|

市场调查报告书

商品编码

1429491

环氧涂料:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Epoxy Coatings - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

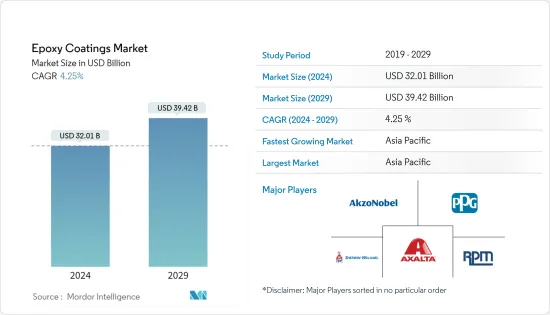

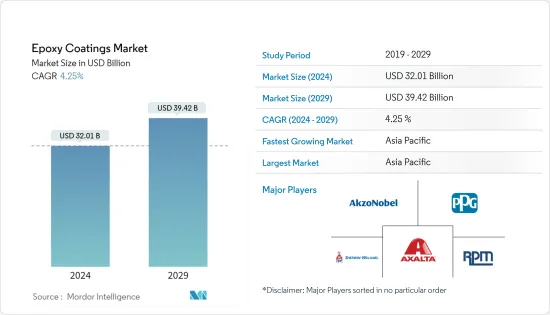

环氧涂料市场规模预计到2024年为320.1亿美元,预计到2029年将达到394.2亿美元,在预测期内(2024-2029年)复合年增长率为4.25%。

环氧涂料市场受到 COVID-19 大流行的负面影响。汽车和运输业的低迷、因疫情封锁而暂时停止的建设活动对相变材料市场的需求产生了负面影响。然而,市场现已达到疫情前的水平,预计在预测期内将稳定成长。

主要亮点

- 推动市场的主要因素是水性环氧涂料的需求不断增加,而建设产业的成长预计也将增加环氧涂料的市场需求。

- 然而,有关挥发性有机化合物(VOC)排放的严格法规预计将阻碍市场成长。

- 引入挥发性有机化合物排放极低或无挥发性有机化合物的环氧树脂可能是未来的一个机会。

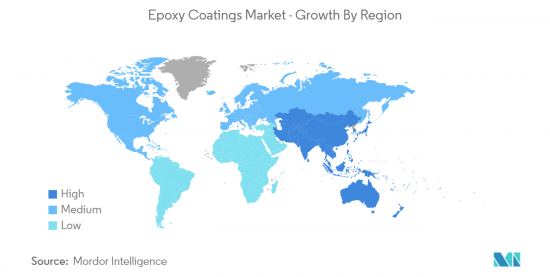

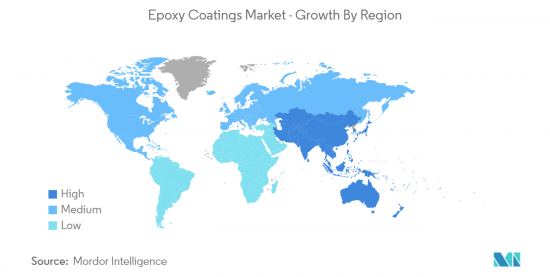

- 环氧涂料消费量最高的亚太地区预计将在预测期内主导全球市场。

环氧涂料市场发展趋势

建设产业的需求不断成长

- 环氧涂料主要用于地板、金属等材料的快干、防护涂层等。环氧涂料可用作工业和商业地板材料等应用中的环氧地板漆。

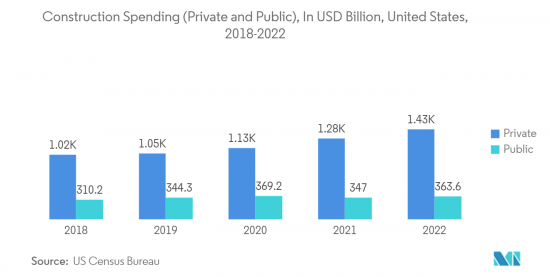

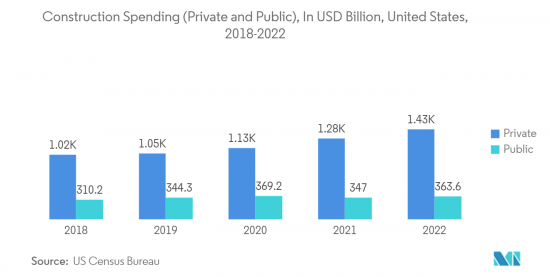

- 根据美国人口普查局的数据,2023 年 4 月的建筑支出经季节已调整的后的年增长率估计为 19,084 亿美元,比 3 月修正后的数字 18,850 亿美元高出 1.2%。 4 月的数字比 2022 年 4 月预测的 17,809 亿美元高出 7.2%。

- 此外,2023年1月至4月期间的建筑支出达到5,667亿美元,比2022年同期的5,339亿美元成长约6%。

- 德国拥有欧洲大陆最大的建筑存量,是欧洲最大的建筑市场。德国政府为该国设定的主要目标之一是经济适用住宅。政府计划每年建造40万套住宅,其中10万套将提供公共补贴。

- 德国也已批准在 2022 年 10 月建造 25,399 套住宅。根据联邦统计局(Destatis)的数据,与 2021 年 10 月相比,建筑许可证数量减少了 4,198 个(14.2%)。此外,2022 年 1 月至 10 月期间总合发放了 297,453 张住宅建筑许可证。

- 建筑业的扩张和普及预计将成为环氧涂料市场的主要驱动力并推动市场向前发展。

亚太地区主导市场

- 由于建筑、汽车、运输和工业等最终用户行业的需求不断增长,预计亚太地区在预测期内将出现最高增长。

- 根据中国国家统计局数据,2022年第四季中国建筑业产值预计达到2,760亿元人民币(约400亿美元),较上一季(276亿美元)成长约50%。随着国家强调节能结构,相变材料也广泛应用于建筑领域。

- 由于在日本举办的活动,预计日本的建筑业也会蓬勃发展。例如,2025年将在大阪举办世博会。大多数建筑的灵感来自于自然灾害的復原和重建。东京车站计划建造两栋高层建筑:一栋37层、高230m的办公大楼计划于2021年开业,一栋61层、高390m的办公大楼计划于2027年开业。

- 此外,根据印度工商联合会(FICCI)的数据,到2022年,印度都市区根据PMAY计划开发和批准的住宅数量预计将分别达到约550万套和1140万套。马苏。

- 此外,中国还是各类汽车产销售量最大、最具主导地位的国家。中国工业协会公布,2022年汽车产量将达2,702万辆,比2021年的2,608万辆成长约3.4%。

- 此外,随着日本汽车产业的扩张,许多汽车製造商增加了在日本的产能。根据日本汽车经销商协会(JADA)的数据,Toyota2022年在国内销售了约125万辆汽车,成为日本最大的汽车製造商。

- 综上所述,亚太地区环氧涂料市场预计在研究期间将显着成长。

环氧涂料产业概况

环氧涂料市场得到部分整合。主要企业包括(排名不分先后)PPG Industries, Inc.、AkzoNobel NV、Axalta Coating Systems, LLC、The Sherwin-Williams Company 和 RPM International Inc.。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 对水性环氧涂料的需求不断增加

- 建筑和建设产业的成长

- 其他司机

- 抑制因素

- 关于VOC排放的严格规定

- 其他阻碍因素

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场区隔(以金额为准的市场规模)

- 科技

- 水基的

- 溶剂型

- 粉底

- 最终用户产业

- 建筑/施工

- 车

- 运输

- 工业

- 其他最终用户产业

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东/非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲

- 亚太地区

第六章 竞争形势

- 併购、合资、联盟、协议

- 市场占有率(%)**/排名分析

- 主要企业策略

- 公司简介

- AkzoNobel NV

- Asian Paints

- Axalta Coating Systems, LLC

- BASF SE

- Berger Paints India Limited

- Dur-A-Flex, Inc.

- The Euclid Chemical Company

- Kansai Paint Co. Ltd

- Koster Bauchemie AG

- Nippon Paint Holdings Co., Ltd.

- Pidilite Industries Limited

- PPG Industries, Inc.

- RPM International Inc.

- The Sherwin-Williams Company

- Tikkurila

- Wanhua

- West Pacific Coatings

第七章 市场机会及未来趋势

- 介绍具有最小或无 VOC排放的环氧树脂

- 其他机会

The Epoxy Coatings Market size is estimated at USD 32.01 billion in 2024, and is expected to reach USD 39.42 billion by 2029, growing at a CAGR of 4.25% during the forecast period (2024-2029).

The epoxy coatings market was affected negatively due to the COVID-19 pandemic. The weakening automotive and transportation industry, as well as a brief halt in construction activity owing to the pandemic lockdown, had a detrimental impact on the phase change materials market demand. However, the market has now reached pre-pandemic levels and is expected to grow at a steady pace during the forecast period.

Key Highlights

- The major factors driving the market studied are increasing demand for water-borne epoxy coatings, and growth in the building and construction industry is also expected to increase the market demand for epoxy coatings.

- However, stringent regulations on volatile organic compounds (VOC) emissions are expected to hinder the market's growth.

- The introduction of epoxies with minimal or no VOC emissions is likely to act as an opportunity in the future.

- Asia-Pacific is expected to dominate the global market, with the largest consumption of epoxy coatings during the forecast period.

Epoxy Coatings Market Trends

Increasing Demand from the Building and Construction Industry

- Epoxy coatings are majorly used for quick-drying, protective coating, etc., for floors, metal, and other materials. Epoxy coatings can be used as epoxy floor paints in applications such as industrial or commercial flooring applications.

- According to the United States Census Bureau, the construction spending during April 2023 was estimated at a seasonally adjusted annual rate of USD 1,908.4 billion, 1.2 percent above the revised March estimate of USD 1,885.0 billion. The April figure is 7.2 percent above the April 2022 estimate of USD 1,780.9 billion.

- Moreover, during the first four months of 2023, the construction spending amounted to USD 566.7 billion, approximately 6 percent above the USD 533.9 billion spending for the same period in 2022.

- With the largest building stock on the continent, Germany is Europe's largest construction market. One of the main goals the German government established for the nation was affordable housing. The government plans to build 400,000 new housing units every year, 100,000 of which would be publicly subsidized.

- Germany had also given the go-ahead for the construction of 25,399 dwellings for October 2022. In comparison to October 2021, this implies a decrease in building permits of 4,198, or 14.2%, according to the Federal Statistics Office (Destatis). Moreover, a total of 297,453 residential building licenses were issued between January and October 2022.

- The expansion and proliferation of the building and construction sector is anticipated to be the main driver of the market for epoxy coating and thus drive the market forward.

Asia-Pacific Region to Dominate the Market

- Asia-Pacific region is expected to have the highest growth during the forecast period, owing to the increase in demand from the end-user industries, including building and construction, automotive, transportation, industrial, and other industries.

- The fourth quarter of 2022 saw an increase in China's construction output of around 50% over the previous quarter (USD 27.6 billion), reaching an estimated CNY 276 billion (about USD 40 billion), according to the National Bureau of Statistics of China. Due to the nation's emphasis on energy-efficient structures, phase change materials are also widely used in the construction sector.

- The Japanese construction sector is also predicted to boom because of the events that will be held in the nation. For example, in 2025, Osaka will host the World Expo. Most of the building is motivated by rehabilitation and recovery after natural catastrophes. Two high-rise structures for Tokyo Stations, a 37-story, 230m tall office tower scheduled to open in 2021 and a 61-story, 390m tall office tower scheduled to open in 2027.

- Furthermore, the number of residences developed and sanctioned under the PMAY plan in India's urban regions in 2022 was probably around 5.5 million and 11.4 million, respectively, according to the Federation of Indian Chambers of Commerce and Industry (FICCI).

- Furthermore, China has been the largest and most dominant nation in terms of vehicle production and sales of all types. In 2022, automotive production in the country reached 27.02 million units, which increased by approximately 3.4%, compared to 26.08 million vehicles produced in 2021, as stated by the China Association of Automobile Manufacturers.

- Additionally, as Japan's automotive sector is expanding, many automobile manufacturers increased their manufacturing capacity in the nation. According to the Japan Automobile Dealers Association (JADA), Toyota was the largest automobile manufacturer in Japan in 2022, selling around 1.25 million vehicles domestically, followed by Suzuki, which sold slightly more than 600,000 vehicles domestically in the same year.

- Hence, the market for epoxy coatings in the Asia-Pacific region is projected to grow significantly during the study period.

Epoxy Coatings Industry Overview

The epoxy coatings market is partially consolidated in nature. The major companies include (not in any particular order) PPG Industries, Inc., AkzoNobel NV, Axalta Coating Systems, LLC, The Sherwin-Williams Company, RPM International Inc, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand for Water-borne Epoxy Coatings

- 4.1.2 Growing Building and Construction Industry

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Stringent Regulation on VOC Emissions

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Technology

- 5.1.1 Water-based

- 5.1.2 Solvent-based

- 5.1.3 Powder-based

- 5.2 End-user Industry

- 5.2.1 Building and Construction

- 5.2.2 Automotive

- 5.2.3 Transportation

- 5.2.4 Industrial

- 5.2.5 Other End-user Industries

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 AkzoNobel NV

- 6.4.2 Asian Paints

- 6.4.3 Axalta Coating Systems, LLC

- 6.4.4 BASF SE

- 6.4.5 Berger Paints India Limited

- 6.4.6 Dur-A-Flex, Inc.

- 6.4.7 The Euclid Chemical Company

- 6.4.8 Kansai Paint Co. Ltd

- 6.4.9 Koster Bauchemie AG

- 6.4.10 Nippon Paint Holdings Co., Ltd.

- 6.4.11 Pidilite Industries Limited

- 6.4.12 PPG Industries, Inc.

- 6.4.13 RPM International Inc.

- 6.4.14 The Sherwin-Williams Company

- 6.4.15 Tikkurila

- 6.4.16 Wanhua

- 6.4.17 West Pacific Coatings

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Introduction of Epoxies with Minimal or No VOC Emissions

- 7.2 Other Opportunities