|

市场调查报告书

商品编码

1639355

精製催化剂 -市场占有率分析、产业趋势与统计、成长预测(2025-2030)Refining Catalysts - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

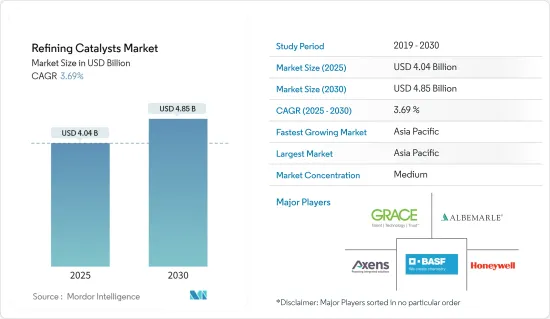

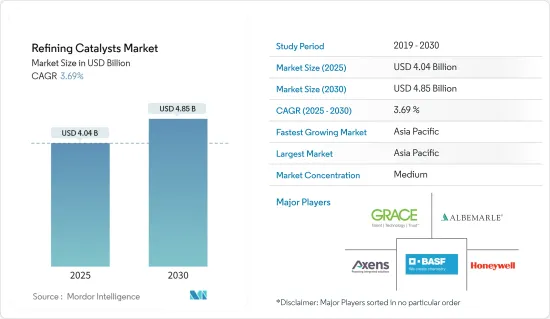

精製催化剂市场规模预计到 2025 年为 40.4 亿美元,预计到 2030 年将达到 48.5 亿美元,预测期内(2025-2030 年)复合年增长率为 3.69%。

由于精製石油产品的消费减少,COVID-19 疫情对市场产生了负面影响。但2021年,产业復苏,市场需求恢復。

主要亮点

- 短期来看,炼油厂投资的增加和高辛烷值燃料需求的加速是推动市场的关键因素。

- 另一方面,贵金属价格的波动预计将阻碍市场成长。

- 焦点转向奈米催化剂被视为未来的机会。

- 亚太地区是炼油精製最大的市场,几乎占全球份额的一半。

精製催化剂市场趋势

流体化媒裂(FCC)催化剂主导市场

- 流体化媒裂(FCC) 製程在从原油生产轻量产品的炼油厂中发挥重要作用。

- FCC设备将各种类型的原料,包括裂解瓦斯油、瓦斯油、脱沥青瓦斯油和真空/常压树脂,转化为更轻、更高价值的产品,如瓦斯油、喷射机燃料、液化石油气、煤油和汽油。

- 原料在FCC设备中进行高温、中压加热。同时,原料与催化剂接触,将高沸点烃液体的长链分子分解成较小的分子,然后以蒸气形式回收。

- 在 FCC 製程中,催化剂以细粉形式使用。先前,FCC设备中使用非晶质二氧化硅-氧化铝等催化剂裂解减压瓦斯油。然而,在 1960 年代初,沸石作为 FCC 催化剂被商业性化,标誌着催化裂解历史上的重大突破。例如,印度石油公司(IOC)计划斥资43.9亿美元扩建其位于哈里亚纳邦帕尼帕特的炼油厂。扩建计画预计将于2024年9月完成,将使炼油厂的产量从每年1,500万吨增加到2,500万吨。

- 由于上述因素,FCC催化剂在预测期内对推动精製催化剂的市场需求非常重要。

亚太地区主导市场

- 亚太地区是石油炼製用催化剂最大的市场,几乎占全球份额的一半。

- 中国是主要市场占有者,占该地区的40%以上。中国精製能力占世界精製能力的14%以上。

- 此外,印度最大的精製之一印度石油公司计划在未来五到七年内投资 229.1 亿美元(其中 76.4 亿美元)扩建其现有的棕地炼油厂。

- 在韩国,由于乙烯工厂产能增加以及亚洲塑胶需求增加,预计石脑油用量将持续扩大。例如,韩国2022年燃料油产量约13.6亿公升,较2021年成长28.55%。近年来,韩国燃料油产量增加。因此,该国燃料产量的增加预计将导致精製催化剂市场需求的增加。

- 此外,印尼正在加快计划,几乎提高其精製能力,以尽量减少对进口石油产品的依赖。政府希望在 2030 年将国内石油产量增加到 100 万桶/日。这将需要鼓励额外的研究和投资来改善老化油田的采收方法。

- 上述因素预计将在预测期内推动该国精製催化剂市场的发展。

精製催化剂产业概况

精製催化剂市场因其性质而部分整合。该市场的主要企业包括(排名不分先后)WR Grace &Co.-Conn、Albemarle Corporation、 BASF SE、Axens、Honeywell International 等。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 对高辛烷值燃料的需求加速成长

- 扩大石油和天然气活动

- 其他司机

- 抑制因素

- 贵金属价格波动

- 其他限制因素

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场区隔(市场规模(金额/数量))

- 产品

- CoMo

- 镍钼

- 氧化铝贵金属

- NiW

- 沸石

- 其他的

- 过程

- 加氢处理

- 汽油

- 煤油

- 柴油引擎

- 真空瓦斯油

- 催化裂解汽油

- 剩余饲料

- 流体化媒裂(FCC)

- 渣油催化裂解(RFCC)

- 加氢裂解

- 加氢处理

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 东南亚国协

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 西班牙

- 俄罗斯

- 欧洲其他地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东/非洲

- 沙乌地阿拉伯

- 南非

- 其他中东/非洲

- 亚太地区

第六章 竞争状况

- 併购、合资、联盟、协议

- 市场占有率(%)**/排名分析

- 主要企业策略

- 公司简介

- Albemarle Corporation

- Axens

- BASF SE

- China Petrochemical Corporation

- Exxon Mobil Corporation

- Topsoe

- Honeywell International

- JGC C & C

- Johnson Matthey

- Royal Dutch Shell PLC

- WR Grace & Co.-Conn

- Chevron Lummus Global(CLG)

- KNT Group

第七章 市场机会及未来趋势

- OPEC国家未来投资与产能扩张

- 其他机会

The Refining Catalysts Market size is estimated at USD 4.04 billion in 2025, and is expected to reach USD 4.85 billion by 2030, at a CAGR of 3.69% during the forecast period (2025-2030).

The COVID-19 outbreak negatively impacted the market due to reduced consumption of oil-refined products. However, the industry witnessed a recovery in 2021, thus rebounding the demand for the market studied.

Key Highlights

- Over the short term, increasing investment in refineries and the accelerating demand for higher octane fuel are the major factors driving the market studied.

- On the flip side, the volatility in precious metal prices is expected to hinder market growth.

- The shifting focus toward nanocatalysts will likely act as an opportunity in the future.

- Asia-Pacific region accounted for the largest market for refining catalysts, with almost half of the global share, and is also expected to be the fastest-growing market.

Refining Catalysts Market Trends

Fluid Catalytic Cracking (FCC) Catalysts to Dominate the Market

- The fluid catalytic cracking (FCC) process plays a crucial role in refineries while producing lighter products from crude oil.

- FCC unit helps in converting a variety of feed types, such as cracked gas oil, gas oil, deasphalted gas oils, vacuum/atmospheric resins, and others, into lighter and high-value products, such as diesel oil, jet fuel, LPG, kerosene, and gasoline.

- The feedstock is heated at high temperatures and moderate pressure in the FCC unit. Along with this, the feedstock is brought in contact with a catalyst which helps break the long-chain molecules of the high-boiling hydrocarbon liquids into small molecules, which are further collected as vapors.

- In the FCC process, the catalysts are used as fine powders. Previously, catalysts, such as amorphous silica-alumina, were used for cracking vacuum gas oils in the FCC unit. However, in the early 1960s, zeolite was commercially introduced as an FCC catalyst, a significant advancement in the history of catalytic cracking. For instance, the Indian Oil Corporation (IOC) intends to spend USD 4.39 billion on expanding its oil refinery in Panipat, Haryana. The extension scheme, which is expected to be completed by September 2024, will expand the refinery's production from 15 million tons annually to 25 million tons annually.

- Due to the abovementioned factors, FCC catalysts are important in propelling the market demand for refining catalysts in the forecast period.

Asia-Pacific to Dominate the Market

- Asia-Pacific region accounted for the largest market for refining catalysts, with almost half of the global share, and is also expected to be the fastest-growing market.

- China is the primary market holder, accounting for more than 40% of the region. China's refinery capacity accounts for over 14% of the world's refining capacity.

- Additionally, one of the top oil refiners in India, Indian Oil Corp, plans to invest USD 22.91 billion, including USD 7.64 billion, for expanding its existing brownfield refineries in the next 5 to 7 years.

- Naphtha use will likely continue expanding in South Korea due to capacity additions at ethylene plants and the rising demand for plastics in Asia. For instance, in 2022, the production volume of fuel oil in South Korea amounted to around 1.36 billion liters, which shows an increase of 28.55% compared to 2021. Fuel oil production in South Korea has risen in recent years. Therefore, increasing the production volume of fuel in the country is expected to create an upside demand for the refining catalysts market.

- Moreover, Indonesia is speeding up plans to nearly increase its oil refining capacity to minimize its reliance on imported petroleum products. By 2030, the government wants to increase domestic petroleum output to 1 million bpd. It seeks to do this by stimulating additional research and investment in improved recovery procedures for aging fields.

- All the factors above, in turn, are expected to drive the market for refining catalysts in the country during the forecast period.

Refining Catalysts Industry Overview

The refining catalysts market is partially consolidated in nature. The major players in this market include (not in any particular order) W. R. Grace & Co.-Conn, Albemarle Corporation, BASF SE, Axens, and Honeywell International, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Accelerating Demand for Higher-Octane Fuel

- 4.1.2 Expansion of Oil and Gas Activities

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Volatility in Precious Metal Prices

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value and Volume)

- 5.1 Product

- 5.1.1 CoMo

- 5.1.2 NiMo

- 5.1.3 Alumina-based Noble Metal

- 5.1.4 NiW

- 5.1.5 Zeolites

- 5.1.6 Other Products

- 5.2 Process

- 5.2.1 Hydrotreating

- 5.2.1.1 Gasoline

- 5.2.1.2 Kerosene

- 5.2.1.3 Diesel

- 5.2.1.4 Vacuum Gas Oil

- 5.2.1.5 Catalytic Cracking Gasoline

- 5.2.1.6 Residual Feed

- 5.2.2 Fluid Catalytic Cracking (FCC)

- 5.2.3 Residue Fluid Catalytic Cracking (RFCC)

- 5.2.4 Hydrocracking

- 5.2.1 Hydrotreating

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 ASEAN Countries

- 5.3.1.6 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Spain

- 5.3.3.6 Russia

- 5.3.3.7 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Albemarle Corporation

- 6.4.2 Axens

- 6.4.3 BASF SE

- 6.4.4 China Petrochemical Corporation

- 6.4.5 Exxon Mobil Corporation

- 6.4.6 Topsoe

- 6.4.7 Honeywell International

- 6.4.8 JGC C & C

- 6.4.9 Johnson Matthey

- 6.4.10 Royal Dutch Shell PLC

- 6.4.11 W. R. Grace & Co.-Conn

- 6.4.12 Chevron Lummus Global (CLG)

- 6.4.13 KNT Group

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Upcoming Investments and Capacity Additions in OPEC Countries

- 7.2 Other Opportunities