- KH Neochem Co. Ltd

- LyondellBasell Industries Holdings BV

- Nippon Nyukazai Co. Ltd

- Oxiteno

- Recochem, Inc.(HIG Capital)

- Shell

- Sasol Limited

第七章 市场机会及未来趋势

- 意识不断增强,导致对用于低排放气体燃料的 P 系列乙二醇的需求过剩

- 其他机会

The Glycol Ethers Market size is estimated at 0.9 Million tons in 2024, and is expected to reach 1.12 Million tons by 2029, growing at a CAGR of 4.5% during the forecast period (2024-2029).

The COVID-19 outbreak, nationwide lockdowns around the world, disruption in manufacturing activities and supply chains, and production halts negatively impacted the market in 2020. However, the conditions started recovering in 2021, thereby restoring the growth trajectory of the market.

Key Highlights

- The major factors driving the growth of the market studied are the increasing usage of cosmetics and personal care products and accelerating demand in the paints and coatings industry.

- On the flip side, REACH and EPA regulations regarding the usage of glycol ethers, and the emergence of new products to use as a solvent for cleaning agents are restraining the growth of the market studied.

- The growing awareness leading to excess demand for P-series glycol for low emission oxygenated diesel fuel, is likely to provide opportunities for the market studied, during the forecast period.

- North America is the dominating region in the global glycol ethers market and Asia-Pacific is expected to grow at a fastest rate during the forecast period.

Glycol Ethers Market Trends

Paints and Coatings Segment to Dominate the Market

- Glycol ether helps in the formation of a proper film during coating cure and acts as an active solvent in resins. It helps in optimizing the evaporation rate of the solvent in a coating. It is also helpful in improving the flow out characteristics of the paint, and in eliminating brush marks during painting.

- The paints and coatings industry is the largest consumer of glycol ethers. Paints and coatings are extensively used in various industries, such as construction, automotive, and packaging.

- Many companies in paints and coatings market are adopting several business strategies in order to maintain their position in the global market. For instance, in February 2022, The Sherwin-Williams Company has acquired AquaSurTech, a producer of durable coatings for building applications. This helped the company to strengthen its position in coating industry for the building products market.

- Similarly, in June 2022, The Sherwin-Williams Company has acquited Gross & PerthunGmbH, a Germany based leading tracter coating company. This acquisition has helped the company to stregthen its position high-performance coatings industry.

- Residential and commercial construction has been increasing significantly across the world, which is driving the demand for glycol ethers, for their application in the production of architectural paints and coatings.

- According to the Indian Brand Equity Foundation (IBEF), by 2025, India is expected build 11.5 million homes a year and become third largest construction market with a value of around USD 1 trillion. Furthermore, by 2023, United States and China are expected to account for 60 per cent of the global growth in the construction sector. This is expected to incraese the demand for paints and coatings, in turn boosting the demand for glycol ethers.

- Furthermore, the global growth in automotive production is expected to propel the demand for paints and coatings. For instance, according to OICA, in 2022, the world motor vehicle production accounted for 85,016,728 units which was increased by 6% compared to 2021.

- Hence, the aforementioned trends are likely to increase the demand and production in the paints and coatings market, which may further drive the demand for raw materials, like glycol ethers.

Asia-Pacific is the Fastest Growing Market

- The Asia-Pacific the fastest growing region in the global glycol ethers market owing to the presence of significant countries such as China, India, and Japan.

- The surge in demand for products, such as paints, coatings, and adhesives, has been increasing in the end-user industries, such as automotive, construction, electronics, and packaging.

- The automobile industry in the China is witnessing a significant growth in terms of productions. For instance, according to International Organization of Motor Vehicles (OICA), in 2022, total production of motor vehicles in China accounted for 27,020,615 units which was increased by 3% compared to 2021.

- Further, switching trends in the country as the consumer are more inclined toward battery-operated vehicles is on the higher side. Moreover, the government of China estimates a 20% penetration rate of electric vehicle production by 2025. This is reflected in the electric vehicle sales trend in the country, which went record-breaking high in 2022. As per the China Passenger Car Association, the country sold 5.67 million units of EVs and plug-ins in 2022, touching almost double the sales figures achieved in 2021.

- Cosmetics and personal care products demand is increasing at a noticeable rate in the region, owing to the influence of western culture and increased cosmetic demand from the youth population. With this, the market players are increasing investments and production, thereby driving the demand for raw materials, including glycol ethers.

- The pharmaceutical industry in India, South Korea, and ASEAN countries are witnessing huge investments from foreign countries, in order to exploit the market opportunities, which may increase the demand for glycol ethers in the region, during the forecast period.

- The pharmaceutical industry in China is one of the largest in the world. The country is involved in the production of generics, therapeutic medicines, active pharmaceutical ingredients, and traditional Chinese medicine.

- Hence, such favorable market trends are likely to drive the growth of the glycol ethers market in the region, during the forecast period.

Glycol Ethers Industry Overview

The glycol ethers market is fragmented, with numerous players holding insignificant market share to affect the market dynamics individually. Some of the noticeable players in the market include BASF SE, Eastman Chemicals Company, LyondellBasell Industries Holdings B.V., Shell, and Dow, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Use in Cosmetics and Personal Care Products

- 4.1.2 Accelerating Use in Paints and Coatings Industry

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 REACH and EPA Regulations Regarding the Use of Glycol Ether

- 4.2.2 Emergence of New Products to Use as a Solvent for Cleaning Agents

- 4.2.3 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Type

- 5.1.1 E-series

- 5.1.1.1 Methyl Glycol Ether

- 5.1.1.2 Ethyl Glycol Ether

- 5.1.1.3 Butyl Glycol Ether

- 5.1.2 P-series

- 5.1.2.1 Propylene Glycol Monomethyl Ether (PM)

- 5.1.2.2 Dipropylene Glycol Monomethyl Ether (DPM)

- 5.1.2.3 Tripropylene Glycol Monomethyl Ether (TPM)

- 5.1.2.4 Other Propylene Glycol Ethers

- 5.1.1 E-series

- 5.2 Application

- 5.2.1 Solvent

- 5.2.2 Anti-Icing Agent

- 5.2.3 Hydraulic and Brake Fluid

- 5.2.4 Chemical Intermediate

- 5.3 End-user Industry

- 5.3.1 Paints and Coatings

- 5.3.2 Printing

- 5.3.3 Pharmaceuticals

- 5.3.4 Cosmetics and Personal Care

- 5.3.5 Adhesives

- 5.3.6 Other End-user Industries

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 BASF SE

- 6.4.2 Dow

- 6.4.3 Eastman Chemical Company

- 6.4.4 FBC Chemical

- 6.4.5 India Glycols Ltd

- 6.4.6 Ineos Group Limited

- 6.4.7 Kemipex

- 6.4.8 KH Neochem Co. Ltd

- 6.4.9 LyondellBasell Industries Holdings B.V.

- 6.4.10 Nippon Nyukazai Co. Ltd

- 6.4.11 Oxiteno

- 6.4.12 Recochem, Inc. (H.I.G. Capital)

- 6.4.13 Shell

- 6.4.14 Sasol Limited

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Awareness Leading to Excess Demand for P-series Glycol for Low Emission Oxygenated Diesel Fuel

- 7.2 Other Opportunities