|

市场调查报告书

商品编码

1430509

电动汽车继电器:市场占有率分析、产业趋势、成长预测(2024-2029)Electric Vehicle Relay - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

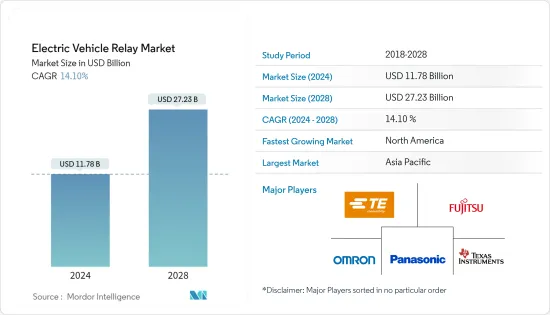

电动车继电器市场规模预计2024年为117.8亿美元,预计2028年将达272.3亿美元,预测期内(2024-2028年)复合年增长率为14.10%,预计将会成长。

电动车的日益普及推动了市场的发展。此外,政府促进电动车销售的措施和减少二氧化碳排放的严格政策将促进市场成长。因此,这些技术被广泛应用于各种汽车应用。

例如,根据国际能源总署(IEA)的数据,2022年全球电动车销量将超过1,000万辆,预计2023年将再成长35%,达到1,400万辆。

继电器在各种应用中发挥重要作用,包括汽车充电器、灯控制、各种马达控制、加热器控制和电磁阀控制。由于电动车的高需求,继电器製造商正在关注其产品的技术进步。

例如,2022年5月,德州仪器(TI)将推出两款固态继电器晶片,旨在取代传统汽车机械继电器。

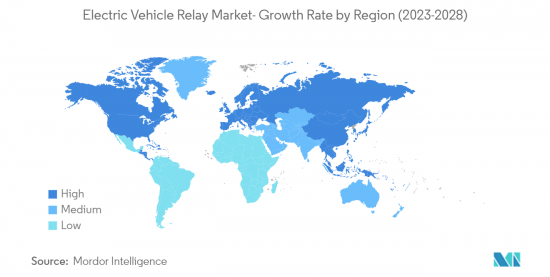

预计亚太地区所占份额最高。在政府 32 亿美元奖励计画的支持下,印度电动车和零件製造正在蓬勃发展,该计画到 2022 年将吸引总计 83 亿美元的投资。泰国和印尼也加强了政策支援体系,这可以为其他寻求扩大电动车普及的新兴市场经济体提供宝贵的经验。

因此,上述因素可能会推动市场成长。

电动汽车继电器的市场趋势

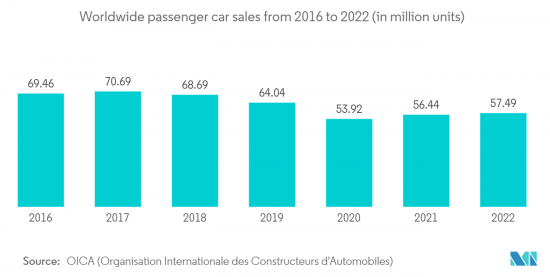

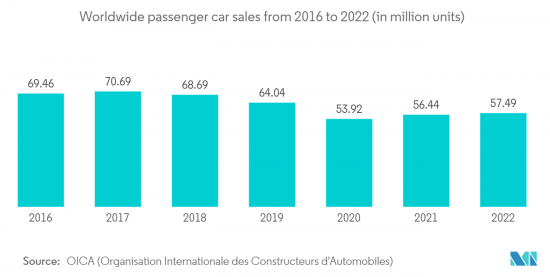

小客车市占率最高

近年来,小客车以其时尚的设计、紧凑的尺寸和经济的价值等特点受到了驾驶者的广泛欢迎。小客车已成为许多已开发国家最常见的交通途径。生活方式的改善、可支配收入的增加、品牌知名度的提高和经济效益的提高正在推动客户偏好的变化,并导致全球小客车销售的增加。

由于驾驶因素的日益便利,小客车中越来越多地采用继电器,这对所研究市场的成长产生了积极影响。这也是由于对提高车辆安全性和舒适性的零件的需求不断增加。由于各种政府倡议,例如发布汽车安全评级的 GNCAP(全球新车评估计划)和汽车碰撞测试机构,许多购车者正在寻找高品质的汽车和其他安全功能。能力建设的重要性。

考虑到这一点,汽车製造商更加重视汽车的先进安全功能,以满足对汽车先进安全功能不断增长的需求。常见的主动式安全功能包括防锁死煞车系统(ABS)、电子稳定控制系统(ESC)、轮胎压力监测系统(TPMS)和车道偏离警告系统(LDWS)。例如,现代汽车将为其下一代车型配备新的安全功能,如车辆稳定性管理和三点式安全带。

此外,促进生产更安全车辆的政府政策正在推动市场成长。例如,2023年8月,道路运输和公路部启动了巴拉特新车评估计画(Bharat NCAP)。该计划是印度政府将车辆安全标准提高到 3.5 吨来改善道路安全的承诺向前迈出的重要一步。

因此,上述因素正在推动市场成长。

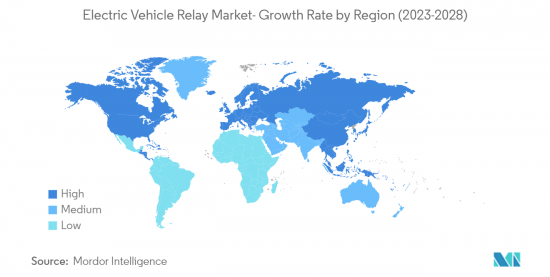

亚太地区占有较高市场份额

由于印度、中国和日本等主要市场的需求不断增加,预计亚太地区在预测期内将占据显着的市场份额。

中国和印度被认为是汽车消费大国,在全球整体汽车需求中占有很大份额。不断增长的中等收入群体和大量青年人口等因素可能会推动强劲的需求。

例如,CEEW 能源金融中心的一项研究表明,到 2030 年,印度电动车将面临 2,060 亿美元的机会。

印度和中国等国家的政府正在重点制定促进电动车销售的政策,并推出电动车倡议,以成为电动车产业的世界领导者。此外,政府还制定了多项计划和奖励来增加对电动车的需求。汽车製造商正在投资电动车及相关基础设施的研发。

印度政府预计,透过实施廉价道路通行费、报废和改造奖励,到 2030 年电动车普及将达到 30%。

此外,石油进口的增加和污染的加剧正迫使各国政府加快向电动交通的转型。

电动车现在销往世界各地,对电动车的需求正在迅速成长。考虑到这种情况,预计市场将会成长。

电动汽车继电器产业概况

电动汽车继电器市场由全球和地区知名企业整合和主导。公司正在采取新产品发布和联盟等策略来维持其市场地位。例如

2023 年 8 月,LS Electric Co. 旗下专门生产电动车 (EV) 零件的子公司 LS e-Mobility Solutions 宣布了一份价值 2,500 亿韩元(1.87 亿美元)的供应合约。该协议由 LS Electric 正式宣布,凸显了 LS e-Mobility Solutions 子公司 LS Mobility Solutions 已与现代起亚汽车签署协议。该合约将为电动车供应电动汽车继电器。零件预计将于 2025 年上半年交货。

该市场的主要企业包括松下公司、德州仪器公司、欧姆龙公司和富士通有限公司。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究成果

- 研究场所

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 市场驱动因素

- 对更安全汽车的需求不断增长

- 市场限制因素

- 继电器製造成本高

- 波特五力分析

- 供应商的议价能力

- 买家/消费者的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章市场区隔

- 推进类型

- 纯电动车(BEV)

- 混合动力电动车(HEV)

- 产品类别

- 印刷电路板继电器

- 插入式继电器

- 车辆类型

- 小客车

- 商用车

- 应用

- 电子动力方向盘

- 防锁死煞车系统

- 门锁

- 动力温顿

- 空调

- 其他应用

- 地区

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 其他欧洲国家

- 亚太地区

- 印度

- 中国

- 日本

- 韩国

- 其他亚太地区

- 世界其他地区

- 南美洲

- 中东/非洲

- 北美洲

第六章 竞争形势

- 供应商市场占有率

- 公司简介

- Panasonic Corporation

- Omron Corporation

- Fujitsu Limited

- Texas Instruments Incorporated

- TE Connectivity Ltd.

- Denso Corporation

- HELLA GmbH & Co.

- Ningbo Forward Relay Corp.Ltd.

- Jiangxi Weiqi Electric Co. Ltd.

第七章 市场机会及未来趋势

The Electric Vehicle Relay Market size is estimated at USD 11.78 billion in 2024, and is expected to reach USD 27.23 billion by 2028, growing at a CAGR of 14.10% during the forecast period (2024-2028).

The market is expected to be driven by the rising adoption of electric vehicles. Moreover, initiatives taken by the government to boost sales of electric vehicles and stringent policies to reduce CO2 emissions will drive the market growth. Hence, there has been widespread utilization of these technologies in various automotive applications.

For instance, according to the International Energy Agency, more than 10 million electric cars will be sold worldwide in 2022, and sales are expected to grow by another 35% to reach 14 million in 2023.

Relay plays an important role in various kinds of applications such as on-board chargers, lamp controls, various motor controls, heater controls, and solenoid controls. With the high demand for electric vehicles, relay manufacturers are focusing on technological advancements in their products.

For example, in May 2022, Texas Instruments (TI) is rolling out two solid-state relay chips designed to replace traditional automotive mechanical relays.

Asia Pacific is expected to hold the highest share. In India, EV and component manufacturing is ramping up, supported by the government's USD 3.2 billion incentive program that has attracted investments totaling USD 8.3 billion in 2022. Thailand and Indonesia are also strengthening their policy support schemes, potentially providing valuable experience for other emerging market economies seeking to foster EV adoption.

Thus, the above factors will likely drive market growth.

Electric Vehicle Relay Market Trends

Passenger Car holds Highest Share in the Market

Passenger cars have gained immense popularity among drivers over the past few years due to features such as stylish design, compact size, and economic value. Passenger cars are the most common mode of transportation in numerous advanced countries. The improving lifestyles, increasing disposable income, raising brand awareness, and economy are leading to customer preference changes across the globe, resulting in high sales of passenger cars.

The increasing adoption of relays in passenger vehicles for driver convenience is favorably impacting the growth of the market studied. This is also attributed to the rising demand for vehicle safety and comfort components. Various Government measures and car crash test organizations like the Global New Car Assessment Program (GNCAP), which publishes car safety ratings, have created awareness among many car buyers regarding the importance of building quality vehicles and other safety features.

Considering this, the automakers are focusing more on advanced safety features in vehicles to cater to the rising demand for advanced safety features in vehicles. Some of the common active safety features include an anti-lock braking system (ABS), Electronic Stability Control (ESC), Tyre Pressure Monitoring System (TPMS), Lane Departure Warning System (LDWS), etc. For example, Hyundai Motors launches new safety features like Vehicle Stability Management and 3-point seatbelts in its upcoming models.

Moreover, government policies to promote the production of much safer cars drive the market growth. For instance, in August 2023 Ministry of Road Transport & Highways launched the Bharat New Car Assessment Programme (Bharat NCAP). This program is a significant step forward in the Government's commitment to improving road safety by raising the safety standards of motor vehicles to 3.5 tons in India.

Thus, the above factors drive market growth.

Asia-Pacific holds Highest Share in the Market

The Asia-Pacific region is expected to hold a notable share of the market during the forecast period owing to rising demand from key markets like India, China, Japan, and others.

China and India are considered to be the major automotive consumers and hold a significant share of automotive demand across the world. Factors such as rising middle-class income and a huge youth population will result in strong demand.

For instance, A study by the CEEW Centre for Energy Finance recognized a USD 206 billion opportunity for electric vehicles in India by 2030.

The Governments of countries like India and China are focusing on policies to promote sales of electric vehicles and become a worldwide leader in the EV industry by introducing Initiatives for electric vehicles. Moreover, the Government has developed several programs and incentives to increase demand for electric cars. Automotive manufacturers are investing in the R&D of electric vehicles and related infrastructure.

The Government of India is projecting 30% EVs by 2030 by implementing cheaper road fees, scrapping, and refit incentives.

Moreover, the growing expense of oil imports and increased levels of pollution make governments expedite the transition to e-mobility.

With the growth of electric vehicle sales across the globe, the demand for electric vehicles really will also grow exponentially, and companies are focusing on increasing their production capacity to cater to the high demand. Considering the scenario, the market is expected to grow.

Electric Vehicle Relay Industry Overview

The electric vehicle relay market is consolidated and led by globally and regionally established players. The companies adopt strategies such as new product launches and collaborations to sustain market positions. For instance

In August 2023, LS e-Mobility Solutions, a subsidiary focused on electric vehicle (EV) components under LS Electric Co., secured a supply contract valued at 250 billion won (USD187 million) to provide relays for electric vehicles manufactured by Hyundai Motor Co. and Kia Corp. The agreement was officially announced by LS Electric, highlighting that LS Mobility Solutions, a branch of LS e-Mobility Solutions, has entered into a contract with Hyundai-Kia Motors. The agreement entails the supply of EV relays for electric vehicles. The components are scheduled for delivery in the first half of 2025.

Some of the major players in the market include Panasonic Corporation, Texas Instruments, Omron Corporation, and Fujitsu Limited.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing demand for safer vehicles

- 4.3 Market Restraints

- 4.3.1 High Production Cost of Relays

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Propulsion Type

- 5.1.1 Battery Electric Vehicle (BEV)

- 5.1.2 Hybrid Electric Vehicle (HEV)

- 5.2 Product Type

- 5.2.1 PCB Relay

- 5.2.2 Plug-in Relay

- 5.3 Vehicle Type

- 5.3.1 Passenger Car

- 5.3.2 Commercial Vehicle

- 5.4 Application

- 5.4.1 Electronic Power Steering

- 5.4.2 Anti-Lock Braking System

- 5.4.3 Door Lock

- 5.4.4 Power Windon

- 5.4.5 Air-Conditioner

- 5.4.6 Other Applications

- 5.5 Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Rest of North America

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Spain

- 5.5.2.5 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 India

- 5.5.3.2 China

- 5.5.3.3 Japan

- 5.5.3.4 South Korea

- 5.5.3.5 Rest of Asia-Pacific

- 5.5.4 Rest of the World

- 5.5.4.1 South America

- 5.5.4.2 Middle East and Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Panasonic Corporation

- 6.2.2 Omron Corporation

- 6.2.3 Fujitsu Limited

- 6.2.4 Texas Instruments Incorporated

- 6.2.5 TE Connectivity Ltd.

- 6.2.6 Denso Corporation

- 6.2.7 HELLA GmbH & Co.

- 6.2.8 Ningbo Forward Relay Corp.Ltd.

- 6.2.9 Jiangxi Weiqi Electric Co. Ltd.